Gilead's takeover of Forty Seven should soothe shareholders' worries

Gilean, the biopharma giant, is stocking up on potentially lucrative cancer drugs by snapping up smaller operators.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

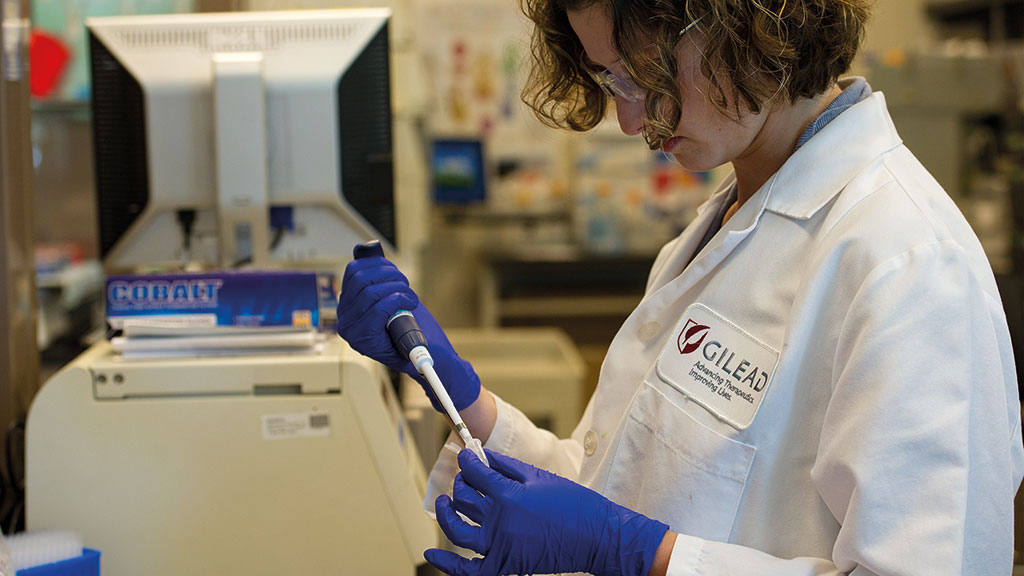

Biopharmaceutical giant Gilead Sciences has been facing “increasing unrest” from shareholders recently, says Josh Nathan-Kazis in Barron’s. They have been asking what it plans to do with its “substantial” amount of cash. Now they have their answer. Gilead has decided to buy “small cancer-focused biotech” Forty Seven for $4.9bn. Gilead hopes that the deal, which has boosted Forty Seven’s shares by 62%, will add “significant potential” to its clinical pipeline, particularly in the field of immuno-oncology, where the emphasis is on using the body’s own immune system to fight cancer. One particularly promising drug by Forty Seven is magrolimab, designed to treat several cancers, including myelodysplastic syndrome (in which some blood cells in bone marrow do not mature properly and become unhealthy) and a form of leukaemia.

Gilead needed to do something, say Marthe Fourcade and Kristen Brown on Bloomberg. While Gilead’s hepatitis C franchise may have turned the company into a “drug-industry giant”, sales of the treatments have “slipped from their peak” and the firm “has struggled to find new streams of revenue”. The deal with Forty Seven complements its 2017 acquisition of Kite Pharma, bringing on board “an experimental therapy that has potential to be the first in its class”. If Gilead hadn’t jumped on Forty Seven a competitor would probably have snapped it up; “other potential suitors” had been eyeing it up.

Why cancer drugs are all the rage

Whether the deal proves a success or not, Gilead “is not alone” in turning to mergers and acquisitions to bolster its portfolio of cancer drugs, say Ortenca Aliaj and Eric Platt in the Financial Times. For example, early last year Bristol-Myers Squibb purchased Celgene for $93bn, while Pfizer snapped up Array BioPharma for $11bn in June. Rivals Eli Lilly and GlaxoSmithKline have also “bet billions of dollars” on cancer treatments over the past 18 months. The takeover of Forty Seven also “shares many of the hallmarks of other big cancer deals, where a recently listed start-up is acquired after its treatments show good progress in clinical trials”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It’s not surprising that many companies are starting to invest in oncology, says Joseph Walker in The Wall Street Journal. Cancer drugs can “command high prices and receive relatively fast regulatory approvals”. US spending on cancer drugs has more than doubled to $56.7bn in 2018 from $27.3bn in 2013. Gilead has been working on an “experimental antiviral treatment which is being tested against... Covid-19”, says Robert Cyran on Breakingviews. However, it “can be hard to profit from epidemics because they are often short lived and always politically fraught”. As a result, it’s “always nice to have other options”, especially as Forty Seven’s price is “reasonable enough for a deal of this kind”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.