Inflation risk continues for bond yields

Bond yields are ticking up even as interest rates fall, but they still don’t offer much protection against inflation.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Short-term interest rates are going down – the only questions are how much central banks cut, and how fast. Longer-term rates are another matter. Yields on US ten-year Treasuries are up by half a percentage point to 4.2% over the past month and UK ten-year gilts are up by a quarter point at the same level. That’s unusual: the only time in recent history that ten-year Treasuries have risen by that much immediately after the US Federal Reserve began cutting was during the 1995 soft landing.

Markets clearly do not believe we will return to the ultra-low rates of the past decade. This seems reasonable. Since 1962, the average (median) yield on the ten-year Treasury has been 5.6% and average inflation over the same period has been 3.09%. As a crude estimate of the real (inflation-adjusted) yields that investors might have been expecting (not what they got, which requires hindsight), the average difference between the two at each point was 2%.

If you figure that inflation will match the Fed’s target of 2%, then a 4.2% yield will give you an after-inflation return in line with the long-term average. If we consider inflation and yields only since 1990, when they’ve been consistently lower than in the 1970s and 1980s, the median difference was about 1.5%. The gap for the UK has been a bit higher: over 3% since the 1960s, but 2% since 1990. So overall bonds look priced for roughly fair value, if that’s the outcome we get.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Time to worry about structural deficits?

Whether inflation will run at 2% is the big question. If it’s significantly higher, we’d expect investors to demand higher real yields (not just higher nominal yields). If it’s lower, we’d expect the opposite. We mentioned reasons why inflation could settle higher without being out of control, from fiscal policy to global trade to geopolitics. The latter is unpredictable, but the former seems clear.

The US runs a large deficit and that won’t change regardless of who wins the election. The UK is also heading in a direction of higher public spending. This is one plausible explanation for why yields are ticking up despite rate cuts: investors are worried about structurally larger deficits and higher inflation. In theory, long-term interest rates should be higher than short-term rates to reflect the risks that an investor takes in lending money for a longer period, so it may seem odd that ten-year yields are fairly close to both five-year yields (US: 4.05%, UK: 4.04%) and 30-year yields (US: 4.52%, UK 4.75%).

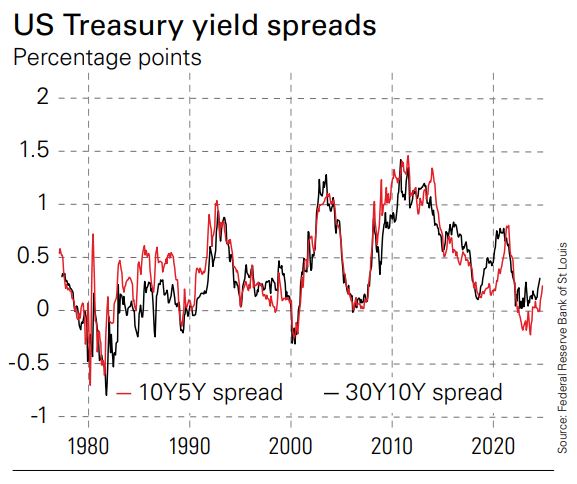

In practice, the typical term premium for holding longer-term bonds has been surprisingly modest. For the US, since 1977 when the 30-year bond was introduced, the average spread between the 30-year and the ten-year has been 0.28 percentage points and 0.34 percentage points between the ten-year and the five-year. True, spreads have been very volatile (see chart) and sometimes gone even lower.

Still, when starting from these yields, there isn’t much cushion if inflation beats expectations. Buying 30-year bonds now will be the right call if inflation turns out much lower, but on the balance of risks, shorter-term bonds look like better value.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?