Mini-Budget: what we know

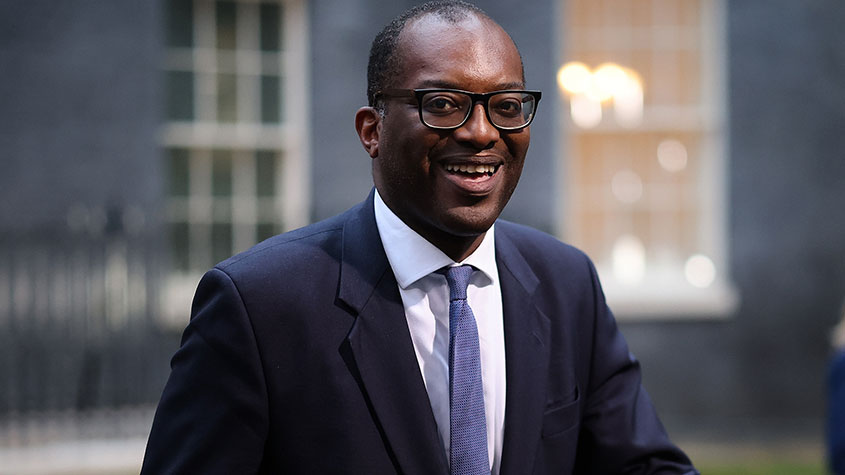

New chancellor Kwasi Kwarteng is to deliver a “mini-Budget”. Nicole García Mérida explains what we can expect to see.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Kwasi Kwarteng, the new chancellor of the exchequer, is delivering a “mini-Budget” tomorrow, Friday 23 September, packed with a series of tax cuts that are expected to affect everything from National Insurance to stamp duty to banker’s bonuses.

Prime minister Liz Truss has already promised several tax cuts throughout her leadership campaign with the goal of boosting economic growth. Take a look at what you can expect from the announcement.

National Insurance cuts

Truss repeatedly promised throughout her campaign to reverse the 1.25% hike in National Insurance implemented by then-chancellor Rishi Sunak back in April. A statement from the treasury released today (22 September) has confirmed it ahead of the official mini-Budget announcement.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The government will also cancel the planned health and social care levy, a separate tax which was expected to come into force April 2023. According to the government this will help nearly 28 million people across the country keep a larger portion of their salary.

The threshold at which workers begin to pay National Insurance, which was increased to £12,500 by Sunak after widespread calls for him to scrap the NI hike, is expected to remain the same.

A cut in stamp duty

There are also reports that suggest there are plans to also introduce a stamp duty holiday in order to stimulate the property market at a time of rising mortgage rates.

Stamp duty is a levy you pay when you purchase a property. You pay nothing on the first £125,000, 2% on the next £125,000, 5% on the next £675,000, 10% on the next £575,000 and 12% on anything above that.

First time buyers don’t pay stamp duty on the first £300,000 and then pay 5% on anything from £301,000 to £500,000.

However there are concerns it could do more harm than good.

Sarah Coles, personal finance expert at Hargreaves Lansdown, said: “Even if it does stimulate demand, it overlooks the fact that the real brakes on the property market is a severe shortage of supply. With an average of 36 properties on each agent’s books, we’re still close to an all-time low in the availability of property for sale. Driving demand without addressing supply would risk more buyers chasing a tiny number of properties, which would push prices up.

“By ramping up prices at a time of rising mortgage rates, the end result would be higher monthly mortgage costs, which would be increasingly unaffordable. And the Stamp Duty holiday wouldn’t help on this front. This in itself could be enough to put buyers off, and if it deters enough of them, it could end up having the opposite impact to the one that’s intended.”

The last time we saw a stamp duty holiday was during the pandemic in an attempt to boost economic growth — buyers paid no tax on the first £500,000 of a purchase. While this heated up the property market it also led to a mammoth increase in house prices.

However Truss believes the highest rate of stamp duty was preventing more transactions from taking place, so a source told The Times we can expect “radical” cuts to the levy. However, we think cuts to stamp duty aren’t enough. As my colleague Merryn Somerset Webb explains, we shouldn’t be cutting stamp duty, we should abolish stamp duty altogether.

Marriage tax allowance

Currently, married couples and those in civil partnerships are entitled to the marriage allowance, which lets one spouse or civil partner to transfer 10% (£1,250) of their personal allowance to the other, which means the latter pays less tax.

To be able to do so, either spouse has to earn below the personal allowance (£12,500) while the other has to pay income tax at the basic rate. This could lead to a £262 saving on income tax bill.

Kwarteng is expected to announce an extension to this tax relief by which couples could transfer their entire personal tax allowance to the other. This could save couples as much as £2,500, and would heavily benefit lower earners.

No increase to corporation tax and scrapping the cap on bankers’ bonuses

Truss has essentially confirmed she will not go ahead with the planned 1.25% increase in corporation tax, freezing it instead at 19%.

Kwarteng and Truss have also both proposed to scrap the cap on banker’s bonuses, which was introduced after the 2008 financial crisis to prevent bankers from making risky financial decisions to earn a higher bonus.

The aim is to help Britain “become more competitive” and to “help more investment flowing through the country”.

The pensions triple lock returns

The pensions triple lock was introduced in 2010 to guarantee that the state pension wouldn’t lose value in real terms and instead increase by the highest of average earnings, consumer price inflation, or 2.5%.

The government suspended the triple lock for 2022-2023 to avoid an increase to the state pension following the pandemic. Sunak confirmed the triple lock would return in 2023 and Truss has reiterated her commitment to the measure, even hinting at a 9%-10% increase in pensions next year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Conservatives pledge to cut National Insurance again – how much could you save?

Conservatives pledge to cut National Insurance again – how much could you save?News A 2p reduction in National Insurance is a key feature of the Tory’s general election manifesto.

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?