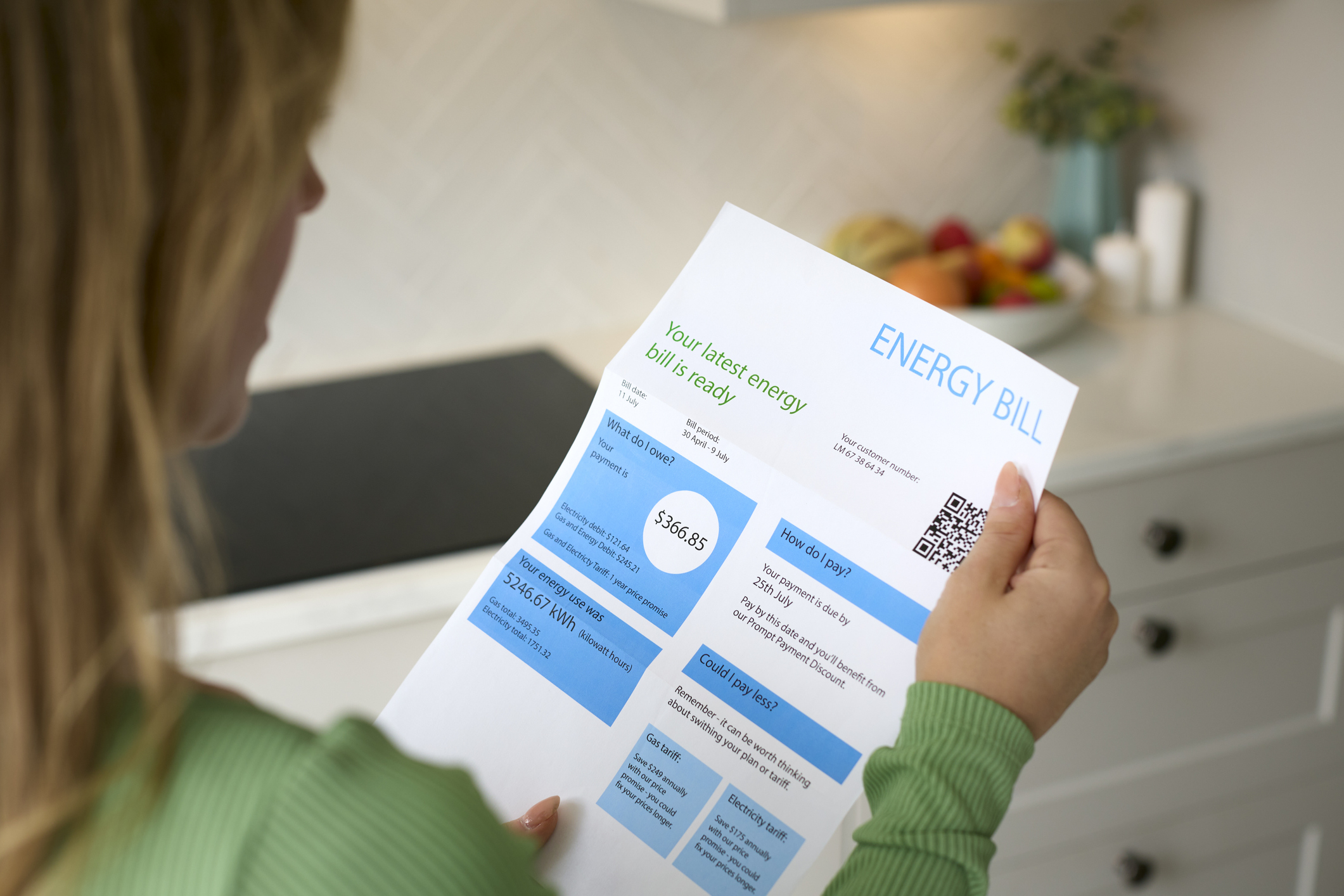

Gas and electricity bills to rise 5% under new energy price cap

The energy price cap will increase in the new year Ofgem, the energy regulator, has announced. We look at what your energy bill will look like in the new year

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Households will see typical gas and electricity bills rise by 5% from the new year after Ofgem unveiled an increase in the energy price cap this morning.

