If you'd invested in: Halma and Ophir

Shares in hazard detection copay Halma have risen 158% in the past five years, while those in oil and gas firm Ophir have plunged.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If only...

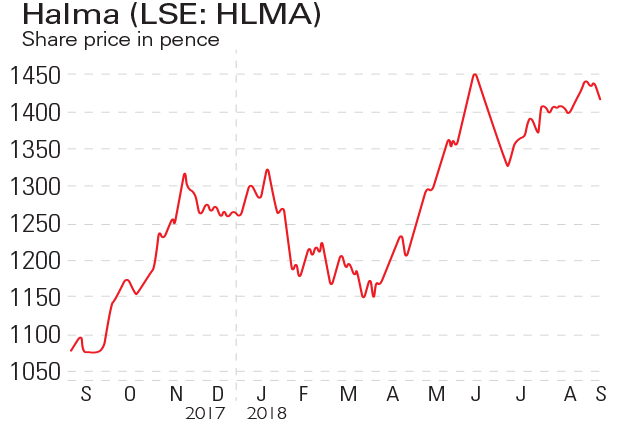

Halma (LSE: HLMA) is a technology group specialising in hazard detection. Its shares have risen 158% in the past five years, allowing the firm to join the FTSE 100 last year. Halma has benefited from solid demand for industrial safety gear and environmental clean-up equipment, particularly in Asia and emerging markets. In full-year results released in June, the firm posted a 10% increase in revenue, while profits rose 9%. It reported net debt of £220m, which is higher than last year, but is a result of acquisitions. Halma also said that the dividend would increase by 7% to 14.6p.

Be glad you didn't buy...

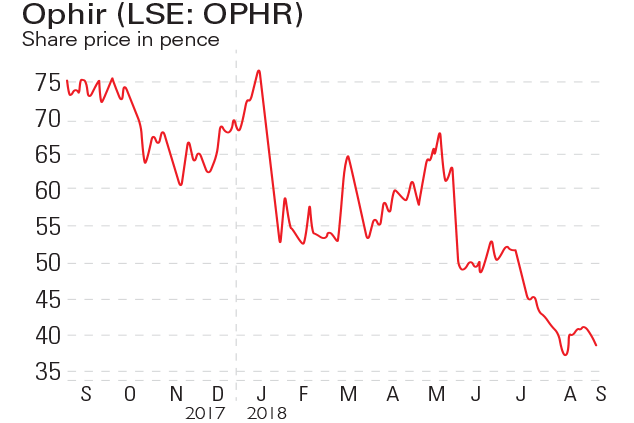

Ophir Energy (LSE: OPHR) is an oil and gas company focused on Asia and Africa. Its share price declined in May, first on news that CEO Nick Cooper, wholed the group's public listing in 2011, would step down with immediate effect. It then plunged again at the end of the month as services group Schlumberger pulled out of the firm's Fortuna deepwater liquefied natural gas(FLNG) project in Equatorial Guinea. The project is regarded as potentially transformational for Ophir, but there have been repeated delays in securing the required $1.2bn financing.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge