Profit from the potential in auto-immune disease drugs

Some debilitating conditions are caused by the body’s defence mechanism going awry. Dr Mike Tubbs appraises a key subsector of the pharmaceuticals market.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

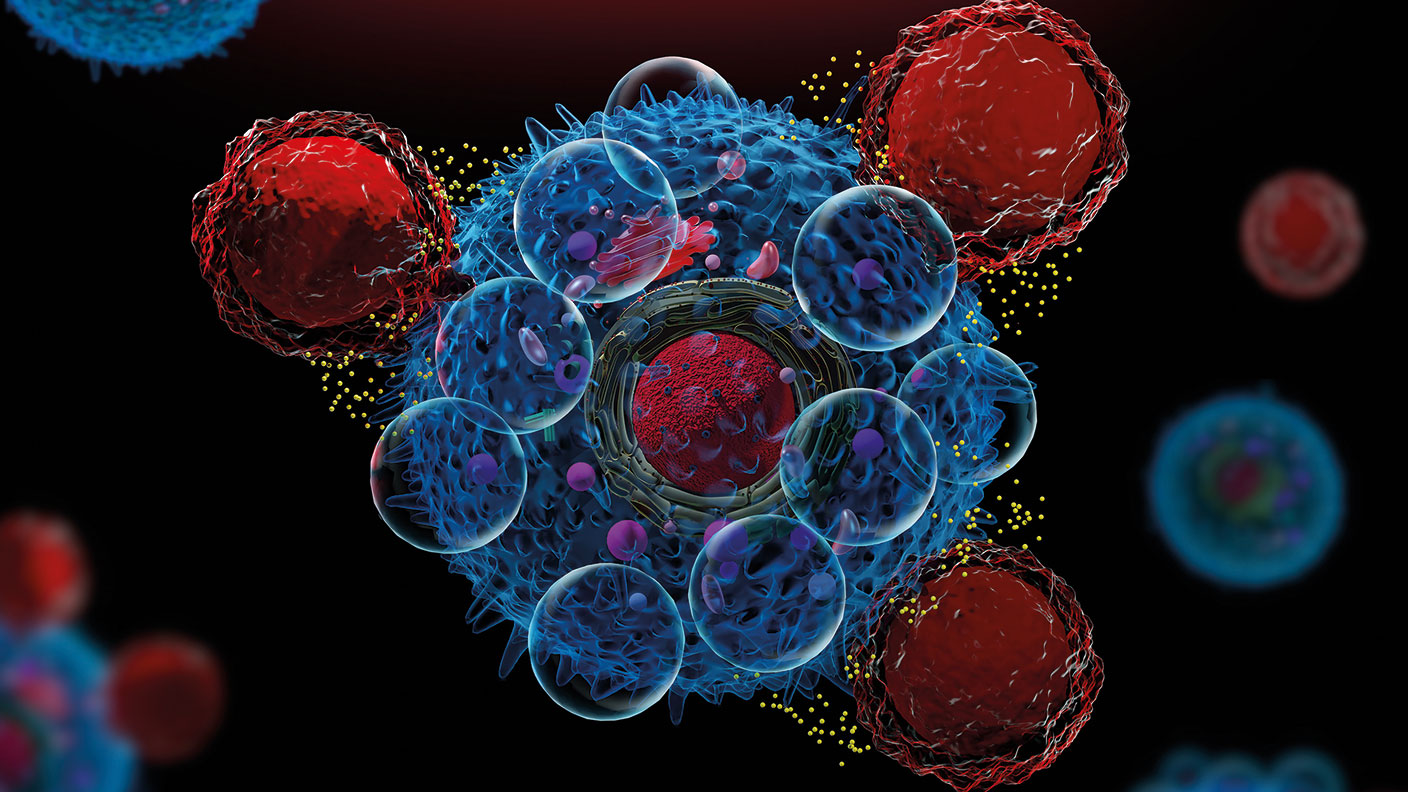

Auto-immune diseases are among the most debilitating chronic illnesses in existence. They are all caused by your immune system mistakenly attacking your body. They include rheumatoid arthritis (RA), Type-1 diabetes (see page 33), multiple sclerosis (MS), psoriasis, the skin condition whereby skin cells multiply up to ten times faster than normal, and psoriatic arthritis, a type of arthritis affecting psoriasis sufferers.

The list also includes lupus, whereby the immune system becomes hyperactive, causing symptoms such as joint pain and rashes, and inflammatory bowel disease (IBD). IBD covers two main conditions: Crohn’s disease, which can inflame any part of the gastrointestinal tract, and ulcerative colitis, inflammation of the colon.

Drugs to treat these common diseases are taken over many years and are therefore very profitable for pharmaceutical companies. For example, AbbVie’s Humira, a treatment for RA, psoriasis, psoriatic arthritis and Crohn’s disease, was the world’s best-selling drug in 2018, raking in $19.9bn, well ahead of the second-best seller, Eliquis, for the prevention of stroke, with $9.8bn.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We’ll assess the prospects of the main companies involved in three major autoimmune diseases: RA, psoriasis/psoriatic arthritis (Ps/PsA) and IBD. The World Health Organisation estimates that 23 million people worldwide have RA, with 1.3 million diagnosed in the US. It is more than twice as prevalent in women as in men.

Psoriasis is even more widespread, with 125 million sufferers worldwide and a tenth of Ps patients go on to develop PsA. There are about seven million sufferers of IBD – Crohn’s disease and ulcerative colitis – in the world.

Biologics: a new type of treatment

RA used to be treated with anti-inflammatory drugs or drugs that slowed the progression of the disease, such as hydroxychloroquine. These drugs, however, are made from chemicals and have been eclipsed by a new kind of treatment: biologic drugs.

Biologic drugs are made from living organisms or parts of living organisms. Vaccines are simple examples of biologic drugs. The new drugs target the parts of the immune system causing joint and tissue damage more precisely than their chemical predecessors. The best known is Humira.

Biologic drugs are improving all the time. The first ones were called TNF inhibitors. TNF is a protein made in the body that can cause the inflammation that leads to joint and tissue damage. Unfortunately, TNF inhibitors also increase the risk of infections. In 2019 TNF inhibitors accounted for about 70% of the RA market with JAK inhibitors, a newer class of biologics, taking about 5% of the market and several even newer biologics under development. The JAK inhibitors stop the immune system making cytokines, which stimulate inflammation in the joints, so they greatly reduce inflammation.

Several JAK inhibitors have recently been approved by America’s Food and Drug Administration (FDA). The newer, second-generation JAK inhibitors have smaller adverse effects than those of the first generation and seem more effective than the older TNF inhibitors.

The global RA market in 2025 is expected to be worth over $50bn, up from around $34bn now, and this accounts for the strong interest among biopharma companies (those developing pills from living organisms rather than chemicals).

The market for many RA drugs is larger than it appears since they are also effective against other autoimmune diseases. For example, Humira is effective against RA, plaque psoriasis (PPs), psoriatic arthritis (PsA), Crohn’s disease and ankylosing spondylitis (AS, a rare type of arthritis of the spine).

The main players in the subsector

Sales of TNF-inhibitor injectable RA drugs in the fourth quarter of 2019 were led by AbbVie’s Humira ($4.39bn) followed by Amgen’s Enbrel ($1.35bn) and Johnson & Johnson’s (J&J) Remicade ($1.04bn); these quarterly results imply annual sales in the range of $4bn-$18bn.

Several companies have developed JAK inhibitors that can be taken in tablet form. For example, AbbVie has Rinvoq, a JAK inhibitor, approved for RA and in Phase-III trials (the last of three stages of clinical trials in drug development) for PsA, IBD and five other immunological diseases. Some medium-sized firms also dabble in autoimmune diseases. Gilead Sciences is best known for its HIV and Hepatitis-C treatments, but it also has a strong pipeline of oncology and immunology drugs.

It has submitted Filgotinib, a highly selective JAK inhibitor to treat RA, for priority review by the Food and Drug Administration (FDA). Filgotinib is also in Phase III-trials for IBD and PsA and Phase II for AS. There are two other drugs in Phase II for ulcerative colitis and osteoarthritis and five others in Phase I for inflammatory diseases.

Then there is Germany’s MorphoSys. It specialises in antibody drugs, which stimulate the immune system; antibodies are made by the immune system and attach themselves to cells. MorphoSys makes its own range of antibodies, develops new drugs from them and then forms partnerships with big pharma companies to commercialise them.

It developed the antibody that is the basis of J&J’s Tremfya for PsA and PPs; Tremfya is also in Phase III-trials for Crohn’s disease and Phase II for ulcerative colitis. MorphoSys is partnering with GlaxoSmithKline for the antibody drug Otilimab, which is in Phase III-trials for RA, with J&J again for two further immunology drugs in Phases I and II, and with Novartis for an RA drug in Phase I.

There are also some interesting RA drugs in the pipelines of smaller biotechs. For example, Astellas Pharma’s Peficitinib, a JAK inhibitor, has been approved in Japan for RA. Pipeline drug ATI-450 from Aclaris Therapeutics is an oral drug that blocks the cellular communication that leads to inflammation. It has shown promise in Phase I trials.

Finding promising prospects

We have yet to discover a cure for autoimmune diseases, so patients need to take drugs for them on a long-term basis. This provides a steady stream of income for the biopharmaceutical companies involved. And the case of Abbvie’s Humira, the world’s best-selling drug for several years, shows how large this income stream can be.

Since these diseases are serious, the drugs to treat them are likely to continue to be prescribed during the ongoing pandemic. Most of the companies with strong positions in immunological drugs also have substantial investments in other therapeutic areas, so investors need to assess the performance of a company’s whole product range, together with the quality of its pipeline.

Among the big pharma companies, AbbVie and J&J stand out. AbbVie completed its $63bn acquisition of Allergan, the Botox company, in May 2020. The purchase added 26% to revenues and yielded new growth opportunities in neuroscience. AbbVie’s results in the second quarter of 2020 showed 46% of revenues coming from Humira for RA. Humira’s sales are decreasing in Europe as its patent there expired in 2018, allowing generic competition to take market share. Revenue will fall in the US too when the patent there expires in 2023, although market-research group EvaluatePharma estimates that Humira’s revenues will still be $12.4bn in 2024.

But AbbVie has Skyrizi approved for PPs and Rinvoq for RA, together with a strong pipeline of RA and other immunology drugs, which should help to compensate for Humira’s steady decline. Rinvoq has also produced excellent recent trials data for dermatitis, which implies another major revenue stream.

Moreover, AbbVie’s successful blood-cancer drugs contributed $1.6bn in the second quarter of 2020, up 26% on the previous year. Allergan’s botox and cosmetic drugs have suffered with other elective procedures because of the virus, but sales should pick up as the virus becomes controlled.

J&J is the world’s largest healthcare company, with around half of revenues from pharmaceuticals and the rest from medical devices and consumer products. It is a sound defensive investment with a record of increasing its dividend every year for the last 58 years.

Among the medium-sized firms, Gilead Sciences and MorphoSys are interesting. Gilead is investing cash flows from its successful HIV and Hepatitis C drugs into other areas, including immunology. This shows in its pipeline, which has 23 clinical trials in oncology, 14 in immunology and inflammation, and six in fibrotic diseases. There are also two trials designed to find a cure for Hepatitis B and two for Remdesivir, a treatment for Covid-19. MorphoSys has nearly 80 clinical trials in progress for 27 different antibody drugs. Of the 27, 12 are for cancer with four for immunology or inflammation. MorphoSys has cash of €1.1bn and should get close to breaking even this year. Longer-term profitability depends on more successes emerging from the late stage pipeline.

The stocks to buy now

The best bet for investors interested in this subsector is AbbVie (NYSE: ABBV). Thanks to Humira, it boasts the pharma sector’s strongest presence in immunology. Its 2021 price/earnings ratio (p/e) is 7.2 and the yield is 5.4%. Gilead Sciences (Nasdaq: GILD) and MorphoSys (Frankfurt: MOR) are primarily investments in oncology, but have sizeable interests in immunology. Gilead has a price/earnings ratio (p/e) of 9.1 and a yield of 4.3%; MorphoSys is still in the red. J&J (NYSE: JNJ) is an excellent general healthcare investment with some exposure to immunology; note that J&J is the big-pharma partner for three of MorphoSys’s immunology drugs. J&J’s 2021 p/e is 16.8 and it yields 2.7%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive