Mpac Group: making steady profits from premium packaging

Mpac Group’s automated packaging machines are sold to blue-chip clients in more than 80 countries worldwide. Dr Mike Tubbs looks at the company's potential for investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The word “packaging” calls to mind a commoditised industry and visions of Amazon’s cheap cardboard boxes. But specialised forms of packaging require sophisticated packaging machinery and provide much more value. A good example is the pharmaceuticals industry, where packaging requires sterile conditions and accurate dosing.

Britain’s Mpac Group (Aim: MPAC) is a key player in the field of specialised packaging. It designs and makes the automated packaging machines needed for the healthcare and food industries. Approximately 50% of its revenue comes from the healthcare sector, with another 45% from food and beverages.

A global footprint

Mpac has installed more than 10,000 of its packaging machines in 80 countries and has many blue-chip customers, including 3M, Abbott, CooperVision (a leading manufacturer of contact lenses), Diageo, GSK, Johnson & Johnson, Kraft and Smith & Nephew. It is a truly international company, with 64% of sales made in the Americas, 28% in Europe, the Middle East and Africa (41% of this from the UK) and 8% in the Asia-Pacific region. It services its own machines to maintain optimal performance for customers, with service accounting for 22% of sales and original equipment for the rest. Mpac has two innovation laboratories working on improving packaging machinery and 180 of its 500 staff are engineers and designers.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The company has a five-step approach to a job. First, it establishes exactly what the customer needs, then designs innovative machines to meet those needs, installs them, monitors performance and finally optimises performance through regular servicing and upgrades throughout the machine’s life. Mpac has an excellent record of growth through a combination of organic growth and acquisitions. Turnover more than doubled to £88.8m between 2016 and 2019. It acquired Lambert Automation in 2019 for £15m. Lambert specialises in healthcare-automation and packaging.

Mpac’s full-year results for 2019 show revenue of £88.8m, up from £58.3m in 2018. Underlying pre-tax profit was £7.5m, up from £1.4m. In December 2019 there was net cash of £18.9m on the balance sheet. The half-year results to 30 June 2020 showed the effects of the virus, with sales down by almost a fifth from the same period in 2019. However, the order book at the end of June 2020 was up by 14% year-on-year at £45.4m. What seems to have happened is that several projects were delayed by the first wave of the virus.

Exceeding expectations

The trading update for 2020 as a whole was issued on 7 January 2021. Encouragingly, this update reported trading performance ahead of market expectations. The order book going into 2021 stands at £55.5m, with no orders cancelled due to the virus.

The update also reported that the acquisition of US firm Switchback Industries in September 2020 for $15m had been successfully completed, with the purchase adding to earnings and fully integrated into the overall group. Switchback provides automation and packaging for the food, beverage and healthcare sectors, Mpac’s core areas of activity. The update stresses the absence of order cancellations and says that virtual exhibitions have been held for customers throughout the difficult Covid-19 period, with customers being offered digital solutions for remote machine testing and servicing.

Equity Development, the equity research company, said in July 2020 that there was scope for Mpac to win market share as clients settle on best-in-class original equipment manufacturers who can provide worldwide service and fully integrated smart-factory technologies.

