Revealed: The cost of running the Bank of Mum and Dad

Parents of children buying homes in certain parts of the country will need to spend significantly more to help their kids onto the property ladder

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The Bank of Mum and Dad is typically helping homebuyers almost double their deposits to get on the property ladder.

High house prices and falling stamp duty thresholds have pushed up the cost of buying a home.

Many buyers may also struggle with high mortgage rates.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wealthy parents have been able to step in and are playing an increasing role in property transactions.

Around 30 per cent of homebuyers received assistance from the so-called Bank of Mum and Dad last year, according to UK Finance data.

This is helping buyers get on the property ladder earlier.

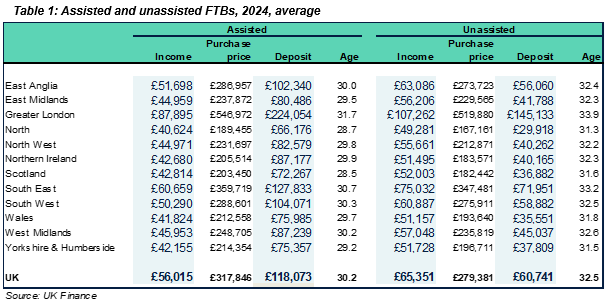

Nationally, first-time buyers who receive assistance are able to buy a home at an average age of just over 30.

In contrast, those purchasing without support tend to be older – over 32 years old.

The assistance also means buyers can purchase higher priced properties.

Here is how much it could cost to help your child onto the property ladder across difference regions.

The cost of being the Bank of Mum and Dad

Research by UK Finance shows the average unassisted first-time buyer deposit to buy a property last year was £60,741.

But the figure almost doubles for those with assistance, at £118,073.

The higher deposit also means parents can help their loved ones purchase more expensive homes.

Assisted first-time buyers were last year able to purchase a property worth £317,846 on average compared with £279,381 for those without support.

There are regional variations but the difference in deposit amounts is most pronounced in London. In 2024, a first-time buyer purchasing in the capital without support typically put down a deposit of almost £150,000. However, for those receiving family assistance, the average deposit was just under £225,000.

This helped them purchase properties in London worth £546,972 compared with £519,880.

London, perhaps unsurprisingly, was the most expensive part of the country to support a first-time buyer with a deposit.

In contrast, parents in the north only had to support deposits worth £66,176 on average.

James Tatch, UK Finance’s head of analytics, said: "First-time buyers are essential to the UK housing market, helping to unlock transactions further up the chain and maintain overall liquidity.

“While the majority of first-time buyers are still managing to purchase without help, the growing reliance on family support risks deepening inequality in the housing market. A balanced approach which addresses both supply and affordability issues is essential to ensure the door to homeownership remains open to all.”

Toby Leek, president of estate agency trade body NAEA Propertymark, said these figures demonstrate that there is still much work to be done to help first-time buyers get onto the property ladder.

He said: “For many people under the age of 30, homeownership is not a realistic aspiration without financial support from parents.

"With interest rates higher than many people are used to and the average deposit needed to purchase a home now sitting around £50,000, it is imperative that further support is available and all governments across the UK fulfil their housing targets to help even out demand and supply levels in the long-term.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and the i newspaper. He also co-presents the In For A Penny financial planning podcast.

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar