How to keep investing simple

The financial services industry wants you to believe investing is complicated, says Cris Sholto Heaton. But for those who know how, the reality is very different.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

One of the biggest myths about investing is that it needs to be complicated.The existence of this myth isn't surprising, since it serves the financial services industry rather well: the more difficult something appears to be, the more willing people are to pay an expert to help them with it. Yet the reality is that a sensible investment strategy can be very simple and arguably should be whether you know a great deal about investing or almost nothing at all.

For a good example of this, take a recent article by Jonathan Eley in the FT. Eley has been the personal finance editor of the FT and the editor of Investors Chronicle, so he has plenty of experience in financial markets. Despite that, "the vast majority of my [individual savings account (Isa) money is invested in a single security", he writes. While that may seem "an amazing statement for somebody in my position", "it's entirely consistent with my views on investing generally".

Why is that? Eley says his main investment is an exchange-traded fund (ETF) that tracks the MSCI World index. (He doesn't name the fund, but it's probably the iShares Core MSCI World (LSE: SWDA)). This is an extremely broad global stock index that tracks more than 1,600 shares from around the globe. So through a single fund, an investor can spread their risk among plenty of individual companies and a wide range of different economies thereby fulfilling the fundamental investment principle of diversification.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And it's extremely cheap the fund charges just 0.2% per year and Eley reckons he pays about £70 per year in stockbroking costs. "So my total investing costs are about 0.34%." For somebody who lacks the time to implement "complicated investment strategies", it's a very practical and efficient solution.

This is about the simplest approach it's possible to imagine for an investor who's focused mainly on growing their wealth. It wouldn't be suitable for everybody stocks have outperformed other assets over the long term, but have also been far more volatile (they dropped around 40% peak to trough in the dotcom crash and the global financial crisis).

Many people struggle to stay the course through that kind of downturn, so they might want to invest part of their portfolio into a government bond ETF such as the Vanguard UK Government Bond (LSE: VGOV), which should help to reduce the volatility.

And with only a slight increase in cost and complexity, you could fine-tune your exposure to different markets and hedge against different risks. But regardless of exactly which investments you choose to hold, a back-to-basics approach of a simple portfolio using cheap ETFs is a good foundation.

That's true even if you invest through managed funds or run your own stock portfolio. There's little point in paying higher fees or spending time researching and choosing stocks if the eventual returns are worse than you'd get from a cheap tracker. So begin by planning a model portfolio using equivalent ETFs. For example, if you plan to buy a US equity fund, add a S&P500 ETF to your model portfolio. If you plan to invest mostly in UK stocks, benchmark yourself against a FTSE 100 or FTSE 250 ETF.

Work out the likely costs of your planned portfolio and consider whether you're likely to beat the ETF portfolio after expenses. Then, if you still decide to invest in managed funds or individual stocks, monitor the ongoing performance of your portfolio against the ETF model portfolio. Even if the results don't make you want to pursue a simpler strategy, they may help you find ways to improve your returns, such as trading less or cutting costs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify

-

Fundsmith Equity: a setback for a high-quality portfolio

Fundsmith Equity: a setback for a high-quality portfolioAdvice Rupert Hargreaves explains why investors should focus on Fundsmith Equity’s process rather than its losses

-

The irresistible rise of ESG investing

The irresistible rise of ESG investingAnalysis Many fund managers talk up their green credentials to sell funds, but buying an environmental and sustainability specialist is the best way to profit from the boom, says Bruce Packard.

-

Why investors may need to pivot from ESG towards carbon-intensive industries

Why investors may need to pivot from ESG towards carbon-intensive industriesCover Story Investors have been keen to show their green credentials by shunning carbon-intensive industries. The cost of that virtue signalling is now becoming apparent, says Frédéric Guirinec.

-

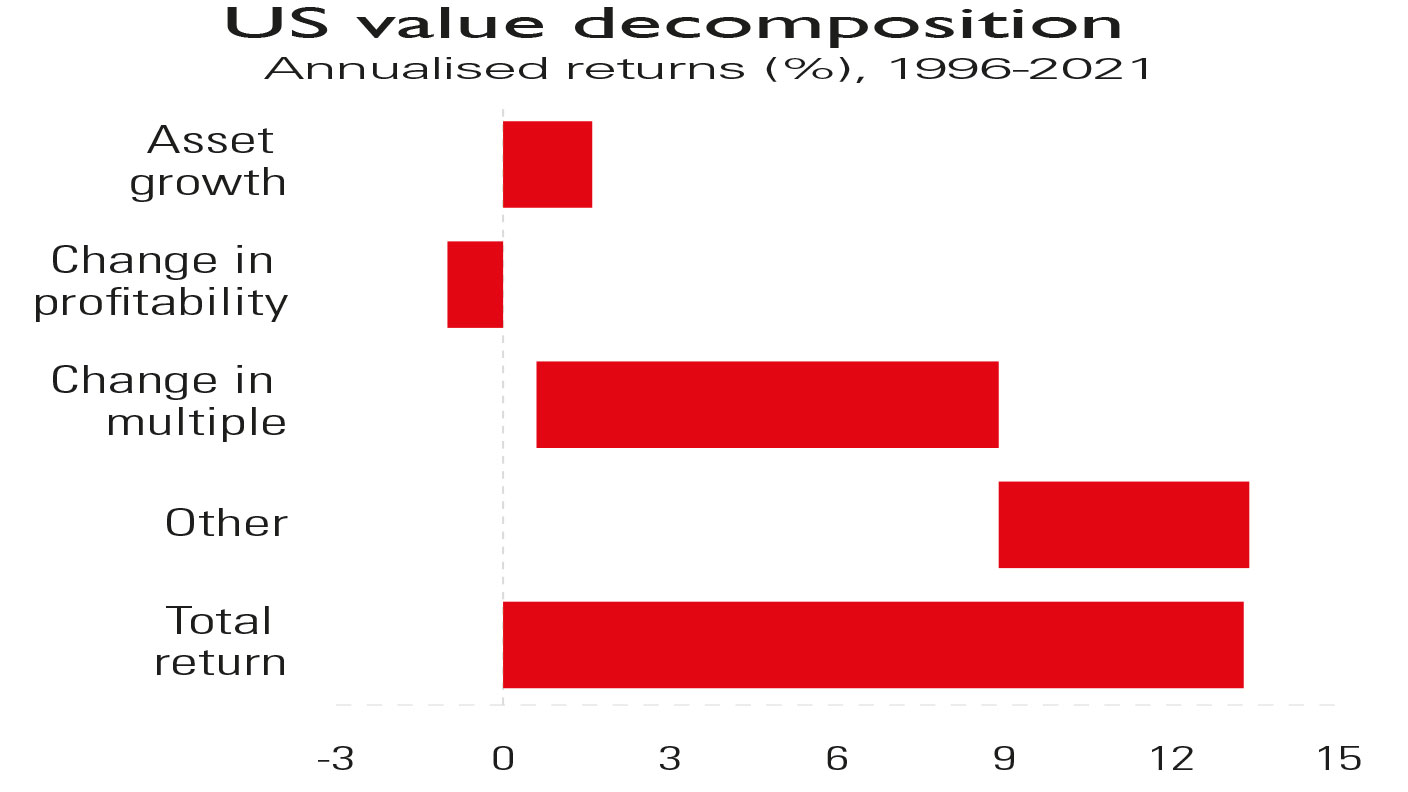

Value stocks: when cheaper isn’t cheap enough

Value stocks: when cheaper isn’t cheap enoughAdvice Value stocks will probably beat growth stocks in the years ahead, but that won’t necessarily mean high returns, says Cris Sholto Heaton

-

How to build your own ultimate tracker fund

How to build your own ultimate tracker fundAdvice Efforts to build the “ultimate” tracker fund reveal how easy it is to over-complicate your asset allocation.

-

Why investment advice could be about to get a lot cheaper

Why investment advice could be about to get a lot cheaperOpinion Vanguard, the world’s second-biggest asset manager, is launching its own cut-price financial advice service. It’s something the industry badly needs, says John Stepek.

-

Ethical investing: how to find an ESG tracker fund

Advice The number of ethical exchange-traded funds is growing ever larger – David C Stevenson outlines your options.

-

What is an emerging market, and should you invest in them?

What is an emerging market, and should you invest in them?Emerging markets can be a great way to add diversification to your investment portfolio, but what is an emerging market, and is now a good time to buy into them?