Frenzied house price boom leaves buyers desperate

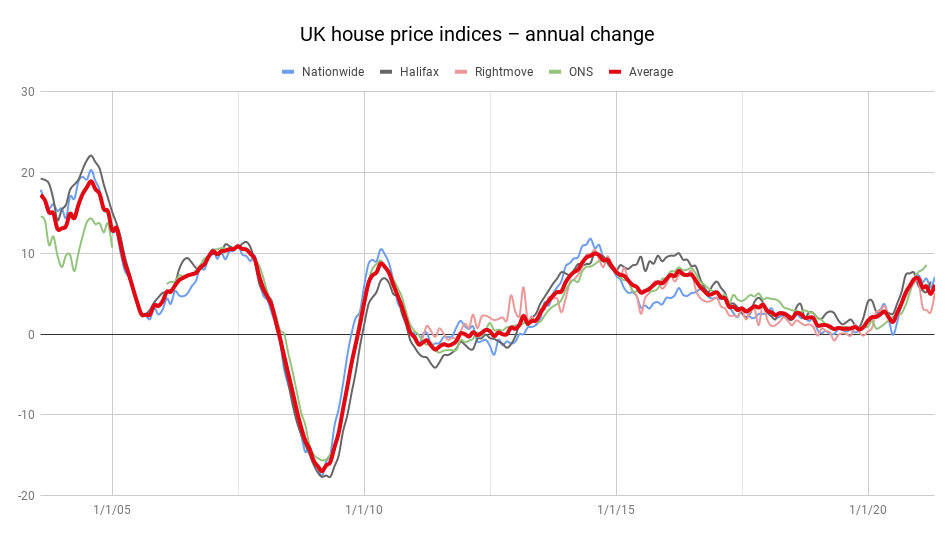

House prices are rising faster than at any time since 2004. And buyers are getting desperate, says Nicole Garcia-Merida.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

House prices saw their biggest monthly rise since February 2004 this April, jumping 2.1% month on month to reach a new record high average price of £238,831. Over the last 12 months they have risen by 7.1%, or by an average of £15,916.

Nationwide’s latest house price index adds to what we have been saying for a while now — the boom that started last July when the stamp duty holiday was announced does not seem to be abating. April’s 7.1% yearly rise is only slightly below the peak of 7.3% recorded in December and up from 5.7% in March.

Everyone predicted the market would slow by the end of March because that is when the stamp duty holiday was meant to end, but its extension came with a whole new set of predictions on the “reacceleration” of the market that are proving true.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, we have moved past buyers trying to take advantage of the stamp duty holiday, says Robert Gardner, Nationwide’s chief economist. “For most people it is not the key motivating factor prompting them to move in the first place.” Three quarters of the homeowners surveyed at the end of April that were either moving or considering a move said they would’ve done so regardless of the stamp duty holiday extension. This can perhaps be attributed to the wider shift in our priorities since the pandemic upended life as we knew it. The death of the commute and the “race for space” have meant homeowners’ needs and wants for their future abodes have changed, potentially forever.

What’s more, the conditions that allow them to turn thought into action are still present. Borrowing costs are low and new mortgage offerings are popping up left, right and centre. The stock of homes on the market remains “relatively constrained”, however, and so prices could be driven further. “If house prices remain flat in month-on-month terms over the next two months, the annual rate of growth will reach double digits in June.”

“Given the forces at play in the market, it’s highly unlikely that prices are going anywhere but up in the immediate future,” says Sarah Coles of Hargreaves Lansdown. “This kind of market can be very dangerous for buyers. It’s easy to start to panic about how fast properties are being snapped up, and be sucked into bidding wars that leave you overpaying for the property.”

“In London, the market is starting to enter frenzy territory,” says Lucy Pendleton, property expert at James Pendleton estate agents. “We haven’t seen this much anxiety in buyers’ eyes for years. They’re losing out left and right to cash buyers bidding over asking price. Pictures this month of people camping outside an estate agent overnight sums up the general picture. Prices have run away and vendors feel they’re now able to test the water with valuations that would have seemed unthinkable a year ago.”

So buyers are buying, but sellers aren’t selling. And when they are, they’re selling for a lot more than they would have before the property boom kicked off last July. And we know where that led to for New Zealand’s property market. However we also know unemployment is expected to rise later in the year when the furlough scheme comes to a close, so there are no guarantees that the market will continue its “steep climb”, says Coles. “If you’re buying at the moment, take some time to think things through. It’s difficult to keep your cool when the market is this hot, but it’s the best way to ensure you don’t get burned.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

How should a good Catholic invest? Like the Vatican’s new stock index, it seems

How should a good Catholic invest? Like the Vatican’s new stock index, it seemsThe Vatican Bank has launched its first-ever stock index, championing companies that align with “Catholic principles”. But how well would it perform?

-

The most single-friendly areas to buy a property

The most single-friendly areas to buy a propertyThere can be a single premium when it comes to getting on the property ladder but Zoopla has identified parts of the UK that remain affordable if you aren’t coupled-up

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.