Shares in focus: Diageo looks frothy

The shares are doing well, but can that continue? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The shares are doing well, but profits may be drying up, says Phil Oakley.

Arthur Guinness paved the way for today's Diageo when he opened a brewery in Dublin in 1759. Over 200 years later, the merger of Guinness and Grand Metropolitan in 1997 to form Diageo was meant to create a drinks giant that would do great things for its shareholders.

For over a decade it failed to do so. It started out as an unfocused conglomerate that owned Burger King restaurants and the Pillsbury baking products business as well as many spirits brands. It bought up other drinks firms, such as Seagram, but the City was often underwhelmed with its performance.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

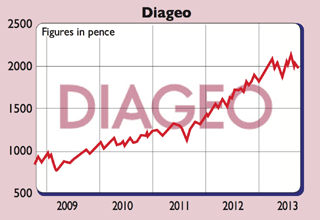

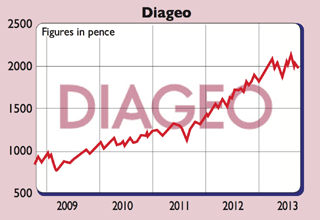

During the last two years, though, Diageo has been a terrific investment. The share price has soared as the firm set itself ambitious sales and profit growth targets that it has so far managed to meet. It has also benefited from investors' appetite for the dependable, growing profits of consumer goods firms since the financial crisis. For some time this has made Diageo look more expensive to buy compared with its profits and dividends.

Buying good-quality firms at reasonable prices is usually a good way to make money over the long haul. But are investors being asked to pay too much and can it keep it profits growing?

How the business is doing

It is underpinned by its market-leading position in America the world's biggest spirits market. This is its biggest business, but it's rapidly being caught up by its emergingmarkets side, which is growing strongly.

In America and the healthier economies of western Europe, Diageo has been good at getting customers to buy more expensive spirits, despite the fact that they are not drinking more. It has spent money developing and marketing super and ultra premium whiskies, gin and liqueurs. This has meant higher sales and bigger profit margins.

The real profit growth is coming from emerging markets. As these grow, more people are moving into the middle class and developing a taste for the good things in life. In eastern Europe, Turkey, China and southeast Asia demand for Diageo's spirits is soaring. In Africa, where it is bullish about its prospects, consumers are drinking more premium beers.

Diageo has also bought up local drinks firms. This will take time to pay off. But if you believe growth of the emerging markets' middle class has further to go, then the prospects could be good indeed.

But it's not all plain sailing. Southern Europe and Ireland remain tough, with people not buying as many premium spirits brands as they were a few years ago.

All is not well in Asia-Pacific either, where there was no sales growth at all during the second half of Diageo's last financial year due to weakness in Korea. With the Chinese government cracking down on lavish entertainment and Unilever warning that emerging-markets growth is slowing, some fear the future may not be as rosy.

What to do with the shares now

return on capital employed (ROCE)

More focused on profits growth, the City still expects Diageo to grow earnings and dividends per share by 9%-10% for the next two years. So many analysts are telling fund managers to buy the shares. A growing dividend is welcome but investors should concentrate on total returns (the sum of dividends received and the changes in the share price). You will only make money on Diageo shares if investors will still pay the punchy price/earnings (p/e) ratio in the future.

With low interest rates (a key factor behind high p/e ratios) across the world likely to rise, combined with the risks of an emerging-markets slowdown, there's a good chance this won't happen. Diageo is a good firm, but we'd steer clear of the shares for now.

Verdict: one for the watchlist

What the analysts say

Key facts

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Three UK stocks for long-term growth

Three UK stocks for long-term growthUK Stocks Professional investor Nick Train picks three UK stocks to invest in the British boom.

-

Three iconic brands that lost their shine

Three iconic brands that lost their shineMany famous brands have lasted for decades, but history shows that they can suddenly fade away.

-

7 sin stocks to buy yielding up to 8%!

7 sin stocks to buy yielding up to 8%!Stocks and shares Sin stocks don’t have the best reputation, but when it comes to investment returns, they’re certainly worth a closer look.

-

Investors should drink to Diageo’s growth

Investors should drink to Diageo’s growthTips The group operates in 180 countries and has just increased its dividend. The shares look cheap too.

-

Three quality companies with compelling prospects

Three quality companies with compelling prospectsOpinion Owning quality companies, especially during periods of uncertainty and volatility, pays off over the long-term, says professional investor Michael Foster. Here, he picks three of his favourites.

-

Don’t be tempted to buy banks – here are two better options

Don’t be tempted to buy banks – here are two better optionsFeatures Bank shares might look cheap right now, but don't be tempted. There are better places to put your money, says Ed Bowsher. Here, he picks two stocks to consider instead.