Melrose Industries: a British manufacturer that is well-placed for recovery

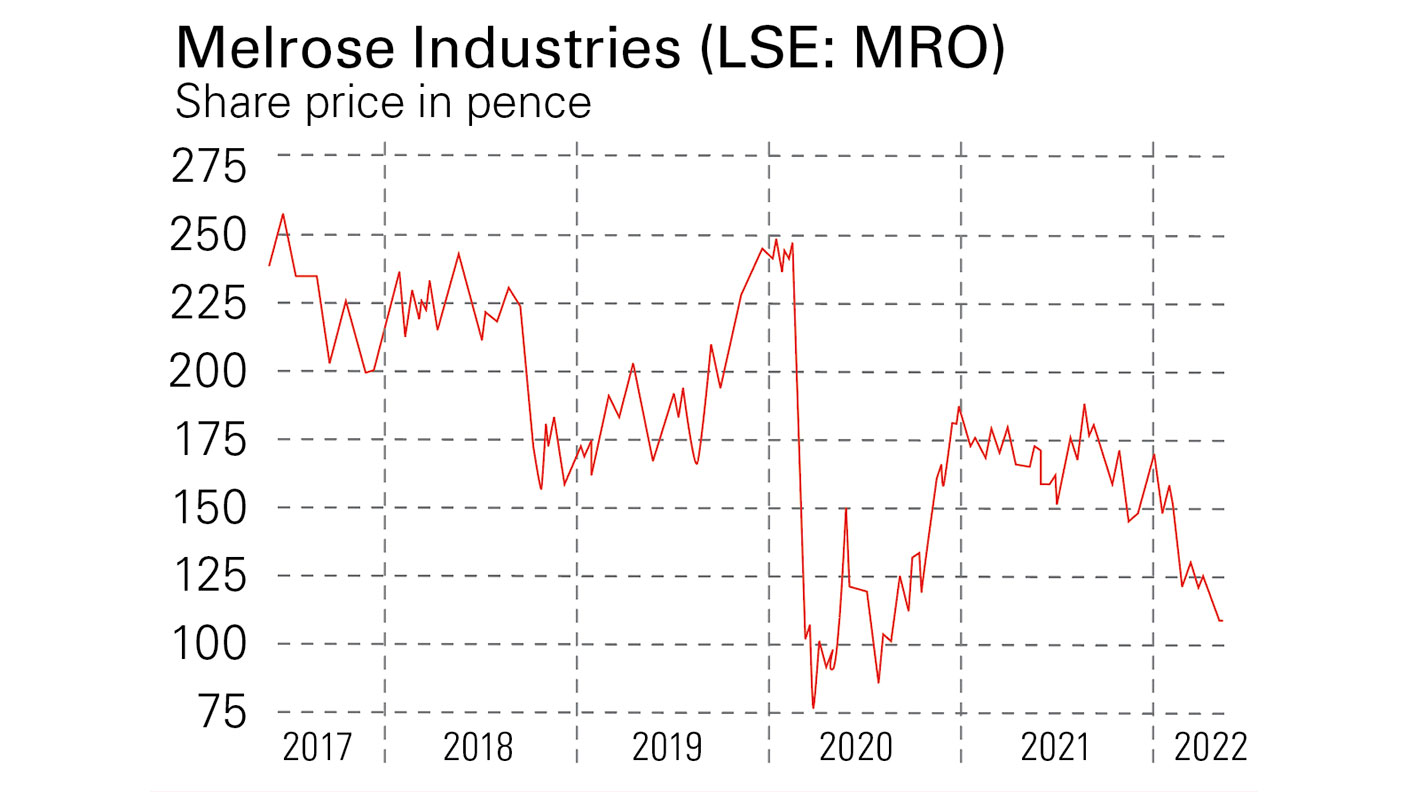

Melrose, the aerospace and automotive manufacturer, has been hit by the pandemic, but the shares are unduly cheap says David J Stevenson.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Britain’s economy is driven by services, with the idea of making things relegated to the back seat long ago. Last year the manufacturing sector contributed just 9.7% of economic output; service sectors such as retail, financial services, leisure and the public sector provided 80%.

This means that British manufacturing concentrates on quality rather than quantity, yet there are still pockets of engineering excellence. Melrose Industries (LSE: MRO) falls into that category.

Melrose acquires good-quality manufacturing businesses with strong fundamentals that are nonetheless underperforming and invests in them via extra research and development. It makes operational improvements and refocuses on profitability, sustainability and operating cash generation. When it believes the time is right, Melrose sells out and returns the proceeds to its shareholders.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The company has followed this “buy, improve, sell” strategy since floating on London's Aim market in 2003. It made its first acquisition in 2005 and has achieved an average annualised return on equity investment of 19% in that time. It has so far returned £5.5bn to shareholders, including £729m last year. At the same time it delivered real improvements in the businesses it buys, with an operating margin increase of between 5% and 9% by the time they were sold.

Down to the GKN core

Melrose is now in the FTSE 100 and has a market cap of £5.2bn. Its primary assets are businesses under the GKN name, which it bought four years ago. GKN – formerly Guest, Keen & Nettlefolds – was a listed engineering group whose roots date back to the Industrial Revolution. Under Melrose’s ownership, it was split into three core divisions.

GKN Aerospace makes products that enable aircraft to fly safely and more efficiently. It’s a global leader based on technological innovation, advanced processes and engineering excellence. The firm’s technology is used in a range of vehicles, from high-use, single-aisle aircraft and the longest-haul passenger planes through to business jets, helicopters and the most advanced fighter planes and space launchers.

GKN Automotive is a leading supplier of power-transmission systems to the global automotive industry. It works with more than 90% of the world’s car manufacturers on electrification, all-wheel drive programmes and new vehicle concepts.

GKN Powder Metallurgy is a world leader in precision powder metal parts for the automotive and industrial sectors, as well as in metal powder production. Last year this division spun off GKN Hydrogen to focus on commercialising metal hydride technology to store hydrogen in a safe and compact manner.

Melrose’s final division is US-based Ergotron, a leading maker of ergonomic products used in offices, education and healthcare. This business was acquired as part of another deal in 2016 and Melrose is reportedly looking for buyers.

Hit by the pandemic

Melrose supplies the aerospace and automotive industries, both of which have been severely affected by the pandemic. It’s taken large asset writedowns and restructuring costs as a result. In the year to 31 December, the company made a headline operating loss of £451m on sales of £6.88bn, even though adjusted operating profit increased to £375m from the previous year’s £141m.

What’s more, management recently announced it was deferring the return of any more capital to shareholders because of Ukraine-related uncertainties. The net effect has been that Melrose has been treated predictably harshly by the current bout of market volatility. The shares have fallen 29% this year and are down by around 56% from February 2020 levels. This seems excessive given that prospects are improving (see below) and has created a chance to snap up shares in a high-quality firm on the cheap.

Coping with the challenges

Melrose’s 2021 annual report suggests that conditions are looking up in two divisions. “GKN Automotive and GKN Powder Metallurgy… saw the start of some recovery momentum in the final quarter of 2021, close to that seen in the first half,” says the CEO. “Early signs in the new year show this recovery continuing, and as the constraints of the semiconductor shortage (which has curbed vehicle output) ease further, focus will start to move towards realisation of this value.”

The turnaround focus is now on the aerospace division. “The aviation market continues to navigate pandemic travel restrictions with our businesses expecting growth for the coming year, albeit still below pre-pandemic levels,” the report continues. “There is a heavy focus on improvement in GKN Aerospace in 2022 and we are confident this will position the business for a strong future.” More details of this will be set out in a briefing for investors on 8 June.

Consensus forecasts are for turnover of £7.7bn in 2022 and £8.2bn in 2023, putting the stock on price/sales ratios of 0.68 and 0.63. Average earnings per share estimates for this year are 7p, with 11.23p pencilled in for 2023. That implies price/earnings ratios of 17 for 2022 and just over 10.5 for next year. Dividends are forecast to be 2.78p in 2022 and 3.84p in 2023. The firm has cash available to return to investors after asset sales last year reduced net debt to £947m, from £2.85bn the year before, but has put on hold its plans to do so due to uncertain conditions.

The obvious risks are mostly macroeconomic rather than related to the company, including the possibility that inflation squeezes margins, supply constraints continue, or economic growth falters. Despite that, Melrose is a very interesting recovery play at this price.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David J. Stevenson has a long history of investment analysis, becoming a UK fund manager for Oppenheimer UK back in 1983.

Switching his focus across the English Channel in 1986, he managed European funds over many years for Hill Samuel, Cigna UK and Lloyds Bank subsidiary IAI International.

Sandwiched within those roles was a three-year spell as Head of Research at stockbroker BNP Securities.

David became Associate Editor of MoneyWeek in 2008. In 2012, he took over the reins at The Fleet Street Letter, the UK’s longest-running investment bulletin. And in 2015 he became Investment Director of the Strategic Intelligence UK newsletter.

Eschewing retirement prospects, he once again contributes regularly to MoneyWeek.

Having lived through several stock market booms and busts, David is always alert for financial markets’ capacity to spring ‘surprises’.

Investment style-wise, he prefers value stocks to growth companies and is a confirmed contrarian thinker.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.