Invest in commercial property – British landlords are back in business

Much of the UK commercial property sector was hit hard by the pandemic. Property prices are now snapping back, but there’s still compelling value in retail, says David J Stevenson

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The UK’s commercial property market has long been a magnet for both institutional and private investors, including overseas buyers who valued Britain’s stability and strong property rights. Then along came Covid-19 and widespread fears about whether the property world would ever be the same again.

Vast chunks of Britain’s workforce were suddenly working from home. With few employees in the office, lots of very expensive buildings were largely empty. Employers were forking out for desk space they didn’t want any more. Shopping became a mainly online exercise as most stores were forced to close. This was devastating for swathes of retail tenants who were unable to pay their rent bills, which in turn meant that landlords were clobbered by soaring defaults and found their own finances under pressure. Manufacturing tried to persevere as normal, and warehouses and logistics were needed more than ever to cope with the growth of online orders. But pessimists argued that demand for many forms of bricks and mortar would never recover. Many real estate investment trusts (Reits) plummeted as a result. Office and retail landlords Land Securities and British Land – typically seen as bellwethers because of their national reach – fell by around 50%.

Then came the recovery. The pandemic waned and people returned to shops and entertainment (a lot) and offices (at least part of the week – there seems to have been a genuine shift to working from home some of the time). Last year saw a clear rebound in the sector and that has continued this year, although many Reits remain below where they were before the pandemic. The question is whether they offer good value for contrarian investors or whether the fundamentals have changed in a way that makes them permanently less attractive than they used to be.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Understanding property values

To answer, we need to dig deeper into the sector’s fundamentals. First, let’s consider how UK commercial properties are valued. Real estate should be worth what it can earn. That’s the same basis on which the majority of other financial assets are assessed – but with real estate, the links are a bit more obvious.

Let’s take a simple example of a retail site whose tenant pays an annual rent of £10,000. Let’s assume that prevailing average annual rental yields for shops in the vicinity of this site are 8% (for simplicity, we’ll ignore tenant status – in practice, the higher financial quality the lessee, the lower the assumed yield you demand to compensate you for the risk that they won’t pay up). The calculation is simple: £10,000 divided by 8% equates to a capital value of £125,000.

If a commercial property owner uses this calculation for his or her own business, the capital valuation of the property is estimated by applying the prevailing yield to the owner’s notional annual rental cost. The yield used is often referred to as the capitalisation rate or cap rate.

So what determines that 8% cap rate and hence the capital value of the property? Ultimately these are matters of opinion, just as with residential property, but broadly they are set by comparisons with interest and inflation rates. If interest rates increase in isolation, the property yields used in the calculation also tend to go up (investors can get higher yields elsewhere and demand higher yields on property to compensate). That would depress capital values. However, if consumer price inflation climbs faster than interest rates, rents would be likely to increase, which could more than offset those rising property yields. In the above example, if the annual rent were hiked to £11,000 while yields went up to 8.5%, the capital value would be lifted to £129,412.

There are several factors that determine interest and inflation rates, such as the state of the economy as well as the demand for credit, and these will all have an effect on the property market. However, all else being equal, negative real interest rates – ie, rates that are lower than inflation – will generally support higher values for commercial property (you can simplistically see this as investors favouring property because they think rents will keep pace with inflation).

Sector by sector

Now let’s take a ground-eye view of the different parts of the commercial property market. There are three main segments: retail, office and industrial. This is not such a free-for-all as you might expect – you can’t just take a property and switch from one use to another. The official classifications are defined by the Town and Country Planning (Uses Classes) Order of 1987, a riveting read that determines acceptable uses for each commercial property type. Any business carried out in commercial buildings must comply with planning rules, otherwise occupiers may be fined.

For example, Class A1 sites can be used for retail operations, post offices, travel agents, sandwich shops, hairdressers, funeral parlours and advertisements. A2 covers financial institutions such as banks and professional services except health or medical. It also includes betting offices. A3 applies to restaurants, snack bars and cafés, while A4 is for pubs and wine bars and A5 covers takeaways. ‘B’ classification sites include offices that don’t fall under A2, such as research and development functions (eg, laboratories or high-tech industries), general industrial operations and storage or distribution warehouses.

Thus when we say that UK commercial property has been starting to recover strongly, it depends which segment we are talking about. All-property rents grew by 0.8% month-on-month in March, according to MSCI. Year-on-year rental growth rose to 3.8%, a step up from February’s 3.1% advance and the highest increase since the first half of 2016. But office rents increased by just 0.1% month on month for the fifth month in a row, keeping the annual growth rate at 1.1%. In contrast, industrial rents rose faster than 11% year on year – that testifies to the continued strong demand for warehouses and logistics.

Retail is perhaps the most interesting trend here. UK retail rents were falling year on year since well before the pandemic swept the rug out from under the sector – they began dropping in late 2018, in fact. Yet March saw this sub-sector ring up a 0.2% increase, despite a drop in supermarket rents dipping. This was retail’s first instance of monthly rental growth in four years and it lowered the annual fall in retail rents to 1.8%.

Commercial property values – as opposed to rents – were further boosted in March by falling yields (remember, lower market yields used in calculations mean higher valuations). All-property equivalent yields declined by another seven basis points (0.07 percentage points), says Pieter du Preez at Capital Economics. Most of the movement came in retail yields, which dropped by 18 basis points, while industrial and office yields dipped by seven and three basis points respectively. As a result, the year-on-year increase in capital values reached 18.2% in March, lifting all-property annual total returns to more than 24%.

Those returns were on a par with returns in July 2010, which in turn were the highest since 1994. In other words, commercial property values are coming back well from the crisis. So it’s no wonder that investment in UK commercial property in March was at its highest level for three years, while the total for the first quarter as a whole was 10% up on the equivalent period last year.

An uncertain outlook

This optimism is reflected in the latest Royal Institution of Chartered Surveyors survey, which confirmed a decent improvement in office and retail activity in this year’s first quarter and a more positive view about prospects over the next 12 months. So everything’s booming again? Not necessarily. Rising interest rates and potentially slowing economic growth aren’t a great backdrop for the sector. The former would affect capital values (higher rates equal lower capital values), while the latter would inhibit landlords’ ability to push through rent increases. Sure, the office sub-sector recovery may have proved better than expected on stronger-than-forecast demand. However, assuming no resumption of Covid-19 restrictions, uncertainties remain about the future of working from home. If this becomes a longer-term trend, there’s a clear risk of more office space appearing on the market. That would halt the rebound in its tracks.

The retail pick-up also looks patchy. “We are not convinced that rental growth will turn around quickly,” says Capital Economics’ Du Preez. “The worsening cost- of-living crisis brings further risks to demand.” He thinks it will “be a year or more before shopping-centre rents move into positive territory”. That said, there are still reasons for looking favourably at retail. “Our measures indicate that shopping centres are more undervalued than any other sub-sector.”

Industrial property probably has the clearest picture. Rents are likely to see an average annual increase of 3.1% between 2022 and 2026, outperforming office and retail, according to commercial property consultancy Knight Frank. This indicates that momentum here will be maintained for the moment, though it’s worth repeating that rising interest rates could lift yields and damage capital values.

In a nutshell, then, it may still be possible to make money in UK commercial property. But investors need to be very selective in seeking out deep-value opportunities. And, to state the obvious, direct investing in property is difficult. The minimum investable amount is prohibitively high, especially if you want a diversified portfolio. Managing properties presents its own problems and costs. Illiquidity is another potential hazard – it can be very tough to sell your investment quickly, particularly if the market is falling. Commercial properties span a wide quality spectrum, ranging from super-prime locations through to sub-prime. Investing in commercial subprime can provide higher returns than more expensive better-quality properties, at greater risk.

A thriving Reit market

Fortunately, Reits provide an easy, liquid alternative to direct investment and to open-end property funds that are vulnerable to being suspended at critical times. Reits were introduced in the UK in 2007 and there are now more than 50. Some Reits were set up as property funds when the legislation came in; others were long-established property holding companies that converted to Reit status for the tax benefits. The market is now large and diverse enough that you can take a view on a wide range of sub-sectors and trends.

In brief, Reits are property-owning portfolio managers whose long-term aim is to grow rental income and capital values on behalf of their shareholders. Property rental must represent at least 75% of a UK Reit’s profits and assets and it must own at least three properties. In exchange for distributing 90% of their property income profits to shareholders, Reits are exempt from corporation tax on rental income, as well as on gains made by selling investment properties or shares in property investment companies used in their UK property business (profits on activities other than property rental are subject to corporation tax).

Investors pay withholding tax – at 20% for basic rate taxpayers – on the property income distributions (PIDs) and any distributions of exempt gains they receive from a Reit. However, if you hold your Reits within an individual savings account (Isa) or a self-invested personal pension (Sipp) the distribution should be paid gross of tax and you will not have any income tax liability. That makes them an attractive choice for an income portfolio.

The caveat here is that a slowdown in economic growth is on the horizon plus rising interest rates may not be a great environment for income growth. Yet some Reits are still priced as if this combination will be as devastating for the sector as the GFC or the pandemic and trade on big discounts to their net asset value (NAV). Admittedly, buying such shares is no guarantee of making money. Yet discounts can act as a buffer zone in the event of falling capital values, while providing greater upside potential should property market prices rise. Overall, sentiment feels excessively pessimistic. This has created a number of value opportunities such as the two below.

Two top bets on a retail recovery

Everyone’s heard of London’s “swinging 60s” cultural centre Carnaby Street. It’s now part of the property portfolio of Shaftesbury (LSE: SHB), a Reit that invests exclusively in the heart of the capital’s West End. Shaftesbury owns a total of 1.9 million square feet, plus another 0.3 million square feet in joint ventures, across Chinatown, Covent Garden, Fitzrovia and Soho. The portfolio split as at end-September 2021 was 37% hospitality and leisure, 27% retail, 18% office and 18% residential.

Net property income for the financial year to 30 September 2021 was £65m, down from £73m and £98m in the two prior years, due to the fallout from Covid-19 hitting the company’s tenant base. After allowing for downward property revaluations of £197m, Shaftesbury made an operating loss of £157m. That led to the axing of the dividend.

However, net debt at the financial year-end had fallen to £748.5m, down from £987m 12 months before. What’s more, Shaftesbury has just disclosed that the indicative valuation of its wholly-owned portfolio as at 31 March 2022 was £3.26bn. That’s up around 7.5% from 1 October 2021, which in turn follows a 5.2% like-for-like increase in the six months to 30 September 2021.

This all indicates that Shaftesbury’s NAV is quite a bit higher than its end-September 2021 level of £2.37bn. Despite that, the current market cap is just £2.3bn – ie, no more than its NAV at the end of the last financial year. In other words, this REIT is clearly cheap. And unlike Carnaby Street the shares are right out of fashion, having dropped by 40% over the last four years. For long-term investors, they look well worth tucking away.

