Summary

- Nvidia rounds off Magnificent Seven results season with an earnings beat;

- Revenue increased 69% year-over-year to $44.1 billion;

- Nvidia’s quarterly earnings per share came in at $0.81, beating analyst expectations but down on the previous quarter for the first time since 2022;

- Nvidia's shares gained 4.9% in after-hours trading following the earnings beat;

- Trump's tariffs have been challenged by a US court, lifting stocks further today.

The team at MoneyWeek is reporting live. Scroll for the latest news and analysis.

| Nvidia shares | Magnificent seven stocks | US-China trade | Tech and AI stocks to watch |

Nvidia's quarterly earnings: the lay of the land

Good morning, and welcome to our live blog covering Nvidia’s earnings release. What a difference a quarter makes.

Three months ago, the question on every investor’s lips was whether Nvidia could defy DeepSeek, the Chinese AI chatbot that appeared to be able to outperform Western models like ChatGPT, without relying on Nvidia’s premium chips.

That now seems a distant memory, with Donald Trump’s ‘Liberation Day’ tariffs having since thrown global markets into turmoil. While the worst of the tariffs are now mostly subject to temporary pauses, the future for the global economy, particularly US-China trade, is far from certain.

Nvidia’s earnings is always one of the highlights of the investing calendar, and the team at MoneyWeek are ready to bring you rolling news and in-depth analysis in the run-up and as the event unfolds. Stay with us for all the updates.

When does Nvidia announce results?

Nvidia’s results will be announced tomorrow (Wednesday 28 May) after markets close in the US, which happens at 9pm in the UK.

Nvidia’s earnings call is scheduled to take place at 2pm PT, which is 10pm in the UK. This is where we’ll hear CEO Jensen Huang discuss the company’s outlook and field calls from analysts. This is where you’d expect to see investors’ big questions, particularly the impact of Trump’s frosty trading relationship with China on Nvidia’s outlook, get answered.

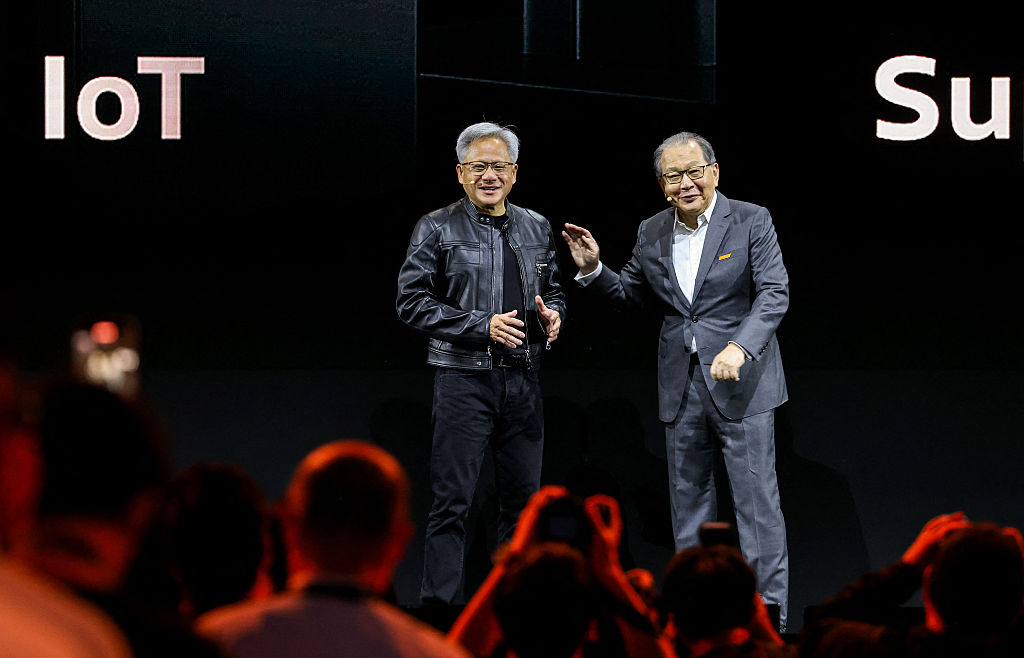

Nvidia CEO Jensen Huang (left) on stage with MediaTek CEO Rick Tsai during a keynote speech for Computex 2025 at the Taipei Nangang Exhibition Center Hall in Taiwan last week. Given Nvidia’s reliance on Taiwan in its supply chain and the size of the Chinese market for semiconductors, questions over the impact of US trade tariffs will likely loom large over Nvidia’s upcoming earnings release.

US markets will be closed, but the shares will be traded in after-hours trading, which will give an indication of markets’ initial reaction to Nvidia’s results and management’s comments.

Nvidia’s results: what to expect

So what are we expecting from Nvidia’s upcoming earnings release?

Analysts polled by London Stock Exchange Group (LSEG) expect Nvidia’s earnings per share (EPS) to increase 44.3% year-over-year to $0.88 for the first quarter of its 2026 financial year.

If that figure is accurate, it implies a slight decline quarter-over-quarter, with Nvidia’s Q4 2025 EPS having hit $0.89. That would make it Nvidia’s first quarterly EPS decline since Q2 of its 2023 financial year (which coincided with Putin’s invasion of Ukraine, which significantly dented the performance of technology companies).

Quarterly revenue is expected to increase 65.9% year-over-year to $43.21 billion.

Export controls could cost Nvidia $50 billion

Besides the headline numbers, investors will be particularly interested in the sales of Nvidia’s individual products, particularly its latest generations of AI chips, as well as the impact that trade tensions between the US and China could have on its profits.

“Much attention will fall on the rollout of Blackwell Ultra GPUs – Nvidia’s latest high-performance chips boasting up to 30% better performance and improved efficiency,” says Alex Rudolph, market analyst at IG. “Alongside this, the RTX 50-Series – including the more accessible RTX 5060 – extends Nvidia’s AI push into the consumer space.”

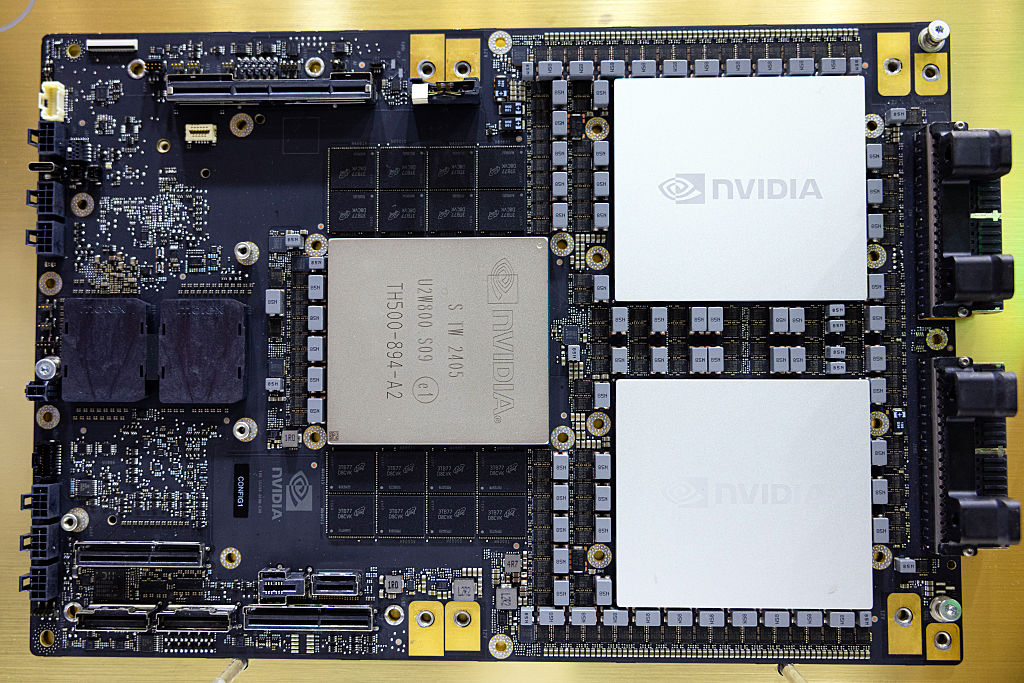

An Nvidia Corp. GB200 Grace Blackwell superchip. Investors will watch for the success of the Blackwell rollout closely when Nvidia announces earnings tomorrow.

But “geopolitics remains a drag”, Rudolph adds. Nvidia’s CEO Jensen Huang has warned that export controls on its highest-end chips, as part of US government initiatives to restrict China’s access to AI technology that began under Joe Biden, could cost the company $50 billion.

“Recent tariff relief offers a sliver of optimism,” says Rudolph.

Nvidia shares open 2% higher

US markets have started trading for the day, and Nvidia’s shares have opened 2.2% above last week’s close.

Nvidia stock has fallen 0.1% in the year to date, but has staged a recovery since the downturn that Trump’s tariffs instigated, gaining 28% over the past month.

Nvidia developing cheaper Chinese chip

Nvidia is developing a new AI chipset for the Chinese market, which will be priced at around $6,500-8,000, significantly lower than the $10-12,000 that its H20 chips currently sell for, according to sources familiar with the matter cited by Reuters.

If the chip is approved for sale in China, it could “soften the blow” of export restrictions which could cost the business $15 billion in sales next year alone, according to Lale Akoner, global market analyst at eToro.

“The Godfather of AI”: why Nvidia’s earnings matter to you

Why do Nvidia’s results matter to the average investor?

There’s a credible argument that Nvidia is the most important individual stock in the world at present. It is the world’s second-most valuable company by market cap (as of market close on 23 May) and comprises about 6% of the S&P 500, making it the index’s second-largest constituent.

Unlike Microsoft, which currently occupies top spot on both counts, Nvidia is a true bellwether for the AI market, which underpins the investment case for Microsoft and the rest of the Magnificent Seven stocks. It builds the infrastructure for AI, and as such, its performance and outlook are a direct reflection of market confidence in the future of the technology economy, which has been the biggest stock market driver for over a decade.

“There is no company in the world more important to the markets and global investor sentiment than Nvidia,” says Dan Ives, global head of technology research at Wedbush Securities. “The Street [will be] laser focused tomorrow after the bell when we hear April results/guidance from the Godfather of AI Jensen [Huang].”

Nvidia CEO Jensen Huang has been branded “the Godfather of AI” by a top Wall Street analyst, ahead of Nvidia's earnings release tomorrow.

In a very real sense, the strength of investor sentiment following Nvidia’s earnings release tomorrow will directly impact the tracker funds that, most likely, comprise much of your pension fund – so even if you don’t consider yourself an active investor, you are likely far more exposed to Nvidia’s shares than you realise.

Nvidia’s earnings: investors will look for guidance, says eToro

Investors will be just as focused on the forward-looking numbers – the guidance – as they are on Nvidia’s raw Q1 numbers, which after all are backward-looking at this point.

What the company says it will achieve, and how CEO Jensen Huang and the wider management team respond to analyst questions in the earnings call, will dictate the short-term market reaction to tomorrow’s earnings results.

“The real test lies in [Nvidia’s] guidance and ability to ease investor concerns,” says Lale Akoner, global market analyst at eToro.

Could Middle East make up for Nvidia’s lost China sales?

The US administration is in the process of rewriting the rules surrounding the export of advanced AI chips, like Nvidia’s, to China.

Jensen Huang has been outspoken about the impact of the restrictions, calling them “fundamentally flawed” during a conference in Taiwan last week. Some analysts, though, think that Nvidia will make up for the lost sales thanks to a concerted effort in the Middle East to boost the region’s AI capabilities.

Donald Trump is reported to have negotiated deals allowing Nvidia and rival Advanced Micro Devices (AMD) to export more of their high-end AI chips to US allies in the region, particularly Saudi Arabia and the United Arab Emirates.

These countries “are pouring billions into AI infrastructure, buying hundreds of thousands of GPUs,” says Lale Akoner, global market analyst at eToro.

“This is all part of a regional focus in the Middle East building out datacenters and the AI Revolution which will start to vault UAE, Saudi, Qatar to the priority list for US tech companies,” says Dan Ives, global head of technology research at Wedbush Securities.

Thanks for following the blog today. That's everything from us for now.

Join us tomorrow for more previews of Nvidia's results, plus live coverage of the release itself and the accompanying earnings call.

Good morning, and welcome back for Nvidia's results day. Stay tuned throughout the day for rolling preview, and live analysis this evening as we cover Nvidia's earnings call live.

Nvidia’s shares gain 3% on penultimate session before earnings

Nvidia’s shares made a strong start to yesterday’s session and closed the day out 3.2% up.

Pre-market trading suggests that today could be a different story. Nvidia shares are down 0.2% in pre-market trading this morning.

“A wait-and-see mood looks set to spread on Wall Street,” says Susannah Streeter, head of money and markets, Hargreaves Lansdown. “All eyes will be drawn to Nvidia’s results due out later, and given the trade tariff turmoil which struck in April, there’s an expectation that the numbers and guidance might not be as stellar as investors have become used to.”

Wedbush Securities bullish on Nvidia

California-based financial services firm Wedbush Securities maintains a bullish outlook on Nvidia heading into this earnings release.

Despite the ban on sales of H20 chips to China that came into effect during the quarter, Matt Bryson, managing director at Wedbush, thinks that H20 sales were running ahead of expectations prior to the ban.

“We also believe Blackwell, if anything, has ramped better than anticipated following some initial stumbles,” Bryson adds.

He reiterates an Outperform rating for Nvidia stock as well as a price target of $175, which implies 29.2% upside from yesterday’s close.

Could Nvidia’s earnings fall this quarter?

Nvidia has become one of the dominant stock market players because, for around three years, it has consistently posted huge revenue and earnings increases in its quarterly results.

These have generally exceeded analysts’ expectations, which have struggled to keep pace with Nvidia’s seemingly inexorable rise.

It’s of course impossible for a company to keep growing at the kind of exponential rates that Nvidia posted for much of this run (its earnings per share (EPS) multiplied by more than 12 in the year to Q3 of its fiscal year 2024, i.e. August-October 2023).

The trend has been consistently upwards, though, even if the pace of growth has slowed. But analysts polled by FactSet currently expect Nvidia to post EPS of $0.73 this quarter.

That marks a 19.7% year-over-year increase, but it would imply a drop since the first quarter if it is correct. That would be the first time that Nvidia’s earnings have fallen quarter-over-quarter in almost three years.

Salesforce also announcing results

It isn’t just Nvidia’s earnings that we have to look forward to this evening in the world of big tech. Salesforce is also announcing its quarterly earnings after the bell today.

Analysts polled by FactSet forecast earnings per share (EPS) of $2.55 for the quarter. That implies a 4.5% increase year-over-year.

Salesforce recently announced that it was acquiring Informatica, a data management software firm, for around $8 billion in equity.

Dan Ives, global head of technology research at Wedbush Securities, calls this the “right deal at the right time” for Salesforce.

“We view this deal as a smart and strategic deal for customer acquisition as Infromatica’s strong customer base of over 5,000 customers, including… over 80% of the Fortune 100, leverages this technology for analytics and AI-powered processes which could strengthen CRM’s AI strategy,” Ives adds.

Nvidia shares make cautious start ahead of earnings

US markets have now opened, and Nvidia’s stock began the final session before its earnings release 0.4% above yesterday’s close. However, the stock has since fallen back to around 0.2% below where it closed yesterday.

There is apparently a degree of caution among investors surrounding the chipmaker, which is permeating the wider market. The S&P 500 is trading flat so far.

Recap: What time does Nvidia announce results?

As a reminder, Nvidia’s earnings release is expected after US markets close today, at 9pm BST.

The earnings call, which is likely to include the most relevant details about the company’s future growth expectations and how management expects the simmering trade tensions to impact its business, will start at 10pm BST.

Nvidia’s shares will continue to be traded in after-hours trading until 1am tomorrow. Price movements in Nvidia’s stock during this period will reflect the market’s initial reaction to the earnings release and management commentary.

What do analysts expect from Nvidia’s earnings guidance?

The quarter for which Nvidia is announcing results is to a large extent ancient history. It mostly predates the imposition of tariffs which will likely have a huge bearing on Nvidia’s performance over coming months and, possibly, years.

The immediate mood is likely to be set by the guidance that the business issues for the upcoming quarter. Here’s what analysts polled by FactSet expect on that front:

Q2 revenue | Q2 earnings per share (EPS) |

|---|---|

$45.9 billion | $1.00 |

Nvidia’s stock price movements in after-hours trading could well be informed by management’s statements in relation to these figures, rather than whether or not Nvidia’s results beat or miss the expectations for the quarter just ended.

There's going to be a break in reporting for a little while. We'll post any breaking stories as they come up, but full coverage will resume from 9pm when we'll bring you live coverage of Nvidia's results and earnings call.

China sales ban complicates setup ahead of Nvidia’s results

Welcome back to our live coverage. As we approach the close of US markets, Nvidia stock has fallen around 0.2% today. We should have the financial results within the next hour or so, and these – plus the management comments during the following earnings call – will dictate how the stock looks come tomorrow morning.

The short-term share price reaction is hard to predict. Nvidia could well be about to post its first quarter-over-quarter earnings per share (EPS) decline in almost three years, if analysts are to be believed.

Christopher Rossbach, chief investment officer at J. Stern & Co, isn’t concerned about the impact of a quarterly drop in EPS.

“The issues are due to the ban on selling H20 chips to China and the associated $5.5 billion charge for inventory and purchase commitments Nvidia has made,” Rossbach tells MoneyWeek. The setup ahead of this release is “confusing”, he says, because some analysts have factored this impact in their forecasts, while others haven’t.

“In our view, investors and analysts who follow the company closely have already priced in these factors and should not be unsettled by the headline results,” he says. “The stock should not react significantly to a quarter on quarter revenue decline alone – unless it indicates a notable slowdown. What will matter more for the share price is what Nvidia says about the scale of its fundamental business opportunity.”

Nvidia shares close 0.5% down

Today’s trading has closed; Nvidia’s results are due imminently.

Nvidia stock fell 0.5% today, but will continue to trade for the next four hours in after-hours trading. That’s where we’d expect the earnings-related volatility.

BREAKING: Nvidia beats analyst earnings expectations

Nvidia has announced earnings per share (EPS) of $0.81, on revenue of $44.1 billion, beating FactSet analyst estimates of $0.73 on revenue of $43.3 billion.

Nvidia stock pops 3% on earnings release

Nvidia’s shares have gained 3.1% in after-hours trading on the strength of that release.

More details on the figures to come shortly.

Nvidia’s earnings fall 9% since last quarter

Adjusted EPS has increased 33% year-over-year to $0.81, but that means the stock has slipped by 9% on a quarter-over-quarter basis for the first time since early 2022.

However, Nvidia clarified that absent a $4.5 billion charge for excess inventory and purchase obligations of its H20 chips, which were hit by export controls to China during the quarter, EPS would have been $0.96.

Revenue increased 69% year-over-year to $44.06 billion.

Jensen Huang: AI is becoming infrastructure

In written comments accompanying Nvidia’s results, CEO Jensen Huang said the following:

“Our breakthrough Blackwell NVL72 AI supercomputer – a ‘thinking machine’ designed for reasoning – is now in full-scale production across system makers and cloud service providers,” said Huang.

“Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate.

“Countries around the world are recognizing AI as essential infrastructure — just like electricity and the internet — and NVIDIA stands at the center of this profound transformation,” said Huang.

Nvidia Q2 guidance

Analysts had been expecting Q2 revenue guidance of $45.9 billion ahead of the earnings release.

The results themselves give the following guidance for the next quarter:

Revenue is expected to be $45.0 billion, plus or minus 2%. This outlook reflects a loss in H20 revenue of approximately $8.0 billion due to the recent export control limitations.

So perhaps a little underwhelming on paper. But the theme that is emerging with the results – and will likely persist throughout the earnings call (and the coming weeks) – is that Nvidia is not being shy about quantifying the business costs of the recent trade disruption.

Nvidia earnings call begins

The earnings call is underway. We’ll shortly hear from Nvidia’s CEO Jensen Huang and wider management on the results that have just been announced.

Nvidia CFO: No grace period for H20 export controls

Colette Kress, chief financial officer at Nvidia, has opened the call by diving straight into the impact of the H20 chip export restrictions.

“On April 9, the US government issued new export controls on H20, our data centre GPU designed specifically for the China market," said Kress.

“Although our H20 has been in the market for over a year and does not have a market outside of China, the new export controls on H20 did not provide a grace period to allow us to sell through our inventory.

“In Q1 we recognised $4.6 billion in H20 revenue, which occurred prior to April 9, but also recognised a $4.5 billion charge as we wrote down inventory and purchase obligations tied to orders we had received prior to April 9.”

Kress also included a pointed remark that Nvidia “sold H20 with the approval of the previous administration”.

Blackwell chips account for 70% of data centre revenue

Kress has provided a positive update on the rollout of the latest Blackwell chips, the next generation on from the previous Hopper chips.

“Blackwell contributed nearly 70% of data centre compute revenue in the quarter, with a transition from Hopper nearly complete,” she says.

China revenue will be significantly lower in Q2

Kress has warned that the trade disruption will lead to a significant decrease in revenue from China next quarter.

“China as a percentage of our data centre revenue was slightly below our expectations and down sequentially due to H20 export licensing controls,” she says.

“For Q2 we expect a meaningful decrease in China data centre revenue.”

Jensen Huang: China market effectively closed

Nvidia’s founder and CEO Jensen Huang is now speaking, and is directly attacking the restrictions that are blocking chip exports to the country.

“China is one of the world's largest AI markets and a springboard to global success, with half of the world's AI researchers based there,” says Huang. “The platform that wins China is positioned to lead globally.

“Today, however, the $50 billion China market is effectively closed to US industry.

“As a result, we are taking a multi-billion dollar write-off on inventory that cannot be sold or repurposed,” says Huang.

Huang: China already has AI

Huang goes on to question the rationale of blocking US businesses from exporting AI hardware to China.

“China's AI moves on with or without us,” Huang continues. “It has the compute to train and deploy advanced models.

“The question is not whether China will have AI: it already does. The question is whether one of the world's largest AI markets will run on American platforms. Shielding Chinese chipmakers from US competition only strengthens them abroad and weakens America's position.

“The US has based its policy on the assumption that China cannot make AI chips. That assumption was always questionable, and now it's clearly wrong. China has enormous manufacturing capability,” he says.

Nvidia's place in the America-first agenda

Huang has, however, then stepped back from criticism of White House policy.

“President Trump has outlined a bold vision to reshore advanced manufacturing, create jobs and strengthen national security,” he says. “We share that vision.”

He details the plans that supplier Foxconn has, in partnership with Nvidia, to boost its manufacturing capacity in the US, whilst outlining “our goal, from chip to supercomputer, built in America within a year”.

He has also praised Trump for his role in facilitating the sovereign AI deals, particularly in the Middle East.

“The deals [Trump] announced are wins for America, creating jobs, advancing infrastructure, generating tax revenue and reducing the US trade deficit,” he says.

Huang: AI is the infrastructure of the future

We are now into the analyst questions. Huang is going strong on a line that AI is becoming a form of infrastructure comparable to electricity or the internet, and that Nvidia is building the factories that will produce it.

“We’re clearly at the beginning of the build out of this infrastructure. Every country will have it: that I’m certain of.

“What’s unique about this infrastructure, is it needs factories.”