The energy regulator has set the price cap for January to March at £1,928 per year for typical customers who pay by direct debit, compared with £1,834 in October - though the actual amount you pay will depend on how much you use, as the cap is based on the unit price and not your total bill.

It comes after the price cap fell in October, providing some relief for household bills and pushing inflation down. But Ofgem says rising wholesale gas prices have gone up in recent months due to world events, including the conflict in the Middle East, meaning bills will rise from the new year.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The new cap, which comes into play on 1 January 2024, means average households will pay around £94 extra per year.

“This is a difficult time for many people, and any increase in bills will be worrying,” says Jonathan Brearley, chief executive of Ofgem.

“But this rise – around the levels we saw in August – is a result of the wholesale cost of gas and electricity rising, which needs to be reflected in the price that we all pay.

“It is important that customers are supported and we have made clear to suppliers that we expect them to identify and offer help to those who are struggling with bills.”

The price cap changes every three months and analysts are hopeful that energy bills could come down again in the spring.

What is the energy price cap?

The energy price cap limits how much suppliers can charge customers on default out-of-contract deals.

This applies to most users at the moment due to a lack of competitive fixed rate energy tariffs, but Ofgem is hopeful that this will change.

“We are seeing the return of choice to the market, which is a positive sign and customers could benefit from shopping around, with a range of tariffs now available offering the security of a fixed rate or a more flexible deal that tracks below the price cap,” adds Brearley.

“People should weigh up all the information, seek independent advice from trusted sources and consider what is most important for them, whether that’s the lowest price or the security of a fixed deal.”

Ofgem sets different caps depending on how bills are paid.

What are the new energy unit rates and standing charges?

From 1 January 2024, for a typical user paying by direct debit, the new rates are:

- 29p/kWh for electricity

- 7p/kWh for gas.

- The average daily standing charge will be 53 p/day for electricity and 30 p/day for gas.

That equates to paying £1,928 per year.

Customers using other payment methods tend to pay more.

The cap for prepayment meter users will increase from £1,861 to £1,960, while those who pay once they get the bill will see costs rise from £1,959 to £2,050.

Economy 7 users will be hit with a price cap rise from £1,219 to £1,272

Will standing charges be scrapped?

One of the main factors influencing energy bills is the standing charge, making up around 16% of household gas and electricity costs, which is set by individual suppliers but has a price cap based on where you live.

Ofgem is consulting on reforming this charge that could remove regional differences or combine it with the main price cap, although this could mean higher bills.

“It’s a timely reminder that inflation might be falling but some prices are still rising,” says Danni Hewson, head of financial analysis at Aj Bell.

“For households still trying to work out what yesterday’s Autumn Statement means for their finances, the news their energy bills are going up once again from January will be a bitter pill to swallow.

“Whilst it might work out at just £7.83 a month, that extra cost comes on top of all the other extra costs and doesn’t come with the government help many families relied on this time last year.

“So far this winter has been relatively mild, but that’s not likely to last. All those energy savings tips that have helped people limit their usage only go so far and turning down the thermostat by another degree will just mean unpleasantly cold rooms.”

When will energy prices fall?

Analysts are hopeful that energy bills will drop once the next price cap is set for April but households may have to wait until the summer to see a big difference.

Energy consultancy Cornwall Insight has forecast that the typical bill will fall back to £1,816 from the start of April, but users will have to wait until July to see a more significant drop to £1,793.

The analyst is then expecting the price cap to be £1,833 by October 2024.

You may be able to save money by opting for a fixed energy tariff, depending how the rates compare.

“With little in the way of direct energy bill support coming out of the autumn statement, consumers are likely to look at lowering energy usage to counteract high bills – particularly given that bills remain well above their historic averages,” says Dr Craig Lowrey, principal consultant at Cornwall Insight.

“However, as we move through 2024, it’s not just the persistently high unit costs that will be a worry; the looming rise in electricity standing charges from April adds another layer to the equation.

“Fundamentally, the solution extends beyond tweaking energy bills, given the underlying cause of rising energy bills over the last 24 months.

“We need a long-term strategy that reduces our dependence on imports of energy – particularly gas.

“By investing in domestic renewable energy sources, we can start to break free from the international market fluctuations and stabilise our energy prices for homes and businesses alike.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and the i newspaper. He also co-presents the In For A Penny financial planning podcast.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge