AI will maintain Moody’s market lead, says Stephen Connolly

Veteran data provider Moody's has adapted well to the modern world, and is one of Warren Buffett’s longest-held investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I remember flicking through old investment books in my father’s study in my teens. They were published in America by the financial-data firm Moody’s and were a gold standard for accurate financial data and quality ratings of public companies. This was just over 40 years ago, well before the internet. People and businesses paid to have reliable data brought together in an accessible form for analysis and decision-making. This is Moody’s business. Accessing firms’ data by post in book form has long since given way to sourcing it via computers, the internet and AI. Companies and the securities they issue have grown exponentially. But Moody’s has more than kept pace, supplying and analysing the data the market needs.

Valued today at around $83 billion, Moody’s has issued credit ratings on nearly $76 trillion of outstanding debt and more than 33,300 organisations and structured finance deals, which investors rely on as independent assessments of an issuer’s financial wherewithal to service its obligations. It’s also providing analytical tools that combine its data and research for risk-assessment and decision-making to nearly 15,000 clients, such as corporations, banks, brokers, asset managers, hedge funds, insurers and property dealers.

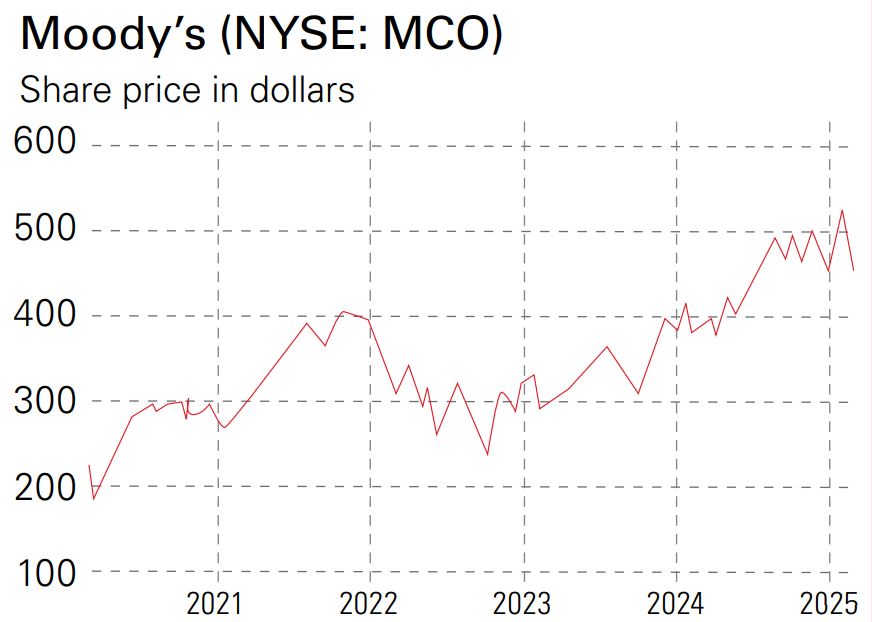

The net result for investors in Moody’s has been both long- and medium-term stock market outperformance – it has beaten S&P 500 returns more than fourfold over the past 20 years, and by more than 10% over the past five. During the fourth-quarter results announcement last month, the company said this year’s earnings per share could be $14.50, higher than forecasts of closer to $13.50. This would be a 16.3% gain on last year’s results, which were themselves ahead of expectations as the business lifted sales across the board. The balance sheet remains strong, with growing cash balances, and last year the company repurchased one million of its own shares at around $477, just above the current price.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The optimism is supported by multiple industry drivers. Lower interest rates, economic expansion and an anticipated increase in merger and takeover activity could encourage more borrowing. And newcomers are helping firms raise money directly from investors, breaking into more traditional bank-lending activities. To drive demand from investors, it’s important that these loan issues have credit ratings to give an independent view of creditworthiness, which is where Moody’s comes in – more debt issuance means more business.

And on the analytics side of the business, Moody’s has been investing in AI for longer than the year or two that most investors have been aware of it. The company is on track to become a “go-to” AI provider of all information to Wall Street. It’s building tools that businesses are working with to analyse data that, crucially, has the stamp of authority and accuracy from Moody’s – unlike most AI output, which has little regard for whether it’s right or wrong. Financial analysis is deep and there’s no room for mistakes, so investors will only source good data from reliable names. And few can compete with Moody’s, which has been building and selling proprietary financial data to Wall Street for more than 115 years. AI is likely to entrench rather than unsettle Moody’s dominant market position.

Given the solid business model and growth opportunities in the financial-services industry, it’s little surprise that Warren Buffett has been invested in Moody’s for at least 25 years. It ticks all his boxes of what makes a great long-term investment. His holding company, Berkshire Hathaway, owns just over 13% of Moody’s stock, worth £11 billion. Competition is narrow in the niche financial-data sector, but companies such as S&P Global and Bloomberg are active. Yet analysts see strong sales and earnings growth ahead for Moody’s, with its enduring record and strong brand. The consensus price target is $544, giving a potential 18% upside. There are plenty of positive catalysts likely over the coming 12 months that could see this price target climb yet higher.

Why Moody’s ticks Warren Buffett’s boxes

Warren Buffett likes Moody’s because it has many of the attributes that he considers make for a great long-term investment. First, it has a strong “moat”, protecting it from competition. Its long-term record of harvesting data, together with its strong brand and regulatory positioning, make it hard for new entrants to take business away from it. The main competitor with Moody’s is S&P Global, and together they are a duopoly, a bit like Visa and Mastercard.

Issuing credit ratings is attractive because it should reliably grow at least in line with expanding economic activity (companies need to borrow to get bigger) and with the seemingly never-ending new issues and products from the financial services industry. It gets paid for each credit rating it gives as issuers want the Moody’s seal of approval to help them sell the bonds. The combination of high demand for ratings products from just two suppliers plus many research services paid for on a recurring subscription basis makes Moody’s a dependable and predictable business model. Investors assign premium valuations to the shares of such high-quality businesses.

What’s more, when you’re one of just two suppliers dominating your market with little chance of competition, you can exert great control of the prices you can charge. This pricing power is attractive because a company can manage and maintain its margins and therefore deliver consistent profits. In turn, the higher the margins and profits, the more cash a company generates, and this strengthens the balance sheet and thus adds to the protection investors can expect, creating a so-called “margin of safety”.

And while Moody’s is a growth company, it’s also considered “defensive”, meaning it’s highly insulated from the economy’s ups and downs. If markets decline, all that long-term debt in issuance still needs to have ratings reviewed and updated, so Moody’s is still charging. The subscription payments should also hold up well because, although institutions might cut costs such as expenses, they’re less likely to drop essentials such as data and research, which might risk permanently damaging their business model.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton