Investors should drink to Diageo’s growth

The group operates in 180 countries and has just increased its dividend. The shares look cheap too.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

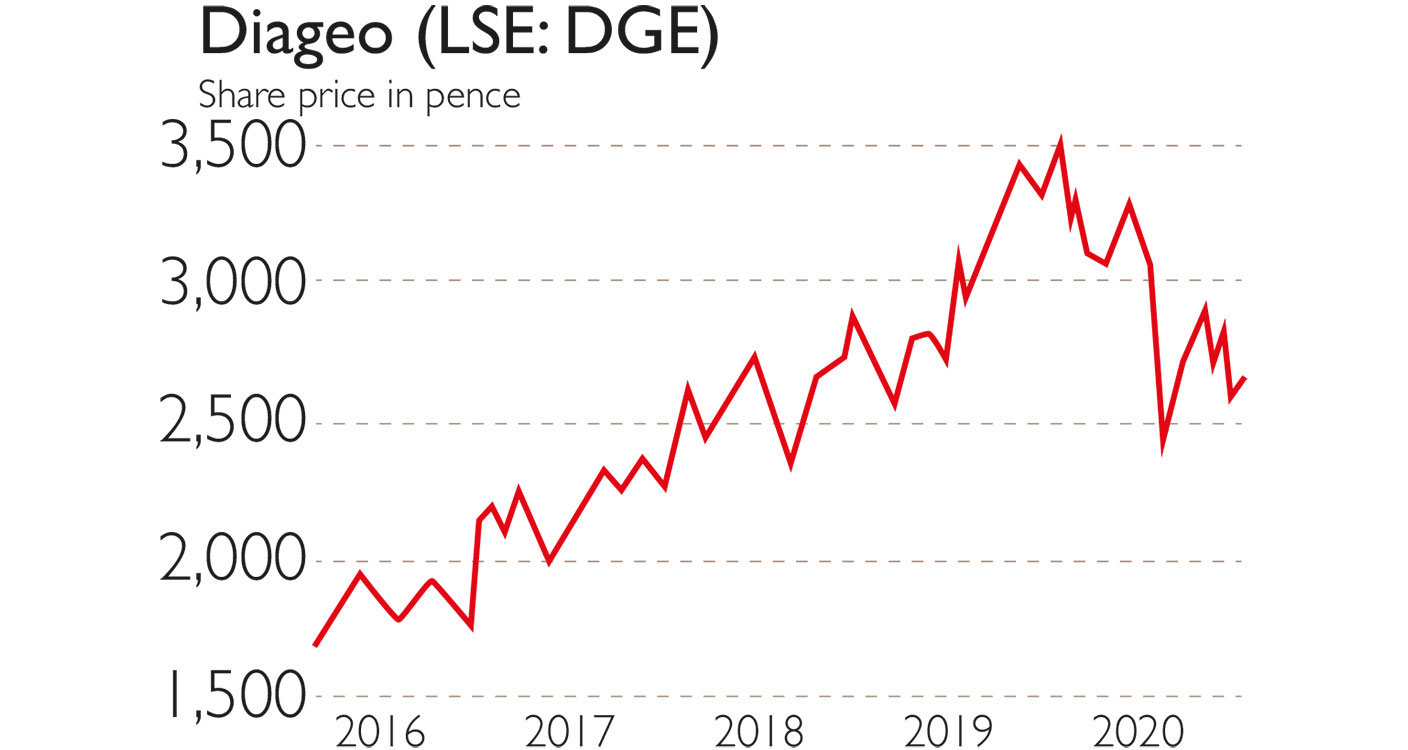

Over the years investors have become very fond of global drinks giant Diageo’s (LSE: DGE) shares as well as its brands, which include Johnnie Walker, Gordon’s Gin and Guinness. A history of rising sales and dividends has kept the market happy.

But disruption from Covid-19 appears to have undermined Diageo’s reputation for reliability. The group’s annual results earlier this month left the market unimpressed and the shares down by over 10%.

It’s not just that the market was expecting better than the 8.4% fall in sales to £11.8bn for the year to June. The shortfall also appears to have prompted questions about whether Diageo is quite as resilient as widely assumed.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It has long been an outperformer, earning its “premium” stockmarket valuation because its well-established and diverse drinks range is seen as strong in the face of economic ups and downs. But this year the shares have failed to shine compared with the FTSE 100 index; they have slid by 16%.

The nervousness seems overdone, however. Diageo may not have lived up to the expectations of a group of analysts on this occasion, but does it matter in the midst of a pandemic? Given none of them has ever before experienced a global economic shutdown, they are arguably just as clueless about the future as the rest of us. Any worries about Diageo’s resilience could prove short-lived as the recovery gains momentum around the world and the business gradually regains its footing.

A bold decision

A sign of Diageo’s own confidence that things will get back to normal is the bold decision to lift the dividend despite the difficult trading. Some commentators had cautioned that there could be a cut. The shares now yield over 2.7%, a strong draw for many investors seeking a progressive income that is well supported by cash flow and has been growing much faster than inflation (at more than 4% a year) over the past decade.

Certainly, before the lockdown it had been business as usual. The group talks of a “good, consistent performance” in the first half of its financial year, before Covid-19. And despite the pandemic, the North America business managed to lift sales 2% for the year as a whole, thanks largely to a 36% jump in tequila sales from its Don Julio and Casamigos labels, along with growth in pre-mixed drinks such as Smirnoff vodka fruit seltzers. However, sales in the region are heavily skewed towards supermarkets and stores. Diageo’s other markets depend more on bars and restaurants.

Meanwhile, early signs following the end of the financial year in June are positive. Chief financial officer Kathryn Mikells has spoken of an improvement in July compared with June and enough recovery in sales volumes coming through to make up for the economic downturn.

Drinks never go out of style

News from some of Diageo’s rivals also bodes well. In France, for example, both Pernod Ricard – which owns Beefeater gin – and Rémy Cointreau said the pandemic would affect their businesses less than originally believed.

Just as the pandemic is unique, there is scant knowledge of consumers’ psychology and behaviour after such lengthy, isolating lockdowns are eased. Some people say they enjoyed the tranquillity, while for others it has left scars. We’re in uncharted territory.

Pubs and restaurants are slowly gaining ground and while some cities might still be ghost towns, anecdotal evidence suggests suburban and village pubs are doing much better. Tourists, big sport and all manner of events will be back too. Drinks are key to social interaction, which will intensify as the pandemic eases, making Diageo a solid long-term bet on getting back to real life.

Diageo: a dependable and diversified giant

Valued at over £61.5bn, London-headquartered Diageo is a leading global alcoholic drinks business selling in 180 countries. It was created relatively recently, in 1997, emerging from the merger of two major players, Grand Metropolitan and Guinness.

Its history goes back much further: Haig Scotch whisky first appeared in 1627, for instance, while Arthur Guinness started brewing ale in Dublin in 1759. Diageo also has interests in established brands such as Hennessy Cognac, Moët & Chandon, Krug, Veuve Clicquot and Taylor’s Port. This is due to a joint venture with Moët Hennessy, which is owned by the global luxury group LVMH.

The portfolio of over 200 durable brands – this week it added Aviation American Gin to the mix – makes Diageo quite rare and is the foundation of its consistent long-term returns of around 10% annually over the past ten years.

While this may pale relative to the earnings growth of Microsoft or Visa, say, the steady growth and progressive dividend payout come together to offer an attractive total return for long-term investors.

Buttressing the strong brand foundations is the global spread of sales, with about 35% in North America, 23% in Europe and the remaining 42% in emerging markets.

It boasts a 36% market share in India and 23% in Latin America, for example. And the breadth of products, from aged Scotch whisky to stout, adds further diversification. The impact of lockdown has varied, depending on the region and the route the group’s products take to reach the market – whether through retailers or bars and restaurants. Early forecasts suggest a return to double-digit earnings growth next year, implying a price/earnings ratio of about 20. That represents a near-20% discount to its valuation over the last few years.

• Stephen Connolly writes on finance and business, and has worked in investment banking and asset management for over 25 years (sc@plainmoney.co.uk)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?