- The Office for National Statistics (ONS) has confirmed that the Consumer Prices Index rose by 3.6% in the year to October, a fall from the three preceding months

- The Bank of England (BoE) had previously expected September to mark the high point of the current phase of inflation

- Inflation as measured by the Consumer Prices Index (CPI) came in at 3.8% for September, below expectations of 4% and unchanged from August and July

- The BoE’s Monetary Policy Committee held interest rates unchanged earlier in November, despite a weakening UK economy, over concerns about persistent inflation.

| What is inflation? | CPI versus RPI inflation | Upcoming CPI release dates |

Good afternoon, and thank you for joining our live coverage of the upcoming UK inflation data release.

Tomorrow morning, the Office for National Statistics ONS will announce the latest inflation data, covering October.

This is something of a pivotal release as far as the current inflation cycle is concerned, as the Bank of England’s forecasters expect the previous month to have marked the peak of the inflation cycle.

The headline CPI figure for September was unchanged from August, at 3.8%. If they are to resume their interest rate cutting cycle, policymakers will be looking for tomorrow’s inflation figure to come in below that level and confirm the current hypothesis – even though the number was below where most analysts had expected CPI would be for September.

Follow along for rolling preview and analysis today, plus live coverage of and reaction to the data release tomorrow morning.

When is UK inflation data released?

The ONS will release the latest UK inflation figures at 7am tomorrow (19 November). We’ll cover the release live here, and bring you live reaction afterwards.

See our explainer on upcoming CPI release dates for the calendar of future ONS inflation releases.

Where did inflation go in 2025?

Inflation has been on the rise for much of 2025, climbing from 3% in January to 3.8% in September, the latest month for which data is available.

Price growth fell in the first quarter of the year, going down to 2.6% in March. However, a combination of bill increases, minimum wage hikes, and disruption to global trade meant this decline was short-lived.

Inflation jumped 0.9 percentage points between March and April, reaching 3.5% – it was the largest month-on-month increase in inflation since October 2022, at the height of the cost of living crisis.

Since then, inflation has remained stubbornly high, climbing to an 18-month high of 3.8% in July and remaining at that level in August and September.

What do analysts expect for October UK inflation?

According to its November report, the Monetary Policy Committee (MPC) – the group within the Bank of England responsible for setting interest rates – expects inflation to fall from the September figure of 3.8% thanks to cooling in energy and food price increases as well as the inflationary impacts of the last Autumn Budget having worked their way through the system.

As such the MPC expects inflation to fall to 3.5% in the fourth quarter of 2025.

For October in particular, analysts expect to see a drop in inflation from the 3.8% level it sat at for the three preceding months.

“We estimate UK inflation will slightly improve in October's figures, slowing to 3.6% - a 0.2% improvement on the previous month,” said Grant Slade, UK economist at Morningstar. “The disinflation process remains intact, in our view. A weakening labour market and well-anchored long-term inflation expectations should allow for the impact of prior supply-side shocks to fade progressively over the coming quarters.”

Robert Wood and Elliott Jordan-Doak, chief UK economist and senior UK economist respectively at Pantheon Macroeconomics, forecast October inflation to fall to 3.5%.

What is inflation?

In brief, inflation measures the speed at which prices are rising.

Economists, particularly those at the ONS, measure price changes in a basket of goods that represent general spending patterns. Inflation typically refers to the percentage change in prices of that basket of goods over a 12-month period.

Prices of everyday goods such as groceries are one of the key inputs when calculating inflation.

There are various different baskets that can be analysed for different purposes, but the key one as far as most economists and policymakers are concerned is the Consumer Prices Index (CPI) – unless specified, it’s that figure we’re referring to here when we cite ‘inflation’ figures (like the 3.8% figure from September).

Read more on different inflation measures here: CPI versus RPI inflation.

It is important to remember that inflation measures the rate at which prices are changing. If CPI falls from 3.8% to (say) 3.6%, that doesn’t mean prices have fallen (what’s known as ‘deflation’), but that the pace at which they are increasing has slowed.

