Summary

- Amazon and Apple both reported their quarterly results on 1 May after US markets closed.

- Amazon beat consensus estimates on earnings per share (EPS), which came in at $1.59, up 62% from a year ago.

- At $155.7 billion, revenues were roughly in line with consensus estimates.

- Apple beat expectations on both earnings and revenues.

- EPS came in at $1.65, up 8% from a year ago. Analysts had forecast $1.61.

- Revenue came in at $95.4 billion, up 5% from a year ago. Analysts had forecast $94 billion.

- Despite beating expectations, shares in both companies dropped in after-hours trading, as investors honed in on mediocre revenue growth in Amazon's cloud computing business and Apple's services arm.

- Tesla, Alphabet, Meta, Microsoft, Apple and Amazon have all now published their results. The only Magnificent Seven company yet to report is semiconductor giant Nvidia.

The MoneyWeek team is bringing you rolling previews and analysis, along with live coverage and reaction. Keep following for the latest.

Tesla earnings release kicks off Magnificent Seven results

Good afternoon, and welcome to our live blog covering Magnificent Seven earnings season, starting with Tesla’s results on Tuesday 22 April.

Like last week’s UK inflation data, the upcoming round of big tech earnings promises to be something of a snapshot into a bygone era, with the sweeping tariffs that president Donald Trump announced at the beginning of Q2 2025 having completely upended the stock market and thrown all future forecasts out of the window.

The Magnificent Seven – Tesla especially – have, however, been judged far more on their future outlook than their past performance over recent years, though. More than ever, this earnings season promises to be one of volatility and unpredictability, as nervous global investors watch for any clues as to the future of US tech dominance.

We’ll bring you live updates and rolling analysis, to help you keep track of every major development as it happens.

When does Tesla announce earnings?

Tesla announces its earnings after US markets close on Tuesday 22 April – that is, soon after 4pm UK ET, 9pm in the UK.

The post-earnings call, which is likely to have the biggest influence on the market reaction, is scheduled for 5.30pm ET (10.30pm in the UK).

Deliveries and DOGE

Tesla’s earnings are unusual among the Magnificent Seven, in that investors usually have a fairly good idea of how the preceding quarter has gone from a sales perspective. This is because Tesla announces its delivery numbers for the quarter several weeks before it releases its full results.

On that basis, analysts have been slashing expectations ahead of Tuesday’s release. Tesla’s delivery miss during Q1, announced on 2 April, saw quarterly vehicle sales fall to their lowest level for nearly three years.

Analysts had forecast 498,000 deliveries; Tesla fell short, with 495,570.

It’s thought that CEO Elon Musk’s close association with the Trump administration, as well as his activity with the Department of Government Efficiency (DOGE) contributed to the miss by prompting a widespread backlash against Tesla cars.

Tesla CEO Elon Musk’s political activities have caused a backlash among consumers, even Tesla fans. This bumper sticker was photographed in Lafayette, California on 28 March, 2025.

Markets will have already priced in a poor set of financial results for Tesla for Q1. However, of all the Magnificent Seven stocks, Tesla’s valuation is often based far less in what it has done before, and what markets expect it to do in the future. We’ll be delving into the details of what markets will be watching out for, particularly during the all-important post-earnings call.

The DOGE days are over?

Despite its delivery miss, Tesla’s shares eventually gained on 2 April, thanks to a Politico report suggesting that Musk would be stepping back from his work with DOGE in the coming months.

The report wasn’t confirmed – and has been contradicted by official White House statements. As such, Musk’s relationship with DOGE is likely to come under the microscope following Tesla’s earnings release tomorrow.

“We would expect Musk to address his role in the Trump Administration, and he will be asked about if he plans to stay in an advisory role for the White House,” says Dan Ives, global head of technology research at Wedbush Securities.

“We view this as a fork in the road time: if Musk leaves the White House there will be permanent brand damage, but Tesla will have its most important asset and strategic thinker back as full time CEO,” Ives continues.

Musk’s involvement with Trump and DOGE has already damaged the Tesla brand, according to Wedbush’s Dan Ives. Here, an activist in Washington DC holds a sign symbolising Tesla’s share price decline during a protest in March.

“If Musk chooses to stay with the Trump White House it could change the future of Tesla/brand damage will grow,” says Ives. “A huge week ahead for Musk, Tesla, and investors.”

Tesla shares down at start of earnings week

It has been a torrid few months for Tesla's share price, and the selloff continues this morning as the stock opens 4.6% below its close last week.

Tesla's market cap is currently around $776 billion, having been over $1 trillion just two months ago.

Read more: Should you invest in Tesla?

Tesla and tariffs

Musk’s DOGE involvement is no longer the biggest threat to Tesla shares coming out of the White House.

On the same day that Tesla announced its delivery miss, Trump unveiled his long-awaited tariff regime. This was both broader and deeper than many observers had expected, and had huge implications for global trade.

While most of the ‘reciprocal’ tariffs on individual countries have been paused for 90 days, a 10% baseline tariff remains on all imports to the US. This rises to 25% for auto imports, as well as for steel and aluminium.

More worrying yet is the trade war that ramped up rapidly once China responded by placing its own tariffs on US imports. That prompted a rapid-fire ratcheting up of each nation’s tariff barriers.

By 11 April, trade between the two superpowers had effectively been nullified; China is levying 125% on US imports, while US imports from China are subject to a 145% tariff.

That’s not good for anybody, but it’s particularly bad news for companies like Tesla. Not only is China the world’s largest market for electric vehicles (EVs) but it is also home to much of Tesla’s production and supply chain. Tesla’s gigafactory in Shanghai reportedly produces around half of all its cars.

The trade war between China and the US could hit Tesla particularly hard. Its gigafactory in Shanghai produces around half of all the world’s Teslas.

Given the tariffs came into effect after the reporting period, they won’t have any impact on Tesla’s Q1 results. However, make no mistake: talk of tariffs will likely dominate the post-earnings call.

Musk has made a rare break with the White House party line on tariffs, clashing publicly with Trump’s senior trade advisor Peter Navarro – who Musk has referred to as a “moron” and “dumber than a sack of bricks”.

What do analysts expect from Magnificent Seven results season?

We’ve covered the context for Tesla’s results, but what do analysts actually expect the company and its Magnificent Seven colleagues to announce when they release earnings?

Here are the consensus expectations from analysts polled by FactSet for each of the Magnificent Seven:

Ticker | Earnings per share ($) | Sales ($ million) |

|---|---|---|

GOOGL | 2.01 | 89,248 |

AMZN | 1.37 | 155,097 |

AAPL | 1.61 | 93,932 |

META | 5.24 | 41,427 |

MSFT | 3.23 | 68,513 |

NVDA | 0.91 | 43,177 |

TSLA | 0.43 | 21,452 |

Source: FactSet consensus estimates, as of 16 April 2025.

Alphabet is reporting its earnings this Thursday. We’ll bring live analysis and reaction to those results on this blog too.

Remember that, given how much movement there has been in the markets so far this week, the numbers published on earnings days are likely to have little impact on each company’s share price movements compared to what you might normally expect during earnings season.

The biggest drivers in after-hours trading will likely be how each company’s management addresses the tariff situation, which has completely changed the outlook for big tech and for the global economy since the periods these results cover.

Autonomy is key for Tesla

In Tesla’s case, analysts are going to be far more focused on how the company – and Musk in particular – is addressing the various challenges that it’s up against.

These can be broadly summarised as:

- Tesla’s status as a symbol of the Trump administration and DOGE, and the impact this has had on its share price;

- Brand damage done to Tesla as a result, and its impact on Q1 delivery numbers. Dan Ives, global head of technology research at Wedbush Securities, estimates this could imply 15-20% “permanent demand destruction for future Tesla buyers”;

- The impact of tariffs on the business, particularly on the rollout of Tesla’s long-awaited low-cost model.

And, as always with Tesla, demonstrable progress on autonomy is vital.

Despite its share price declines, Tesla stock still trades at over 100 times trailing earnings and around 90 times projected earnings. That’s an enormous multiple even by Magnificent Seven standards, a group not known for its bargain valuations.

It is based on a long-held assumption among investors that Tesla is the company closest to cracking full self-driving (FSD) technology, opening up a potentially brand new robotaxi market in which Tesla would enjoy first-mover advantage.

However, Tesla has repeatedly delayed full reveal of its promised robotaxi. Musk promised that one would be unveiled in August this year, and investors will want reassurance that this, at least, is still on track, even if Tesla is facing multiple headwinds elsewhere.

“Musk needs to lay out for investors the timing/rollout of unsupervised FSD in Austin this summer,” says Ives. “It’s time to lay out the timeline/hard facts around autonomous and robotics/Optimus rollout over the next 6-12 months.”

When are other Magnificent Seven companies announcing their results?

As a reminder, we’ll be covering the first six Magnificent Seven companies to announce their earnings here on this blog. Given it reports later than the others, there will likely be a separate blog to cover Nvidia’s earnings release.

The full timeline for Magnificent Seven earnings is:

Company | Earnings date | Time |

|---|---|---|

TSLA | 22/04/2025 | After markets close (AMC) |

GOOGL | 24/04/2025 | AMC |

META | 30/04/2025 | AMC |

MSFT | 30/04/2025 | AMC |

AMZN | 01/05/2025 | AMC |

AAPL | 01/05/2025 | AMC |

NVDA | 28/05/2025 | AMC |

Thanks for following the live blog today. We're going to wrap up here for this evening, but join us tomorrow when we'll have more build-up and analysis ahead of Tesla's earnings release tomorrow evening.

Tesla shares down ahead of earnings

Good morning, and welcome back to our live blog. Magnificent Seven earnings season officially kicks off today, with Tesla announcing results after markets close.

The carmaker has hit a speed bump in the run-up, though, with shares falling 5.7% during yesterday’s session.

Stay with us for rolling analysis ahead of the announcement, live coverage as Tesla announces its results this evening, and all the reaction tomorrow.

We’ll also start previewing the other Magnificent Seven companies. Alphabet is the next to announce its results, this Thursday evening.

Tesla earnings expected to fall

Analysts polled by FactSet expect Tesla to post quarterly earnings per share (EPS) of $0.43 this evening, on revenue of around $21.45 billion.

If accurate, that would represent a year-over-year decline in EPS, from $0.45 during the equivalent period last year.

The FactSet estimate implies a slight increase in revenue – from $21.3 billion a year ago. However, not all analysts are convinced that Tesla will achieve even that small increase. Analysts polled by London Stock Exchange Group (LSEG) yield a consensus revenue estimate of $21.2 billion, which would mark a 0.47% decline in revenue year-over-year.

Analyst calls on Musk to step up

CEO Elon Musk, who for a long time looked like Tesla’s greatest asset, risks turning into a liability for the company.

His high-profile political exploits have alienated large swathes of Tesla’s potential consumer base, both in the US and globally. Outside of politics, his attention doesn’t seem to be on the carmaker.

X, formerly Twitter, and its acquisition by Musk’s AI company xAI, will have soaked up a lot of his attention over recent months. SpaceX is another massive venture demanding Musk’s attention. With so much going on, there is a danger that Tesla gets left by the wayside.

“Musk will need to step up if Tesla shares are to shift out of reverse in 2025,” says Josh Gilbert, market analyst at eToro. “Investors have started to lose patience with the EV giant due to poor vehicle deliveries, auto tariffs and [Musk] taking his eye off the ball.”

Analysts are calling for Tesla CEO Elon Musk to signal a greater focus on Tesla’s key priorities at tonight’s earnings call.

Gilbert calls for three areas of clarity on tonight’s earnings call: how tariffs on US auto imports are likely to impact Tesla; how long Musk plans to remain at DOGE; and the rollout of cheaper Tesla models going forward.

Musk has called cheaper EVs a ‘game-changer’ in the past, but timelines keep slipping. Over the weekend, Reuters reported that the cheaper Model Y, which had been slated for release in the first half of the year, is set to have its production date pushed back, citing three sources with knowledge of the matter.

If true, yet another delay could further stretch investors’ patience.

What time does Tesla announce earnings?

To recap, here’s the timeline of the key events that are happening today in the runup to Tesla’s earnings announcement. All times are BST unless specified.

When (22 April unless specified) | What |

|---|---|

2.30pm | US markets open |

9pm | US markets close |

9pm-10.30pm | Tesla posts Q1 2025 financial results |

10.30pm | Tesla will host its post-earnings call |

1am, 23 April | After-hours trading in the US closes |

Earnings calls tend to last around one hour. Tesla will post its earnings report online any time between the close of US markets and the start of its earnings call.

Each of the events in this table represents something of a milestone as far as trading Tesla shares is concerned. However, it’s important to bear in mind that there is often lots of volatility around earnings releases, and that’s likely to be especially true today given the amount of uncertainty in the markets.

MoneyWeek tends to advocate a long term approach wherein investors ignore the short-term volatility and avoid trying to time buying and selling shares, sticking instead to a consistent, sustainable investing strategy.

Tesla’s share price rise and fall

As of US market close last night, Tesla shares have fallen 43.7% so far in 2025. They are 52.6% below the stock’s peak on 17 December.

During that time, the company’s market cap has fallen from $1.53 trillion to $776.4 billion.

This rise and fall in Tesla’s share price can be put down, simply, to Trump’s election win and how investors’ attitudes towards the new administration have changed.

Tesla shares gained over 90% between 5 November, when it became clear that Trump had won the election, and 17 December.

At first, investors expected a boon to Tesla from Musk’s proximity to the new president. Perhaps a fast-track for its full self-driving approval, or other perks. Something along these lines could well still be coming, further down the road.

However, the prevailing assumption at the time was that Trump would be a fundamentally pro-business president, and that assumption is quickly being damaged. Opposition to his tariffs and DOGE’s slashing of US federal agencies has changed the mood considerably, especially among wealthy liberals in the US and abroad – Tesla’s target market.

The tariffs themselves threaten material damage to Tesla’s bottom line, particularly if the escalating US-China trade war raises the costs of exporting the cars from China, where around half of all Teslas are manufactured.

Tesla no longer one of America’s top 10

Tesla’s share price decline yesterday has seen the carmaker drop out of the S&P 500’s top 10 largest companies. Tesla is now the 12th most valuable company in the index by market cap.

No. | Company Name | Market Cap ($ billion) |

|---|---|---|

1 | Apple Inc. | 2,901.66 |

2 | Microsoft Corporation | 2,669.69 |

3 | NVIDIA Corporation | 2,364.60 |

4 | Alphabet Inc. | 1,812.14 |

5 | Alphabet Inc. | 1,800.10 |

6 | Amazon.com, Inc. | 1,775.66 |

7 | Meta Platforms, Inc. | 1,227.96 |

8 | Berkshire Hathaway Inc. | 1,093.66 |

9 | Broadcom Inc. | 781.51 |

10 | Walmart Inc. | 740.84 |

11 | Eli Lilly and Company | 734.57 |

12 | Tesla, Inc. | 731.76 |

Source: Stockanalysis.com as of 21 April, market close. *Alphabet's dual listing mean that two stocks here represents just one company.

As things stand though, Tesla could be set for a rebound today. Shares are up around 1.4% in premarket trading, just over half an hour before US markets open.

Tesla shares make strong start to final session before earnings

Tesla shares have indeed gained ground today. The stock opened 1.5% up, and as of now are around 3.8% up on yesterday's close.

Are the Magnificent 7 still driving the S&P 500?

Part of the reason that Tesla and the rest of the Magnificent Seven have become the biggest names in the stock market over recent years is that their earnings growth has outpaced the rest of the S&P 500. Is that dynamic shifting, though?

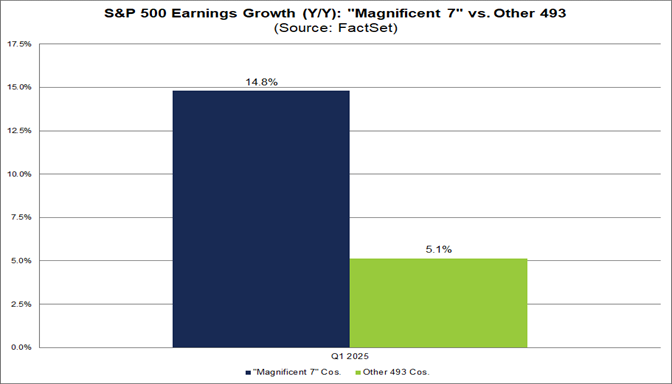

Consensus estimates from analysts polled by FactSet puts the Magnificent Seven (including Tesla and Alphabet, both announcing earnings this week) on course to grow earnings by 14.8% in aggregate during Q1 2025. The equivalent figure for the other 493 S&P 500 companies is 5.1%.

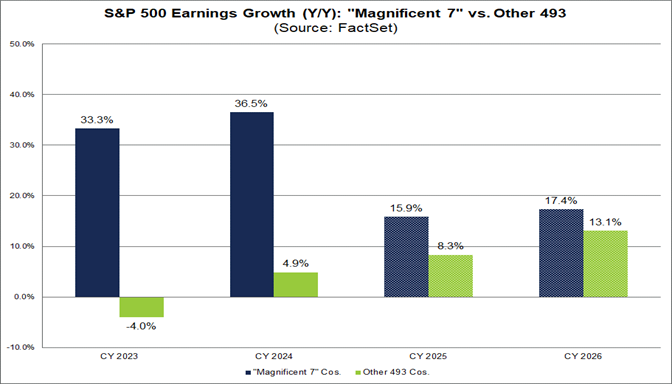

Still leading the way, then. But when compared to the broader historical trend and future forecast, it’s clear that these seven companies aren’t standing out in the way that they used to.

Mag7 earnings growth is expected to be much lower this year, while the rest of the S&P 500 is expected to contribute more.

“Thus, analysts expect lower earnings growth from the ‘Magnificent 7’ companies and higher earnings growth from the other 493 companies for 2025 relative to 2024,” says John Butters, senior earnings analyst at FactSet.

That narrows again in 2026, according to current forecasts, to the Mag7 contributing just 4.3 percentage points more aggregate earnings than the rest of the index.

Tesla’s earnings “all about guidance”

Tesla and the other Magnificent Seven stocks are effectively giant growth stocks.

The markets are generally less interested in what they did last year than what they’re going to do next. There’s usually a bigger difference between the two than you’d expect from companies worth hundreds or billions, or even trillions, of dollars.

Add onto that the fact that markets have already priced in a dismal quarter for deliveries, and tonight’s earnings call becomes all about the forward perspective for Tesla.

“It is all about the guidance rather than the numbers,” says Rory McPherson, chief investment officer at Wren Sterling. “The market will be wanting guidance which isn’t unsettling and it will be another test/proof point of investors’ risk appetite in uncertain times.”

As for the rest of the Magnificent Seven, McPherson thinks the key focus “will be whether there is any change to the planned $300 billion+ of AI spend that was announced in their earnings reports back in January.

“High conviction here could draw investors back into the AI trade whilst a stepping back from planned spending would be in keeping with the love lost for American exceptionalism and the AI trade that the market has been pricing.”

Tesla shares resurgent

The malaise that saw Tesla’s share price fall 5.7% yesterday has been shaken off. Shares are up 4.5% today at time of writing, with that number reaching as high as 6.7% earlier in the session.

The broader US stock market has also recovered much of the ground that was lost yesterday. The S&P 500 is up 2.7% while the Nasdaq Composite is up 2.4%.

Just over an hour to go until US markets close, and Tesla shares are still a little over 4% up today.

Will tonight's earnings release and analyst call keep investors on side?

Tesla closes 4.6% up ahead of earnings

US markets have closed for the day, with Tesla share price 4.6% up ahead of its earnings release.

The stock will continue to be traded in after-hours trading for another four hours, and that will likely see big movements as the company hosts a call with analysts. Follow here for live updates from the call, which begins at 10.30pm UK time.

In the meantime, we’ll get Tesla’s earnings release. Analysts are forecasting EPS of $0.41 on revenue of $21.27 billion. That’s unlikely to be the big influence tonight though: all will hinge on what Elon Musk says about his and the company’s future on the earnings call.

BREAKING: Tesla reports earnings miss

Tesla has reported earnings per share of $0.27 on revenue of $19.34 billion, missing analyst expectations.

Tesla shares falling in after-hours trading

Expectations were low following the delivery numbers that had already been reported, but that's a bad set of results for Tesla all the same.

Revenue is down 9% year-over-year; earnings have fallen 40%.

The stock initially fell around 1% in after-hours trading, but is fluctuating rapidly at present. Expect that volatility to continue.

Tesla puts revenue miss down to Model Y changeover

The wording on Tesla’s earnings release is revealing as to what the company wants to pin its disappointing quarter on.

“In Q1, we accomplished an industry first: simultaneously changing over production lines across all factories for the world’s best-selling vehicle – the Model Y.”

It also draws attention to the potential of AI as “a major pillar of growth for Tesla”, and comments that it is contributing to “rapid load growth”. This all feeds into the energy storage play, which many analysts think is another key vertical for Tesla in the medium term.

“While the tariff landscape will have a relatively larger impact on our Energy business compared to automotive, we are taking actions to stabilize the business in the medium to long-term and focus on maintaining its health.”

Affordable Tesla still on track?

There had been speculation in the run-up to Tesla’s earnings release that the tariff fallout would delay production of its more affordable Model Y, but the earnings release claims that “plans for new vehicles, including more affordable models, remain on track for start of production in the first half of 2025”.

That implies the new cheaper Teslas will begin production in the next two months or so. There’s very little further detail available as yet, though.

Tesla’s net income falls 71%

One of the most striking figures in Tesla’s earnings report is a 71% drop in GAAP net income, which fell from $1.39 billion in Q1 2024 to $409 million in the most recent quarter.

On a non-GAAP basis, net income fell 39%, to $934 million.

Operating margins are also down 343 basis points, to 2.1%.

Tesla’s energy revenue continues to impress

Tesla’s earnings summary drew attention to the strength of its energy division.

Revenue from energy generation and storage increased 67% year-over-year. This is good news for Tesla as many believe this could be its most profitable arm in the future.

However, the warning on energy is that this division is especially exposed to the tariff disruption.

As a reminder, Tesla's earnings call will start at 10.30pm BST. We'll bring you live coverage from the call, so be sure to keep checking in for updates.

Musk leaving DOGE could lift sentiment after earnings miss

“Tesla’s first-quarter delivery and production numbers on 2 April were as ugly as its Cybertruck design,” says Dan Coatsworth, investment analyst at AJ Bell. “That meant expectations were rock-bottom in the run-up to its financial results and it’s why the shares didn’t tank upon release of the Q1 earnings.”

However, the brand has clearly been damaged by Musk’s involvement in the Trump regime. Even political supporters of Trump would feel more comfortable if Musk was seen to be behind the wheel of his flagship company, rather than hoping – like the much-anticipated robotaxi – that it will drive itself.

“Reports suggest that Musk may soon leave the White House inner circle and such a move could be viewed positively by financial markets,” says Coatsworth. “One could argue that taking government work off Musk’s plate and freeing him up to get back to the day job is what’s needed to win back the market’s favour.”

Keep a close eye out for Musk’s comments on his future with DOGE during the earnings call.

BREAKING: Musk to step back from work with DOGE

“Never a dull moment,” says Musk as he opens Tesla's earnings call.

He goes on to explain what he views as the importance of his work with the Department of Government Efficiency (DOGE).

“If the ship of America goes down, we all go with it,” he says.

Protests against his work aimed at Tesla, he says, are because those receiving “the waste and fraud” want to keep receiving it.

The work needed to address the challenges of DOGE is, though, “mostly done”.

“Starting next month, my time allocation to DOGE will drop significantly”.

Tesla shares jump on Musk’s DOGE stepdown

Musk’s statement that he is about to step back from his work with DOGE has seen Tesla shares spike. The stock is up over 5% in after-hours trading.

Musk on tariffs

Tesla, says Musk, is the car company that is least exposed to tariffs, having been working for years to localise its supply chains.

“The tariff decision is entirely up to the president of the United States,” he says. “I've been on the right board many times saying that I believe lower tariffs are generally a good idea for prosperity, but this decision is fundamentally up to the elected representative of the people.”

Musk reiterates the start of fully autonomous rides in June

While it is unlikely to “significantly move the financial needle”, Musk has reiterated that fully autonomous rides are expected to begin in Austin, Texas, from June.

He says that the vast majority of the Tesla fleet so far produced is capable of operating as a robotaxi – calling the conflation with the Cybercab “confusing”.

Scaling fully autonomous driving from one city – as is expected in Austin – is, he says, a small step. “Once we can make it work in a few cities in America, we can make it work anywhere in America”.

He also says that Tesla’s Optimus robots will be produced in their millions by 2030.

Energy storage “doing very well” and scaling

“The energy business is doing very well,” says Musk. “We expect the stationary energy storage business to scale, ultimately to terawatts per year.”

Tesla's CFO, Vaibhav Taneja, is now speaking, and has commented on the impact of tariffs on Tesla's energy business.

"The impact of tariffs on the energy business will be outsized since we source LFP battery cells from China," he says. While Tesla is moving to onshore production of batteries to the US, "the equipment we have can only service a fraction of our total installed capacity.

"It will take time," he adds.

Full self driving available by the end of the year

There is a question on when full self-driving (FSD) will be available to personal Tesla owners in their cars. Musk responds that this will be available by the end of the year in certain locations.

“We’re absolutely hardcore about safety,” says Musk. “We want to be very careful. We want autonomy to be dependably safer than manual driving.

“It’s not enough to be as safe. It has to be meaningfully safer than manual driving.”

That, he says, is why Tesla is being cautious about rolling out FSD.

“With that said, I think we should be able to have it working in several cities later this year for personal use.”

Musk confident of wide rollout of autonomous Teslas by 2026

By the end of the year, says Musk, "a Model Y will drive itself all the way to the customer" once it rolls off the production line.