Nvidia is fully repositioning itself as no longer a manufacturer of chips, but the builder of these AI factories: the supplier of the global utility of the future, as he describes it.

Nvidia stock responds to earnings call

These remarks are going well down with investors. Nvidia's share price has gained 4.6% in after-hours trading.

Could Nvidia develop a new chip for China?

There’s a question on the exact situation regarding export controls to China, and whether or not Nvidia is able to develop a new chip to replace the H20 and export there.

“It’s the end of the road for Hopper,” says Huang. He emphasises that the limits on exports are the key to understanding why they can’t simplify Hopper any further.

“We’re considering it and thinking about it… when the time comes we’ll engage the administration and discuss that,” he says.

The earnings call has now concluded. Nvidia has once again beaten earnings expectations and seen its share price rise in after-hours trading, with investors lapping up the bold vision of the future that CEO Jensen Huang has depicted.

That concludes our coverage for this evening. Thanks for following today, and join us tomorrow for more analysis and reaction to Nvidia's results.

Nvidia shares surge, tariff halt lifts US stocks

Good morning, and welcome back to our coverage of the aftermath of Nvidia’s Q1 results.

Nvidia stock was 4.9% up at the close of after-hours trading yesterday, and is making further gains this morning, trading 5.3% above yesterday’s regular hours close.

That’s in part due to a strong earnings release. But US stock market futures as well as European and Asian stocks have been lifted on news that a US court has moved to block the most stringent of Donald Trump’s tariffs.

Plenty to dive into there given how much trade talk dominated the earnings call last night, as well as analysis of the results themselves. We’ll bring you rolling updates throughout the day: stay tuned!

Sovereign AI boosts Nvidia on earnings call

One of the key themes that Nvidia CEO Jensen Huang stuck to on last night’s earnings call was the idea of sovereign AI, like the huge spending that the Saudi Arabian government has recently committed to.

This agreement, which will see the Kingdom build up to 500 megawatts of AI capacity, will deploy an 18,000 NVIDIA GB300 Grace Blackwell AI supercomputer as its first phase.

“The AI Revolution is heading into its next gear of growth despite the Trump tariff war playing out,” says Dan Ives, global head of technology research at Wedbush Securities. “We also note that the ongoing US/China negotiations could yield positive results for Nvidia over the coming months that could get Nvidia back in the China H20 game.”

Nvidia’s cash pile

It was all about the mood music that came from Nvidia’s management on the call last night.

Despite short-term challenges, the outlook from Huang and Colette Kress, Nvidia’s chief financial officer, painted a robust, bullish and compelling vision of an AI-driven near future, powered of course by Nvidia’s chips.

“Investors came into this quarter looking for signs that Nvidia could alleviate short-term concerns. What they got was a clear message that demand remains robust [and] Blackwell is ramping up fast, says Josh Gilbert, market analyst at eToro.

Gilbert draws attention to the “war chest” of cash that Nvidia has amassed.

| Header Cell - Column 0 | 27 April 2025 | 28 April 2024 |

|---|---|---|

Cash, cash equivalents and marketable securities (millions) | $53,691 | $31,438 |

Adding nearly $22 billion in cash over the course of a year has given Nvidia “the firepower to keep innovating through R&D, maintain its leadership at the forefront of AI and potentially even reward shareholders with buybacks or dividends,” says Gilbert.

It’s noteworthy that this cash pile has been amassed despite over $14 billion worth of shares having been repurchased in the previous quarter.

AI not the only game in town for Nvidia

With much of the focus understandably on AI, it should not be overlooked that “Nvidia hasn’t forgotten its gaming roots”, says Derren Nathan, head of equity research at Hargreaves Lansdown.

Nvidia “announced that it’s the force behind the latest incarnation of the Nintendo Switch”, says Nathan, as sales of gaming and AI PC chips increased 48% to $3.8 billion during the quarter.

During last night’s earnings call, Nvidia revealed that its gaming chips and AI technology will power the upcoming Nintendo Switch 2.

The Nintendo Switch 2 is due for release on 5 June, and “leverages Nvidia's neuro rendering and AI technologies”, according to Nvidia’s chief financial officer Colette Kress, speaking in last night’s earnings call.

Salesforce earnings

Nvidia was not the only big tech company announcing earnings yesterday.

Salesforce also delivered a strong set of results. Revenue of $9.83 billion beat analyst expectations of $9.75 billion, while earnings per share (EPS) came in at $2.58, compared to expectations of $2.55.

Dan Ives, head of global technology research at Wedbush Securities, praised the rollout of Agentforce, Salesforce’s agentic AI model to assist sales professionals, in particular.

“With Agentforce monetisation starting to take hold and bolstering the growth of CRM’s AI strategy, we believe the company is now going on the offensive in scaling this strategy over the next 12-18 months,” said Ives.

Salesforce raised its full year guidance, to $41.0 - 41.3 billion in revenue with a non-GAAP margin of approximately 34%. Wedbush reiterated an Outperform rating and a $425 price target, implying 54% potential upside from yesterday’s close.

Nvidia stock opens 5.5% higher

US stock markets are open, and Nvidia’s share price began trading 5.5% above yesterday’s regular hours close. The news that Trump’s tariff regime could be facing a legal roadblock also appears to have lifted the stock slightly over the gains it made in after-hours trading yesterday.

Nvidia’s political balancing act

Nvidia CEO Jensen Huang clearly had a tricky remit during yesterday’s earnings call.

Certain headline figures that, on paper, would have been hugely disappointing were tied closely and unquestionably to Trump’s trade policy. Particularly, the $4.5 billion charge incurred as a result of bans on H20 chip exports to China, the absence of which would have boosted Nvidia’s quarterly earnings to an impressive $0.96 per share.

“The US has based its policy on the assumption that China cannot make AI chips. That assumption was always questionable, and now it's clearly wrong,” said Huang.

Trump, though, is clearly not a man to upset, and Huang was as careful to praise every aspect of the president’s agenda that he could.

“While Nvidia did talk to the significance of the lost opportunity in China, Jensen [Huang] also appeared to make a concerted effort to credit the current administration for recent sovereign deals, talk to Nvidia’s plans to further US investment (a key touch point for president Trump), while also suggesting management has faith in the US government's likely future actions with regards to trade and AI,” says Matt Bryson, managing director at Wedbush Securities.

“While we believe this approach is likely best suited to minimizing potential political headwinds for NVDA, it also highlights that political decisions (AI diffusion, tariff, and China policies) are seemingly the only potential significant stumbling blocks for NVDA over the next 12+ months,” Bryson added.

How does tariff ruling impact Nvidia?

News this morning that the US Court of International Trade (CIT) has challenged the legal basis for Trump’s tariffs has buoyed stock markets. What does it mean for Nvidia in particular, though?

If the decision survives the upcoming appeal from the Trump administration then one impact would be to reduce Nvidia’s materials costs.

“The decision invalidated much of the Trump-era import duty regime, which had threatened to raise the cost of semiconductor components and other tech hardware, items Nvidia depends on for its high-end AI chips and GPUs,” Kate Leaman, chief market analyst at AvaTrade, tells MoneyWeek.

Taiwan Semiconductor Manufacturing Company's (TSMC) factory in Shanghai, China. TSMC is a major supplier to Nvidia, and given its operations are largely based in Taiwan and China, could be a source of increased costs for Nvidia should reciprocal tariffs remain.

These increased costs had previously forced Nvidia to raise prices by 10-15%. But in light of the CIT’s ruling, “Nvidia stands to benefit from an immediate drop in import-related expenses… welcome news for a company whose most advanced chips are produced through overseas partners like Taiwan’s TSMC”, adds Leaman.

Should the decision stand, removing the tariffs should give Nvidia greater pricing flexibility and help to preserve its margins.

Thank you for following Nvidia’s earnings news with us. We’re going to end live coverage here for now, but join us again in three months’ time, when Nvidia next announces results.