Babcock International: a turnaround play in a growing sector

Britain’s defence spending is set to rise and Babcock International could soon return to favour, says David J Stevenson.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The “Long Peace”, otherwise called the Pax Americana (America’s peace), has held sway since the end of World War II. It commemorates a period of more than 75 years without wars between major economic and military powers. Over this time, the amount spent on defence gradually declined in relative terms.

In the early 1950s Britain spent more than 11% of its GDP on its armed forces. By the early 1990s, the share of the UK economy devoted to defence had declined to 4%. And by last year, military expenditure had decreased to just 2% of national output.

But the global geopolitical game has changed. With Russia’s invasion of Ukraine, world stability is no longer assured. The Long Peace is history. Now, the UK – one of the biggest weapons suppliers to Ukraine – is being forced into a rethink about how to defend itself. The government will increase spending on the armed forces to 2.5% of GDP by 2030, prime minister Boris Johnson announced last week.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

At a time of considerable uncertainty in the stockmarket, this is clearly good news for one sector: defence companies. And one firm in particular tends to fly under the radar.

A crucial UK defence firm

Babcock International (LSE: BAB) is a FTSE 250-listed international aerospace, defence and security firm. Its main markets apart from the UK are Australasia, South Africa, France and Canada. It operates in four sectors: marine, land, aviation and nuclear. These divisions do both civil and defence work, but 56% of 2021 revenues were defence related. Two-thirds of overall revenue came from the UK.

For example, the marine division supports the Royal Navy (and other world navies) via delivery of ship and submarine sustainment programmes. It provides defence and maritime training. And it owns and operates marine engineering facilities at Devonport (Plymouth) and Rosyth (Scotland) that include large-scale docks able to accommodate Queen Elizabeth-class aircraft carriers, along with several other services.

Babcock undertakes around 75% of UK surface warship fleet refits and upgrades, and 50% of fleet maintenance, along with 100% of deep maintenance for the UK’s nuclear-powered submarine fleet. It is also working on delivering five Type 31 frigates that will be at the future core of the Royal Navy’s surface fleet. Non-defence contracts include work for the oil and gas industry.

The land sector maintains vehicles and equipment for the British Army, including fleet management of over 50,000 vehicles ranging from quad bikes to battle tanks. Aviation, which has worked with the Royal Air Force for more than 100 years, supplies training and maintenance services, and aerial emergency medical aircraft. The nuclear sector decommissions nuclear power plants and maintains the nuclear submarine fleet.

Expensive write-downs

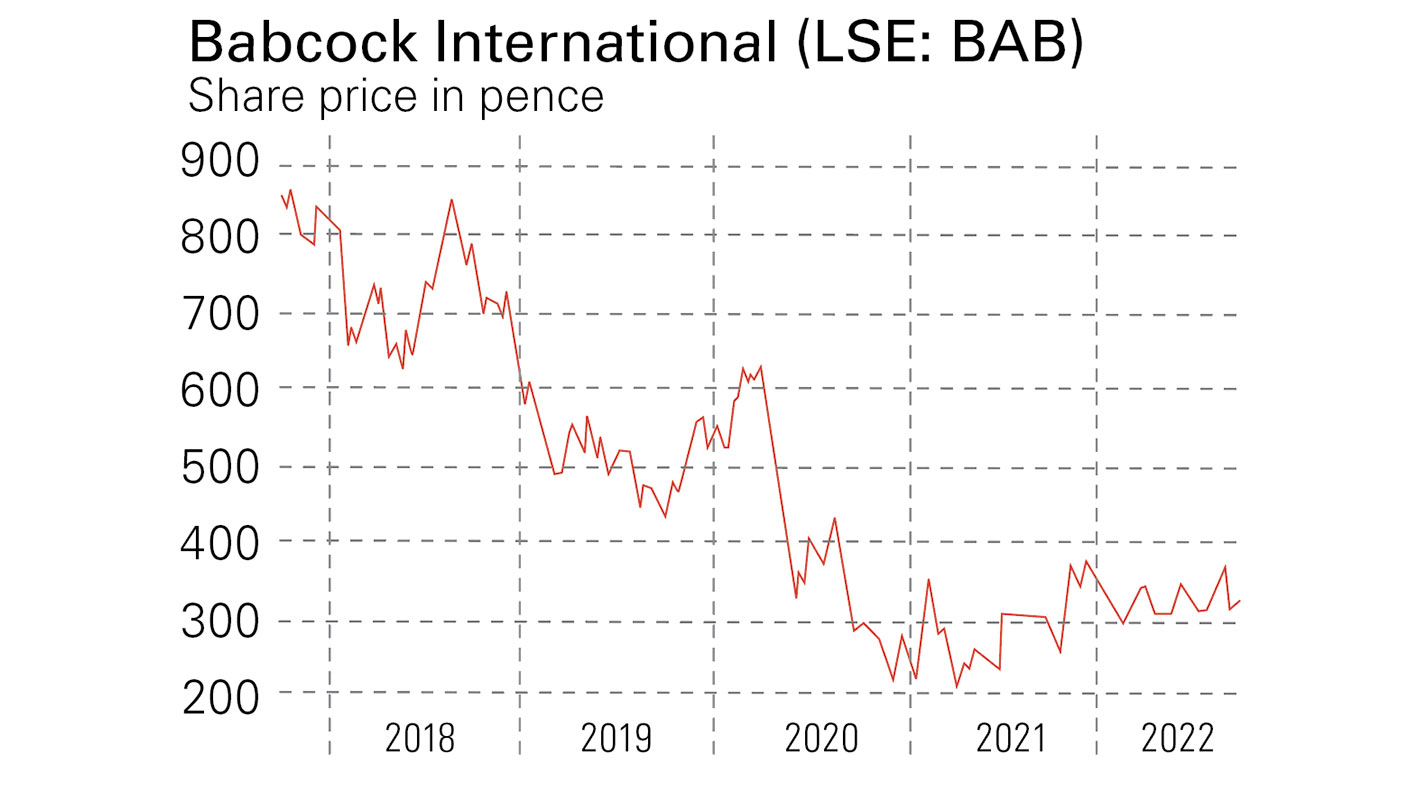

Despite Babcock’s importance to national security, it has been a poor investment in recent times. The share price has plunged by 75% over the last eight years. That’s no great surprise when you look at its financial performance. For the 12 months to 31 March 2014, earnings per share (EPS) before asset write-downs – adjusted for a cash-raising rights issue – were 62p. By contrast, for the 12 months to 31 March 2021, it made a loss per share of -337p.

That resulted from a huge write-down of the value of some of its contracts. A new CEO took over, carried out a review of contracts and the balance sheet, and put aside £1.7bn to cover potential losses.

This was painful for shareholders at the time, but it’s good news for new investors. The share-price collapse should have factored in all the financial damage, leaving Babcock as a cheap and potentially exciting recovery stock in a growing sector.

Clear signs of improvement

Babcock’s financial fortunes began to improve last year. The interim results for the six months to 30 September 2021 saw revenue rising by 8% to £2.22bn. Headline operating profit was £75m, versus a £785m loss for the equivalent period a year earlier. And underlying EPS – ie, before one-off items – amounted to 15.3p.

What’s more, the firm’s financial position was recovering too. Net debt dropped to £1.35bn from £1.6bn as at 30 September 2020. In addition, three disposals were announced in the period to the end of September 2021. These were set to generate proceeds of £400m that were earmarked for further debt repayment. And a new group-wide operating model is targeting around £40m of annualised cost savings.

Babcock also disclosed that its contract backlog (ie, its order book) was £10.9bn as at end-September 2021 (this compares with full-year revenue of £4.2bn last year).

In its latest update in February 2022, the company said that overall trading for the first ten months to 31 January 2022 was in line with expectations. Its full-year outlook was unchanged. In addition, a fourth disposal in the year to end-March 2022 has lifted asset sale proceeds to £448m from £400m.

For the current 12 months to the end of March 2023, the average of analysts’ turnover forecasts is £4.3bn, putting the stock on a price/sales ratio of just 0.37. The average EPS estimate is 36p, implying that Babcock is on a prospective price/earnings (p/e) ratio of below nine. Analysts also forecast a dividend for the current financial year of 8p per share.

Babcock has become cheap due to its past problems. But with these in the rear-view mirror, there’s the potential for a re-rating. This out-of-favour stock could prove to be a very profitable play on higher UK defence spending.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David J. Stevenson has a long history of investment analysis, becoming a UK fund manager for Oppenheimer UK back in 1983.

Switching his focus across the English Channel in 1986, he managed European funds over many years for Hill Samuel, Cigna UK and Lloyds Bank subsidiary IAI International.

Sandwiched within those roles was a three-year spell as Head of Research at stockbroker BNP Securities.

David became Associate Editor of MoneyWeek in 2008. In 2012, he took over the reins at The Fleet Street Letter, the UK’s longest-running investment bulletin. And in 2015 he became Investment Director of the Strategic Intelligence UK newsletter.

Eschewing retirement prospects, he once again contributes regularly to MoneyWeek.

Having lived through several stock market booms and busts, David is always alert for financial markets’ capacity to spring ‘surprises’.

Investment style-wise, he prefers value stocks to growth companies and is a confirmed contrarian thinker.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

No peace dividend in Trump's Ukraine plan

No peace dividend in Trump's Ukraine planOpinion An end to fighting in Ukraine will hurt defence shares in the short term, but the boom is likely to continue given US isolationism, says Matthew Lynn

-

Investors need to get ready for an age of uncertainty and upheaval

Investors need to get ready for an age of uncertainty and upheavalTectonic geopolitical and economic shifts are underway. Investors need to consider a range of tools when positioning portfolios to accommodate these changes

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.