Shares in focus: A dependable dividend-payer

This utility company pays out better than bonds for just a little more risk, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

National Grid pays out better than bonds for just a little more risk, says Phil Oakley.

Many people rely on income from investments. In a world where interest rates have been held at rock-bottom levels for four years, finding decent levels of income without taking lots of risk has become more and more difficult.

Given this backdrop, it's hardly surprising that investors have turned to utility companies' shares. As we all need gas, electricity and water, these companies have reliable income streams, allowing them to pay chunky dividends.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

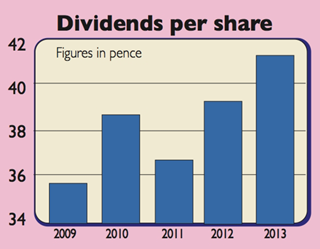

A dependable dividend-payer

National Grid has been able to pay bigger dividends for many reasons. Firstly, it has done a good job of running its regulated British gas and electricity networks. Despite the regulator, Ofgem, capping charges to customers, National Grid has invested a lot of money in its transmission and distribution assets. This has seen its regulatory asset value (RAV) grow a lot, which has allowed it to make more money as profits are a function of assets multiplied by the allowed rate of return on them.

It has also kept a tight lid on costs and spent less than its regulatory allowances. This has boosted profits and helped it make more money than the regulator expected. These extra profits have been paid out to shareholders.

National Grid has also taken advantage of low interest rates and taken on cheaper debt, enabling it to increase the difference between what it earns on its regulated assets and what it pays to lenders. That's been good news for shareholders too.

Can it keep paying out?

National Grid has £22bn of debt. This will keep rising as its British and American businesses have big investment requirements. While this will let profits grow, a bigger share will go to lenders rather than shareholders. Will there be money left for bigger dividends? Another concern is that the American business has regularly earned less than its regulatory allowance. It often asks permission to raise bills to make up the difference.

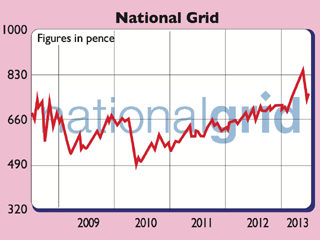

There's also the worry of rising interest rates. The firm must raise around £3bn of fresh debt each year to finance new investment and repay existing borrowings. Rising rates would make this pricier. But it's also a problem for the share price. Utility stocks are good substitutes for bonds because of their dividends. Rising bond yields and falling bond prices could see National Grid's share price fall too. In short, there's rarely a free lunch in investing but that's why the shares yield 5.5%. On the upside, management is confident its dividend growth target can withstand most events. It also has a lot of regulatory clarity as it has just entered an eight-year price control in Britain.

So if dividends can grow in line with inflation, then I can think of worse homes for your money. National Grid's shares could resemble an inflation-proofed bond, albeit with a little more risk. UK government index-linked bonds currentlyhave a real yield of minus 0.5% (0.5% less than inflation). With RPI inflation at 3.3%, National Grid yields 2.2% more than inflation (5.5% less 3.3%). Some premium is justified, but the shares look worth buying at current levels.

Verdict: buy for dividends

The numbers: National Grid (LSE: NG)

Key facts

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Investing in the energy sector – is the reward worth the risks?

Investing in the energy sector – is the reward worth the risks?The energy sector used to offer predictable returns, but now you need to tread carefully. Is the risk worth it?

-

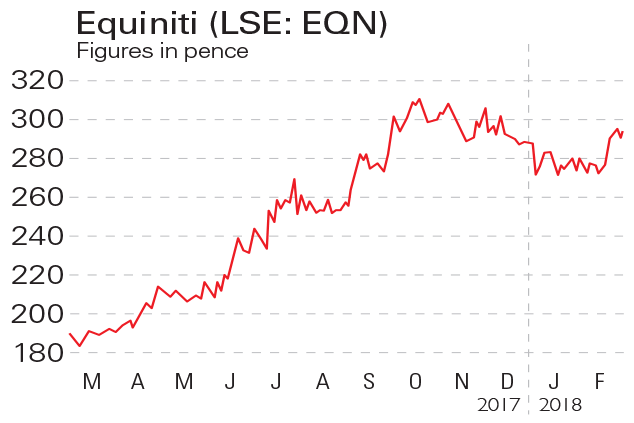

If you’d invested in: Equiniti and National Grid

If you’d invested in: Equiniti and National GridOpinion Financial services firm Equiniti has gone from strength to strength, while National Grid is facing uncertainty.

-

Shares in focus: Just how sheltered is National Grid?

Shares in focus: Just how sheltered is National Grid?Features The utility giant has been one of the better safe havens to own. So, should you snap up the shares? Phil Oakley investigates.

-

Is it time to pull the plug on National Grid?

Features Investors' favourite National Grid is on a collision course with the energy regulator over what it charges its customers. That could spell trouble for the attractive dividend. So is time to sell National Grid? Phil Oakley investigates.

-

Should you buy National Grid bonds?

Features National Grid has launched a new bond for the retail market. Its key attraction for hard-pressed savers is that over the ten years the capital value of the bond rises in line with the RPI. So should you buy it?