Financial stocks look cheap – but so they should

Philip Gibbs, manager of the Jupiter Financial Opportunities Fund, is buying financial stocks. They're cheap, he says. But they're cheap for very good reasons.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's still a good time to buy financial stocks. So says Philip Gibbs, manager of the Jupiter Financial Opportunities Fund. And to prove it, he's launching another finance-focused fund.

Now, you can ignore a lot of what fund managers say as being mere hype to sell their own products. But Gibbs isn't so easily dismissed. The Jupiter Fund has made a total return of 868% since launch in June 1997, ranking it first out of all 748 unit trusts over that period. And he played the financial crisis well, switching from equities to cash in 2007, because he was worried about high levels of household borrowing in the US and Britain. He was also sharp enough to move most of his investments outside Britain, avoiding the slide in sterling.

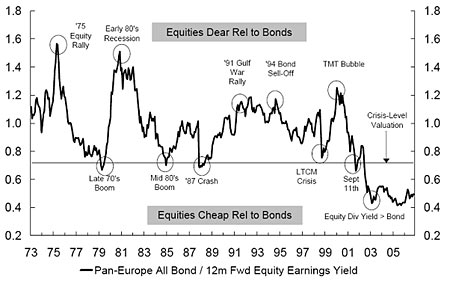

Now he reckons that stocks look good again. "Looking at the period between 1997 and 2002, the average ratio between the equity earnings yield and bond yields has been one to one and has never slipped below 0.7. However, since then the ratio has been around 0.5. In other words, you are getting double the earnings yield on equities as on government bond yields." Just look at the chart below. (Source: Jupiter)

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Financial equities look particularly attractive, he says. Cash is paying a return of close to 0%, while government bonds pay 3%-4%, corporate bonds 6%-7% and financial equities 10%. Some stocks are even paying more. For example, the equity earnings yield on Barclays is 14%.

It all sounds very compelling. But financials could be cheap for a reason. As MoneyWeek's James Ferguson points out, therearea lot of bogeymen still lurking around on bank balance sheets. HBOS and Lloyds combined, for example, have only declared loss ratios of 6.7% on their securities. US banks, on the other hand, have realised securities losses of 16.9%. "Our banks appear to have either been very lucky, very clever or still have further losses to realise."

And then there's today's Pre-Budget Report punishment to deal with. Whatever Alistair Darling pulls out of his little red bag, it's unlikely to be good news for banking profits. So despite Gibbs' undeniable track record, we'd have to disagree we'dsuggest steering clear of financials for now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jody studied at the University of Limerick and was a senior writer for MoneyWeek. Jody is experienced in interviewing, for example digging into the lives of an ex-M15 agent and quirky business owners who have made millions. Jody’s other areas of expertise include advice on funds, stocks and house prices.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

House prices to crash? Your house may still be making you money, but not for much longer

House prices to crash? Your house may still be making you money, but not for much longerOpinion If you’re relying on your property to fund your pension, you may have to think again. But, says Merryn Somerset Webb, if house prices start to fall there may be a silver lining.

-

Prepare your portfolio for recession

Prepare your portfolio for recessionOpinion A recession is looking increasingly likely. Add in a bear market and soaring inflation, and things are going to get very complicated for investors, says Merryn Somerset Webb.

-

Investing for income? Here are six investment trusts to buy now

Investing for income? Here are six investment trusts to buy nowOpinion For many savers and investors, income is getting hard to find. But it's not impossible to find, says Merryn Somerset Webb. Here, she picks six investment trusts that are currently yielding more than 4%.

-

Stories are great – but investors should stick to reality

Stories are great – but investors should stick to realityOpinion Everybody loves a story – and investors are no exception. But it’s easy to get carried away, says Merryn Somerset Webb, and forget the underlying truth of the market.

-

Everything is collapsing at once – here’s what to do about it

Everything is collapsing at once – here’s what to do about itOpinion Equity and bond markets are crashing, while inflation destroys the value of cash. Merryn Somerset Webb looks at where investors can turn to protect their wealth.

-

ESG investing could end up being a classic mistake

ESG investing could end up being a classic mistakeOpinion ESG investing has been embraced with enormous speed and zeal. But think long and hard before buying in, says Merryn Somerset Webb.

-

UK house prices will fall – but not for a few years

UK house prices will fall – but not for a few yearsOpinion UK house prices look out of reach for many. But the truth is that British property is surprisingly affordable, says Merryn Somerset Webb. Prices will fall at some point – but not yet.

-

This isn’t the stagflationary 1970s – but neither is it the low-rate world of the 2010s

This isn’t the stagflationary 1970s – but neither is it the low-rate world of the 2010sOpinion With soaring energy prices and high inflation, it might seem like we’re on a fast track back to the 1970s. We’re not, says Merryn Somerset Webb. But we’re not going back to the 2010s either.