Buy this ports operator and get a free hedge fund

This investment company is valued at less than its Brazilian ports and logistics assets alone

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

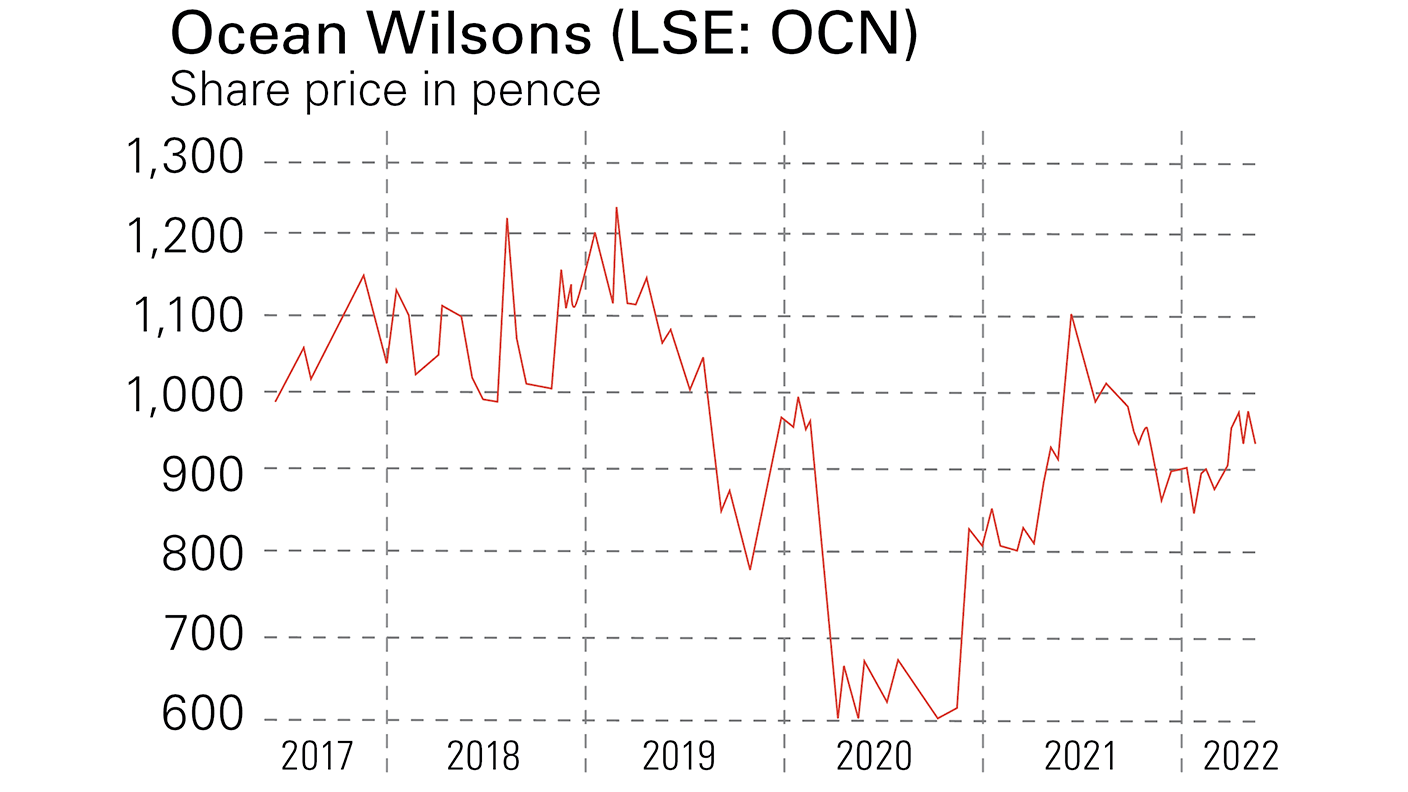

Commodities have had a poor decade, but as we face possible stagflation, companies such as Shell (up by 45% year-to-date) and Glencore (up by 33%) have begun to benefit. Meanwhile, absolute-return hedge funds – those that try to deliver steady returns in all market conditions – have struggled to cope with central banks’ quantitative easing (QE) since the financial crisis, but could now do better as QE is withdrawn. Ocean Wilsons (LSE: OCN) is a small, relatively obscure UK-listed company that could benefit from both trends.

This 180-year-old firm is something of an oddity, consisting of a 58% interest in Wilson Sons (a Brazilian ports and maritime services firm) and 100% ownership of an investment subsidiary (Ocean Wilsons Investments).

Taking the former first, Wilson Sons was set up in the Brazilian port of Salvador by two Scottish brothers, Edward and Fleetwood Pellow Wilson in 1837. Last year, it listed on Brazil’s Novo Mercado exchange in São Paulo, where it has a market cap of about 4.17bn Brazilian reals ($870m/£690m). The market price of Ocean Wilsons’ 58% stake in the ports business alone is worth about 1,100p per share versus a UK share price for the group of 930p.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Ports are attractive monopolies

Ports can be excellent investments because they represent natural monopolies. The successful private investor John Lee mentions Associated British Ports, which was the first of Margaret Thatcher’s privatisations in 1983. The shares were sold to the public at 112p and over the next couple of decades rose 70-fold, before eventually being bought by a Goldman Sachs-led consortium and delisted in 2006. I repeat: a 70-fold increase! By comparison, when the government listed Royal Mail on the London Stock Exchange at 330p in 2013, it was accused of selling too cheaply. Almost ten years later the price is just 325p.

Wilson Sons is recovering well from the pandemic. It recently reported that first-quarter revenue grew by 10% to $93m and net profit increased by 5.8 times to $28m versus the same quarter last year. These are encouraging results, given that performance is still constrained by lack of empty shipping containers and supply-chain bottlenecks in China.

Annualising the first-quarter results gives $372m revenue, well below peak revenue of $698m in 2011, although the operating margin is now considerably higher at 24.5% in the 2021 financial year. Brazil is a commodity-driven economy and the real is one of the few currencies to have strengthened against the US dollar (and against sterling) so far this year.

A free hedge-fund portfolio with every share

The tide may also be turning for the investment portfolio. For more than a decade, central banks, who were once considered the “lender of last resort”, have consistently intervened in financial markets and become the “dealer of last resort”. This behaviour has had its critics, not least from absolute-return hedge funds, who need market panics to create mispriced assets so that they can outperform the index.

This is now changing as central banks commit to tighter monetary policy. Earlier in May the Bank of England said that it was prepared to raise interest rates to bring inflation back under control, even if it caused a recession by doing so. It’s unlikely that broad market indices such as the S&P 500 or FTSE All-Share index would perform well in a recession. But a sell off should present hedge funds with an opportunity to demonstrate their superior skills, which would benefit Ocean Wilsons’ investments.

The performance of this sprawling portfolio has been unremarkable over the past decade (see below), but it is still worth around 708p per share. Since Ocean Wilsons is already valued at less than its stake in Wilson Sons, investors are effectively getting it for nothing.

A decade of underperforming the S&P 500

Ocean Wilsons’ investment portfolio consists of around 90 hedge funds, valued at $328m at the end of March (a 7% decrease since December last year). That equates to 708p per share. The largest fund (Findlay Park) represents just over 10% of that $328m.

Owning 90 hedge funds suggests that the management team is spreading its bets and doesn’t believe it can identify the next George Soros or Jim Simons ahead of time. Management claims that the portfolio of funds outperforms its benchmark. That may be true, but since the benchmark is the US consumer-price index, this is not demanding.

Management would have been far better off buying a low-cost S&P 500 index tracker. The investment portfolio has achieved a 48% increase in value, which is lagging well behind the S&P 500, which was up by 262% in the last decade. Compounded annually the S&P has achieved a 13.8% compound annual growth rate over the last ten years, while Ocean Wilsons has achieved just 4.5% per year.

If the portfolio does not outperform in 2022, in what ought to be ideal conditions, perhaps management will need to have a rethink. In 2008, Warren Buffett bet $1m that the S&P 500 would outperform a basket of hedge funds after costs over ten years. He won the bet easily. Ocean Wilsons’ majority shareholder, Hansa Investment Company (controlled by William Salmon and Christopher Townsend), has been incredibly slow to take that lesson on board. If they had invested in the S&P 500 instead, the portfolio would have been worth more than 1,750p per share at the end of 2021.

In March, Ocean Wilsons announced its new chair will be Caroline Foulger, a retired partner of PwC Bermuda. While an accountant is unlikely to rock the boat, she should at least be asking whether the investment subsidiary really needs to own 90 hedge funds.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Bruce is a self-invested, low-frequency, buy-and-hold investor focused on quality. A former equity analyst, specialising in UK banks, Bruce now writes for MoneyWeek and Sharepad. He also does his own investing, and enjoy beach volleyball in my spare time. Bruce co-hosts the Investors' Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.