Buy Microsoft: Covid-19 is no crisis for big tech stocks

The global lockdowns have greatly accelerated changes in how we live and work. Tech stocks are set top profit – with Microsoft leading the way.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

As Covid-19 spread, the world went remote. People were forced into isolation, physical interaction outside households was outlawed and everything had to be done from afar. This disruption has offered investors their clearest view yet of how the world will adapt and integrate technology. And given tech stocks are trouncing everything else this year, they like what they’re seeing.

To appreciate tech right now means recognising that it’s serving two needs. There’s the immediate surge in demand so that things can still get done. Online videoconferencing is an obvious one, because people can’t get together for business meetings. Then there’s the more far-reaching paradigm shift in which the way we’ve been doing things changes for good across an industry or society as a whole. Working from home, for example, will become the norm for many because it’s effective and cheaper than renting office space. So tech companies are needed to help businesses bring together staff, documents and processes anywhere to build virtual offices.

Accelerating change

This rapid adjustment means everything suddenly seems to be happening at once. “We’ve seen two years’ worth of digital transformation in two months,” said Satya Nadella, chief executive of tech titan Microsoft, recently. Progress is leapfrogging. Investors gauging where firms might be in one, two or five years’ time could find that their hopes (and profits) arrive sooner.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It’s little surprise, then, that while UK and eurozone stocks are down 20% this year, sterling investors in the US tech sector are up 15%. Of course, buying into tech has never really been a bad long-term decision. For all the experts dithering and debating over whether tech is expensive, due a correction or going to be overtaken by apparently cheaper, so-called value stocks, if you’d bought the tech sector at any time over the last decade and sat tight, you’d be winning.

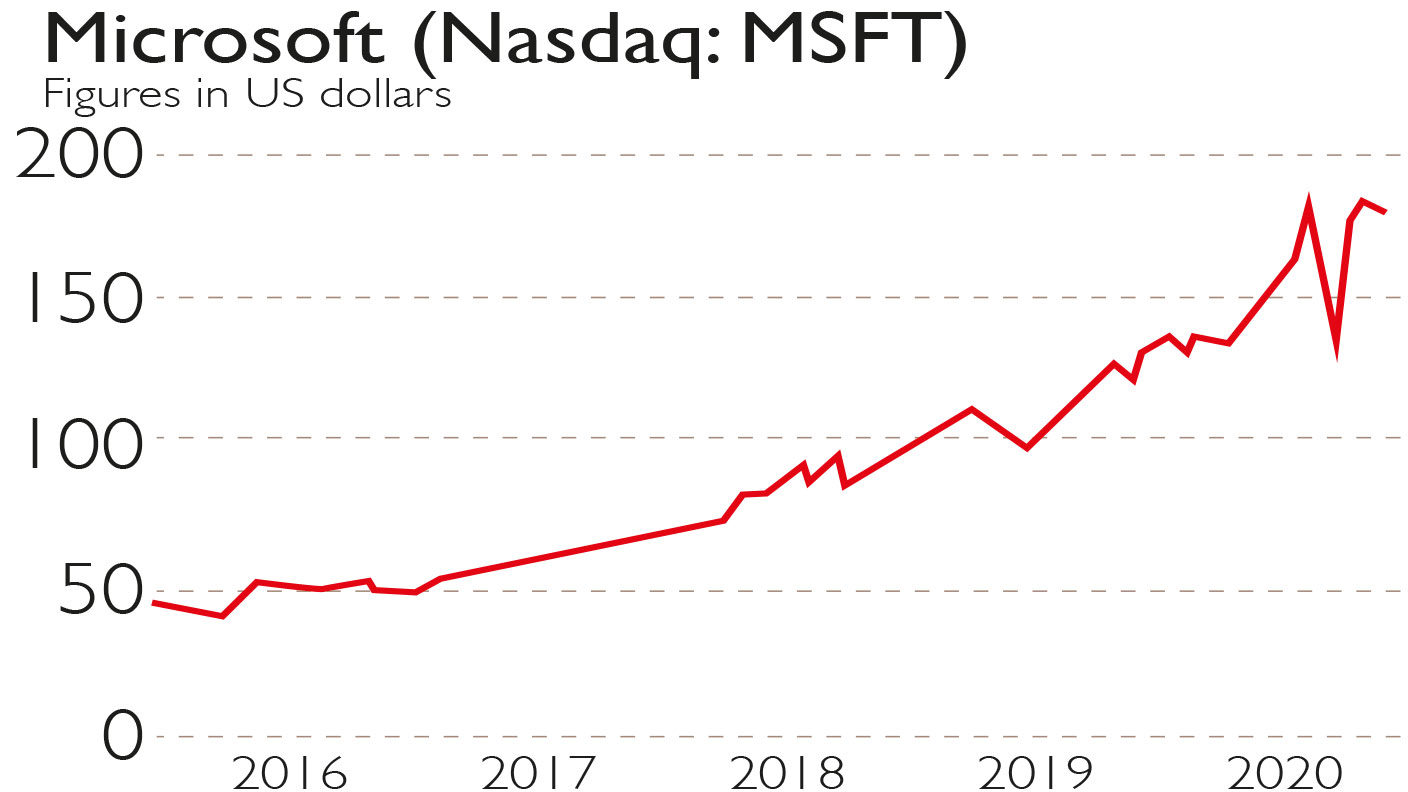

Microsoft (Nasdaq: MSFT) has been no exception, leading much of the advance. Satya Nadella is widely credited with transforming a business that was losing its way when he took the top job in 2014. He dropped the smartphone aspirations, cut the advertising business and shed staff. The focus instead became cloud computing, which is all about seamlessly connecting computers and devices anywhere – a high-growth area today. Rising sales and profits quickly followed, and investors couldn’t get enough. If you’d backed him, £10,000 would be worth about £55,000 now, while an investment in the US market as a whole wouldn’t have reached £20,000. Big doesn’t always mean boring and the story is far from over.

Powering the cloud

The shares have returned 24% in sterling this year, helped by recently well-received results showing another round of double-digit sales and earnings growth.

Change is ongoing, but the direction of travel is clear and the speed accelerating. People need linking up so they can work, study and communicate anywhere; physical offices are going online; and vast cloud capability is needed to manage all this economically.

It’s hard to think of a firm better placed for this than Microsoft, which is one of the market-leading cloud businesses and is beating expectations. The Windows 10 operating system is now on a billion devices, 30% more than last year. Its Teams software now has 75 million users and is helping them collaborate and share projects anywhere. And it’s a powerhouse in productivity, sales management and computing software – everyone is familiar with applications such as Word and Excel. From beginning to end, Microsoft is enabling businesses from Coca-Cola to Vodafone to go virtual.

Double-digit growth is set to continue and its high cash flows should keep lifting the $137bn-plus cash pile, making it defensive while also allowing for rising dividends and bolt-on investments – great qualities in what are difficult but also auspicious times as the world adjusts. The numbers are showing that Microsoft is largely immune to Covid-19. Both it and its shareholders will be all the stronger for it as the new normal emerges.

Microsoft: a long-term holding for a changing world

Microsoft’s quarterly results in April were strong again, with earnings per share growth of over 20%. Cash-flow generation remained high and the balance sheet is robust. Of course, shares trading near their peaks on high valuations are not to everyone’s taste. However, Microsoft’s dominant offering and positioning in a rapidly changing world means it has exceptional opportunities to grow further. Its strong balance sheet and cash generation, meanwhile, give it defensive qualities.

Microsoft is vulnerable to economic ups and downs like many others. While Covid-19 presents opportunities as companies adjust, hard-hit sectors may look to cut costs and IT spending could suffer. Having said that, the imperatives for facilitating working remotely, for example, can’t be ignored. Moreover, switching to cloud computing will save businesses money and this is a secular trend that to some degree can ride through periods of general economic weakness.

Microsoft is a long-term investment and should be bought on that basis. The company is optimistic and has put out well-received profit guidance for the rest of the year. Management is highly regarded and extremely sure-footed. The risk/reward is favourable and the opportunity to profit from the fast-changing world that is still lying ahead of us should prove rewarding.

Stephen Connolly (sc@plainmoney.co.uk) writes on finance and business. He has worked in investment banking and asset management for over 25 years.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.