7 sin stocks to buy yielding up to 8%!

Sin stocks don’t have the best reputation, but when it comes to investment returns, they’re certainly worth a closer look.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Sin stocks, such as companies in the gambling, alcohol, tobacco and defence sectors are widely deemed ethically dubious.

But they are highly profitable and boast solid long-term prospects, that’s why investors should consider investing in these businesses.

The sin stocks to buy

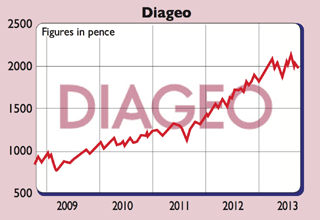

My favourite of all the sin stocks is the drinks giant Diageo (LSE: DGE). It owns a range of highly valued brands that would be almost impossible for a competitor to challenge, such as Guinness and Johnnie Walker whisky.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It is looking to increase its share of the “total beverage alcohol” (TBA) market value from 4% to 6% by 2030. The global drinks market is expected to produce a compound annual growth rate of 3% per year until 2030.

Acquisitions are a crucial part of this growth strategy. The group can afford to buy its growth. Its operating profit margin in fiscal 2022 was 28.5% – a fantastic figure compared with fellow consumer-goods giant Unilever’s 15.2%.

It also spends 18% of its net sales on marketing, which will help drive growth and reinforce the value of its brands.

Defend your portfolio

The best defence companies are in the country with the highest defence budget, the US.

Raytheon Technologies (NYSE: RTX) is a global leader in aerospace and defence, notably missiles. Following the merger with United Technologies in 2020, the group became the world’s second-largest aerospace and defence company by sales.

The group’s primary business line is missile technology, but it also has a significant space division (it makes satellites) and civil aerospace business. All three are growth areas, not just for the group but also for the global economy in general.

Consequently, while the business might be suffering from some supply-chain indigestion today, its long-term growth prospects are highly encouraging.

It may also be worth researching Britain’s BAE Systems (LSE: BA). While this company does not have the reach of some of its US peers, recent contract wins to build frigates for the Royal Navy and the Royal Australian Navy mean the corporation has a large order backlog, providing visibility over future growth.

At the end of June, the company’s order backlog stood at £52.7bn, locking in more than two-and-a-half years of sales. In the first six months of the year alone, the group’s order intake hit £18bn, compared with just £21.5bn for the whole of 2021.

Sin stocks benefit from regulation

The UK is often attacked for not nurturing its technology industry. But where we really excel is gambling technology, primarily online. Entain (LSE: ENT) is one of the world’s largest companies in this field. Having conquered the UK and European markets, the group is now focusing on the fledgling US sports-betting market.

According to analysts at Swiss bank UBS, its US online sportsbook joint venture with MGM, BetMGM, will be a growth engine over the next few years. They reckon this joint venture can triple its revenues by 2025 and turn profitable next year.

Although there are plenty of competitors in the US market, Entain has the scale, technology and financial resources to comply with regulations and market its product effectively, while others might struggle. Analysts estimate that the global sports-betting market is set to grow more than 10% per annum until the end of the decade.

In the physical world, one of the largest and most established players in the casino market is Caesars Entertainment (Nasdaq: CZR).

With an unrivalled presence on the Las Vegas strip, this could be the best business to own for exposure to the premier gambling destination in the United States.

Activity in Las Vegas has bounced back since the pandemic. The company recently told investors that October was the “strongest month ever” for its Las Vegas business, and occupancy across its hotels reached 94% in the third quarter. Gambling revenue also hit an all-time high.

Caesars is one of the few companies in the US market with the resources and regulatory backing to pursue growth in the country’s fledgling sports-gambling market.

Caesars Digital, which comprises Caesars Entertainment’s digital sportsbook and online casino, enjoyed a 121% rise in revenue during the third quarter of 2022. The segment’s loss declined to $38m, a massive improvement from last year’s loss of $164m.

Tobacco…

I’ve left tobacco until the end of this article because I think it is the sector likely to spark the most debate among investors. Tobacco is highly addictive, and the adverse health effects cost economies hundreds of billions of dollars annually. Still, not every tobacco company is the same and over the past few decades the tobacco industry has consolidated into a handful of major players, handing the remaining giants vast economies of scale.

Philip Morris (NYSE: PM) is the biggest and owns the rights to the Marlboro cigarette brand globally. Altria (NYSE: MO) is the top player in the US, owning the rights to the Marlboro brand inside the country’s borders. Altria also owns a 10% stake in the world’s largest brewing company, AB InBev, and investments in smoke-free tobacco products and cannabis.

Last year, Philip Morris acquired the UK pharmaceutical group Vectura, which specialises in treating lung disease, following in the path of Japan Tobacco (Tokyo: 2914), which generates 90% of its income from tobacco, 6.3% from processed foods and 3.5% from pharmaceuticals.

We have British American Tobacco (LSE: BATS) and Imperial Brands (LSE: IMB) here in the UK. Both firms are making significant inroads into the e-cigarette and smokeless tobacco markets, in addition to investing in cannabis.

The companies that look most attractive from a diversification perspective are Japan Tobacco and Altria. From an income perspective, British American and Altria are the most appealing. These two equities offer dividend yields of 6.5% and 8.5%, respectively.

• Rupert Hargreaves owns shares in Diageo and British American Tobacco.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three UK stocks for long-term growth

Three UK stocks for long-term growthUK Stocks Professional investor Nick Train picks three UK stocks to invest in the British boom.

-

Three iconic brands that lost their shine

Three iconic brands that lost their shineMany famous brands have lasted for decades, but history shows that they can suddenly fade away.

-

Investors should drink to Diageo’s growth

Investors should drink to Diageo’s growthTips The group operates in 180 countries and has just increased its dividend. The shares look cheap too.

-

Three quality companies with compelling prospects

Three quality companies with compelling prospectsOpinion Owning quality companies, especially during periods of uncertainty and volatility, pays off over the long-term, says professional investor Michael Foster. Here, he picks three of his favourites.

-

Don’t be tempted to buy banks – here are two better options

Don’t be tempted to buy banks – here are two better optionsFeatures Bank shares might look cheap right now, but don't be tempted. There are better places to put your money, says Ed Bowsher. Here, he picks two stocks to consider instead.

-

Shares in focus: Diageo looks frothy

Shares in focus: Diageo looks frothyFeatures The shares are doing well, but can that continue? Phil Oakley investigates.