Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Five to buy

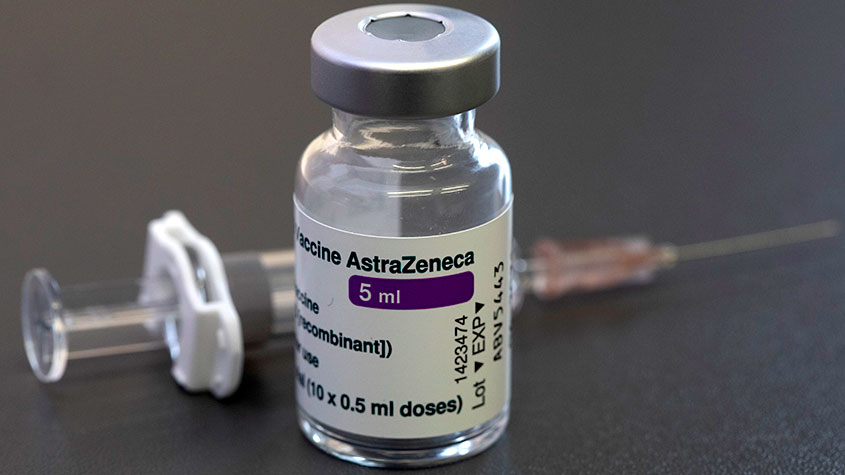

AstraZeneca

The Times

Pharmaceuticals giant AstraZeneca has spent the last ten years slimming down its “previously disparate drug portfolio” and increasing investment in research and development, which now comprises 20% of revenue each year. “The result has been... sales growth outstripping listed peers.”

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The company also boasts 13 “blockbuster” drugs generating at least $1bn in sales a year. While the patent for two of them will expire in 2025, it boasts a “meaty pipeline” and several ongoing clinical trials. The shares have doubled since 2017 and “they could perform just as well to 2027”. 9,763p

Finsbury Foods

The Mail on Sunday

“If you’ve had Thorntons caramel shortbread, a Mary Berry-branded chocolate sponge or a boozy Gordon’s gin cake,” you have tasted Finsbury Foods’ products. The company produces many of the country’s well-known cake brands, and in 2018 expanded into gluten-free goods with the acquisition of Ultrapharm.

The company has warned of rising costs, but it reported record full-year results this week thanks to a “strong post-Covid recovery in cake buying”, both in the UK and overseas. The uncertain outlook explains the shares’ “lowly” rating; they are down 28% in five years. But patient investors “could benefit in the long term. Buy on current weakness.” 81p

Kape Technologies

The Sunday Times

High-growth tech companies in the UK have been “consumed by foreign suitors in recent months”. Kape could be a target too. Despite only being five years old the company has seven million paying subscribers to its digital-security software products, which provide secure internet connections and protection against viruses, trackers and malware.

The company has benefited from the increase in cybersecurity threats. First-half results showed that revenues rose from $95m for the same period last year to over $300m this year, and it has an impressive customer retention rate of 82%. 250p

Ten Entertainment

Investors’ Chronicle

Is there is a downturn-proof sector? “One somewhat left-field option… is ten-pin bowling.” In its results for the six months to 26 June, the bowling-alley operator Ten Entertainment highlighted a “new sustainable baseline” for demand that sits 30% above pre-pandemic levels. The firm says like-for-like revenue was 46% up on 2019 levels in the first half of 2022.

Ten stands a good chance against inflation as “compared with other leisure activities” the price of bowling is reasonable. “[Earnings] upgrades, strong trading and solid projections” make the stock a buy. 214p

JPMorgan Global Growth & Income

Shares

The Scottish Investment Trust was subsumed into the JPMogan Global Growth & Income fund in early September. Existing investors in both funds are due to benefit, while this is a “great time to buy shares in the combined entity”. Volatile markets have “created opportunities to invest in great businesses at more attractive prices”, which the combined trusts excel at.

Management relies on a skilled group of analysts tracking 2,500 stocks in 19 different sectors. This has resulted in a portfolio free of pricey, unprofitable tech businesses. The trust also aims to pay a dividend of 4% of its net asset value (NAV). 42p

...and the rest

Investors’ Chronicle

Digital publisher LBG Media has slipped from an interim profit in 2021 to a statutory

loss in the first half of 2022 despite an increase in its global audience to 215 million. Investment in staff in the second half of 2021 was the key culprit. Costs have continued to rise, casting doubt on further growth.

Sell (80p).

Shares

“Marmite-to-Magnum ice cream maker” Unilever’s brand strength, pricing power and potential in emerging markets make it a stock to hold onto. The company’s valuation is also attractive compared with its peers, and a “long streak of underperformance has begun to reverse”. Buy (4,064p).

The Mail on Sunday

Octopus Renewables Infrastructure Trust offers exposure to the “long-term theme” of renewable energy. While the energy market is currently unstable, the trust’s 8% discount to NAV makes it attractive “for the brave”. Buy (101p).

The Times

Land Securities operates “ultra-prime” offices in central London, demand for which could fall as companies

struggle with inflation and dearer debt. A further decline in property values could also be on the cards. Avoid (530p).

Venture-capital company Molten Ventures invests in early-stage, unprofitable firms across Europe. It is now vying “for the title of the FTSE 250’s worst performer this year”, as these young technology companies become more difficult to value thanks to the uncertain inflation outlook and the jittery pound. Avoid (307p).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.