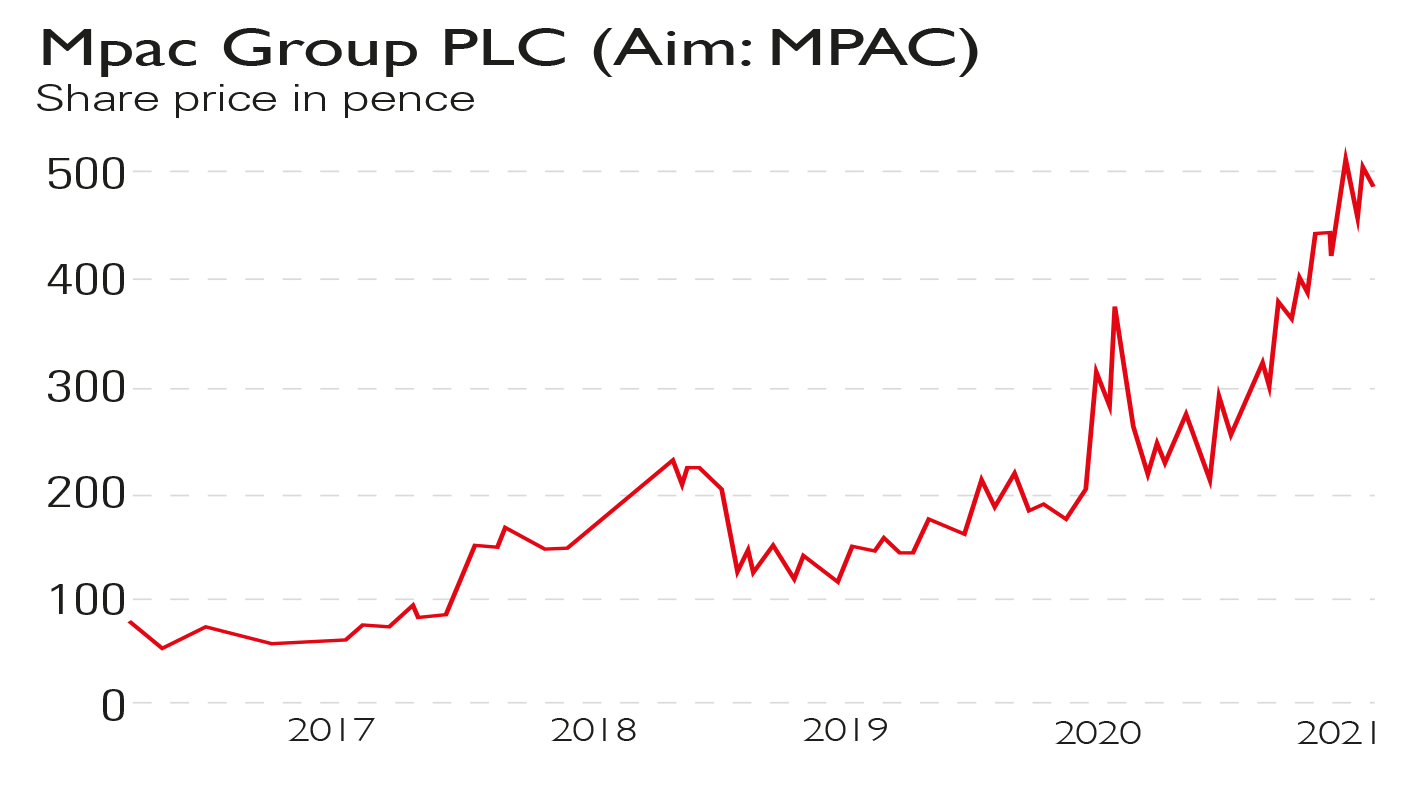

Looking forward to 2021, Mpac’s medical-grade packaging expertise should enable it to take a slice of the market for packaging Covid-19 test kits and vaccine ampoules. Panmure Gordon’s 2021 earnings-per-share estimate is 36.1p so, at the recent price of 490p, the forward price/earnings (p/e) ratio is 13.6. The balance sheet looks solid too. At the end of June Mpac had net cash of £22.5m, up from around £19m at the end of December 2019. The initial payment for Switchback was £10m, so at the end of December 2020 there would have been around £12m plus the cash generated in the second half (around £2.5m) on the balance sheet.

Why this stock ticks all the boxes

Mpac has most of the characteristics I look for in an investment – it invests in innovation, occupies a profitable and growing market niche, has sales spread over the main developed global economies, has net cash, a positive trading update and a lowish forward p/e ratio even though the share price has doubled since last May. It has not paid a dividend over the last few years because it has been investing in growth, but a dividend of 1.5p per share was declared for 2019.

The risks to the outlook include the potential delay of customers’ projects should the virus situation get worse, a change in the asset/liability ratio for the pension scheme and the usual problem of higher share-price volatility for smaller companies (Mpac’s market value is only £101m). At a recent price of 490p and a 2021 p/e of 13.6, this is a reasonable entry point. Mpac’s full-year results for 2020 are due in the first week of March and should prove encouraging. CEO Tony Steels said in the trading update of 7 January that “we will be able to report a robust financial performance for 2020 and a positive outlook for 2021, which is testament to the fundamental strengths of the group”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton