Pandemic no barrier as house prices rise faster than at any time since 2014

December saw the biggest annual rise in house prices for over seven years, as buyers rushed into the market to be sure of completion before the end of the stamp duty holiday.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

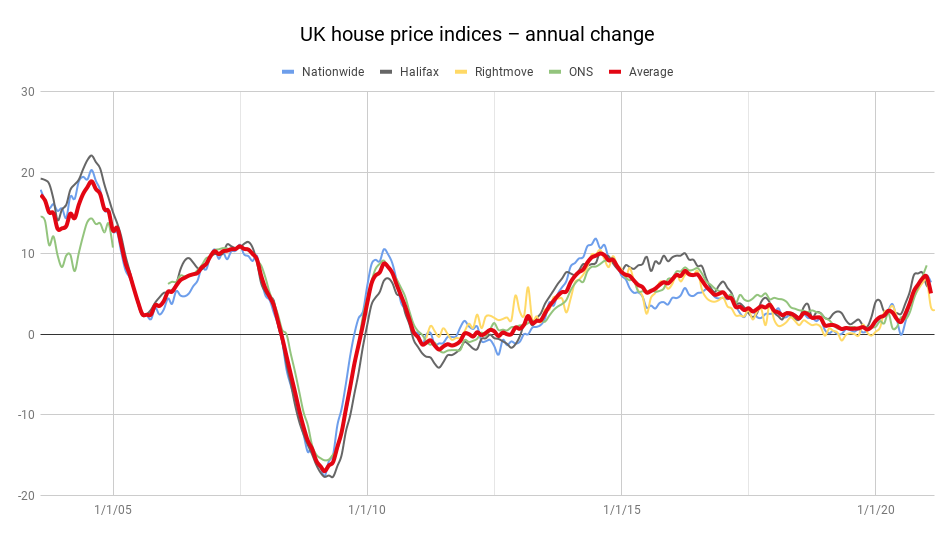

December 2020 saw the end of the second national lockdown and the beginning of the third. So it might seem odd that the housing market continued to break records. But that's exactly what happened: the average UK house price jumped 8.5% year-on-year, up from 7.1% in November, to a record high of £252,000, according to the latest data from the Office for National Statistics. That’s the highest annual growth rate the UK has seen since October 2014.

The rise could reflect several things we’ve touched on before: pent-up demand, changes in housing preferences as more and more people prioritised space and greenery over city living, and of course buyers taking advantage of the stamp duty tax holiday, where properties in England and Wales up to the value of £500,000 would incur no tax.

Though the Halifax house price index (which we discussed last week) shows demand is slowing as we come to the end of the stamp duty holiday, the market managed to end 2020 with far more growth than it had seen in years. An extension to the tax holiday hasn’t been ruled out, so if that were to be extended, prices could continue to rise into the first quarter of 2021.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A six-week extension to the stamp duty holiday could benefit between 120,000 and 160,000 additional property transactions, saving buyers a potential £1bn, says property website Rightmove. Right now, there are around 412,000 sales agreed at the end of last year that are still making their way through the conveyancing process.

“The delays we’ve seen in the home-moving process have been through no fault of the buyers and sellers who agreed a sale last year and who are now desperately trying to get their deals over the line,” says Tim Bannister from Rightmove. Any delays have come as a result of lockdowns, those involved in the process facing the intricacies of working from home, and just the sheer volume of transactions attempting to go through.

One in five buyers who agreed to a purchase last July have yet to complete over six months later, says Rightmove. And, despite it being too late for them to beat the stamp duty deadline, the number of buyers has continued to grow; the number of agreed purchases was up 7% in February on the same time last year. “These are strong signs that new buyer demand is not facing a cliff-edge after 31 March,” says Bannister, “It remains to be seen if this momentum will be enough to make up for the removal of the stamp duty savings that are benefitting many buyers and have been adding a sense of urgency to the whole market.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.