SoftBank steadies the ship with asset disposals

Softbank looked to be in trouble a few months ago. But asset disposals and progress at WeWork have improved the outlook. Matthew Partridge reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Japanese technology conglomerate SoftBank Group Corporation is “exploring” either selling or floating British chip designer Arm Holdings, which it bought four years ago for $32bn, say Dana Cimilluca and Cara Lombardo in The Wall Street Journal. The review is at an “early stage”, so it is possible that SoftBank will “ultimately choose to do nothing”.

However, a sale would help it raise cash to “mollify” activist investor Elliott Management, which has been “agitating for changes at the company”. This money could be used to buy back its own shares, which trade at a “steep discount relative to net asset value”.

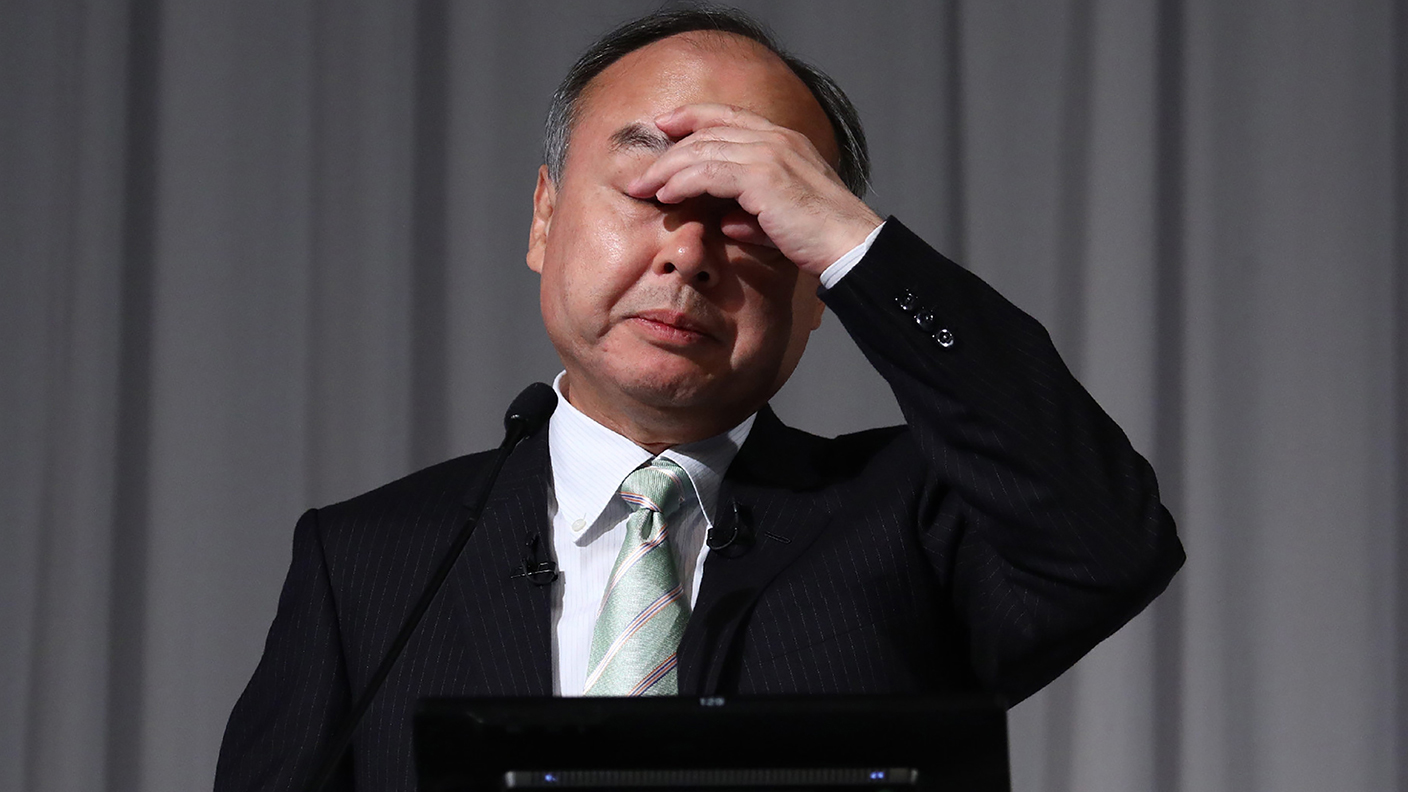

Good luck getting much cash for Arm Holdings, says Alec Macfarlane on Breakingviews. While SoftBank’s CEO, Masayoshi Son, once called Arm Holdings his “most important acquisition”, he may struggle to get buyers to feel the same way. Despite Arm Holdings splurging on research and development spending, making big acquisitions and going on a “hiring spree”, sales have failed to take off, growing by a “paltry” 2% in the fiscal year to March. Industry tracker IDC forecasts that shipments this year will decline by 12% amid Covid-19 disruptions, hinting at “further pain to come”. With rival chipmaker Intel trading at around three times historical sales, Arm Holdings could be worth as little as $6bn.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Still, even if getting rid of it proves more difficult than expected, SoftBank may not need to sell it, since the conglomerate has already managed to sell a lot of assets over the past few months, say Arash Massoudi and Kana Inagaki in the Financial Times.

SoftBank managed to raise $23.2bn last month from selling its stake in the company created by the merger of Sprint with T-Mobile. SoftBank has also sold down its holdings in Chinese ecommerce group Alibaba, which has hit “record after record” this year. As a result, it is already 90% of the way towards its goal of raising $41bn.

WeWork is working better

Even SoftBank’s most controversial investment, shared-workspace provider WeWork, is looking better these days, says Catherine Shu on TechCrunch. Thanks to financial and management issues that led to the resignation of founder Adam Neumann, WeWork’s valuation plunged from as much as $47bn at the beginning of 2019 to $2.9bn in March, leading to an overall $24bn loss for SoftBank. However, thanks to “aggressive cost-cutting measures”, which have reduced WeWork’s headcount from 14,000 to 5,600, and the sale of several of its businesses, WeWork now expects positive cash flow in 2021.

No wonder, then, that SoftBank’s shares “have more than doubled from their March low”, increasing Son’s personal fortune to $20bn, says Bloomberg. The bounce could endure. Earnings are set to recover from last quarter’s “record loss”, while short-sellers are under pressure to “cover losing bets”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Student loans debate: should you fund your child through university?

Student loans debate: should you fund your child through university?Graduates are complaining about their levels of student debt so should wealthy parents be helping them avoid student loans?

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom