A cheap and cheerful pub chain to buy now

JD Wetherspoon’s shares have slumped this year. Yet a recovery is now in sight, says David J Stevenson.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Which stocks do you buy when recession looms? High-technology firms? Utilities? The safest consumer staple (a retailer of essential items)?

The problem is that shares in these sectors may still be holding their own, despite signs of an impending downturn. Investors’ expectations may still be bullish over the long term, with pullbacks seen as a buying opportunity. In other words, there may not be many chances to snap up these stocks on the cheap.

Contrarians, by contrast, go where most other investors are afraid to tread. Consumer cyclicals are a classic case in point. We’re talking about companies that are highly dependent on how much money people can afford to spend on discretionary items such as holidays, furniture, cars and entertainment.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Buy when markets are gloomy

Shares in these stocks are likely to fall sharply as a recession approaches, as is the case now. Yet just as the outlook seems about as dire as can be, they often start to recover in anticipation of an economic rebound. Investors who buy in the depths of gloom and doom can make massive returns in the bounce back.

Publican JD Wetherspoon (LSE: JDW), is firmly in this category. Founded in 1979 by Tim Martin, who still owns a fifth of the firm, it grew strongly in its early days. It listed on the stock exchange in 1992, at which point it had 50 pubs. Within two years, Wetherspoon had doubled its estate.

In 2001 Wetherspoon had opened its 500th outlet and was recognised as Britain’s fastest-growing company and the ninth-fastest-expanding firm in Europe. After reaching the 900-pub milestone in 2013, the company began rationalising its estate and expanding its hotel business. It currently has 859 pubs and 57 hotels.

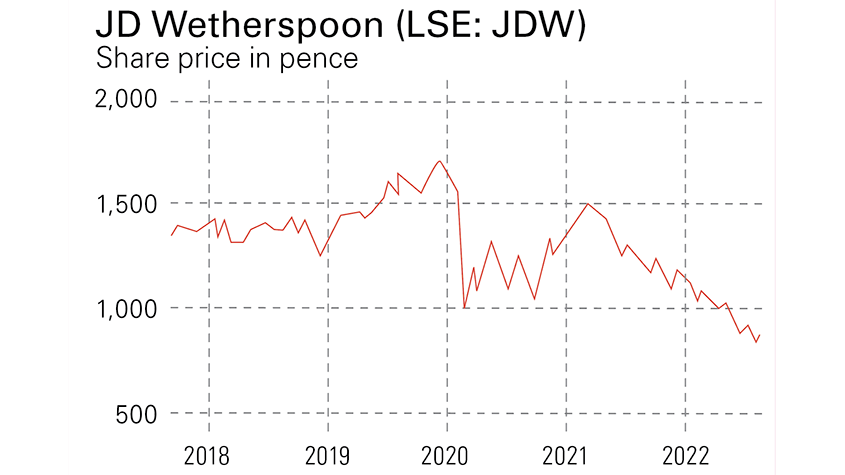

Having tripled between the beginning of 2005 and early 2007, Wetherspoon’s stock price crashed during the financial crisis. Having troughed at 175p in July 2008, two months before investment bank Lehman Brothers went bankrupt, the shares rallied to £17 at the end of 2019. That’s a stunning 870% return, and shows how even sectors as unfashionable as pubs can make investors rich.

Then, of course, Covid-19 hit. Wetherspoon’s shares more than halved as a result of lockdowns. Despite subsequently doubling as pandemic fears receded, they have since fallen to around £5 as the company began making losses amid warnings about climbing costs. Indeed, the recent increase in inflation – in particular soaring energy costs – has become another deterrent for customers considering pubs.

A solid niche

In spite of this gloomy backdrop, however, there are reasons for optimism. As Rupert Steiner points out in Barron’s, Wetherspoon’s “fundamentals that set it apart from rivals – it has a niche selling inexpensive pints of beer in unfussy venues – remain solid. Value-conscious consumers are sure to find this approach attractive.”

Steiner notes that the company “will also benefit from its strategy of owning larger pubs rather than a collection of smaller ones; that will provide savings in rent and labour”. In turn, Wetherspoon is likely to continue to pick up market share over the longer term. And measures by new UK prime minister Liz Truss to limit soaring energy bills should improve consumers’ discretionary spending, helping firms such as Wetherspoon.

The share price is back at its level of ten years ago. It’s been a painful experience for buy-and-hold investors. Yet for new players, it could be time to consider snapping up the stock at today’s bargain-basement levels. We look at the latest news from the chain, and its valuation, below.

Keeping a tight lids on costs

Wetherspoon has said that like-for-like sales in the first 11 weeks of the quarter to 31 July 2022 were 0.4% lower than the same, pre-pandemic, period in 2019. This was an improvement versus the 4% sales drop in the previous quarter.

Sales of spirits (up 4.4%), cocktails (18.6%), food (2.1%) and hotel rooms (8.4%) rose in the quarter, but turnover in draught ales, lagers and ciders – the largest past contributors to pub revenues – were 8% below 2019 levels. Wetherspoon says that it has invested heavily in labour, repairs and marketing to strengthen its position for the new year that started on 1 August 2022.

Losses for the previous financial year will therefore be higher than expected at about £30m. There is no dividend, nor was any restoration mentioned in the update.

Wetherspoon owns 68% of its estate. The net book value of property, plant and equipment in January 2022 was £1.4bn, including £1.1bn of freehold and long-leasehold sites that haven’t been revalued since 1999.

However, this illustrates both strengths and risks inherent within the firm. Net debt after derivatives and lease liabilities was also £1.4bn. So Wetherspoon is not only a consumer-dependent pub chain, it’s also a highly leveraged property play.

Yet there were positives. The firm has secured its energy supplies until August 2023 at fixed rates that predate the current price spike. It has arranged long-term contracts for many bar and food purchases. As a result, Wetherspoon believes that in this financial year its overall costs will increase by less than current inflation.

On a forward price/earnings (p/e) multiple of 12 for this year, falling to 10.6 for the following year, Wetherspoon’s looks cheap. The stock could slip further but there is scope for a large recovery.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David J. Stevenson has a long history of investment analysis, becoming a UK fund manager for Oppenheimer UK back in 1983.

Switching his focus across the English Channel in 1986, he managed European funds over many years for Hill Samuel, Cigna UK and Lloyds Bank subsidiary IAI International.

Sandwiched within those roles was a three-year spell as Head of Research at stockbroker BNP Securities.

David became Associate Editor of MoneyWeek in 2008. In 2012, he took over the reins at The Fleet Street Letter, the UK’s longest-running investment bulletin. And in 2015 he became Investment Director of the Strategic Intelligence UK newsletter.

Eschewing retirement prospects, he once again contributes regularly to MoneyWeek.

Having lived through several stock market booms and busts, David is always alert for financial markets’ capacity to spring ‘surprises’.

Investment style-wise, he prefers value stocks to growth companies and is a confirmed contrarian thinker.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.