Building firm Keller presents low debt and ample scope for growth

Geotechnical contractor Keller, which supports vital global infrastructure, boasts rising profits and a cheap valuation

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Keller (LSE: KLR) is the world’s largest specialist geotechnical contractor, quite literally preparing the ground for major construction projects. Its work has included groundworks for Zayed City, a new “downtown” area in Abu Dhabi; a tunnel at the iconic Hard Rock Casino in Florida; mining the 2,700ft long First Street Tunnel in Washington DC; building work on a drop-shaft for London’s Thames Tideway project; and overseeing work on a renewable-energy refinery for Nestlé in Singapore.

Keller’s teams of engineers are experts in geotechnical theory and experienced in a wide range of techniques, so the company can offer a service known as “project design and build”, whereby the optimum solution is first selected and then built. Some 40% of the 5,500 contracts executed each year are design-and-build schemes.

Keller's wide array of options

The projects mentioned illustrate Keller’s wide range of expertise. However, there are many specific technical options available within each discipline and engineers choose the most appropriate one for a particular site and set of ground conditions, structural design and loadings.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Take deep foundations such as those required in Zayed City. These are needed whenever the ground is too weak to take the loads required for the structure to be built. This means piles need to be built to take the loads down to stronger underlying rock or soil.

The choice is between bored piles, umbrella tubes, auger cast piles, driven pre-cast or cast-in-situ piles, ductile iron piles, helical piles or Franki piles (pressure-injected footings with enlarged bases). The optimum choice is made by Keller’s engineers after careful assessment of the site’s underground conditions and loads to be carried.

Keller works across all sectors, from commercial, institutional and residential to power, industrial and infrastructure. The company was founded in 1860, invented the so-called “vibro” ground improvement method in the 1930s and compensation grouting techniques in the 1970s (these are used to correct the way buildings settle in the soil). Keller was listed on the London Stock Exchange in 1994 after a management buyout and is now in the FTSE 250 with a market value of £990 million. Last year’s turnover was £2.9 billion, with an underlying operating profit of £212.6 million.

North America is the company’s largest market, accounting for 59.8% of 2024 revenue, followed by Europe-Middle East with 28% and Asia-Pacific (APAC) with 12.2%. A region’s revenue can vary significantly if a major project is completed early in a particular financial year. For example, a major North American liquefied natural gas (LNG) project was completed early in 2023, so overall revenue for the region was a little less than in 2022.

In Australia, by contrast, the highest ever levels of federal and state infrastructure projects contributed to a record increase APAC revenue in 2023 that was not repeated in 2024, so APAC’s revenue fell by 2.1%. A presence spanning three regions smooths out overall performance. Keller has 160 branches across the world, enabling it to maintain close relationships with customers and gain insight into local market developments.

Dividend champion

Keller has a 31-year unbroken record of dividend payments starting from when the company was listed in 1994.

Revenue was just over £2 billion in 2017 and rose almost 50% by 2024, when it reached £2.9 billion.

Revenue dipped in 2020 and 2021 because of Covid but recovered in 2022 when it was 28% higher than in 2019.

Pre-tax profit was 3.3 times higher in 2024 than in 2022. The company was profitable in all the years mentioned and the dividend in the Covid years of 2020 and 2021 was held at the same level as in 2018.

Low debt and ample scope for growth

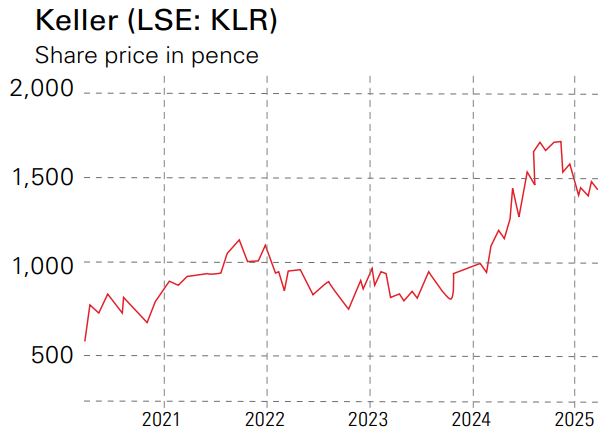

The annual results to 31 December 2024 were released in early March and welcomed with a 7.7% rise in the share price.

They show the order book has risen to £1.6 billion, revenue is up 4% to £2.9 billion and underlying operating profit is up 22% to £212.6 million.

Meanwhile, earnings per share (EPS) have risen 60% to 199.9p – well above analysts’ estimates – and the dividend per share is up 10% to 49.7p. Net debt is down 80% to £29.5 million, while the debt/earnings before interest, taxes, depreciation and amortisation (Ebitda) ratio is just 0.1%.

CEO Michael Speakman said that 2024 was “another outstanding year for Keller, ahead of expectations, delivering improved performance across all key metrics – profits, earnings, margin, return on capital, cash conversion and debt reduction”.

He added: “Our record year-end order book of £1.6 billion across our diverse revenue streams underpins our expectations for growth… Whilst we remain mindful of the uncertain geopolitical and macroeconomic environment in the short term, we anticipate further progress in 2025.”

Speakman added that the group is now focusing on growing market share within its current geographic footprint, both through organic investment and targeted bolt-on acquisitions. The group’s low debt/Ebitda ratio gives it firepower for purchases.

Keller’s recent share price is 1,380p, with a forward price/earnings (p/e) ratio of only 6.6 and forward dividend yield of 3.6%. Broker Berenberg recently raised its target price to 1,900p and deemed Keller a ‘buy’.

Keller provides an essential engineering service for infrastructure and other projects, has a history of steadily increasing revenue, and has more than trebled pre-tax profit since 2022.

The company has launched a multi-year share buyback programme, with £25 million allocated for the first quarter of 2025.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton