Argentex: opportunities for investors after temporary setback

Currency-exchange specialist Argentex has missed expectations, but growth should resume next year, says Bruce Packard.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When a company floats on the stock exchange, the buoyancy of the share price represents a tension. Management wants to set a high price for the shares existing shareholders are selling, but that high price is anchored on future expectations. But the higher the expectations, the higher the risk of disappointment following the listing.

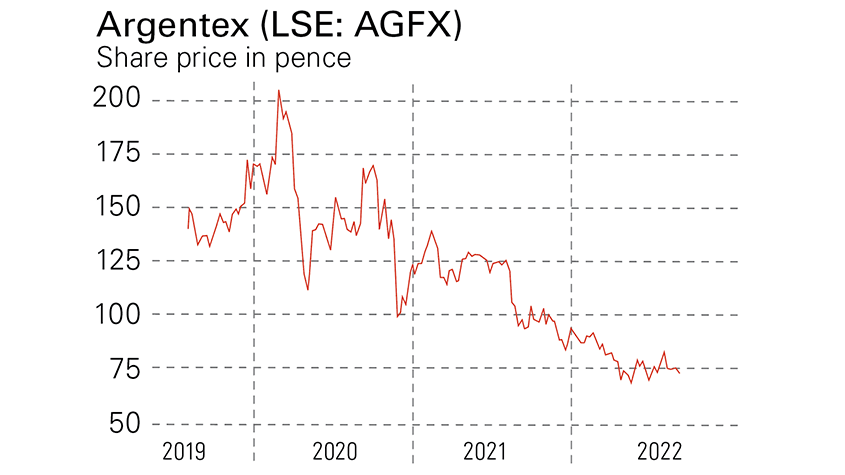

Currency trader Argentex (LSE: AGFX) was founded in 2011 and listed on Aim in June 2019 at 106p, valuing the company at a market capitalisation of £120m. It raised £12.5m in new capital in the initial public offering (IPO), while existing shareholders sold £46m of stock. At the beginning of 2020, the shares peaked at over 200p.

Then came the pandemic, then the departure of a co-CEO who sold his 10% shareholding, followed by earnings downgrades (see below). Investors are disappointed and the shares have tumbled 63% from their January 2020 high. That could now present an opportunity.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Beating the banks

Argentex acts as a “riskless principal”, so does not charge commission for executing trades. Instead, revenue comes from the spread it receives from each deal. That spread is not fixed – pricing depends on the client’s individual trading history and the dealer’s discretion. All the trades are over the counter (OTC) rather than centrally cleared. This might be open to abuse, with traders charging what they think they can get away with, but Argentex says that it wins clients from banks due to superior pricing and service.

Argentex’s customers are companies who need to convert between £1m and £500m annually into another currency. Its largest sector is financial services (ie, fund managers, pension funds and insurance companies) at 37% of revenue. It has signed up 239 clients in the last year to bring the total number of companies for whom it trades to 1,624. Given the bureaucratic nature of know your customer (KYC) and anti-money laundering (AML) forms, it’s unlikely that clients would go to the trouble of switching if the savings were not worth the effort.

Investing in growth

On the other side of the trade are large global banks, who price the trades keenly in return for Argentex meeting minimum trading levels. These counterparties require collateral to be posted in order to deal in forward contracts. That has been a constraint on growth in the past, and some of the £12.5m raised from the IPO in 2019 was supposed to fund growth, by allowing Argentex to increase the total volume of forwards trades with existing clients and win new ones.

The second use of proceeds was to hire a larger sales team. The plan at the IPO was to more than double sales headcount to 50 people within two years. Based on the numbers just reported, it has fallen short, which probably explains the earnings per share (EPS) disappointment. The firm hired 22 new people in sales in the two years following the IPO, but it looks like it wasn’t able to retain all of them. Headcount in sales is less than 40 people in the results to March. That’s important because management says that the longest-serving salespeople are the most productive. In the first year, a salesperson generates on average £42,000 revenue, later growing to £1.8m in year five. There is a large jump from £0.5m in the third year to £1.1m in year four.

