The AI Revolution – a commodities play?

The critical materials that are powering AI

A single search query on Chat GPT consumes around 1500% more energy than a simple search google search. The overall energy amounts are marginal on their own. Even taken in aggregate, it is a blip in terms of total global energy demand. However, it is illustrative of the potential big increases in electricity demand that will come from the AI revolution.

Over the past 20 years, the US has seen its electricity demand stagnate. While its economy has grown, it has been able to avoid boosting its electricity generation thanks to efficiency savings. But this is now changing, and a big reason is the boom in data centre demand – and AI data centre demand in particular

Bloomberg. For illustrative purposes only.

For example, the US’ mid-Atlantic region (referred to as PJM) has one of the densest clusters of data centres in the US. Dominion Resources, the utility company servicing the region, is forecasting a large ramp-up in electricity demand over the coming years. This demand increase is principally being driven by data centres which serve advanced computing and AI needs. Similar patterns can be expected across the country.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This trend is also global, with data centre demand expected to double. As the International Energy Agency states, “Data centres are significant drivers of growth in electricity demand in many regions. After globally consuming an estimated 460 terawatt-hours (TWh) in 2022, data centres’ total electricity consumption could reach more than 1 000 TWh in 2026.” The organisation notes that this increase in demand is roughly equivalent to the electricity consumption of Japan.

So, while many investors often chase the AI theme through exposure to tech stocks, especially through big names such as Microsoft, it is also worth highlighting the materials or commodity angle — a literal picks and shovels approach.

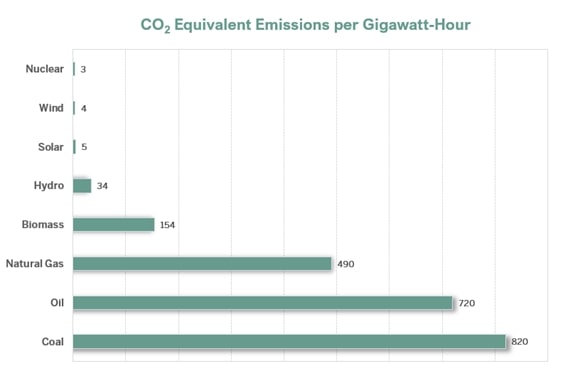

The role of Nuclear Energy

Nuclear energy will potentially play a key role in supplying the electricity for this expected boom in demand, particularly given its zero-carbon credentials. Nuclear energy emits almost no carbon when producing electricity. To meet these growing electricity demands, without derailing the world’s various net-zero targets, nuclear energy is essential.

Sprott Asset Management. For illustrative purposes only

Technology firms are already noting this. Microsoft is increasingly looking to nuclear energy to meet its data centre electricity needs. In 2023, the tech giant signed an agreement with Constellation Energy to buy nuclear power to cover 35% of the energy needs for one of its Virgina data centres.

Meanwhile, Amazon Web Services (AWS), the world’s largest operator of data centres, recently acquired a new data centre campus in Pennsylvania. The data centre sits adjacent to, and will be powered by, the Susquehanna Steam Electric Station, the sixth-largest nuclear power plant in the US.

With more nuclear energy generation, uranium is expected to see greater demand. The uranium market is already tight – primary uranium mine supply is significantly trailing demand, with a cumulative forecasted supply shortfall of approximately 1.5 billion pounds by 2040. This added component will put more pressure on the uranium price, to the potential benefit of the miners.

The importance of copper

But generating electricity is only one part of the story. At the same time, getting the electricity generated by nuclear energy to the end user requires transmission. That requires a lot of copper. A buildout of new data centres will require electricity grid expansions and upgrades.

As with uranium, the copper market is facing a supply deficit. Copper will be a key metal in the energy transition, with 2.5x more copper wiring in an EV than a conventional car, while solar panels and wind turbines require grid expansions and upgrades. The additional demand for copper from the AI revolution and data centre buildout simply adds to this.

So, while the growth of AI presents many potential opportunities within technology stocks, that is only part of the story. The expected surge in electricity demand, driven by AI, will add to the investment case for key metals, whether copper for grid expansions and upgrades, or uranium to meet growing lowcarbon energy needs.

In this anticipated scenario, the miners of these commodities could be poised to benefit. If demand consistently falls short of supply, as forecasts suggest, then miners will need to expand production and extract more of these critical commodities to plug the gap. As the prices of these materials rises, these mining operations should become more profitable, incentivising new miners to enter the field.

To explore HANetf's full range of commodities and mining ETFs, visit our Metals and Mining Hub

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tom Bailey is Head of Research at HANetf, which entails him staying on top of the various themes and asset classes accessible by ETFs or ETCs on the HANetf platform. He is regularly cited in the press, including the Financial Times, Reuters and The Times. Tom was previously ETF specialist at interactive investor. Prior to this, he was a financial journalist and edited the book Money Observer: Your Guide to Investment Trusts.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Three promising emerging-market stocks to diversify your portfolio

Three promising emerging-market stocks to diversify your portfolioOpinion Omar Negyal, portfolio manager, JPMorgan Global Emerging Markets Income Trust, highlights three emerging-market stocks where he’d put his money

-

New year, same market forecasts

New year, same market forecastsForecasts from banks and brokers are as bullish as ever this year, but there is less conviction about the US, says Cris Sholto Heaton

-

How to profit from the UK leisure sector in 2026

How to profit from the UK leisure sector in 2026The UK leisure sector had a straitened few years but now have cash in the bank and are ready to splurge. The sector is best placed to profit

-

Metals and AI power emerging markets

Metals and AI power emerging marketsThis year’s big emerging market winners have tended to offer exposure to one of 2025’s two winning trends – AI-focused tech and the global metals rally

-

Quality emerging market companies with consistent returns

Quality emerging market companies with consistent returnsOpinion Mark Hammonds, portfolio manager at Guinness Global Investors, selects three emerging market stocks where he'd put his money

-

Coreweave is on borrowed time

Coreweave is on borrowed timeAI infrastructure firm Coreweave is heading for trouble and is absurdly pricey, says Matthew Partridge