Nvidia: a bet on the future of technology

Graphics-chip specialist Nvidia will profit from big trends ranging from artificial intelligence to robotics.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Most people will have missed the news that the world is struggling with a major microchip shortage. Big deal, you might think, but with more of the devices we use daily needing them, problems start to mount. No chips means no products, with a slowdown in the manufacture of everything from mobile phones and games consoles to televisions and laptops. Even cars – increasingly smartphones on wheels – have seen production drop.

Lockdowns have triggered the shortages. Sharp slowdowns in industries such as automobiles, for example, put the brakes on car-chip sales. As orders tanked, manufacturers switched to making more sophisticated chips, for which demand soared more than expected on the back of all that gadgetry for working and schooling at home, and they couldn’t keep up. In the meantime the car industry – and its need for chips – rebounded faster than anticipated and yet more demand went unmatched.

The obvious winners are the chipmakers, of course, as they race to keep up with orders. The MVIS US Listed Semiconductor 25 index, which tracks the global leaders, has gained 10% in 2021, almost twice overall global equities’ return. However, its bounce masks high short-term volatility and mixed individual showings: semis were up by 15% for the year in mid-February but then down by 3% in early March.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Neglecting the big picture

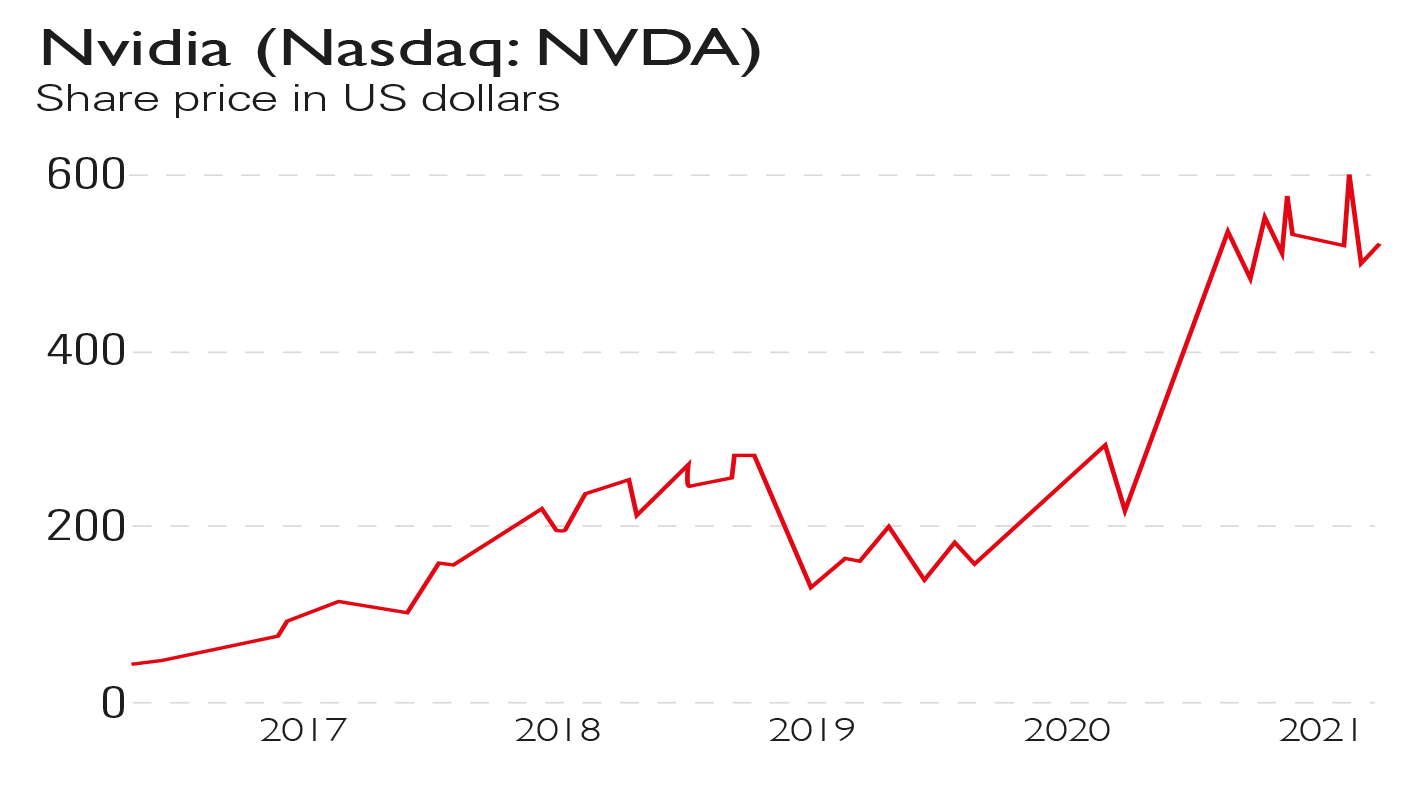

These sharp divergences from different microchip stocks are creating opportunities. Key among them is graphics-chip specialist Nvidia (Nasdaq: NVDA). The former stockmarket darling has moved sideways for a year.

Investors have focused on the very short term and lost sight of the broader picture. I’ve consistently cited Nvidia’s long-term strengths, last highlighting it here 12 months ago at $271, just before it doubled. I’m still upbeat.

Investors are allowing their judgement to be swayed. Firstly, the chip-demand trend is making them turn their noses up at any stock that doesn’t deliver massive short-term, quarter-on-quarter profit growth, and Nvidia hasn’t owing to one-off factors. But it’s delivering strong year-on-year numbers (annual sales are up by more than 50%), and this is what I’m buying into.

Secondly, broader market fears about inflation are cooling sentiment towards big technology stocks. Yet this overlooks the fact that expectations are for Nvidia to grow earnings by anywhere between 32% and 80% next year and by double digits again in each of the following two years. Nvidia is not an overvalued tech stock – it’s relatively cheap and has been getting cheaper.