This looks like a fixable problem, though it will take time. The firm is expanding internationally by opening offices in the Netherlands and Australia. And while Argentex started out with a similar model to a private bank – with a high-touch bespoke service – it is now also building an online trading platform for lower-value transactions. I own the shares, and despite the recent disappointment, they look like they offer good growth prospects at a reasonable price.

Tripped up by ambitious forecasts

In the two years before the IPO, Argentex’s sales and operating profit roughly doubled to £22m and £9m respectively and forecasts were for rapid growth. Management felt comfortable with ambitious forecasts by Numis (its former corporate broker) of 12p in earnings per share (EPS) for the financial year to March 2022, which implied a 15% compound annual growth rate (CAGR) in the bottom line.

But results did not meet expectations. Argentex has just reported adjusted EPS of 7p for the year ending March 2022, which is 42% below the original forecast.

Management has taken the unusual step of changing the firm’s year end from March to December, as well as changing the broker to Singer Capital Markets. Singer expects £47m of revenue in the year to December 2023, rising to £57m the following year, implying 18% growth CAGR from the level just reported. EPS is expected to drop this year, but recover to 6.4p in 2023 and 10.1p in 2024. At a share price of 75p, that puts the shares on a forward price/earnings (p/e) ratio of 11.7 for 2023, dropping to 7.4 for 2024. It’s worth noting that 2024 forecast is still 20% below the original forecast of 12p in 2022.

There are a couple of risks. Competition is one. Wise and Revolut could decide to target the corporate sector. Equals Money, a more directly comparable competitor, just reported that it is growing revenue at 84% in the first half of this year. Given the strong growth at competitors it is rather puzzling that Argentex rates itself above its peers for both price and service. A second risk is client concentration: the top 20 clients on average generate £621,000 of revenue, versus the long tail of customers who generate £14,000 on average. If one of those large clients failed to settle a forward contract, Argentex would be exposed to losses, as there is no centralised clearing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Bruce is a self-invested, low-frequency, buy-and-hold investor focused on quality. A former equity analyst, specialising in UK banks, Bruce now writes for MoneyWeek and Sharepad. He also does his own investing, and enjoy beach volleyball in my spare time. Bruce co-hosts the Investors' Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Europe’s new single stock market is no panacea

Europe’s new single stock market is no panaceaOpinion It is hard to see how a single European stock exchange will fix anything. Friedrich Merz is trying his hand at a failed strategy, says Matthew Lynn

-

Bitcoin 'has become the reserve asset of the internet'

Bitcoin 'has become the reserve asset of the internet'Opinion The cryptocurrency has established itself as the electronic version of gold, says ByteTree’s Charlie Morris

-

London Stock Exchange gets go-ahead to run Pisces private stock market

London Stock Exchange gets go-ahead to run Pisces private stock marketThe Pisces market will allow investors to buy and sell shares in private companies. But how will it work, when will it launch, and who is allowed to use it?

-

It’s time to start backing Britain – the best investments to buy now

It’s time to start backing Britain – the best investments to buy nowThe UK stock market has been languishing for decades. But the tide is turning and smart investors should buy in now

-

James Halstead is a family firm going cheap but should you buy?

James Halstead is a family firm going cheap but should you buy?James Halstead will rebound from a weak patch, while tax changes would be a buying opportunity

-

London Stock Exchange exodus: which companies could be next to go?

London Stock Exchange exodus: which companies could be next to go?As many companies exit London, the steady trickle of stocks listing elsewhere could turn into a stampede. Who will be next, and what does this mean for investors?

-

Is the London Stock Exchange in peril?

Is the London Stock Exchange in peril?More than 150 companies have left the London Stock Exchange or moved their primary listing since the start of 2024. What does it mean for investors and the economy?

-

Shein prepares for London Stock Exchange listing

Shein prepares for London Stock Exchange listingShein plans for a London Stock Exchange listing after facing hurdles in New York. It’s in a race against time. Matthew Partridge reports