The Bank of England, along with most central banks, targets a 2% annual rate of inflation, which is seen as economically healthy. Inflation running significantly above this level makes basic necessities unaffordable for lots of people, while running below this can be bad for economic growth.

Economist: October inflation data should kick off gradual easing

Andrew Goodwin, chief UK economist at Oxford Economics, says “October’s inflation release is likely to mark the beginning of a gradual easing in price pressures.”

He thinks that the impact of energy costs on annual inflation is likely to fall by a little over 0.2 percentage points, following a smaller increase in the energy price cap this year compared to last.

“Though there will be some mitigation from higher petrol prices, with the base effects running in the opposite direction to energy, we expect CPI inflation to fall to 3.6% from 3.8% in September,” said Goodwin.

Why inflation could surprise to the upside

It’s being widely assumed that annual inflation will have fallen between September and October, with most experts predicting a headline figure of around 3.6%.

But Sanjay Raja, chief UK economist at Deutsche Bank, thinks it could surprise to the upside. He expects UK inflation for October to come in at 3.7%.

“Larger rises in airfares and university fees, we think, will push inflation up a leg,” said Raja.

He added, though, that he expects this to “mostly unwind in November”.

Thanks for following our inflation coverage today. We're pausing here for tonight, but join us first thing tomorrow for the data release, which we'll report on live from 7am.

UK inflation day – how did prices change in October?

Good morning and welcome back to live coverage. We’re just minutes away from finding out how prices changed during the year to October.

As a recap, most analysts are expecting a drop from last month’s reading of 3.8%, to somewhere around 3.5% or 3.6%.

Stay with us as we bring you live news of the latest data, plus a wealth of reaction.

BREAKING: UK inflation fell to 3.6% in October

The latest UK inflation data is in, and confirms that the UK Consumer Prices Index increased by 3.6% in the year to October, a slowdown compared to the three preceding months.

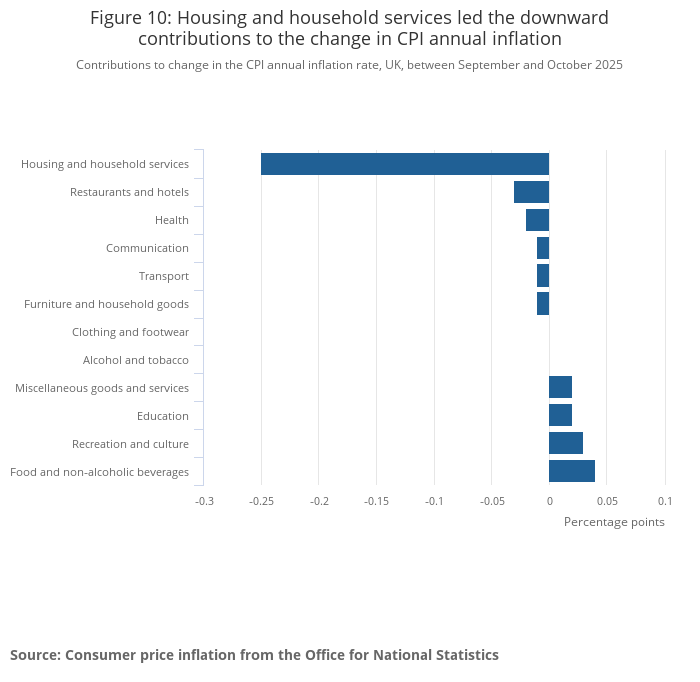

CPI drop driven by falling housing costs

UK inflation fell from 3.8% in the year to September to 3.6% in the year to October. The biggest driver to the slowdown in price increases came from housing and household services costs, which fell from 7.3% in the year to September to 5.2% in the year to October.

Food and drinks the largest offset to slowing price increases

While housing costs slowed their pace of increase, food and non-alcoholic beverages made the largest upward contribution to inflation in the year to October. The rate of price increases in this division increased from 4.5% in the year to September to 4.9% in the year to October.

Will the fall in UK inflation lead to an interest rates cut?

Policymakers at the Bank of England have been waiting for confirmation of their hypothesis that inflation is easing before cutting interest rates further. At high level, today’s inflation read seems to give them that.

There is a potential spanner in the works, though, in the form of chancellor Rachel Reeves’ upcoming Autumn Budget.

“Evidence inflation has peaked should tip the scales towards a December rate cut. But any further rate cuts will largely depend on the contents of the Chancellor’s red box,” said George Brown, senior economist at Schroders. “If VAT and green levies are eliminated from household energy bills, inflation could fall by as much as half a percentage point.”

Brown believes that broader price pressures could linger, with wage growth remaining above target pace especially compared to productivity.

“The Bank must tread carefully given the heightened risk that high inflation becomes entrenched,” he added.

Reeves responds to fall in UK inflation

Chancellor Rachel Reeves has issued a response to the fall in UK inflation during the year to October:

“This fall in inflation is good news for households and businesses across the country, but I’m determined to do more to bring prices down,” said Reeves. “That’s why at the budget next week I will take the fair choices to deliver on the public’s priorities to cut NHS waiting lists, cut national debt and cut the cost of living.”

Rachel Reeves will deliver her Autumn Budget next week - how will it impact inflation?

UK inflation drop is welcome, but picture still mixed

The economic picture is still mixed for UK consumers despite this drop in UK inflation figures.

“An almost 10% depreciation in GBP vs the Euro is adding to the cost of European imports,” said Brad Holland, director of investment strategy at J.P. Morgan Personal Investing. “Petrol and domestic gas prices are lower than they were at the start of the year… Goods inflation pressure is moderate at the moment and services inflation remains the key focus.”

Good CPI inflation fell from 2.9% in the year to September to 2.6% in the year to October, while services inflation fell from 4.7% to 4.5%.

Holland added that with the latest UK growth figures proving lacklustre, there will be pressure on the Bank of England to cut interest rates at its final meeting in December given today’s indication that UK inflation is on its way down.

Inflation figures show monetary policy is working

October’s fall in UK inflation shows that “restrictive monetary policy is working”, says Daniel Casali, chief investment strategist at wealth manager Evelyn Partners.

“Importantly, service producer price inflation (a leading indicator for consumer services inflation) has also started to trend lower, suggesting further disinflation ahead in labour-intensive sectors,” he added.

There is speculation that the Autumn Budget will have to include tax rises in order for Rachel Reeves to meet her fiscal rules. If so, that would act to reduce household disposable income and dampen demand, which should act as a further brake on inflation.

“This fiscal tightening complements monetary restraint, accelerating the path toward the Bank’s 2% inflation target. In short, this makes it harder for the MPC to justify holding rates at current restrictive levels deep into 2026,” said Casali.

Could we see a Christmas rate cut?

Bank of England governor Andrew Bailey indicated at the last Monetary Policy Committee meeting that future data releases before the final interest rates meeting of the year would be key to determining whether there would be a final cut in 2025.

Today’s data puts that firmly on the table in the opinion of Isaac Stell, investment manager at Wealth Club.

“Having remained elevated throughout the summer, it looks as if the inflationary descent is starting to gain momentum. The possibility of a pre-Christmas rate cut is now very much on the cards,” said Stell.

Is the fall in UK inflation an early Christmas present for Bank of England rate-setters?

“All eyes now turn to the Budget,” Stell continued. With the expected fiscal tightening in the form of tax rises a foregone conclusion, policy makers at the BoE will be watching closely to see how these measures affect growth and demand.”

Services inflation is cooling

One of the big highlights in the October UK inflation data was the fall in CPI services inflation from 4.7% to 4.5%. This has been a particularly sticky part of the UK’s inflationary picture, and its cooling off points to the success of the Bank of England’s monetary tightening.

“Weaker than expected travel fares, tuition fees, and accommodation prices all [pulled] services price momentum a touch lower than market expectations,” said Sanjay Raja, chief UK economist at Deutsche Bank.

“Our suite of core services measures, which strips out some of the more volatile and erratic items in the basket, were also broadly positive – highlighting continued disinflation in the economy,” Raja continued.

He added that this gives the MPC a clearer path towards a December rate cut, with Bank of England governor Andrew Bailey likely to hold the deciding vote.

UK inflation recap: headline metrics

To recap: the headline rate of CPI inflation fell from 3.8% in the year to September (which Bank of England forecasters had expected to mark the high point of the current inflation cycle) to 3.6% in the year to October.

Here are some more key inflation indicators. Our explainer on CPI versus RPI inflation will fill you in on some of the terms here.

| Header Cell - Column 0 | September 2025 | October 2025 |

|---|---|---|

CPI 12-month change (%) | 3.8 | 3.6 |

CPI 1-month change (%) | 0.0 | 0.4 |

CPIH 12-month change (%) | 4.1 | 3.8 |

CPIH 1-month change (%) | 0.1 | 0.4 |

RPI 12-month change (%) | 4.5 | 4.3 |

CPI annual goods inflation (%) | 2.9 | 2.6 |

CPI annual services inflation (%) | 4.7 | 4.5 |

Core CPI annual inflation (%) | 3.5 | 3.4 |

Source: Consumer price inflation from the Office for National Statistics

What does falling inflation mean for your savings?

Some savers will be breathing a sigh of relief after inflation fell for the first time in five months, as slowing price growth their savings will be eroded away far slower.

But while inflation is going in the right direction, a reading of 3.6% is certainly not low – and far above the Bank of England’s target of 2%.

What is more, inflation being this far above target means it is still far higher than the interest rates offered by many savings accounts, meaning consumers are seeing their cash become less valuable in real terms.

The interest rate for the average easy access savings account is around 2.5%, according to Hargreaves Lansdown, meaning a 1.1 percentage point gap exists between the average savings account and the rate of inflation.

The good news is that while the average savings rate is lower than inflation, there are still a lot of competitive options on the market.

Mark Hicks, head of active savings at Hargreaves Lansdown, says: “The market is incredibly competitive right now – especially for easy access and cash ISA. It means it’s more important than ever to shop around and consider online banks and savings platforms, because there are still plenty of accounts leading the pack, way ahead of inflation.

For money you don’t need for a specific period, it’s also well worth considering locking in a fixed rate deal now. You can get fixed terms around 4.4%, which look increasingly attractive at a time when rates and inflation are both expected to fall from here.”

The top easy access savings account on the market currently pays an interest rate of 4.55%, provided by West Brom building society, while the best one year fixed saver by Monument Bank offers 4.47%.

BestInvest: Softer inflation a boost for homeowners and buyers

There is some room for optimism among homeowners and prospective buyers after October’s inflation figures were released as slowing price growth offers a boost to affordability.

A December interest rate cut has become more likely because of falling inflation too, setting the stage for a further boost for mortgage payers.

Alice Haine, personal finance analyst at Bestinvest by Evelyn Partners, said: “Easing inflation does bode well for affordability, as it raises the likelihood of further interest rate cuts.

“Mortgage rates have continued to fall in recent days, so a more competitive mortgage landscape, combined with more relaxed stress test rules and slowing market activity ahead of the Budget, provides an opportunity for committed buyers to capitalise.

“When a market hesitates in the face of change, it can be one of the best times to secure a deal,” she added.

Meanwhile, those who are coming to the end of their mortgage term and are shopping around for a better deal may also be able to find a better deal, but a lot depends on how long ago they fixed their rate.

Haine said: “Those coming off short-term fixes taken when rates peaked in 2023 may find better deals now. However, borrowers nearing the end of ultra-low five-year fixes secured before rates began their rapid ascent in late 2021 face a tougher outlook.

“They could see a sharp rise in monthly repayments unless they’ve significantly reduced their balance – though the blow may be softened if mortgage rates continue to ease.”

Where is inflation going next?

For the moment, it appears that the Bank of England’s forecasts for the long-term trajectory of UK inflation is intact.

The good news is that this should see prices fall over the next two years. The Bank of England expects it to recede to the target level of 2% by the end of 2027.

“Looking ahead, inflation is likely to remain at similar levels over the final months of this year, but several factors should pull the headline rate down through next year,” said Edward Allenby, senior economist at Oxford Economics.

Energy prices ought to act as a drag to inflation from next year as their pace of increase slows, while Allenby also feels that food price inflation has peaked and that weaker food commodity prices and a stronger pound should bring food inflation down in 2026.

“Services inflation is expected to ease steadily due to cooling pay growth and strong base effects caused by this year's increase in national insurance contributions,” he added.

Inflation, interest rates, and what it means for savers and investors

The last Monetary Policy Committee (MPC) meeting resulted in a 5-4 split in favour of holding interest rates at their prior level (4.0%), with four members of the panel voting to cut rates to 3.75%.

With the economic situation deteriorating and CPI inflation coming down, a rate cut in December looks very likely according to Nigel Green, CEO of deVere Group.

“We believe that there’s now a high probability of a Bank of England December rate cut,” he said.

That has different implications for your money, depending on whether you favour saving or investing.

“The likely December rate reduction by the Bank of England marks a transition point. For savers, this means challenge; for investors, it means opportunity for those who act with insight,” said Green.

Interest rates falling even as inflation remains above target is bad news for savers, as higher inflation eats into diminishing returns.

It’s more complicated for investors, as lower interest rates increase the present value of future cash flows from equities, bonds and real assets.

“The early adopters in such environments stand to benefit; those who cling to yesterday’s assumptions may be late to the party,” said Green.

Rathbones: "The Budget die is cast"

In terms of macroeconomic data, today’s UK inflation release is the last piece of the puzzle before chancellor Rachel Reeves announces her Autumn Budget on 26 November.

“The die is cast,” said John Wyn-Evans, head of market analysis at Rathbones. In terms of economic data that could shift the chancellor’s thinking, “there is nothing of note between now and 26 November. After what feels like months of speculation, we are now at the sharp end.”

Viewed purely through the lens of inflation control, an increase in income tax – which Reeves hinted at during her unusual pre-Budget speech on 4 November – could have been a benefit, as the tax hike would have acted as a dampener on spending and, as such, had a disinflationary impact.

There is now no further economic data to shape Reeves's plans ahead of her Autumn Budget next week.

But Reeves appeared to U-turn on this front last week, as the Labour government came under attack from within its own party.

“By abandoning the idea of raising income taxes, the chancellor could still be more dependent upon raising levies that increase inflation, such as taxes on any sort of consumption,” said Wyn-Evans. “Thus, we would expect the Bank of England to reserve judgement until it has seen the contents of the red briefcase.”

Recap: UK inflation falls for first time since May

Here’s a recap on the major headlines from today:

- UK inflation, as measured by the Consumer Prices Index (CPI), fell to 3.6% in the year to October – the first time the headline figure fell since May.

- A slowdown in the rate of increases of housing and household services costs was the main driver behind the headline figure falling, while food and non-alcoholic drink prices provided upward pressure on inflation.

- Services inflation, which has been sticky in recent months, fell from 4.5% to 4.7%.

- Analysts now view an interest rate cut in December as likely – though much will depend on Rachel Reeves’s Autumn Budget next week.

Will the Budget reignite inflation?

The recent bout of inflation – which today’s data seems to put in the rear-view mirror – was partly driven by inflationary measures in last year’s Autumn Budget, such as an increase to employers’ national insurance which came into effect in April.

“An increase in employer national insurance from April undoubtedly flowed into business costs and then onto consumers, so the chancellor will be keen to avoid any further policies that further ignite price rises and weigh on growth,” said Rob Morgan, chief investment analyst at Charles Stanley.

And while Reeves will likely target less inflationary measures so as to safeguard stretched household finances, she faces a precarious balancing act with the economy seemingly fragile.

“Targeted raids on income tax, residential property, banks and gambling companies will likely be the order of the day to help fill the fiscal hole without upsetting the growth applecart,” said Morgan.

Thank you for following our coverage of October's inflation data.

Join us next month when we report on November's figures, which will be released on 17 December.