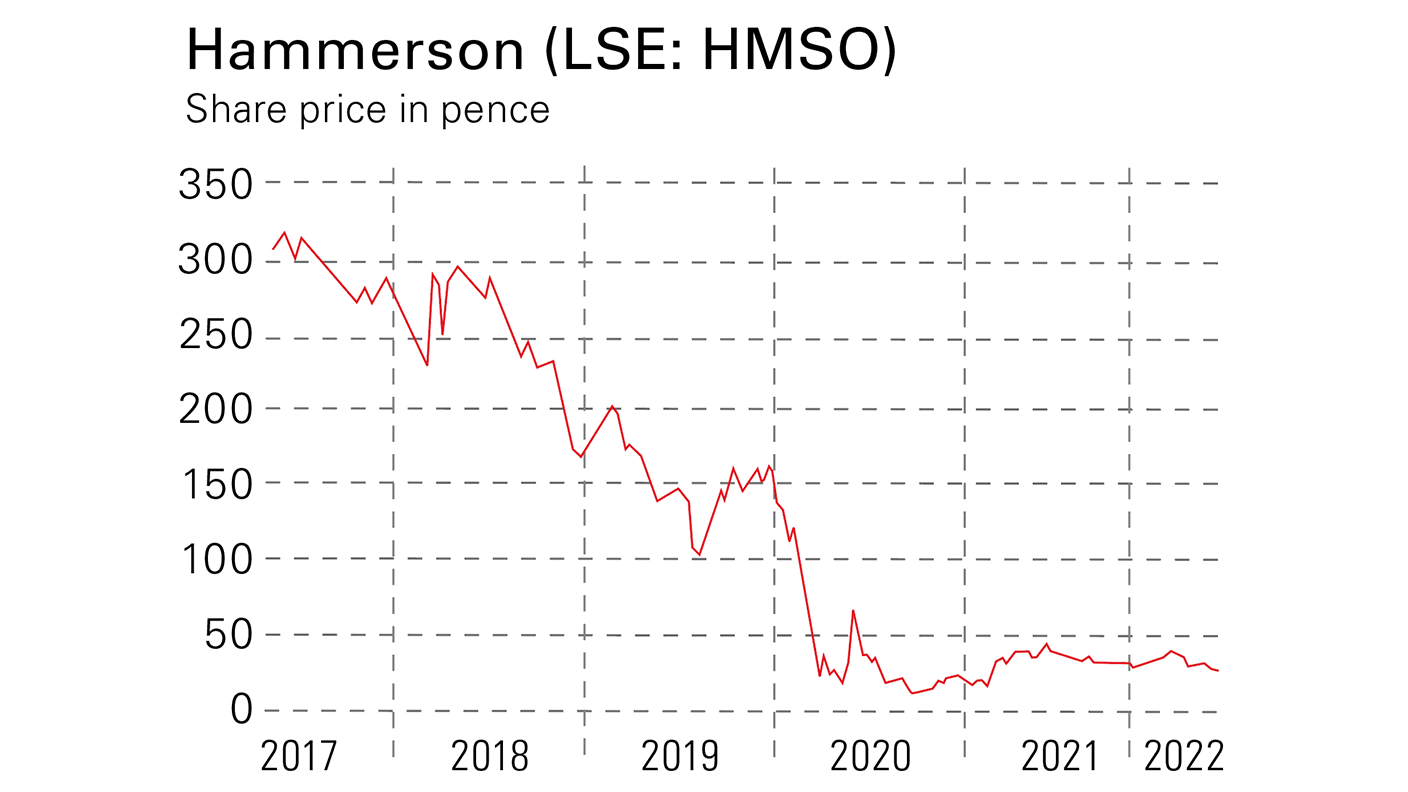

Shaftesbury is an owner of prime London property, and even though its shares are well down on where they used to be, it’s certainly not shunned. For a real deep-value play with the scope to reward long-term investors, but greater risks, look at assets that nobody loves. Hammerson (LSE: HMSO) is a very interesting case. It’s a commercial property behemoth that owns city centre assets in major cities in Britain, France and Ireland, as well as several UK retail parks. The company’s key UK sites include London’s Brent Cross, Birmingham’s Bullring & Grand Central, Bristol’s Cabot Circus, Croydon’s Centrale & Whitgift, Leicester’s Highcross, Southampton’s Westquay, Reading’s Oracle and Aberdeen’s Union Square. In short, it’s a long list of the kind of shopping centres that are supposed to be hugely challenged by the shift to online retail.

After downward revaluations of its properties, Hammerson made a £429m loss in 2021. Yet asset disposals lowered net debt by more than £400m to £1,819m. Further, shareholders’ funds as at 31 December 2021 were £2,746m, equivalent to 64p per share. Compared with the share price of 29p – down by more than 90% over the last 15 years – this equates to a discount to NAV of around 55%. That looks seriously cheap!

It’s true that this NAV could well fall further in the event of deteriorating economic and interest rate developments. Nonetheless, Hammerson’s current valuation seems to be discounting a near-Armageddon scenario in commercial property values. Anything less than this is likely to boost the stock price over time. For long-term value seekers, this is surely a share to lock away.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David J. Stevenson has a long history of investment analysis, becoming a UK fund manager for Oppenheimer UK back in 1983.

Switching his focus across the English Channel in 1986, he managed European funds over many years for Hill Samuel, Cigna UK and Lloyds Bank subsidiary IAI International.

Sandwiched within those roles was a three-year spell as Head of Research at stockbroker BNP Securities.

David became Associate Editor of MoneyWeek in 2008. In 2012, he took over the reins at The Fleet Street Letter, the UK’s longest-running investment bulletin. And in 2015 he became Investment Director of the Strategic Intelligence UK newsletter.

Eschewing retirement prospects, he once again contributes regularly to MoneyWeek.

Having lived through several stock market booms and busts, David is always alert for financial markets’ capacity to spring ‘surprises’.

Investment style-wise, he prefers value stocks to growth companies and is a confirmed contrarian thinker.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward