PZ Cussons – a company that's starting to scrub up nicely

Consumer goods group PZ Cussons has struggled for several years, but its new CEO should should turn it around.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Consumer goods firm PZ Cussons was founded 130 years ago as Patterson Zuchonis by two Georges – Patterson (a Scot) and Zochonis (a Greek) – to trade commodities between the UK and West Africa. In 1953 the company listed on the London Stock Exchange, valued at £1m – versus an £875m market cap today. In 1975 Patterson Zochonis acquired Cussons, which included the Imperial Leather soap brand, and in 2002 the company changed its name to its current form.

Aside from Imperial Leather, its other brands include Carex (hand sanitiser), Original Source (shower gel) St Tropez (self-tan) and Sanctuary Spa (shower oil and body butter). Carex is the number one hand sanitiser brand in the UK (with a 36% market share) and sales doubled at the start of the pandemic. The company estimates that Carex was used to clean one billion hands in the UK in the course of 2020. In short, it should have been a favourable time to be a shareholder.

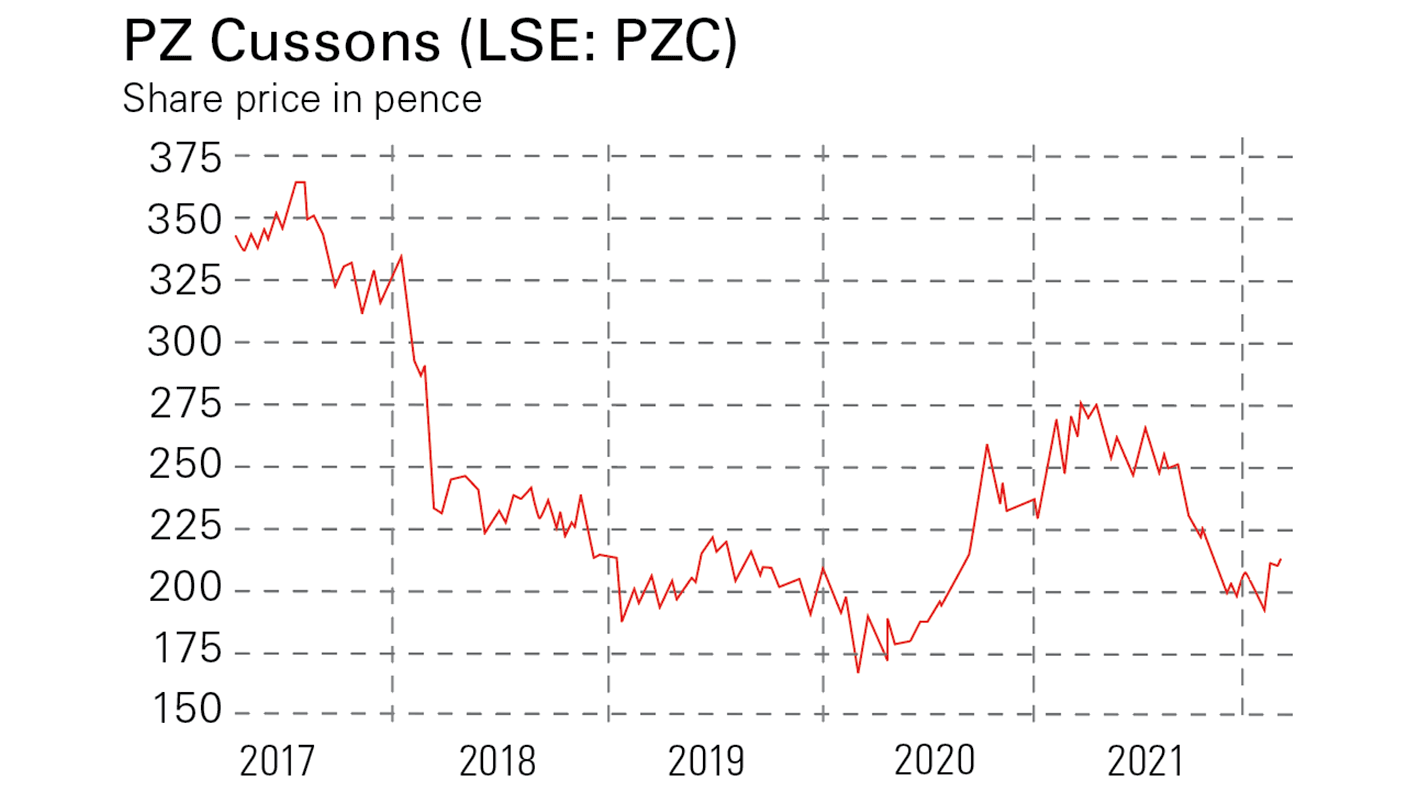

The last decade has been helpful for global consumer brands companies, such as Unilever (shares up by 85% in ten years), Procter & Gamble (up 141%) and L’Oréal (up 321%) over the same time period. Yet even before the pandemic, PZ Cussons had struggled. Between 2013 and 2020, annual revenue fell by a third to £587m. Unlike its larger competitors, the share price has halved from its peak of 430p in 2013.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, top management was replaced in 2020. The new chief executive, Jonathan Myers, presented his turn-around plan in March 2021. He identified eight “must win” brands, which represent half the revenue, but two-thirds of gross profit and three-quarters of brand investment. Myers spent his first 21 years at Procter & Gamble, which has operating margins of 24% – roughly double those of PZ Cussons – so presumably he will be asking tough questions to try to narrow the gap.

A more focused firm

The new strategy is to focus on the “must win” brands – those listed above plus some less familiar ones (Premier, Joy, Morning Fresh and Cussons Baby) which are popular in Nigeria and Indonesia. Imperial Leather, which saw revenue decline last year, is not included, but the firm has said it plans to relaunch this in the 2023 financial year.

In the past couple of years, management has also sold businesses that don’t fit: Minerva, a Greek olive oil brand, Luksja, a Polish beauty brand, five:am yoghurts in Australia and Nutricima a Nigerian milk business. The latter was originally a joint venture with Glanbia, the Irish dairy processing company; its disposal has meant recognising a £40m loss.

The new focus seems to be paying off. At the interim results for the six months to November (announced a couple of weeks ago), sales of “must win” brands were up by 10% excluding Carex, which benefited last year from unprecedented demand for hand sanitiser at the start of the pandemic. Including Carex, sales declined 11%.

Net debt has reduced to £11m versus £165m in 2018. Statutory profit before tax was £35m. However, that profit figure benefited from £11.2m gain on disposal of residential properties in Nigeria, tucked away in the notes of the accounts. Without that one-off gain, the profits and cash position would have looked considerably worse. Net cash generated from operations was £18m.

PZ Cussons operates in four key markets (UK, Australia, Nigeria and Indonesia) which account for 90% of sales, although the brands tend to be strong in only one or two markets. Social media and targeted advertising means that brands no longer need a large advertising budget on national TV to reach their audiences, leaving them more vulnerable to challenger brands. PZ Cussons’ St Tropez brand has benefited from its association with influencer/model Ashley Graham, but there’s no doubt that changes in advertising technology have changed how much brands need to spend to win consumers.

That said, new management seem to have grasped the problem. Nick Train, the well regarded fund manager, took a position just before the pandemic began. Funds run by Lindsell Train currently own just under 5% of the shares.

Beating low expectations

Given PZ Cusson’s share price returns in recent years, a good deal of past disappointment is already baked into expectations. Current analyst forecasts are for below 4% revenue growth in both 2023 and 2024, according to Sharepad.

That seems easily attainable for a business that ought to have pricing power. I’d expect revenue growth to at least keep up with inflation – expected by the Bank of England to reach 7% this spring. At 11.8%, operating margins are below the firm’s historic average, and around half those of peers such as Procter & Gamble. It seems likely that management could also improve return on capital employed from the current level of below 12%.

As financial performance improves, shareholders could receive a double benefit. First, profit before tax could grow towards the £115m achieved back in 2014, before the business lost its way. That is almost double the £66m forecast for the financial year ending in May. Second, there’s potential for the shares to re-rate from the 15-times forecast 2024 earnings. P&G is trading on 23 times forecasts for the same year – a 50% premium, reflecting the US group’s superior record of delivering what it says it’ll do.

Like any turn-around plan, there is execution risk. However, I think PZ Cussons’ shares could make sense as part of a diversified portfolio.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Bruce is a self-invested, low-frequency, buy-and-hold investor focused on quality. A former equity analyst, specialising in UK banks, Bruce now writes for MoneyWeek and Sharepad. He also does his own investing, and enjoy beach volleyball in my spare time. Bruce co-hosts the Investors' Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton