House prices boomed this year: but will that continue in 2021?

Despite everything, it’s been a good year for UK house prices. John Stpeek looks at what’s been driving the rise and asks if that will carry on into 2021.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's Christmas Eve. I'm not saying that you should have a glass in your hand by the time you read this email, but I am saying that I won't judge you if you do.

So rather than inflict the latest Brexit goings-on upon your brain on this day of festive wind-down (watch the pound, that'll tell you what's happening), why don't we have a final look back at everyone's favourite asset class? The UK housing market.

What's driven the housing market higher this year?

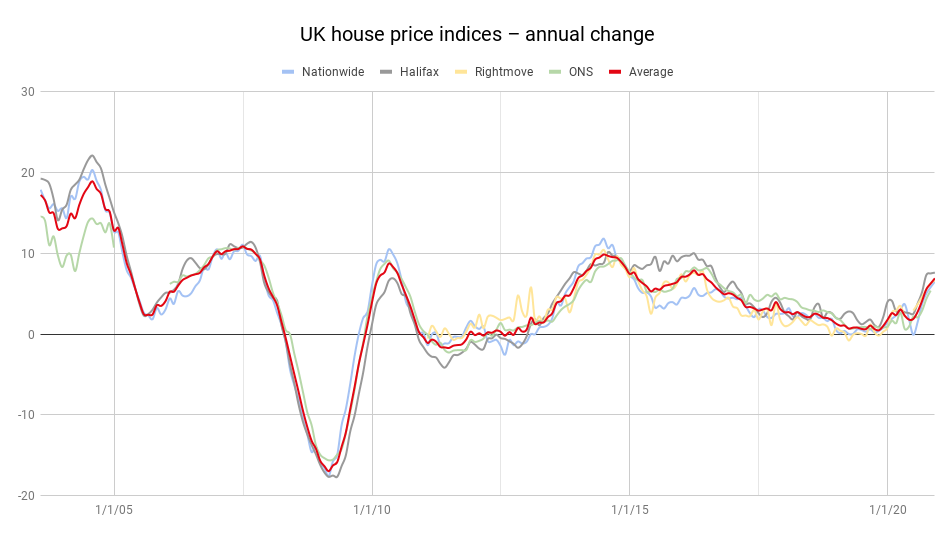

All told, it's been a pretty good year for UK house prices. I mean, coronavirus is bad, but at least it's not Japanese knotweed, eh? Every index shows that house prices have risen this year. The final figures aren't all in for December yet, but all of the most recent ones are pointing to house price growth in the mid-to-high-single-digits. Given where prices started from (particularly in the southeast of England) that's quite the outcome really.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Frankly, it's also not ideal. Our golden scenario here at MoneyWeek for some time has been that house prices would stall, or fall gently in nominal terms. Inflation would rise; you'd get a steady, probably faster-than-expected re-adjustment in house prices, but no one would be dumped into negative equity or faced with losing their home.

That's the ideal scenario. You want a house price crash in “real” terms (ie, after inflation). A nominal one just bankrupts the banks and causes a lot of stress, with the occasional lottery winner who happens to be sitting on a pile of cash at the right time (by the way, this is one good reason always to incorporate some “optionality”, in the form of cash, into your investment portfolio).

Anyway – that's not what happened this year. Instead, this year everyone was banned from moving when the coronavirus broke out. Once that ban was lifted, a surprising number of people decided to move anyway, which clearly suggests that the people who were buying houses were mostly not the same ones whose jobs were at risk. So in the first instance you had a lot of pent-up demand there.

Chancellor Rishi Sunak then offered us money-off vouchers to go and eat out. But that's not all he did – he offered us money-off vouchers to go and buy a house too, in the form of a stamp duty cut. I mean, you can argue that the money-off stamp duty ended up going-on the house prices (Merryn explains all that here) but it certainly has helped to buoy transactions by pulling sales forward from the future.

So pent-up demand combined with pulled-forward demand to deliver us a booming housing market. And no doubt, people revisited their priorities this year. They realised they could work from home a lot more regularly than they had previously believed. They looked around the empty, shuttered city and decided that they'd rather have a garden than a theatre nearby. Some people will regret those moves. Others will wonder why they didn't do it before now. But there's no doubt that coronavirus has triggered certain moves that wouldn't otherwise have happened. What'll happen next year then?

The biggest bargains still seem to be in the rental sector

This is the big question. I mean, if you're buying a house to live in, you shouldn't be fretting about this stuff anyway (yes, I get it, that's easy for me to say, but I can tell you from experience that I bought my first property down here just before the 2008 financial crisis and if we could survive that then you don't need to worry about it either). But it's still interesting to think about.

The big issue – interest rates – aren't going to change. I just don't see that next year. And that's the biggest variable. If you are expecting a house price crash, you have to explain why either the cost of credit will soar, or the supply of credit will vanish (they're basically the same things). If you can't figure out how mortgage rates hit 8% next year, then I'm sorry, but your crash hopes are simply wishful thinking.

Unemployment is a more complicated issue. But in the absence of rising interest rates, rising unemployment alone is unlikely to create a crash. More to the point, employment should recover more rapidly after this recession than is typical, because it's been such an unusual recession. The collapse was ultra fast – but the recovery is likely to be the same. Those are the two biggies.

The other question – that of activity – is perhaps more valid. If the vaccine is widely distributed and lockdown ends, then the urban exodus will grind to a halt. I'm not saying it'll reverse (it might, but I do think that working from home is now a permanent feature of the landscape, and as long as there's a solid arbitrage between the cost of commuting and the price of a house next to the sea with two more bedrooms than you could afford in London, there will always be people keen to take advantage of it). But the urgency will go out of that market.

If you then have an end to the stamp duty holiday (maybe it'll be extended, maybe it won’t) and you throw in the fact that overseas investors will be charged even more from next April, then there's definitely a recipe for a less heated market next year. That said, if general economic activity returns to normal, it's quite possible that this will be offset by a lot of people who had been put off moving by job uncertainty, feeling more secure and taking the leap.

So here's the short answer: a crash is highly unlikely. There might be a slowdown in the market which would tend to take some of the heat out of prices. But then again, there might not be. As I've said before, the one area where you might be able to profit here is if you're renting. I'm still hearing about people getting decent upgrades to their flats in London (better areas, more rooms) without having to pay much or any more. So if you are in a position to move, take some time to look around and drive a polite, but hard bargain.

And with that, I'll wish you a Merry Christmas. Money Morning will be back on Monday 28 December. Enjoy yourself, whatever you're up to.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.