Could SoftBank’s clouded vision lead to its demise?

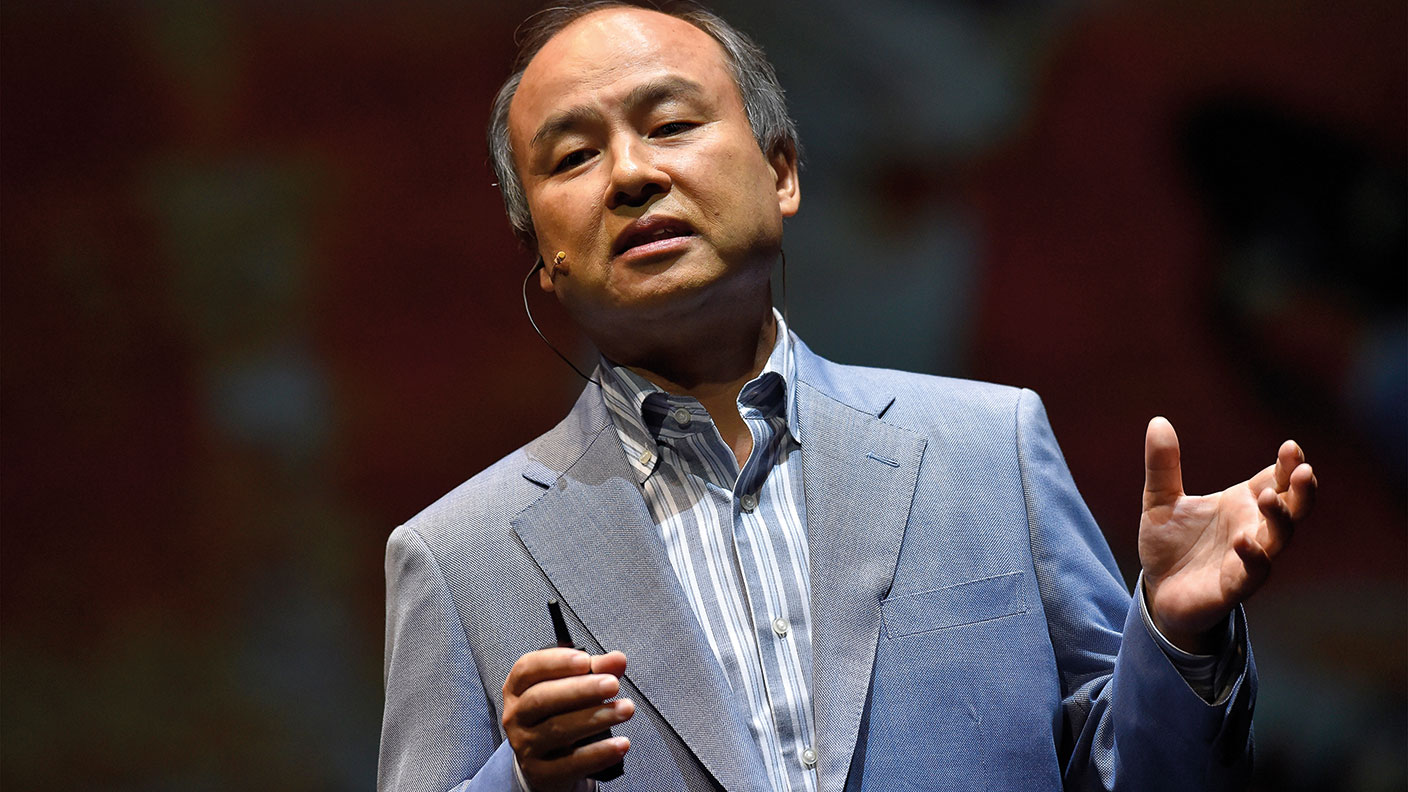

Softbank's technology-investment fund has had a terrible year. Could Masayoshi Son’s empire collapse?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Japanese conglomerate SoftBank, the “world’s largest technology investor”, has admitted that it expects to suffer its “first loss for 15 years”, says Louisa Clarence-Smith in The Times. It is pencilling in an operating loss of $12.5bn in the year to 31 March thanks to the coronavirus outbreak and “ill-judged investments”. Its $100bn Vision Fund, which is backed by Saudi Arabia’s sovereign wealth fund, lost $16.7bn in the company’s latest fiscal year owing to a “string of bad bets on start-ups”.

The most high-profile of these mistakes has been the $10bn invested in WeWork, the serviced-offices group, which had to abandon an attempt to list on the Nasdaq exchange last September. That forced SoftBank to write down the value of its investment drastically.

WeWork, which had its value written down from more than $40bn to $8bn, was SoftBank’s most spectacular failure, say Jonathan Shieber and Alex Wilhelm on TechCrunch. But it was hardly the only dud investment. Others include satellite communications group OneWeb, which collapsed “under the weight of its own capital-intensive vision” and Zume, SoftBank’s robotic pizza-delivery business, which has also folded.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The only things preventing SoftBank’s credibility from being “completely destroyed” have been older investments such as the company’s stake in the Chinese e-commerce site Alibaba, which has proved to be a “cash cow”, as well as a “relatively strong” core business in telecommunications and semiconductor holdings.

The price of over-ambition

Much of the blame lies with SoftBank’s founder and CEO, Masayoshi Son, says Tim Culpan on Bloomberg. Son’s desire to become the “Godfather of venture capitalists” means that he has abandoned the traditional venture-capitalist role of being the “voice of reason” in favour of showering promising startups with cash in order to spur growth. As a result, many of the firms in the portfolio have become “addicted to spending” at the expense of “building fiscal discipline into their business models”, which means even when they do achieve revenue growth they struggle to make money.

One bad quarter isn’t enough to invalidate Son’s ideas about the “long-term potential of tech to create investment value”, says Richard Beales on Breakingviews. Still, those still willing to stick with SoftBank should be aware that Son has pledged as much as 60% of his SoftBank holding to banks as collateral against personal loans.

He has also personally backed bank loans to the founder of India’s Oyo Homes & Hotels, another investment currently suffering. While these actions show “commitment” they also suggest that Son’s ability to see his vision through is becoming “stretched” and that further reversals could bring his whole empire down.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.