The best way to spot cheap shares

Buying cheap shares is the best way to make money from the stock market over the long term. Phil Oakley explains how to spot them.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Making money in the stock market is easy, in theory at least. Just buy cheap shares, and be patient. Plenty of studies show that value investing buying shares for less than shares are worth' produces superior returns to most other stock-picking methods.

It might not make you rich overnight, but do it for long enough and you should beat the market healthily.

But how do you find cheap shares?

That's where it gets tricky. Most investors start with the price/earnings ratio (p/e). It's simple to calculate (just the company's share price divided by earnings per share) and easy to understand. The lower the p/e, the cheaper the stock (because you're paying less per pound of earnings).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Buying low p/e stocks can have great results. John Neff, manager of Vanguard's Windsor Fund in the US, used this method to make 13.7% a year on averagebetween 1964 and 1995, compared tojust 10.6% a year for the US stock market. But p/e ratios have lots of shortcomings.

They are based solely on a company's income statement they reveal nothing about balance sheets. And comparing companies is made trickier by accounting quirks, such as different tax rates.

A better way to value stocks

Fortunately, there is a better way to value stocks. Wesley Gray, an American value investing expert, has done lots of research into picking winning shares. For his money, the best valuation measure to use is to compare earnings before interest and tax (EBIT) or trading profits with a stock's enterprise value (EV).

EV includes the market capitalisation(the number of shares multiplied by the share price the market value of a company's equity, in other words).

EV also includes any debt used to fundthe company (such as bank loans or corporate bonds). This gives a more complete picture of the business. By dividing EBIT by EV, you get an earnings yield for the company, expressed as an interest rate. The higher the interest rate, the cheaper the share.

Gray says the EBIT/EV ratio consistently picks better stocks than the p/e. He looked at 1,000 large and medium-sized companies between 1963 and 2013 and ranked them into deciles, based on EBIT/EV. He then put together lots of random 30-stock portfolios.

He found that an investor buying the cheapest shares would have beaten one paying for the more expensive ones handsomely. Not only that, but the cheap shares were also much less risky, with lower levels of volatility.

EBIT/EV works so well because it gives you a lot of information about what you are paying for the assets of a business (which are financed by its equity and its borrowings the EV) and also the profits that they are producing EBIT.

The danger of just focusing on the equity (as the p/e ratio does) is that debt can make assets look cheaper than they really are. You can see how this works in the example in the box below.

The real magic number

Gray is not the first to advocate using EBIT/EV, of course. Joel Greenblatt, author of The Little Book That Beatsthe Market, uses it as a key part of his magic formula' for picking shares.

He ranks shares by their interest ratesand also their return on capital.He reckons this allows him to buygood-quality businesses (as signalled by a high return on capital) at a cheap price (with a high interest rate).

However, Gray thinks you don't even need to bother worrying about return on capital. In fact, he thinks that paying too much attention to this number can tempt you to overpay for quality.

According to Gray, all the magic in Greenblatt's formula comes from the EBIT/EV part so that's what you should focus on. Below I've picked five shares that look good value right now on this EBIT/EV basis.

Why debt matters

Say there are two identical office blocks for sale where you live.Both have an asking price of £1m.Both generate annual trading profits (EBIT) of £100,000.

The first office, known as Market Place, is financed with an £800,000 bank loan (mortgage) at an interest rate of 5%, leaving it with equity of £200,000. Park Square has no debt at all, so has an equity value of £1m.

By using p/e ratios, you could be misled into thinking that Market Place is considerably cheaper than Park Square. But in fact, on the basis of EBIT/EV, they have the same value.

| Asking price (EV) | £1,000,000 | £1,000,000 |

| Borrowings | £800,000 | £0 |

| Equity (p) | £200,000 | £1,000,000 |

| EBIT | £100,000 | £100,000 |

| Interest costs | (£40,000) | £0 |

| Profit before tax | £60,000 | £100,000 |

| Tax at 20% | (£12,000) | (£20,000) |

| Profit after tax (e) | £48,000 | £80,000 |

| P/e ratio | 4.2 times | 12.5 times |

| EBIT/EV | 10% | 10% |

Five cheap sharesto buy now

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

The irresistible rise of ESG investing

The irresistible rise of ESG investingAnalysis Many fund managers talk up their green credentials to sell funds, but buying an environmental and sustainability specialist is the best way to profit from the boom, says Bruce Packard.

-

Why investors may need to pivot from ESG towards carbon-intensive industries

Why investors may need to pivot from ESG towards carbon-intensive industriesCover Story Investors have been keen to show their green credentials by shunning carbon-intensive industries. The cost of that virtue signalling is now becoming apparent, says Frédéric Guirinec.

-

Why investment advice could be about to get a lot cheaper

Why investment advice could be about to get a lot cheaperOpinion Vanguard, the world’s second-biggest asset manager, is launching its own cut-price financial advice service. It’s something the industry badly needs, says John Stepek.

-

What is a tracker fund?

What is a tracker fund?Instead of trying to beat the market, tracker funds – also known as “passive” funds – try to track its performance. Here's what that means.

-

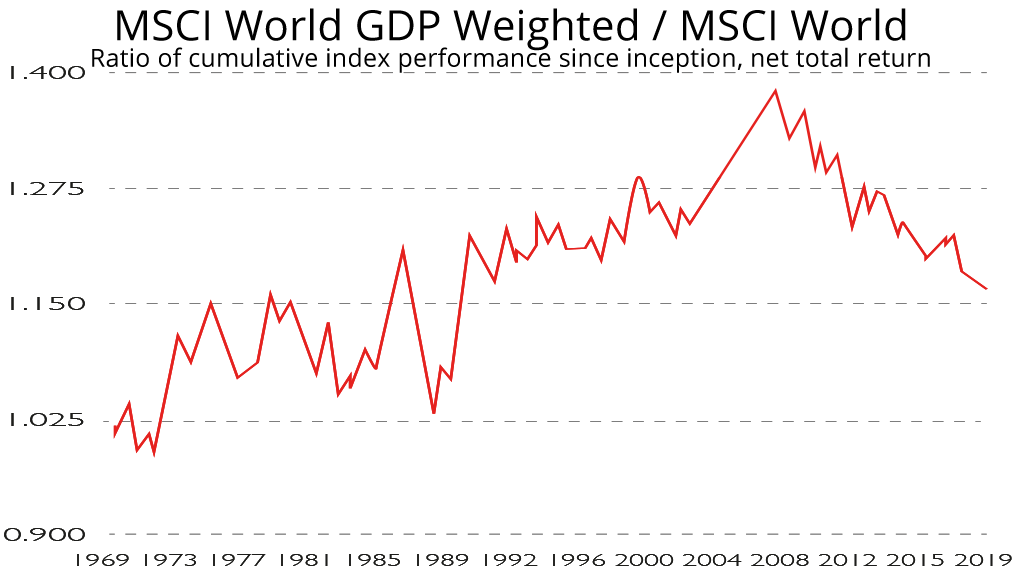

The trouble with "World" stockmarket indices and how to fix them

The trouble with "World" stockmarket indices and how to fix themAdvice Indices such as the MSCI World or the FTSE World are not an accurate reflection of the global economy

-

How to choose a robo-adviser

Features Many of us haven’t got the time, knowledge or the disposition to pick great funds on a regular basis. The answer could be to look at the fast-growing “robo-advice” sector.

-

How to keep investing simple

Tutorials The financial services industry wants you to believe investing is complicated, says Cris Sholto Heaton. But for those who know how, the reality is very different.