How to choose a robo-adviser

Many of us haven’t got the time, knowledge or the disposition to pick great funds on a regular basis. The answer could be to look at the fast-growing “robo-advice” sector.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Many of us haven't got the time, knowledge or the disposition to pick great funds on a regular basis. Often, the solution is to look for a solid all-round fund, but many investors want something more. Actively managed funds can cost a fair bit in fees and they aren't guaranteed to beat the market, so low charges are a priority. Many also want easy access via apps, and better, more transparent reporting of returns. If so, I'd suggest the answer is to look at the fast-growing "robo-advice" sector.

This technological disruption is driving down costs, improving transparency and might even encourage us to invest a little more. It started with clever start ups for example, Nutmeg in the UK but it is now spreading into the mainstream. In the US, outfits such as Charles Schwab (a huge stockbroker platform) and Vanguard (a fund management group) are building a massive market position.

In the UK, IG has hit the ground running first with its IG Smart Portfolios product. It isn't a pure robo-advice start-up the service is built from its existing IG stockbroking business but it looks a lot like the other robo services. The crucial part the asset-allocation decisions is being run in collaboration with BlackRock iShares, the world's leading ETF firm, which also has huge expertise in constructing portfolios. This is a powerful product and other robo-advisers will be watching keenly.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Picking a good platform

A good robo-advice platform has some key characteristics. The investment account is managed and accessed online. It usually involves software which gauges your "risk appetite" on a scale between defensive (low risk) to adventurous (high risk). This results in a model portfolio being chosen for you and built using funds that the platform invests in on your behalf. Most platforms use passive funds usually exchange-traded funds (ETFs) which are fairly cheap when compared to actively managed funds.

Once you've been allocated a core portfolio, there might be some top-level overlay applied: ie, the service might make some tweaks based on market conditions. You can usually contribute a fairly small amount of money, from £1 or £100 per month, and build your savings up over time. Checking on the portfolio is incredibly easy and real-time with graphs and tools that are usually very impressive on most services (most offer access via apps).

Ease of use will be a key factor for most people in choosing a provider, but you also need to consider costs. You should never have to pay more than 1% for the platform, and I'd suggest that the sector will settle at between 0.4% and 0.6%. Also take into account the annual total expense ratio of the ETFs in the portfolios. This would usually add around 20 to 30 basis points, taking the total cost closer to 1%.

Finally, there's the tricky matter of returns. You might have the cheapest platform and the best apps, but it will all be let down if the returns are rubbish. Asset allocation matters. Many platforms say that they don't tweak much, but stick to long-term allocations. But what happens if those fixed allocations blow up in a market crash? Is providing a tech platform really worth charging 0.5% a year? I suspect that good asset allocation knowledge and risk management will be a key selling point, as it is already with Nutmeg and Scaleable Capital.

Measuring performance is still hard, not least because the providers are so young that meaningful data is scarce. We need proper benchmarking for the sector. So I'm going to start investing my own money in as many of the platforms as I can. I'll report back on my adventures in robo-investing wonderland in due course.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

The irresistible rise of ESG investing

The irresistible rise of ESG investingAnalysis Many fund managers talk up their green credentials to sell funds, but buying an environmental and sustainability specialist is the best way to profit from the boom, says Bruce Packard.

-

Why investors may need to pivot from ESG towards carbon-intensive industries

Why investors may need to pivot from ESG towards carbon-intensive industriesCover Story Investors have been keen to show their green credentials by shunning carbon-intensive industries. The cost of that virtue signalling is now becoming apparent, says Frédéric Guirinec.

-

Why investment advice could be about to get a lot cheaper

Why investment advice could be about to get a lot cheaperOpinion Vanguard, the world’s second-biggest asset manager, is launching its own cut-price financial advice service. It’s something the industry badly needs, says John Stepek.

-

What is a tracker fund?

What is a tracker fund?Instead of trying to beat the market, tracker funds – also known as “passive” funds – try to track its performance. Here's what that means.

-

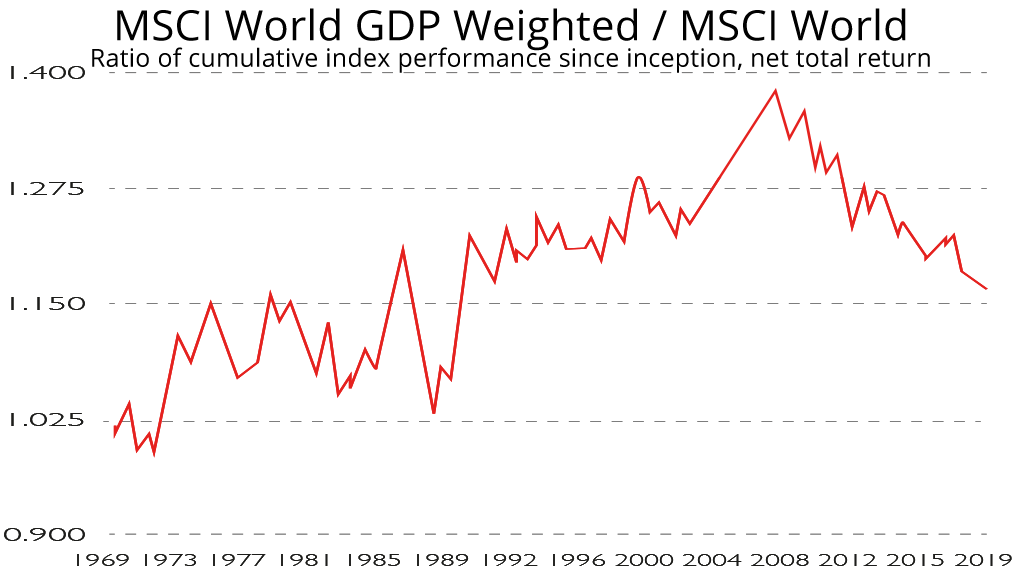

The trouble with "World" stockmarket indices and how to fix them

The trouble with "World" stockmarket indices and how to fix themAdvice Indices such as the MSCI World or the FTSE World are not an accurate reflection of the global economy

-

How to keep investing simple

Tutorials The financial services industry wants you to believe investing is complicated, says Cris Sholto Heaton. But for those who know how, the reality is very different.

-

The best way to spot cheap shares

Tutorials Buying cheap shares is the best way to make money from the stock market over the long term. Phil Oakley explains how to spot them.