Strong long-term demand

More broadly, everyone is becoming a videogamer and every mobile phone is becoming a games platform. There will be a never-ending cycle of billions of mobile phones (just think China) needing chips from Nvidia: graphics, image rendering and the creation of captivating, life-like worlds are the future of our interaction with technology.

It’s this complexity in graphics that also means Nvidia’s processors can generate the necessary computing power crucial for all the big trends that are going to change the world over decades in transportation, robotics, smart cities, healthcare, logistics and retailing. All of this requires huge power, which Nvidia offers. Its chips are also suitable for mining bitcoin.

All of this is huge and Nvidia will be too. It works at the cutting-edge of artificial intelligence, cloud processing and data storage, the fundamental elements of the huge transformational revolution in how we will soon live. It cannot happen without Nvidia.

A 44-fold return in 22 years – and Nvidia is just getting started

It’s still typical to think of technology companies as new, forgetting that some have been around for quite some time. Nvidia, for example, was formed in 1993 and floated on the stockmarket six years later at $12, giving early investors a 44-fold return – and that’s before dividends.

Built on graphics processing, an area in which it has repeatedly revolutionised technology, Nvidia’s chips are now also fuelling high-performance computing. They are used in artificial intelligence, machine learning and virtual reality, all of which are key to how technologies will develop to serve and interact with us. The advance of technology is reliant on Nvidia as its chips are key to supporting innovation.

The chips are also used heavily in smartphones, the devices that everyone will have and use to connect to the virtual world in a never-ending cycle of upgrading and replacing.

Last year Nvidia announced that it would buy British chip designer Arm from the Japanese technology conglomerate and investor Softbank for $40bn. The deal is strategically sound as Arm chips are used heavily in smartphones. The tie-up is not yet concluded, however, and competition rulings are expected.

Analysts are forecasting a bright future with very strong earnings growth. The broader outlook for technology, together with Nvidia’s role in it, suggest further upside. The sideways move in the share price over recent months, in which it has lagged other microchip stocks, is an opportunity for investors keen to back the cutting-edge of technology over the long term.

• Stephen Connolly heads a family investment office, and has worked in investment banking and asset management for over 25 years (sc@plainmoney.co.uk)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton