Investing in property: why it is still a good diversifier for the long-term

The fundamental case for property as an asset class remains intact. While the sector has been overshadowed by relatively strong returns from equities and bonds, there is still a strong case for investing in property for the long-term, ii’s head of fund research, Dzmitry Lipski, argues

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investing in property may have been overlooked as an asset class in the last two years, but there is still a strong case for it to be part of your portfolio as a long-term diversifier.

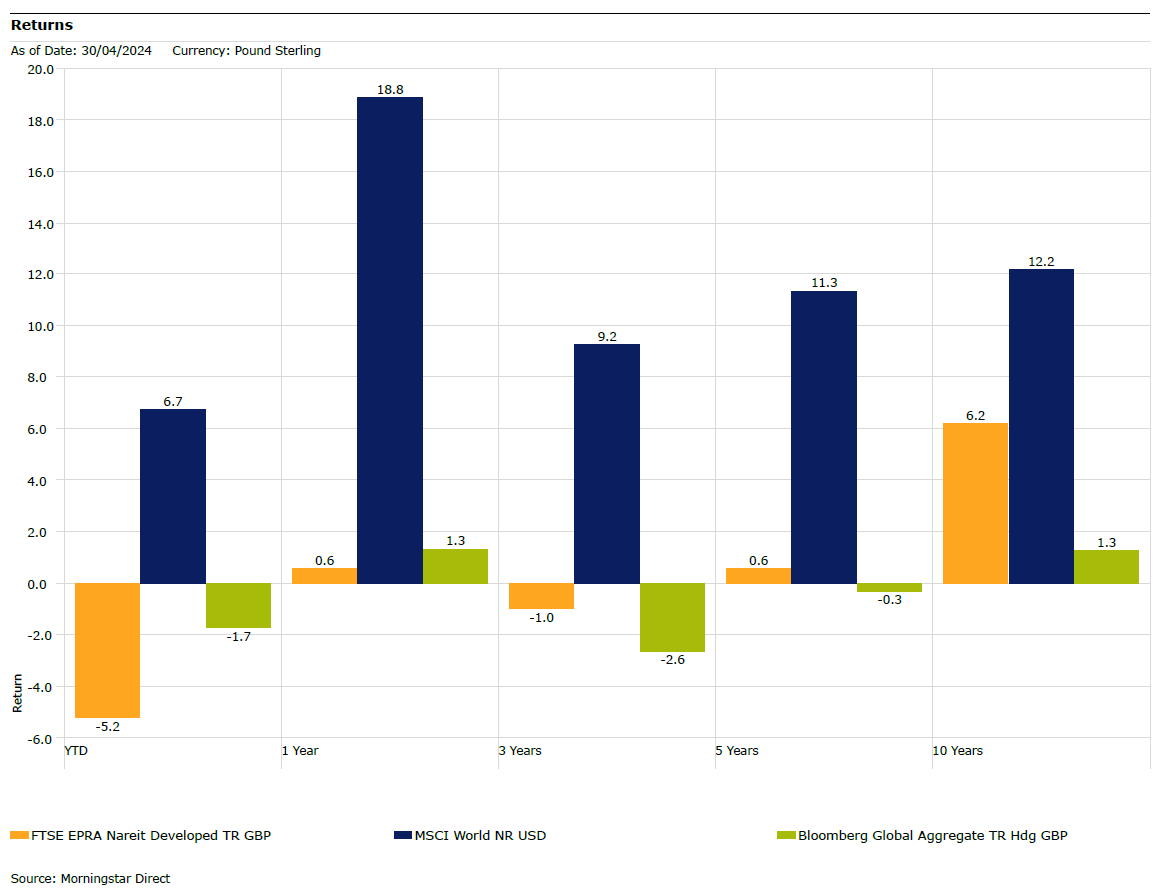

Equity markets have performed well over the past two years, and coupled with attractive bond yields on offer, investor attention has shifted away from alternative assets and property, in particular. However, with interest rate cuts on the horizon, it is expected long-term investors will shift their gaze towards the property sector once more. While property performance has not been strong over the past five years through the pandemic, yields and valuations now look attractive relative to other asset classes.

Being an alternative asset class, property allocation between 5% and 10% of one’s overall portfolio is a good rule of thumb. That said, those numbers can change depending on the objective behind including property in a portfolio – whether it is to try and secure capital growth or stable income.”

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How to add property to your portfolio?

It is important to bear in mind that property may be sensitive to high-risk events, which is why we saw several fund closures. The closed-end fund structure is generally a good way for retail investors to access the property sector. Of course, that is not to say that property trusts will be immune to any turbulence in the sector, as discounts are likely to widen in times of uncertainty, but at least existing investors should be able to access their money if they want to.

If investors want to gain some exposure to property, the TR Property Investment Trust, which invests mainly in the shares of property companies, rather than physical property itself, may be a good option. Marcus Phayre-Mudge, manager of the trust since 2011, can use that strategy to adjust the portfolio more readily than if he were investing in direct properties. Although Phayre-Mudge can invest internationally, most of his holdings are in Europe, including the UK. He can invest in physical property in the UK, but this will generally not account for more than 20% of the portfolio. Managed on a total return basis, the trust has historically outperformed the benchmark. Current yield is almost 5% and is trading at a discount to NAV of 9%.

Is investing in property still worth it?

Structural changes within the property sector have not gone unnoticed. Post-Covid changes to people’s lifestyles and work patterns, such as remote working and online shopping, have put pressure on office and retail space, while warehouses and industrial assets remain resilient.

UK investors are probably more biased towards property than most international investors due to the popularity of property ownership and wealth created over time for many UK residents.

That may be an advantage for investors at this point in time: looking at the bigger picture, the long-term fundamental case for property as an asset class remains intact and history shows that real assets such as property outperform traditional asset classes amid high inflation environments. Yields and valuations look attractive relative to other asset classes, making property a solid option to generate income and diversity in investor portfolios.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Dzmitry Lipski heads up the fund research team at flat-fee investment platform, interactive investor (ii). He joined ii in 2017 after two years at TD Direct Investing, four years as a portfolio analyst at Standard Life, and before that Bank Leumi. A graduate in financial economics from the University of Liverpool, Dzmitry has more than 15 years' investment experience, is a Member of the Chartered Institute for Securities and Investment and holds the Investment Management Certificate.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how