How tramline kisses give your trading an edge – part II

John C Burford explains why swing traders should always be on the look-out for a 'scalded-cat bounce'.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

On Monday, I explained that in my tramline trading system, the tramline kiss is a very important chart pattern that I use for low-risk trade entries. I gave four examples showing how to find them and how to trade them.

The key feature of a genuine kiss is this: after the kiss, the market usually moves swiftly away from the line in what I call a scalded-cat bounce. I call it that in homage to the well-known phrase dead cat bounce', which describes a market that has fallen hard and then stages a small relief rally where short profit-takers dominate trading.

In a scalded-cat bounce, the cat does not die far from it it very much comes to life from the hot water and zooms off in one direction!

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Today, I will follow up on one of the examples and list two current situations. This is to show that tramline kisses are not at all rare, and it is well worth your while to seek them out on your own charts.

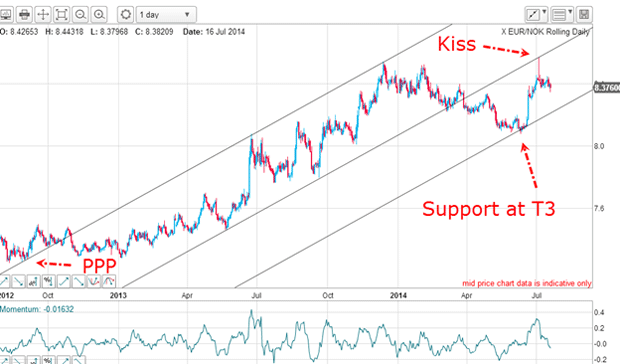

Example one: EUR/NOK

My two upper multi-month tramlines are very reliable, making the spike kiss on the underside of the centre tramline an excellent trade entry point.

But if you missed that and if you blinked, you probably did there were plenty more opportunities for a low-risk trade

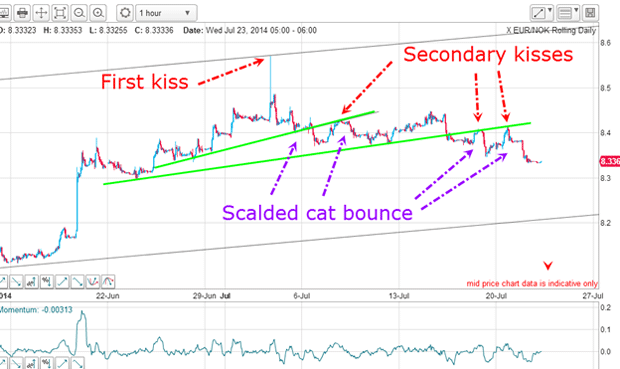

This is the current hourly chart:

The final rally to the upper tramline was over within the hour of the top candlestick. But thereafter, the market moved lower and I can draw some minor trendlines (in green). After the break of each trendline, the market rose up to plant a kiss and then moved away in a scalded-cat bounce.

As I write, the market is making the latest scalded-cat bounce.

Every one of these kisses was a short-trading opportunity for a low-risk entry, where protective stop losses could be entered just above the lines.

The major target for these trades is the lower tramline in the 8.2 region.

Example two: Gold

But let's look at the short-term action on the hourly chart:

I have another excellent tramline pair with multiple touch points on both lines.

Yesterday, the market broke below the lower tramline and in a sharp rally move, planted a kiss on the underside of this line (but with a small overshoot). The market then moved swiftly away in a probable scalded-cat bounce and is consolidating the move as I write.

The key concept to keep in mind is that when the lower tramline (support) was broken, the line then became a line of resistance, which was confirmed by the inability of the market to move above it. The scalded-cat bounce then proved the line was a powerful force driving the market lower.

Example three: AUS/USD

I have a very good centre tramline, but the upper one is poor. I have a good prior pivot point (PPP), but no accurate touch points! However, my third tramline is good with the market having bounced off the support there.

A good trade entry was at the kiss (or even the second one), but this is the position this morning:

The rally through the tramline stopped out the trade. Although it was low-risk, it wasn't no-risk. But the loss was small and well within my 3% rule limit.

The fact that I had a very poor upper tramline was likely an omen that this trade would not work out. In the other examples, which are working out, I had been able to draw in very reliable tramlines.

The lesson? Make sure you have reliable tramlines before using the kiss method.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now