The line on autonomous driving is that there is no need to await the release of a new car, the Cybercab; "millions" of Teslas already in use will be capable of autonomous driving by next year.

Optimus production could be impacted by tariff war

Musk refuses to be drawn on precise predictions for scaling the production of Tesla’s Optimus, a general-purpose humanoid robot. Every component, he says, is brand new.

“When you have a new complex manufactured product, it’ll move as fast as the slowest and least lucky component in the entire thing,” says Musk.

Tariffs on Chinese imports could hit production, as Optimus – more so than other Tesla products – relies on permanent magnets, which require a license in order to be exported from China.

However, Musk predicts that thousands of Optimus robots will be in production by the end of the year.

Musk expects thousands of Optimus robots to be in production by the end of the year.

Tesla says cheaper model will be based on existing designs

One analyst asks for a description of the cheaper model, which Tesla still says is coming in the first half of the year despite recent reports suggesting the tariffs will force its release to be delayed.

“The real thing which we are trying to focus on is affordability and using our existing lines,” says Taneja. “There’s always limitations when you’re using existing lines as to how many different form factors you can bring, so that’s the way you should think about it.”

Lars Moravy, VP of vehicle engineering, adds that “Tesla doesn’t make bad cars. Our intent is not to make a car that’s any worse than any car we’ve ever produced in the past.

“So the models that come out in the next months will be built on our lines and will resemble, in form and shape, the cars we currently make.”

The earnings call has now concluded. Investors seem impressed with what they've heard: Tesla shares are up 4.8% in after-hours trading as things stand, though there's another hour of extended trading to go.

We're ending our coverage here for this evening, but join us tomorrow for all the reaction and analysis to tonight's events, as well as preview analysis of Alphabet's earnings release on Thursday.

In the meantime, thank you for following, and good night.

Recap: Tesla shares rise despite earnings miss

Good morning, and welcome back to our live blog.

In case you missed it last night, Tesla posted disappointing Q1 results, even based on the low expectations that markets had following its Q1 delivery miss.

Revenue fell 9% year-over-year to $19.34 billion, while earnings per share fell 40% to $0.27.

Despite these figures falling well short of analyst expectations, Tesla shares gained 5.4% in after hours trading, largely thanks to CEO Elon Musk saying that he will reduce the level of his activity with the controversial Department of Government Efficiency (DOGE) over the coming months – though he suggested that he will continue to be involved to some extent with the US government.

We’ll bring you more analysis and reaction to those results today, as well as turning our attention to the next Magnificent Seven stock to release earnings: Google parent Alphabet, which announces its results tomorrow evening.

The future is autonomous for Tesla

Besides Musk stepping aside from DOGE, progress towards autonomous driving technology has buoyed Tesla’s stock following a dismal earnings release.

“This quarter was always going to be tough,” says Matt Britzman, senior equity analyst at Hargreaves Lansdown. However, he says, the prospect of autonomous breakthroughs in the near future have raised investors’ hopes.

Britzman calls autonomy “the real jewel in the crown” for Tesla. The June launch of Tesla’s ride-hailing pilot in June marks a key milestone ahead of the Cybercab going into production next year.

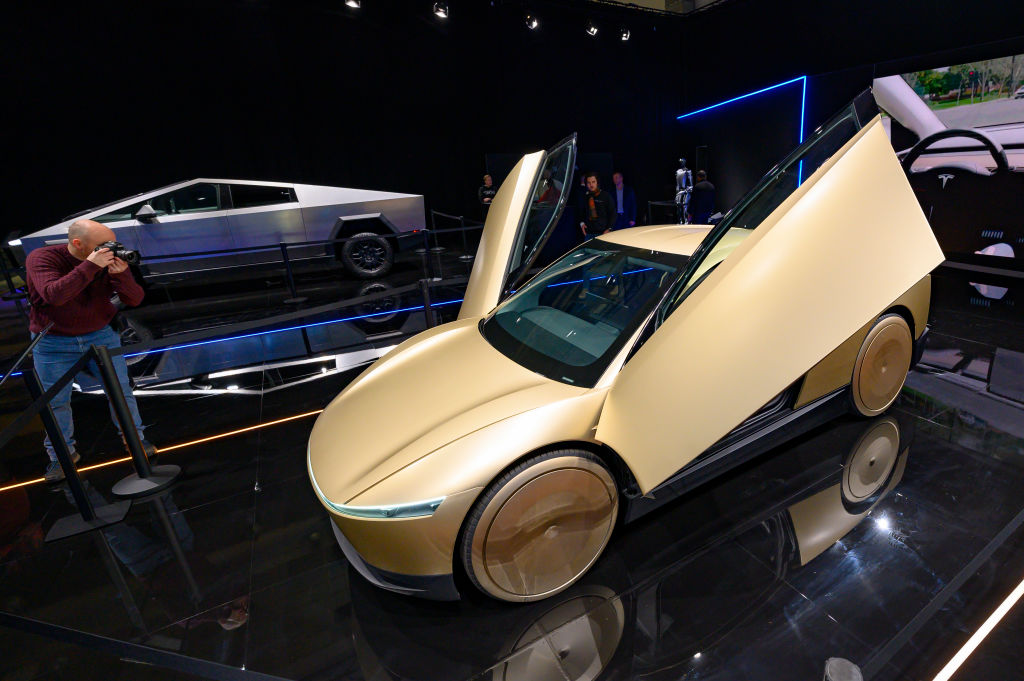

During Tesla's earnings call, Elon Musk suggested that production of the Cyber Cab , pictured here at the 2025 Autosalon in Brussells, will ramp up next year.

“In the race to bring AI into the physical world, Tesla still looks like the company with the most to gain,” says Britzman.

Investors hope Musk can steer Tesla through competition

Musk stepping back from DOGE is a double win for Tesla.

Firstly, the hope is that greater distance between the CEO and the White House will repair some of the brand damage that has been done over recent months. It’s never a good sign if people are protesting outside your shop window, however much you believe you’re in the right.

More importantly, though, spending less time at DOGE means Musk can spend more time at Tesla.

Investors can hope that “a more secure hand is on the tiller once again”, says Chris Beauchamp, chief market analyst at IG Group.

Not a moment too soon. Yesterday, hours before Tesla announced its results, eight Democratic state treasurers in the US – who have a vested interest in Tesla, as controllers of large investments with exposure to the stock – wrote to Tesla’s board of directors, expressing their concern about the governance issues that Musk’s split attention creates.

“These external commitments raise serious questions about whether Tesla’s leadership is fully engaged in addressing the company’s core challenges,” they wrote.

With the amount of global uncertainty brewing, and cheaper competitors like BYD putting ever greater pressure on Tesla’s market share, his full attention needs to be on guiding his flagship business through the storm.

“The competition from other car makers is getting stiffer all the time, meaning that even Musk will have his work cut out in returning Tesla to its previous strong form,” says Beauchamp.

Musk’s DOGE off-ramp

While Musk’s announcement that he will reduce the amount of time he spends at DOGe was timely, it won’t completely erase the damage that has been done to Tesla’s brand, according to Dan Ives, global head of technology research at Wedbush Securities.

“In essence, this was an off ramp for Musk out of the Trump White House in our view,” says Ives. “The global brand damage, political firestorm, and perfect storm chaos over the past few months will now end this volatile political chapter for Musk and we expect minimal, if any time focused on DOGE going forward.”

Elon Musk's involvement with DOGE has led to protests and vandalism at Tesla dealerships in the US and globally.

However, Ives goes on to say that “the brand damage caused by Musk in the White House/DOGE over the past few months will not go away just by this move and some of the damage will be stained forever in Europe and the US.” Ives estimates that this could take 10% off future Tesla demand.

Ives expects deliveries to remain weak in the first half of the year but to pick up during the second half, “as the Model Y refresh and inventories work [their] way through the system”.

Attention shifts to Alphabet’s earnings

With Magnificent Seven earnings season underway, the next of the group to announce earnings is Google parent Alphabet, which announces its results tomorrow evening.

The extent of Google’s diversification means that this is an interesting one to keep an eye on, but there are some broad themes that investors will want to be aware of.

“Google Cloud revenue remains Alphabet’s growth engine,” says Josh Gilbert, market analyst at eToro. The cloud computing unit, he says, is “expected to post roughly 25-30% revenue growth year-on-year, faster than Microsoft’s Azure or Amazon’s AWS.”

Google Cloud revenue is likely to be the key metric that investors look out for in Alphabet’s earnings release tomorrow evening.

“After a slight slowdown in cloud sales last quarter, investors will look for reassurance that demand is staying robust,” Gilbert adds.

Additionally, investors will be on the lookout for signs that Google’s core search and advertising business can withstand competition from the likes of Meta and other AI tools. Updates on Google’s own AI innovation, particularly Gemini, will also be key.

When will Alphabet announce results?

Alphabet will announce earnings after markets close tomorrow, Thursday 24 April.

That means after 9pm in the UK. The earnings call following the release is scheduled for 1.30pm PT – 9.30pm in the UK.

What do analysts expect from Alphabet’s earnings?

Analysts polled by FactSet yield a consensus earnings per share (EPS) estimate of $2.01 for Alphabet, implying a 6% year-over-year increase for Google’s parent company’s profits. Revenue is expected to increase 11% to $89.2 billion.

Google Cloud revenue is expected to drive this: analysts are expecting an increase in the range of 25-30%, which would imply around $12.2 billion of cloud revenue at the mid-point.

Chris Beauchamp, chief market analyst at IG Group, also recommends keeping an eye on Google’s AI spend, and any indication of its plans to monetise this.

“It’s about saying, ‘we are spending on AI, but it is starting to translate into greater activity, or seeing companies prefer to use Google for advertising because of this,’” he tells MoneyWeek.

Might OpenAI buy Google Chrome?

This week’s Magnificent Seven earnings announcement sees the group’s most expensive stock (Tesla) and its cheapest (Alphabet) based on their forward price to earnings (P/E) ratios.

While Tesla trades at over 116 times its projected earnings, Alphabet is around 17.5 (as of yesterday’s market close).

Beauchamp calls this “dirt cheap” compared to the Magnificent Seven, particularly Tesla, but warns that there are good reasons why Alphabet is priced so cautiously.

“It’s partly the fact that [Google] is locked in a battle with Microsoft and Amazon’s cloud computing segments,” he points out.

More to the point though, Google is embroiled in an antitrust suit that could see the breakup of the group if Alphabet loses.

Google and Alphabet CEO Sundar Pichai after testifying in the antitrust case against Google in 2023.

Artificial intelligence competitor OpenAI has waded into the case by saying that it would be interested in buying Google Chrome in the event of a breakup. Nick Turley, head of product at ChatGPT, told the trial in Washington DC OpenAI would be keen to buy the browser in the event of a Google breakup.

"We have no partnership with Google today”, said Turley – who also testified that Google rejected an offer for a partnership when OpenAI was struggling with its own browser provider, according to Reuters.

In the meantime, the antitrust case is “really weighing on Google”, says Beauchamp. He adds that Google will try to argue that its breakup could damage US tech dominance – a poignant argument, at a time when the US is actively trying to protect its economic interests against encroachment from China.

Is Google exposed to tariffs?

On last night’s earnings call, Tesla’s management spent a lot of time outlining the extent to which Donald Trump’s tariff regime could impact its various business units.

Google isn’t as directly exposed, so this isn’t expected to take up as much time on Alphabet’s earnings call tomorrow. However, the tariffs are still a watch-out for the business for less direct reasons.

“Google isn’t a great operator in China because of the way the search engine works,” says Beauchamp. But if the world goes into a recession, he adds, this could cause a slowdown in corporate advertising spend – which could impact Google’s core business.

Alphabet’s CEO Sundar Pichai recently reaffirmed Google’s intention to invest $75 billion into AI, despite the tariff impact. Beauchamp suggests that management could field questions on how these AI investments could shield the business in the event of a global slowdown.

That's all from our live blog for this evening. Thanks for following today, and join us again tomorrow for more analysis and build-up ahead of Alphabet's earnings release.

Good morning, and welcome back to our live blog. Thank you for joining us, as global investors turn their attention to Google's results this evening.

Alphabet, Google's parent company, will announce results after markets close in the US at 9pm BST today. The company's post-earnings call is scheduled for 9.30pm.

We'll bring you all the build-up and analysis on what investors will be looking for throughout the day.

Google earnings could land on a market down day

Shares in Google’s parent company Alphabet gained 2.6% yesterday, on a good day for the markets: the S&P 500 gained 1.7%, as Trump rowed back on previous threats to fire Federal Reserve chairman Jay Powell.

However, trading this morning suggests that markets will open lower today. S&P 500 futures are down 0.6% and Alphabet shares are down 0.7% in premarket trading. Treasury secretary Scott Bessent has dampened hopes of imminent US-China trade talks, replying “not at all” when asked by reporters if Trump had offered Beijing a reduction in the 145% tariff rate that has been slapped on America’s Chinese imports.

Is Google Cloud revenue growth slowing?

Analysts expect Google Cloud revenue to grow by 25-30% year-over-year.

That would mark a slowdown over the past two quarters, which saw Google Cloud revenue grow by approximately 35% in the year to Q3 2024 and 31% in the year to Q4 2024.

The two quarters before that saw Google Cloud revenue growth of around 28%.

If Google Cloud revenue comes in at the low end of expectations – anywhere from $11.97 billion to around $12.25 billion – then this could be interpreted as a sign that cloud revenue growth is slowing, and would likely be negatively received by markets.

Ads at Alphabet’s core

While Google Cloud is Alphabet’s “growth engine”, the core of the business is still advertising, says Josh Gilbert, market analyst at eToro.

“Search and YouTube ad performance will be key,” says Gilbert. “The focus here will be whether Google can defend its ad dominance as competition continues from Amazon, TikTok and Meta.”

While Google Cloud revenue is expected to be the fastest-growing segment, Google Search remains at the core of Alphabet's business and will be scrutinised by investors during tonight's earnings call.

According to Morgan Stanley analysts, Google’s advertising business could be relatively resilient in the event of a global downturn.

“Larger, performance-based platforms [such as Google, Meta and Amazon] with more total advertisers are better positioned to offset ad auction bid density weakness,” wrote Brian Nowak and other equity analysts at Morgan Stanley in a research note last week.

Morgan Stanley’s overweight thesis on Alphabet is based on “continued AI-driven platform-level innovation on Search, YouTube, and other offerings” driving confidence of long term growth. The analysts set a one-year price target of $185, below the consensus target of $207, but still implying 19% gains from last night’s close.

A word on earnings guidance

Tesla’s earnings release had one notable omission: there was no specific guidance for the following quarter, or the 2025 financial year.

Forward guidance is normally one of the key watch-outs during Magnificent Seven earnings season, but this year, the instability and unpredictability engendered by Donald Trump’s tariff regime makes forecasting the future impossible.

"At the current situation we do not expect any tech companies to give any guidance on the 1Q conference calls," wrote Dan Ives, global head of technology research at Wedbush Securities, on 9 April at the height of the tariff turmoil.

As it happens, Alphabet has a tradition of not giving specific guidance figures, so this won’t impact anything too heavily there. However, we can expect Alphabet’s chief financial officer Anat Ashkenazi to give a qualitative view on how the trade war could impact Google’s prospects going forward, and she will probably face several questions on this front from analysts.

Alphabet shares open higher ahead of earnings

Alphabet’s share price has opened 0.5% above the previous day’s close on today’s session: the final one before the Google parent announces its earnings release.

See below for live updates on Alphabet’s share price.

Could Google Chrome be worth $50 million?

We reported yesterday that OpenAI, the maker of ChatGPT, has expressed an interest in acquiring Google Chrome in the event that the ongoing antitrust case forces the breakup of Google’s empire.

Later in the day, Bloomberg reported that Gabriel Weinberg, CEO of search engine rival DuckDuckGo, has told the court that Chrome would be worth “upwards of $50 billion if it went on the market”.

That puts the browser “out of DuckDuckGo’s price range”, but some of the deeper-pocketed big tech companies would surely be tempted to bid for the browser if it became available.

Weinberg said that his $50 billion figure was a “back-of-the-envelope” calculation based on the size of Chrome’s user base. It is higher than the $20 billion that Bloomberg Intelligence analysts had previously estimated Chrome could be worth.

Beating earnings doesn’t guarantee a share-price rise

Josh Gilbert, market analyst at eToro, points out that Alphabet has beaten estimates in its last eight earnings results, however shares have only risen three times out of eight the next day.

“This tells us just how vital cloud growth is compared to earnings growth for investors,” he says. Tech companies have gone all in when it comes to AI spending, and investors want to know they are getting some return on this capital investment.

As we outlined in a previous post, cloud revenue growth is expected to slow to 25-30% year-on-year. It came in at 35% in Q3 2024 and 31% in Q4 2024.

Tariffs shouldn’t hit Q1 advertising revenues – but what lies ahead?

Donald Trump’s tariffs have caused widespread market disruption, but one key area of focus for Alphabet is whether the trade war will disrupt future advertising revenue. Marketing budgets are often one of the first things businesses cut when times are hard – and advertising is a key source of income for Google.

