The house price boom of 2020 shows signs of slowing in 2021

Last year’s big rises in UK house prices looks to be running out of steam, reports Nicole Garcia Merida – 2021 could see a very different picture.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

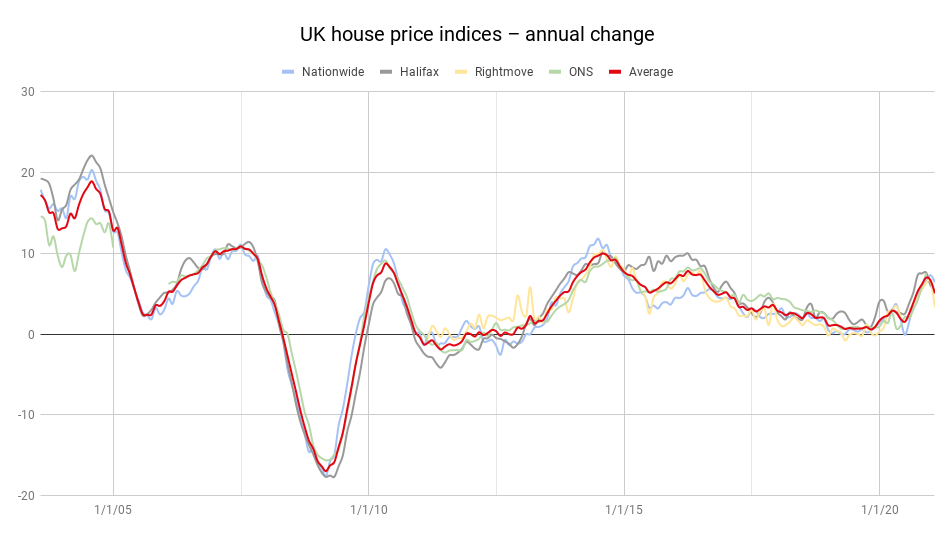

One big surprise of 2020 was that house prices in the UK (and most other parts of the world) surged higher during the year, despite the pandemic. Yet, as 2021 begins, with at least some hope of an end to the pandemic and its associated disruption, it seems that the housing market is slowing somewhat.

According to Halifax’s House Price Index, the average property price slipped by 0.3% from December to January, the biggest monthly fall since April last year. Prices are still around £13,000 higher than they were a year ago, and industry figures for agreed sales are still well above pre-pandemic levels, but “there are some early signs that the upturn in the housing market could be running out of steam”, says Russell Galley, managing director at Halifax. ”New instructions to sell have decreased noticeably, and total stock held by estate agents has risen to its highest level since before the EU referendum in 2016”.

The new lockdown probably won’t have helped, but the signs of a slowdown might be based on something rather more specific – it’s an inevitable consequence of an earlier rush to buy during the stamp duty holiday introduced by chancellor Rishi Sunak last year, which ends in six weeks.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While that end-of-March deadline might still feel far away, in house purchase terms it’s already too late – the purchase process usually takes around four months. So in effect, if you haven’t already started the process, you’re likely to have to pay stamp duty at normal rates.

As a result, new buyer enquiries dropped in January, and agreed sales also fell for the first time since May. Surveyors broadly expect house prices to fall over the next three months for the first time since June. In all, house prices could fall by around 2% over the course of 2021, “provided government policies do not change”, says Samuel Tombs at Pantheon Macroeconomics.

That’s not just down to the end of the stamp duty holiday. Another factor driving last year’s surge was that many people had sought new properties away from cities and with more space, as everyone has been spending more time at or around their homes. The number of mortgages approved for 2020 surpassed that of 2019, even though the economy was around 10% smaller and unemployment was rising.

Yet this extra demand to move to a bigger home or away from cities is likely to subside as the vaccine becomes more widely available and restrictions are lifted. People may not return in droves to the cities (although collapsing rents might tempt more to stay than might otherwise be the case), but nor will the great move to the suburbs continue apace.

The chancellor does have an opportunity to “shore up the market”, notes Tombs, in next month’s budget, perhaps by extending the stamp duty holiday or by setting up a new mortgage guarantee scheme “as mooted in the Conservatives’ 2019 manifesto. But like previous chancellors, we think Mr. Sunak will prefer to wait to pump up the housing market closer to the next election in 2024.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.