5 defence stocks to arm your portfolio

Defence stocks have been in the spotlight for more than a year owing to geopolitical trends predating the Ukraine war and low valuations. Alec Cutler, portfolio manager of the Orbis Global Balanced and Cautious Funds, presents the bullish case.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Defence stocks are not generally considered to be "defensive stocks."

Investment professionals will usually define defensive stocks as those with steady and predictable earnings, competitive advantages that prevent rivals gaining a foothold in their sector, a strong balance sheet and a relatively stable share price. But in reality, what’s considered “defensive” is whatever held up best in the last market sell-off.

In behavioural science this is called recency bias. It causes nervous investors to rush for what they wish they had owned in the last bear market, regardless of whether those companies are well placed for the current one. If market declines are brief enough, the very belief that a company is defensive can help it resist price falls and bolster its defensive reputation.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But when bear markets drag on long enough, actual operating results dictate share-price performance, and some erstwhile defensives prove anything but. Similarly, a new crop of companies emerge that demonstrate the attributes listed above.

As contrarian investors, we are always looking for attractively-priced companies with under-appreciated defensiveness. Often these are in industries that have inherently defensive characteristics and used to be considered defensive, but have recently fallen out of favour. Sometimes real negative change has occurred, and industries may never regain their defensive status.

Telecoms companies are a good example. The world has changed: they no longer dominate the flow of global information and they have to fight with more competitors for a pie that is shrinking owing to technology-driven efficiencies. When was the last time you placed a long-distance phone call?

However, sometimes our research supports the idea that a formerly defensive industry still deserves to trade at a premium defensive valuation, even if it isn’t highly valued right now. We believe defence stocks fall into that category.

Defence stocks jump as China and Russia flex their muscles

Certain defence stocks attracted attention over a year ago, with interest sparked by two developments. Firstly, it was becoming clear that China’s and Russia’s geopolitical assertiveness and military build-up was more secular than cyclical, and that it would spark a similar response from those feeling threatened – as it has since the time of Thucydides.

Secondly, shares that were already inexpensive owing to years of falling defence budgets were, in the case of European companies, being pushed down even harder owing to the announcement of a new EU social taxonomy, which promised to increase the cost of doing business for companies whose activities don’t contribute to the social goals of the EU. Defence stocks were initially considered among the worst offenders.

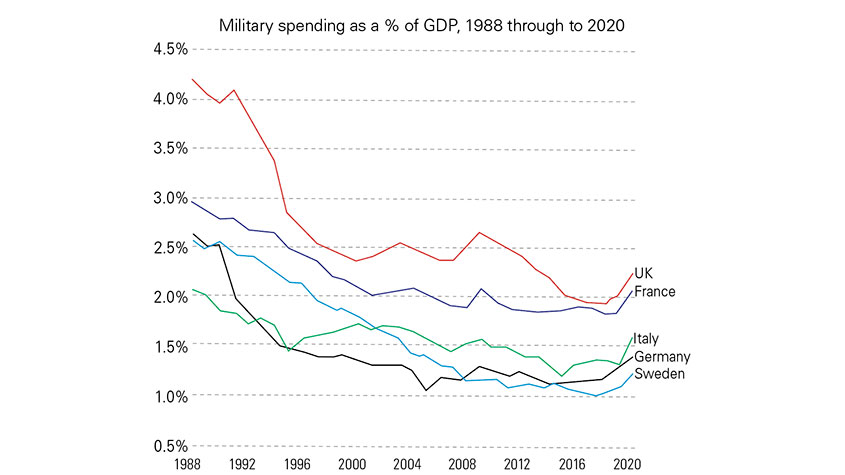

In November of 1989, the Berlin Wall fell and the Cold War ended. With that, defence budgets dropped precipitously, as the West sought to cash in the peace dividend. As the chart below shows, defence spending settled at very low levels for many countries, eclipsed by other social priorities. The vast majority of Nato countries are still below the Nato requirement to spend at least 2% of GDP on defence.

With Russia’s second invasion of Ukraine and China’s increasingly strident stance towards Taiwan, the peace dividend is now clearly eliminated. Some are saying we’re entering a new Cold War, but for Russia and China, it actually never ended, and the profit-driven and optimistic West has been caught underprepared and underinvested in its deterrence against potential aggression.

Russia’s invasion of Ukraine on 24 February ended the period of political rationalisation that followed its 2014 annexation of Crimea. In response, nearly every European country has announced a massive increase in defence budgets. These increases come in ways that signal a long-term shift in attitude, with increases in military force, long-term weapons programmes, and in the case of Germany, Sweden, and Finland, historic changes in their stance towards war.

A crucial sea change

We do not believe that Wall Street analysts are even close to increasing adequately their earnings estimates to account for the coming torrent of defence spending.

Looking at the chart, it is easy to see why. After more than 30 years of dropping revenues, it is incredibly difficult for those covering defence stocks to register the full impact of the change we’re seeing today, or they are assuming what we’re currently experiencing is merely a brief spike.

We disagree. We don’t see an imminent Russian defeat or Putin disappearing, we don’t see China turning away from its regional goals, and we don’t see any sort of worldwide consensus to support the Western powers’ opposition to Russia. In fact, we think it more likely that the world will return to a mix of East and West blocs, and unaligned nations.

This is a recipe for significantly increased defence budgets that then grow steadily off that higher level, not just in Europe but also throughout the world. Korea, Japan, Australia and India have all recently announced increased spending on defence.

That has not gone completely unnoticed by the market, and our defence stocks Saab (Stockholm: SAAB-B), BAE Systems (LSE: BAE), Thales (Paris: HO), Rheinmetall (Frankfurt: RHMD), and Mitsubishi Heavy Industries (Tokyo: 7011) are all up by 30%-60% so far this year, growing from small positions to represent over 5% of the portfolio.

Yet we believe they still have considerable upside. Saab AB makes the Gripen fighter jet, a highly capable and lower-cost alternative to Lockheed’s F-35, which is overbooked on orders, forcing countries to look for alternatives. The Swedish company also makes the NLAW, an anti-tank weapon now in huge demand following its successful use by Ukrainian forces.

BAE makes frigates, submarines, and the Typhoon fighter, all highly sought after, as well as the M777 howitzers recently supplied by the US to Ukraine.

Thales, Rheinmetall, and Mitsubishi Heavy Industries have all been inundated with enquires about their hardware.

Defence stocks will profit as government spending grows

For all five companies, earnings expectations for 2025 have increased, but only modestly – by 10%-15% for BAE, Saab, and Thales, 30% for Mitsubishi Heavy Industries, and 60% for Rheinmetall (driven by Germany’s €100bn increase in defence spending). Following those revisions, the defence stocks now sell at a discount to the market on forward price/earnings, but we believe both the “p” and the “e” should change. On the earnings side, if our assessment of an intensified and protracted Cold War is correct, considerable increases in earnings expectations are likely.

On the price side, we see two compelling cases for higher valuations. Firstly, Russia’s invasion has spurred commentators on environmental, social, and governance (ESG) to rethink their negativity towards the defence industry. Some continue to view contractors as producing equipment that is used to kill people and destroy societies. But other ESG advocates now see the industry as providing the means for societies, especially those that are most aligned with ESG principles, to deter would-be attackers.

For free societies, a healthy advanced defence sector is something they need to have, not something they should just want to have, and recent events have made that obvious even to former critics of the industry. As more clear-eyed views of the sector prevail, this should remove a cloud over defence stocks’ valuations.

Secondly, and more importantly, the defence contractors we hold are fundamentally defensive businesses. Most of their contracts are protected against inflation, and all but Rheinmetall have been less volatile than world stockmarkets over the long term. As those defensive characteristics come to be better appreciated, these firms should warrant a premium price. In a volatile and inflationary world, the real “defensives” may be in defence.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alec Cutler joined Orbis Investment in 2004. Based in Bermuda, he leads the multi-asset team, is one of the portfolio managers for the Orbis Global Balanced Strategy, and has overall responsibility for the strategy. He previously worked for ten years at Brandywine Asset Management LLC managing the Relative Value strategy, co-managing the Large Cap Value area and co-managing the firm as a member of the executive committee.

Alec holds a Bachelor of Science degree in naval architecture from the United States Naval Academy, a Master of Business Administration from the Wharton School of the University of Pennsylvania, and is a Chartered Financial Analyst.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Where to invest in the metals that will engineer the energy transition

Where to invest in the metals that will engineer the energy transitionA professional investor tells us where he’d put his money. This week: John Ciampaglia, manager of the Sprott Energy Transition Materials UCITS ETF.

-

Tap into the key long-term growth trends with these resilient performers

Tap into the key long-term growth trends with these resilient performersA professional investor tells us where he’d put his money. This week: Zehrid Osmani, portfolio manager, Martin Currie Global Portfolio Trust, picks three favourites.

-

Look beyond familiar stockmarkets for reliable returns in rough times

Look beyond familiar stockmarkets for reliable returns in rough timesTips A professional investor tells us where he’d put his money. This week: Giles Parkinson, managing director of global funds at Close Brothers Asset Management.

-

7 winners and losers in the leisure sector

7 winners and losers in the leisure sectorTips It’s been a wild three years for hospitality, but crisis creates opportunities, says Michael Taylor of Shifting Shares.

-

Nationwide: house price growth sees its biggest drop since 2009

Nationwide: house price growth sees its biggest drop since 2009News Nationwide’s latest house price index shows house prices fell in May, and further challenges lie ahead.

-

3 renewable energy stocks to buy

3 renewable energy stocks to buyTips These stocks look poised to benefit as the world transitions to a net zero economy.

-

Look beyond the blue chips for the best bargains in British income stocks

Look beyond the blue chips for the best bargains in British income stocksTips A professional investor tells us where he’d put his money. This week: Chris McVeyof the FP Octopus UK Multi Cap Income Fund highlights three favourites.

-

Three British stocks offering all-weather income

Three British stocks offering all-weather incomeTips A professional investor tells us where he’d put his money. This week: Brendan Gulston, co-manager of the LF Gresham House UK Multi Cap Income Fund.