Student loans: yet another reason they won’t ever be repaid

So few student loans are now being paid off that the government would have been better off not reforming the system at all. It’s all down to ‘salary sacrifice’, says Merryn Somerset Webb.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Got a student loan? Think you might pay it all back over the years? Well, silly you. Hardly anyone else is going to.

Repayment rates on student loans have now fallen so low that the government would almost have been better off not bothering to reformthe university finance system.

Its original estimate wasthat 28% of loans would have to be written off. That number has now been revised to 45%. The tipping point at which the whole thing starts costing, rather than saving, money is 48%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This is partly about graduates earning less than expected; partly about graduates who don't earn (those who go on to be full-time mothers, or the retired perhaps they can take out loans to go to university too); and, as ever, partly about the general tax avoidance incentives built into our system.

In this case, the culprit is salary sacrifice. Here's how Tilney Bestinvest looks at it: "With clever planning, an employee can use salary sacrifice to reduce their income below certain thresholds and therefore make further savings.

"Take student loans, for example; many students leave university with high hopes of landing a top job but can find themselves undone, with low pay and laden with debt. Repayment of student loans is 9% of income earned above £17,335 for those taking out student loans before September 2012, and £21,000 for those taking a loan out after 1 September 2012. This can often leave many university leavers with a lot less take-home pay than they need.

"Taking into account Income Tax and National Insurance, a graduate will take home just 59p in the £1 for part of their income earned above the repayment thresholds. This would further reduce to 49p in the £1 for income earned above the basic rate tax threshold and a quite frightening 32p in the £1 for each pound of income earned between £50,000 and £60,000 if the graduate has two children and is in receipt of Child Benefit payments."

Let's say our graduate earns £30,000, and has a choice of putting money into his pension either via salary sacrifice or out of his net salary (in which case the tax is claimed back). If he does it using salary sacrifice, his official gross salary is not £30,000 but £27,000. That cuts his NI bill and his income tax bill but crucially, it also cuts his loan repayments from £810 to £540. The result is a take home pay of £20,907 instead of £20,277.

That might be good news for individual graduates, but it isn't exactly good news for taxpayers as a whole. It's also one more reason why the idea that salary sacrifice might be in line for the chop on 8 July might not be as silly as some think it is.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now

-

Conservatives pledge to cut National Insurance again – how much could you save?

Conservatives pledge to cut National Insurance again – how much could you save?News A 2p reduction in National Insurance is a key feature of the Tory’s general election manifesto.

-

Beating inflation takes more luck than skill – but are we about to get lucky?

Beating inflation takes more luck than skill – but are we about to get lucky?Opinion The US Federal Reserve managed to beat inflation in the 1980s. But much of that was down to pure luck. Thankfully, says Merryn Somerset Webb, the Bank of England may be about to get lucky.

-

Tax changes: here is what the mini-Budget means for you

Tax changes: here is what the mini-Budget means for youAnalysis Saloni Sardana looks at the tax cuts in the mini-Budget and explains what each one means.

-

Mini-Budget: what we know

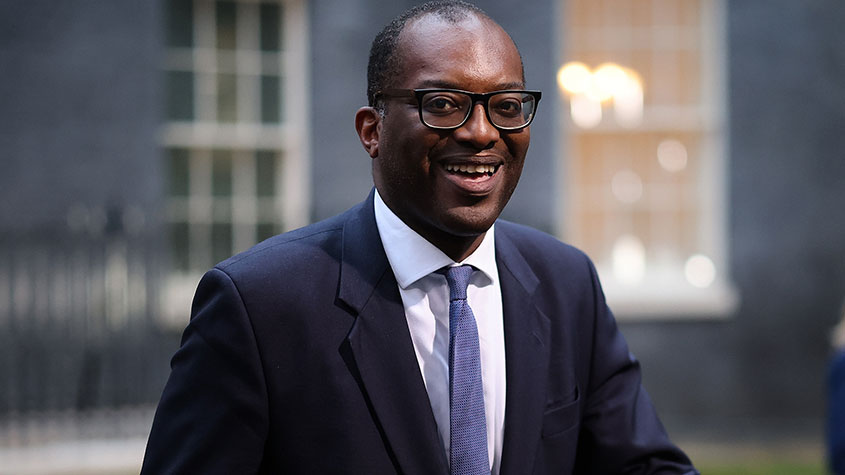

Mini-Budget: what we knowAnalysis New chancellor Kwasi Kwarteng is to deliver a “mini-Budget”. Nicole García Mérida explains what we can expect to see.

-

The public may have reached its limit for tax rises

The public may have reached its limit for tax risesEditor's letter The UK tax burden is now at a 70-year high. And, while there may be some reason to hold off on cuts right now, taxes are too high because the state tries to do too much. Perhaps it should do less, says Merryn Somerset Webb.

-

Rishi Sunak can’t fix all our problems – so why try?

Rishi Sunak can’t fix all our problems – so why try?Opinion Rishi Sunak’s Spring Statement is an attempt to plaster over problems the chancellor can’t fix. So should he even bother trying, asks Merryn Somerset Webb?

-

Here’s what the Spring Statement means for your money

Here’s what the Spring Statement means for your moneyAnalysis David Prosser looks into the details of Rishi Sunak's "jam tomorrow" Spring Statement and explains just what it means for you and your money.

-

The National Insurance rise is not needed – Sunak should have ditched it

The National Insurance rise is not needed – Sunak should have ditched itOpinion With our public finances in better shape than many people think, the chancellor's decision not to ditch the rise in National Insurance contributions is a mistake, says Max King.