Apple sits at the top of the tree after hitting $2trn market capitalisation

The technology giant has become the first US company to reach a market value of $2trn. But its life may get harder now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It took Apple almost 40 years to reach a market value of $1trn. But it took it just two more to hit $2trn, says Jack Nicas in The New York Times. Last Wednesday its shares climbed 1.4% to $468.65, making it the first US corporation to push through the $2trn barrier and cementing its title as the world’s most valuable public company. This is a “new milestone” for the group, which was established in 1976 and floated in 1980. It has been responsible for “world-changing products”, such as the Macintosh computer, the iPod and the iPhone.

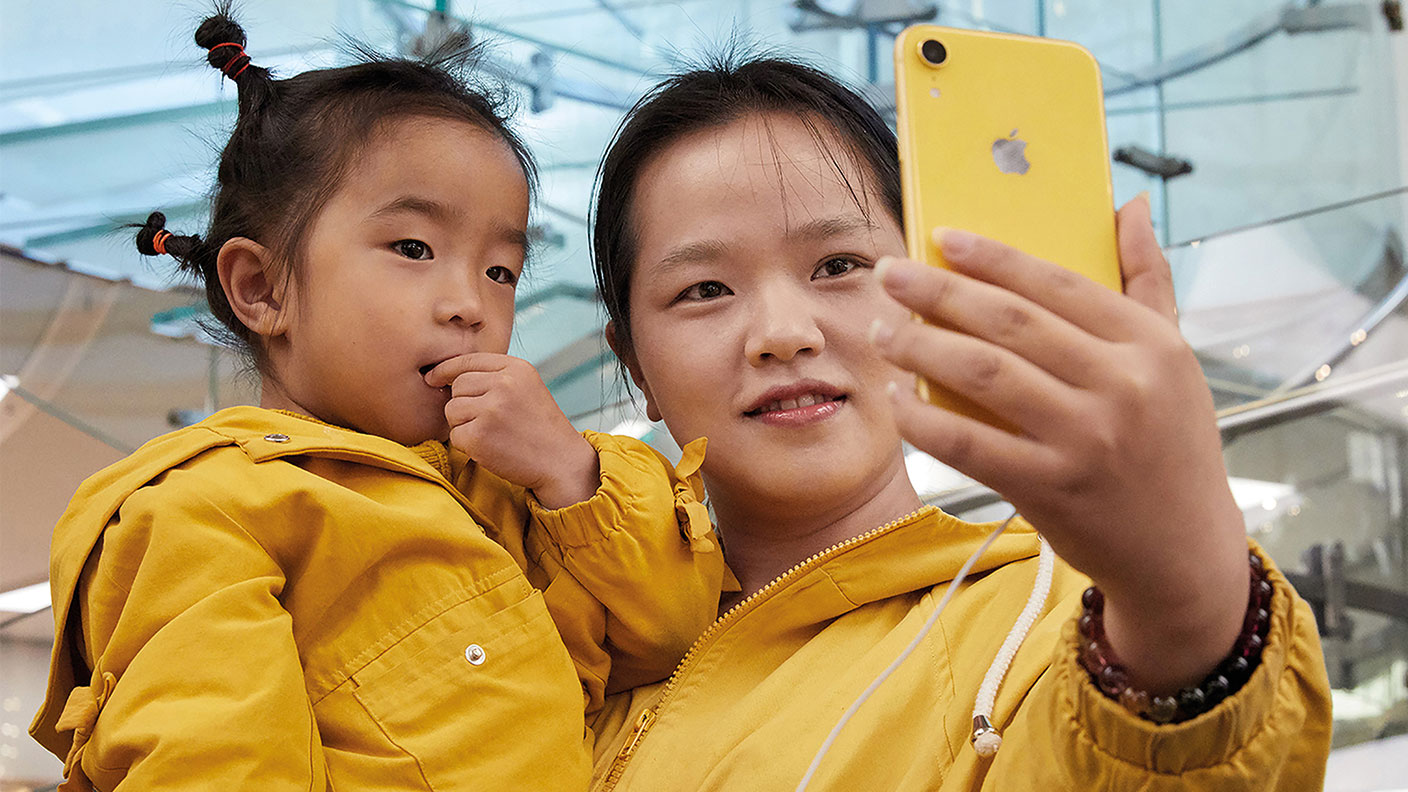

The most important of these products was the iPhone, says Ben Martin in The Times. Launched in 2007, it created a brand “so strong and so consistent” that people “just got locked in”. It has a “minimal” attrition rate, because “once you’ve got an iPhone you just don’t switch”.

However, Apple’s more recent success has been due to the expansion of its services division, which has reduced the group’s reliance on smartphone sales; these now account for less than half of overall revenues. Apple’s “plethora of offerings”, including its App Store, music service and Apple Pay, also gives it a “recurring revenue stream”.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Riding the tech wave

Apple has also benefited from the general surge in technology stocks that has taken place since March, says Amrith Ramkumar in The Wall Street Journal. With “few attractive alternatives” to large tech stocks, many experts expect “other tech behemoths” to join Apple in the $2trn club. Amazon and Microsoft are currently valued at around $1.6trn, while Facebook’s market capitalisation is $750bn.

Don’t count on it, says the Financial Times. It’s true that investors have shown a “big appetite” for Big Tech in recent months as the world has turned to technology to “stay connected”. Apple has also so far managed to defy the “traditional arc” of a pioneering business by staying ahead of the field.

However, the entire sector is threatened by tighter regulation amid heightened concerns over Big Tech’s “increasing dominance”. Some suggest that tech giants “should be subject to the same regulatory burden as traditional public utilities”, while Apple’s Chinese revenues and manufacturing operations could be hit by any US-China trade war.

In any case, while Apple might be a “great company” its shares aren’t necessarily a good investment, says John Authers on Bloomberg. The stock trades at 35 times forward earnings, the highest valuation since 2007. This seems “over-optimistic”. Plenty of growth is already priced in, while it will henceforth be difficult to find a new product to act as a “game-changer” like the iPhone. The price/earnings ratios of the other four technology stocks (Facebook, Amazon, Netflix and Alpahabet/Google) are also in “nosebleed” territory.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Student loans debate: should you fund your child through university?

Student loans debate: should you fund your child through university?Graduates are complaining about their levels of student debt so should wealthy parents be helping them avoid student loans?

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.