Why are Reits still out of favour?

The dividend yield on UK Reits suggests that this long-term property proxy offers unusually attractive value

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Most parts of the market that were badly hit during the pandemic have now recovered. Commercial property is an exception. Office and retail real estate investment trusts (Reits) are trading below where they were at the start of 2020, and even below where they had recovered to in 2021/2022 before interest rate rises started to bite. Logistics Reits, which boomed as e-commerce took off, have also given back most or all of their gains.

This is true across most countries and sectors, with a few exceptions – some major US Reits have rebounded better and certain niches, such as data centres, are doing very well – but the UK looks particularly adrift. While lower-quality assets are in trouble, rents seem to be holding up well for higher-end ones. Dividends have rebounded much better than expected. Yet Reits remain deeply out of favour, trading on yields far higher than they were in 2019.

Four decades of property investment

It’s not easy to find good long-term data for listed property in the UK – credit for the idea I’m using here belongs to Charlie Morris and his MultiAsset Investor letter. TR Property (LSE: TRY) is an investment trust dating back to 1905, but focused on real-estate stocks since the early 1980s. As Charlie points out, its share price and dividend yield should be a fair proxy for long-term trends.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

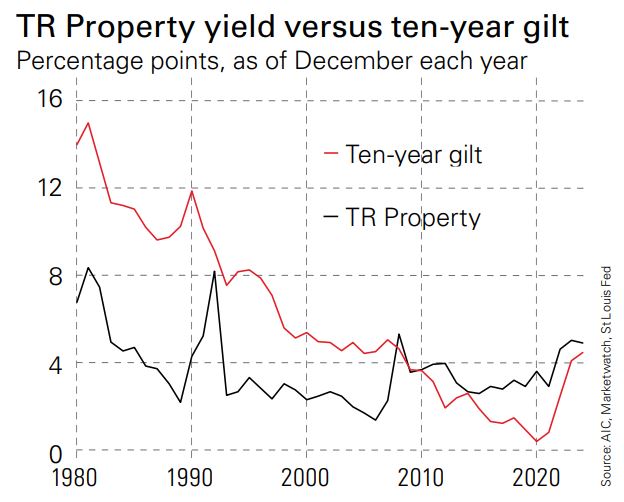

The chart above shows TR Property’s trailing dividend yield towards the end of year versus the ten-year government bond yield. You can see that until the global financial crisis, TR Property usually traded on a much lower yield than ten-year gilts. (That spike in the early 1990s, when the lines almost crossed, reflects the trust’s share price slumping in the aftermath of a massive commercial real-estate bust.) In the 2010s, quantitative easing dragged bond yields below TR Property’s yield and then lower still, until they bottomed in 2020. Since then, bond yields have risen significantly, back to where they were before the crisis, but the dividend yield has also risen and remains higher than the ten-year gilt.

At this point, if you are investing for ten years, the choice between the gilt and a good commercial property portfolio – such as TR Property or iShares UK Property (LSE: IUKP) or your own selection of UK Reits – seems clear. The gilt has a fixed yield that doesn’t change with inflation. Income from property can rise over time to reflect inflation or economic growth – and you get a higher starting yield anyway. You have to be very bearish on UK real estate not to prefer that.

The bear case is that bond yields go still higher, pushing up the cost of debt for property firms. So this decision becomes easiest if you think yields have peaked and will be heading down for now. Long term, I don’t necessarily think yields will be lower – but I think they’d have to rise much more than anybody expects for UK Reits not to offer some value now. And in that scenario, which will surely be the result if high inflation, I’d still rather hold a real asset such as property than a bond.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?