Three quality companies with compelling prospects

Owning quality companies, especially during periods of uncertainty and volatility, pays off over the long-term, says professional investor Michael Foster. Here, he picks three of his favourites.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Each week, a professional investor tells us where he'd put his money. This week: Michael Foster of the Ocean UK Equity fund highlights three favourites.

We seek out the highest-quality companies with the potential to deliver attractive returns. We look at aspects such as margin sustainability, culture, research and development (R&D) budget, vision and integrity of senior personnel, debt and critically attitude to debt.

We believe owning quality companies, especially during periods of heightened uncertainty and volatility, pays off over the long-term. As the famous American investor Peter Lynch pointed out, "more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in the corrections themselves".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

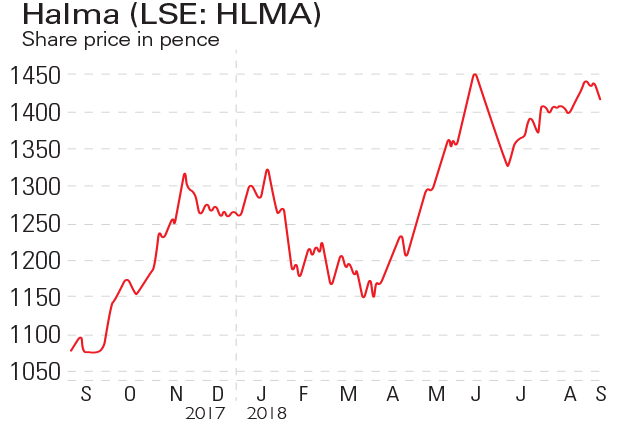

Halma: a finger in several tasty pies

Halma (LSE: HLMA)

Halma operates in sectors benefiting from structural growth, medical regulation and the urbanisation of the developing world. The company spent 11% of sales, £63m, on R&D and £29m on capital expenditure (principally driving automation through the business). It is worth noting that in the last 40 years Halma has only had three chief executives.

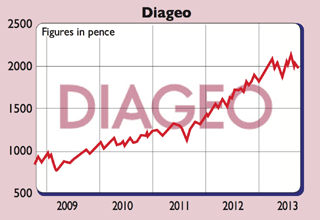

Diageo: pulling ahead of the competition

Diageo (LSE: DGE)

Diageo has also committed itself to various endeavours that make it all the more attractive. For instance, the "grain-to-glass" project, which emphasises the company's awareness of responsibility to consumers and overall sustainability, has resulted in a marked improvement in its carbon emissions and water efficiency.

LVMH: the leaders in luxury

LVMH (Paris: MC)

LVMH's broad range of products gives it a strong advantage over other leading brands. It manufactures and sells wines and spirits, fashion and leather goods, perfumes, cosmetics, watches and jewellery. Its operations are geographically diverse with a third of sales in each of Asia, the Americas and Europe.

Recently the group added to its product base with the purchase of Belmond, which offers hotels, safari camps, trains and cruises. Recent interim results saw sales grow by 15% and profits from recurring operations up 14%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three UK stocks for long-term growth

Three UK stocks for long-term growthUK Stocks Professional investor Nick Train picks three UK stocks to invest in the British boom.

-

Three iconic brands that lost their shine

Three iconic brands that lost their shineMany famous brands have lasted for decades, but history shows that they can suddenly fade away.

-

7 sin stocks to buy yielding up to 8%!

7 sin stocks to buy yielding up to 8%!Stocks and shares Sin stocks don’t have the best reputation, but when it comes to investment returns, they’re certainly worth a closer look.

-

Investors should drink to Diageo’s growth

Investors should drink to Diageo’s growthTips The group operates in 180 countries and has just increased its dividend. The shares look cheap too.

-

If you'd invested in: Halma and Ophir

If you'd invested in: Halma and OphirFeatures Shares in hazard detection copay Halma have risen 158% in the past five years, while those in oil and gas firm Ophir have plunged.

-

Don’t be tempted to buy banks – here are two better options

Don’t be tempted to buy banks – here are two better optionsFeatures Bank shares might look cheap right now, but don't be tempted. There are better places to put your money, says Ed Bowsher. Here, he picks two stocks to consider instead.

-

Shares in focus: Diageo looks frothy

Shares in focus: Diageo looks frothyFeatures The shares are doing well, but can that continue? Phil Oakley investigates.