“Alphabet’s first quarter should not have been affected but there is a risk that its second quarter and beyond will be. Major advertising agencies are already warning of the knock-on effects upon brands’ spending in the event of an economic slowdown and Chinese resellers are active advertisers too,” said Danni Hewson, head of financial analysis at AJ Bell.

“Management may not have too much visibility beyond Q2 so it may be hard for them to say much, but the comparables are tougher in the second half against 2024’s base, which featured both the Olympics and the US presidential election.”

Hewson does concede that Google’s powerful market position could provide some shelter, with businesses cutting back spending with other ad platforms first.

Thank you for following our preview analysis today. We will be back in a few hours when Alphabet publishes its earnings at US market close (around 9pm UK time). To recap, here's what is expected:

Consensus estimates:

- Earnings per share (EPS): EPS is expected to come in at $2.01, according to analysts polled by Factset. This would constitute a 6% year-on-year increase.

- Revenue: Revenue is expected to increase 11% to $89.2 billion.

- Watch out for: Google Cloud revenue. Analysts are expecting a 25-30% increase to around $12.2 billion. This would mark a slowdown compared to the growth rates in previous quarters. Google Could revenue could be an important driver of share price performance in the aftermath of the results, as tech firms have been investing huge amounts of money into AI. Investors want to see that it is paying off.

Join us this evening for live reaction and analysis.

Welcome back. Around ten minutes to go until US markets close. Alphabet is expected to announce its results soon after the bell.

Shares are currently 2.5% up today, with US markets in general showing strength. There could be plenty of movement in after-hours trading, though, depending on what markets make of the results.

Alphabet beats on earnings and revenue

That's a big earnings beat from Alphabet, and GOOGL stock has quickly gained 4.5% in after-hours trading.

Revenue increased 12% year-over-year (14% in constant currency) to $90.2 billion, ahead of analyst expectations.

Google Cloud revenue for the quarter came in at $12.3 billion, around 28% year-over-year growth. That's in line with analyst expectations.

Alphabet CEO: AI Overviews now has more than 1.5 billion users

Sundar Pichai, CEO of Google and Alphabet, made the following statement in the earnings release:

"We’re pleased with our strong Q1 results, which reflect healthy growth and momentum across the business. Underpinning this growth is our unique full stack approach to AI.

"This quarter was super exciting as we rolled out Gemini 2.5, our most intelligent AI model, which is achieving breakthroughs in performance and is an extraordinary foundation for our future innovation.

"Search saw continued strong growth, boosted by the engagement we’re seeing with features like AI Overviews, which now has 1.5 billion users per month.

"Driven by YouTube and Google One, we surpassed 270 million paid subscriptions. And Cloud grew rapidly with significant demand for our solutions."

Google Cloud operating income increases over 140%

A few more details on these results from Alphabet.

Revenue growth across the group has slowed a little, from 15% in the year to Q1 2024 to 12% this time around.

However, Alphabet’s operating margin has increased from 32% to 34%.

There’s also a big increase in the profits from the high-growth Google Cloud segment: operating income in the division increased from $900 million to $2.18 billion in the quarter just ended – a 141.9% year-over-year increase.

Alphabet earnings call: Pichai points to AI success

The earnings call is now underway, with Alphabet CEO Sundar Pichai giving his introductory comments.

Gemini 2.5 is "widely recognised as the best model in the industry", he says. Pichai also mentions AI Studio and Gemini have both grown active users more than 200% since the start of the year.

Pichai highlights AI in Android and Google Search

Pichai is leaning in heavily to AI in his introductory comments, mentioning the incorporation of AI features into Android devices.

He says that AI is one of the most significant technologies for Google Search, "growing the number and types of questions we can answer".

He repeats his comment in the earnings release, that AI Overviews now has more than 1.5 billion users.

YouTube ad revenue up 10% on 20th anniversary

Yesterday, says Pichai marked the 20th anniversary of the first video uploaded to YouTube.

"We continue to diversify subscription options," says Pichai.

YouTube ad revenue increased more than 10% year-over-year.

Google’s chief business officer explains AI growth

Phillipp Schindler, chief business officer at Google, is now speaking. He also describes the growth in AI services:

“With the launch of AI overviews, the volume of commercial queries has increased.

“Q1 marked our largest expansion to date for AI overviews, both in terms of launching to new users and providing responses for more questions. The feature is now available in more than 50 languages across 140 countries.

“For AI overviews, overall, we continue to see monetization at approximately the same rate, which gives us a strong base in which we can innovate even more.”

Alphabet chief financial officer reaffirms capital expenditure plans

Now Anat Ashkenazi, chief financial officer at Alphabet, is going through the financial results.

Capital expenditure came to $17.2 billion for the quarter, “primarily reflecting investment in our technical infrastructure, with the largest component being investment in servers, followed by data centres, to support the growth of our business across Google services, Google Cloud, and Google DeepMind”, she says.

She reiterates Pichai’s previous commitments to spending $75 billion on cap ex over the course of the full year.

Google "not immune" to macro disruption

Now we’re into the Q&A section. The first question dives right into the hot topic of the day: how the “macro backdrop” - presumably a reference to the tariff turmoil - could impact Google’s advertising revenue.

“We’re obviously not immune to the macro environment,” Schindler replies. Retail customers in the APAC region could be impacted by the current disruption, he adds, but emphasises that it is too soon to make predictions about the future.

How is Google driving AI differentiation?

A question comes in from Goldman Sachs on how Google is approaching AI differentiation in the current environment.

Sundar Pichai replies, “it’s an exciting moment on the AI front”. He draws attention to the new models that are being developed, such as Gemini 2.5 and Flash.

“We are already seeing very positive feedback” in AI search, he says, and says that users are receiving positively to innovations in Gemini Live.

Alphabet's shares, having quickly gained around 4.5% after the results were published, then fell back a little as after-hours trading got underway.

They're riding high now, though - up around 5%.

Boosting Gemini users

A question comes in referencing testimony from the ongoing antitrust case, that revealed Gemini has 35 million daily active users (DAUs) – trailing ChatGPT by some way. How is Google trying to boost Gemini’s user numbers?

“By many metrics we have the best model out there now,” Pichai replies. “I think that's going to drive increased adoption.

“Obviously, we have 1.5 billion users through AI overviews,” he adds, “interacting with AI in a deep way, in a very engaged way.”

Waymo to come?

There is a question on the long-term strategy for Waymo, Google’s self-driving car arm.

Pichai replies that this is the first time he’s been asked about the division on an earnings call, which he calls “a sign of its progress”. The focus, he says, is on making it into the best driver possible.

“We are excited about the progress the teams have made through a variety of partnerships,” he says, specifically referencing the partnership with Uber in Austin.

Waymo is expected to be rolled out in Washington DC and Miami next year; it is currently active in parts of San Francisco, Phoenix, and Los Angeles.

The earnings call is now over. Overall, markets seem very happy with that: the stock surged in late trading as the results were announced, and they’ve pretty much maintained those gains during the following comments. GOOGL shares are up around 4.9%.

That’s all from us for this evening. Thank you for following tonight, and we look forward to bringing you more reaction and coverage of Magnificent Seven earnings season tomorrow and next week.

Welcome back – Alphabet still the “king of search”

Welcome back to our live blog on big tech’s earnings season.

Alphabet delivered a strong set of results yesterday evening, beating expectations on earnings and revenue. Shares are up more than 5% in pre-market trading this morning, at the time of writing.

“Alphabet is still the ‘king of search’, and despite a cloud of pessimism hanging over internet stocks ahead of earnings, this was a strong all-around performance,” said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

He points out that Google Search hung onto decent revenue growth, “even as debates rage on about what the future of search looks like in the age of AI”. Revenues from search grew by 9.8% year-on-year.

This should be fairly reassuring to investors who have had questions about what applications like ChatGPT could mean for Google Search usage – and as a result ad revenues.

Investors have also had questions about Google’s “AI Overviews” feature and whether this would impact ad money – for example by pushing traditional search results further down the page and potentially even damaging trust.

Google was upbeat about this feature during its earnings, with chief executive Sundar Pichai saying that search growth was “boosted by the engagement we’re seeing with features like AI Overviews, which now has 1.5 billion users per month”.

Commenting on the results, Britzman added: “AI-generated overviews are not only gaining traction but, crucially, bringing in ad dollars comparable to traditional queries. That’s a positive signal.”

Will “lingering concerns” about tariffs dampen Alphabet’s rally?

Alphabet’s results were received positively by investors yesterday evening, but will the stock be able to sustain its rally? Russ Mould, investment director at AJ Bell, thinks tariffs could create headwinds for the company’s advertising revenues.

“Alphabet seemed to dance around questions on this topic during the conference call and not give a straight answer apart from noting issues involving Asia Pacific retailers would cause ‘slight headwinds’ to its ads business,” he said.

Mould points out that Chinese companies like Temu have reduced their promotional spend on online platforms like Google, after taxes were introduced on small packages entering the US.

Apple shifting assembly to India?

Let’s shift our attention from Alphabet to Apple – one of the Mag7 companies that is yet to report.

An exclusive report published in the FT today said the tech giant plans to shift iPhone assembly from China to India as early as next year. The move comes after Donald Trump imposed tariffs of up to 145% on China.

The change would impact all iPhones sold in the US, according to the report. Currently, more than 60 million are sold in the US each year. The FT says the target would mean doubling iPhone output in India.

“This is a big move away from China and shows how the geopolitics are shifting. It's a big win for India,” Deutsche Bank analysts said in a note this morning.

What to expect from Apple’s earnings

Analysts don’t really know what to expect when Apple unveils its results next week on Thursday, 1 May. Investment platform AJ Bell points out that the last 60 days show three upgrades and three downgrades to estimates.

This is largely because the company offered little forward guidance when it published its first-quarter earnings in January. Currently, consensus estimates from Zacks point to the following:

- Revenues of $93.6 billion, up 3% year-on-year

- Earnings per share of $1.60, up 5% year-on-year

These are “not the most thrilling growth rates for a company whose stock still trades at a substantial premium to the wider US equity market,” said Danni Hewson, head of financial analysis at AJ Bell.

Apple is currently trading at more than 28 times its forecast earnings, while the S&P 500 is closer to 20.

“The case for that premium rests with the sticky nature of Apple’s customers, thanks to the power of its brand, familiarity with the iOS operating system and the ecosystem of apps and app developers,” Hewson said.

She points out that the apps in particular drive a high-margin revenue stream.

“Analysts will look to Apple’s revenue mix and product trends for reassurance that this business remains strong, even if its somewhat enclosed nature is attracting ever-greater regulatory scrutiny,” she added.

More Mag7 earnings next week...

Apple will publish its earnings on Thursday, and may reveal more about its reported shift to India then (see previous posts). We will also hear from Microsoft and Meta next week (30 April).

Join us then, when we will return with further preview analysis and reaction. Thank you for following along.

Magnificent Seven earnings: Microsoft, Meta, Apple and Amazon to announce results

Good morning, and welcome back. Thanks for joining our live coverage of a big week for big tech.

Four Magnificent Seven companies – Meta, Microsoft, Apple and Amazon – announce their results this week. We’ll continue our live coverage, analysis and reaction. Stay here for all the latest.

When do Microsoft and Meta announce their results?

First up in Magnificent Seven earnings this week are Microsoft and Meta. Both announce their earnings after US markets close (9pm BST) on Wednesday 30 April.

Company | Earnings release date | Earnings call time |

|---|---|---|

META | 30 April, AMC | 2pm PT (10pm BST) |

MSFT | 30 April, AMC | 2.30pm PT (10.30pm BST) |

Microsoft’s earnings call is scheduled to start half an hour later than Meta’s. That means there will be some overlap on the two calls, so expect an active evening in after-hours trading.

When do Amazon and Apple announce earnings?

We then have Amazon and Apple’s earnings after US markets close (9pm BST) on Thursday 1 May. The full timings are below:

Company | Earnings release date | Earnings call time |

|---|---|---|

AAPL | 1 May, AMC | 2pm PT (10pm BST) |

AMZN | 1 May, AMC | 2pm PT (10pm BST) |

These two earnings calls clash directly, potentially setting up a second consecutive evening of busy after-hours trading.

Meta earnings: what to expect

So what are analysts expecting from this week’s Magnificent Seven earnings?

Starting with Meta: analysts polled by FactSet yield the following consensus estimates:

- Earnings per share (EPS) at $5.24, up 11.3% year-over-year;

- Revenue of $41.34 billion, up 13.4% year-over-year.

Analysts polled by London Stock Exchange Group (LSEG, formerly Refinitiv) yield an EPS estimate of $5.28 on revenue of $41.39 billion.

Analysts are forecasting double-digit growth in both earnings and revenue when Meta announces its Q1 results on Wednesday.

Microsoft earnings: what to expect

Microsoft’s results are expected to reveal earnings and revenue both growing at approximately 10% over the last year.

Analysts polled by FactSet give the following consensus estimates for Microsoft’s results:

- Earnings per share (EPS) at $3.22, up 9.5% year-over-year;

- Revenue of $68.43 billion, up 10.6% year-over-year.

The LSEG equivalents are EPS of $3.22 on revenue of $68.44 billion.

Wall Street analyst: cloud will drive Microsoft and Amazon’s earnings

Alphabet’s earnings beat last week was underpinned by a decent showing from its Google Cloud division, which grew revenue 28% year-over-year.

Dan Ives, global head of technology research at Wedbush Securities, expects its hyperscaler competitors, Microsoft and Amazon, to follow suit this week when they announce their results.

“[Wall] Street is laser focused to hear from Big Tech titans to get a better grasp on the demand and spending patterns abound from enterprises and consumers,” says Ives in a research note seen by MoneyWeek.

From speaking to “dozens of top CIOs, IT product managers, partners and key enterprise decision makers”, Ives anticipates “very firm cap-ex intentions for 2025”.

An Amazon Web Services data centre in Stone Ridge, Virginia, US. Wedbush Securities expects both Amazon and Microsoft to announce strong cloud revenue when they release earnings this week.

Ives adds that he expects “Microsoft and Amazon will both report strong cloud numbers this week”.

Meta and Microsoft shares make divergent starts to earnings week

US markets have opened, and both the next two Magnificent Seven stocks to release earnings are moving in opposite directions.

Meta shares are up around 0.5% after the first hour or so of trading, but Microsoft’s shares have fallen 0.4%. The S&P 500 is up around 0.1%.

Meta's live share price:

Microsoft’s live share price:

Pressure on Meta to justify AI spend

For two and a half years, investors have got enthusiastically stuck into the stocks they view as leading the AI revolution. It’s not really mattered how much they’re spending; the race is on to lead the pack in this potentially transformative emerging technology.

That still holds true in a basic sense, but Susannah Streeter, head of money and markets at Hargreaves Lansdown, envisages some pressure on Meta to “show the technology is reaping rewards.

“Although Meta is still expected to post solid top line growth, investors may still baulk at how much it’s pouring into artificial intelligence ventures,” she adds.

The impact of the tariff war on Meta’s revenues could also come into focus.

“Big Chinese retailers, such as the fast fashion giants, Temu and Shein, have been hugely helpful buyers of adverts targeting US consumers, but given the onerous duties now imposed, they will lose their competitive edge and may decide it’s a market not worth going after,” she says.

Streeter expects that investors will be especially keen to hear from management on this point, given how reliant Meta has become on China for ad sales growth.

That's all from us this evening, but join us tomorrow for more Magnificent Seven earnings preview and analysis.

Magnificent Seven shares divergent

Good morning, and welcome back to our rolling coverage of Magnificent Seven earnings season.

Meta shares gained 0.45% while Microsoft shares fell 0.18% in yesterday’s session, two days out from tomorrow’s earnings release.

Amazon and Apple, who report their earnings on Thursday, also had divergent days: Apple shares gained 0.41% but Amazon’s fell 0.68%.

It bucks the trend set so far during this earnings season, where the Magnificent Seven share prices have generally moved up and down in tandem with the markets, except immediately after individual earnings.

The S&P 500 split the difference, finishing the day just 0.06% higher.

What’s happening with Microsoft’s capex?

Capital spend is going to be a hot topic for all Magnificent Seven companies this earnings season, given the uncertainty of the macroeconomic environment and their previous commitments to invest heavily into AI infrastructure.

Microsoft, though, may be particularly under the microscope on this front.

At the end of March, Bloomberg reported that Microsoft had cancelled several new data centre projects in the US and Europe amounting to 2 gigawatts of capacity, citing TD Cowen analysts. This followed on from a February note from the analysts detailing other cancelled leases in the US.

One project that has reportedly been impacted is the 210MW data centre in London Docklands. Microsoft had been negotiating to lease space in the development, but Bloomberg reported in April that it is yet to commit to its plans.

The construction site of the Docklands Data Centre Campus in London, UK, on Wednesday, April 2, 2025. Microsoft Corp. was negotiating to lease space at Ada Infrastructure's 210-megawatt Docklands data centre, but reports suggest that it is holding off on committing to the plans.

This sparked concern among investors that demand for Microsoft’s AI compute capacity, in which it has previously pledged to invest $80 billion in the year to June, could be dampening.

However, Jamie Meyers, senior analyst at Laffer Tengler Investments, has downplayed these concerns.

“We’ve heard the rumours over cancelled leases and continue to believe the concern is overblown,” he says. “Entering/exiting contracts is normal course of business when you’re laying out $80 billion – not all contracts will come to fruition for one reason or another – i.e., plans are fluid.”

Meyers adds, though, that “we expect a lot of questions re: capex on the [earnings] call”.

Other considerations for Microsoft’s earnings

Here are some other watch-outs for Microsoft’s earnings release tomorrow, according to Jamie Meyers, senior analyst at Laffer Tengler investments:

- The tariff impact. While software is less vulnerable to tariffs, Meyers thinks markets will want to know whether Microsoft’s sales cycle is being elongated thanks to the tariff impact, and believes that “we could see some weakness in non-AI spending as enterprises cut back on cloud consumption and outlays”;

- Azure growth. On that note, the pace of growth for Azure, Microsoft’s cloud arm, will be key – as it was for Alphabet’s earnings last week. “We expect Microsoft to exceed guidance for Azure growth,” says Meyers. Last quarter, Microsoft forecast 31-32% revenue growth for Azure, which would amount to around $35.1 billion in Intelligent Cloud revenue based on the equivalent period last year.

- AI commentary. As well as strength in AI revenues, Meyers is expecting “strong commentary around the use of Copilot and associated agents”;

- MS365 and Edge growth. Meyers highlights that these products have gained share for 15 consecutive quarters.

Amazon’s earnings: what to expect

Let’s have a look ahead to Thursday’s earnings releases, starting with Amazon.

The latest consensus estimates among analysts polled by FactSet for Amazon’s earnings and revenue are:

- Earnings per share (EPS) of $1.37, up 39.8% year-over-year;

- Revenue of $155.1 billion, up 8.2% year-over-year.

Analysts polled by London Stock Exchange Group (LSEG, formerly Refinitiv) yield an EPS estimate of $1.37 on revenue of $155.0 billion.

Apple earnings: what to expect

The fourth Magnificent Seven company announcing earnings this week is Apple. Here’s what analysts polled by FactSet expect for the iPhone maker on Thursday:

- Earnings per share (EPS) of $1.62, up 5.9% year-over-year;

- Revenue of $94.2 billion, up 3.8% year-over-year.

Analysts polled by London Stock Exchange Group (LSEG, formerly Refinitiv) yield an EPS estimate of $1.63 on revenue of $94.5 billion.

White House lashes out at Amazon over tariff pricing

Amazon has drawn fierce criticism from the Trump administration today, following reports from Bloomberg and Punchbowl News that it will soon display the impacts that tariffs have on prices in its e-commerce store.

“This is a hostile and political act by Amazon,” White House press secretary Karoline Leavitt told reporters.

Amazon could be about to display the impact of tariff on its deliveries when shoppers buy from its e-commerce store.

Amazon shares are 1.3% down after around half an hour’s trading today.

Meta launches AI app

Meta has announced the launch of its new AI app today, ahead of its earnings release tomorrow.

It features greater levels of personalisation as well as a Discover feed that lets users see how others are interacting with AI.

Meta’s new AI app, released today, brings its Llama LLM to users in a dedicated app for the first time.

The app is based on Llama 4, and features newly optimised voice interaction.

Expect CEO Mark Zuckerberg to lean heavily into this new release during tomorrow’s earnings call.

Amazon denies tariff pricing report

An update to that Amazon story we mentioned earlier: the company has released a statement denying the reports that it is planning to list the impact of tariffs on its prices.

The Washington Post reports that Amazon spokesperson Tim Doyle said in a statement that the team that runs its low cost site Haul had "considered listing import charges on certain products", but that it was "never considered" for the main site.

Thanks for following our rolling coverage today. Join us again tomorrow, for the final build-up and analysis ahead of Microsoft and Meta's earnings releases.

Microsoft and Meta earnings day

Good morning and welcome back to our live coverage of Magnificent Seven earnings season.

Today, we’ll see Microsoft and Meta both announce their earnings report, after US markets close this evening.

We’ll cover Meta’s earnings call live, and bring you live updates on Microsoft’s release too – plus market reaction, as well as further previews throughout the day. Stick with us for all the latest!

How Microsoft and Meta shares fare ahead of earnings

Meta’s shares gained 0.85% yesterday while Microsoft’s finished the session up 0.74%, giving both some positive momentum in the penultimate session before they release earnings.

However, early trading today suggests this could reverse: S&P futures are down 0.1% and Meta’s shares have fallen 0.6% in pre-market trading. Microsoft is up 0.2% as things stand, though.

Will it all ad up on Meta’s earnings call?

In contrast to the likes of Amazon, Alphabet and Microsoft, who boast major cloud platforms alongside their other, longer-running sources of revenue, Meta’s income derives almost entirely from a single source: advertising.

Down the line, it will perhaps be able to monetise its AI projects more directly, but in its last earnings release 97% of Meta’s quarterly revenue came from ads.

As such we can expect the commentary and questions on tonight’s call to focus heavily on topics like new advertising technologies and increases in user numbers across Meta’s family of apps. Macro topics could kick in, as any slowdowns for major advertisers – like Chinese retailer Shein – could have a significant impact on demand for ad space on Meta.

An eye on AI in Meta’s earnings call

AI is also likely to be a hot-button topic. Last quarter, Meta’s CEO Mark Zuckerberg fended off concern that open-sourcing Llama, Meta’s generative AI LLM, was a strategic blunder that had facilitated the rise of DeepSeek.

The emergence of DeepSeek threatened to overshadow Meta’s last earnings call, but this quarter, there’s reason to expect the company can address AI developments on its own terms.

“There’s going to be an open-source standard globally,” Zuckerberg told the earnings call. “I think for our national advantage, it’s important that it’s an American standard. We take that seriously, and we want to build the AI system that people around the world are using.”

That reassured investors at the time. With Meta having released its new AI app yesterday, expect plenty of focus on the future direction of travel during tonight’s earnings call.

Microsoft’s war chest

Microsoft’s earnings call is likely to focus heavily on its capex, with the $80 billion investments it has promised into AI and cloud infrastructure in the spotlight as a bellwether for demand.

Can it afford these numbers?

“They’re spending big, but it’s what’s needed to stay ahead,” says Josh Gilbert, market analyst at eToro. He adds that Microsoft “has the balance sheet to back it up: Microsoft’s cash pile is expected to hit $78 billion this quarter.

“While heavy spending may weigh on margins in the short term, Microsoft’s ability to generate high returns on capital and sustained revenue growth should help ease concerns,” adds Gilbert.

US economy contracts, deflating shares ahead of Meta’s earnings

Meta shares are currently down around 3% today – not what Mark Zuckerberg will have wanted in the run-up to tonight’s earnings release. Microsoft is down around 1.3%.

The S&P 500 is down 1.3%. News broke earlier today that the US economy has contracted for the first time in three years, IE the immediate aftermath of Russia’s invasion of Ukraine.

What time does Meta announce results?

Just as a reminder, Meta’s earnings release is due shortly after markets close in the US today – 9pm BST.

Meta’s earnings call is scheduled to start at 2pm PT, which is 10pm BST. If you want to stay up late and catch all the updates live, we’ll be covering that call here.

Microsoft’s earnings release is due at the same time as Meta’s. Its earnings call is scheduled to start half an hour later. We won’t be covering that live in detail, though we’ll do our best to bring you the highlights, with a more thorough debrief coming tomorrow.

We are pausing our coverage now for a few hours but will be back at 9pm when Meta's results are published. Join us then.

Good evening, and welcome back. Not long to go now until Meta's earnings are announced. Microsoft is also presenting its quarterly results tonight.

Both stocks are trading down today, with US markets falling on the back of weak economic data. Meta's shares are particularly hard hit, down around 1.6%. Could strong Magnificent Seven earnings provide a boost of optimism? Follow here to find out.

Meta and Microsoft earnings expectations: recap

A quick reminder of what analysts expect each company to post in their earnings reports.

Meta

- Earnings per share (EPS) at $5.24, up 11.3% year-over-year;

- Revenue of $41.34 billion, up 13.4% year-over-year.

Microsoft

- Earnings per share (EPS) at $3.22, up 9.5% year-over-year;

- Revenue of $68.43 billion, up 10.6% year-over-year.

Breaking: Microsoft beats on earnings revenue

Microsoft's revenue of $70.1 billion beats analyst expectations, and EPS of $3.46 is also above.

Microsoft's shares have surged more than 6% in after-hours trading on those results.

Cloud revenue is up 20% to $42.4 billion.

Breaking: Meta delivers big earnings beat

Meta's revenue comes in at $42.31 billion for the quarter. EPS is a big beat at $6.43.

Meta's shares have gained over 4.5% in after-hours trading on those results dropping. A big result for Meta. We'll bring you a closer look at the details, ahead of the earnings call which is scheduled to start at 10pm BST.

Meta's earnings: year-over-year comparisons