Why investors should avoid market monomania

Today’s overwhelming focus on US markets leaves investors guessing about opportunities and risks elsewhere

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

My hope when markets began to wobble earlier this year was that the spotlight would start to shift a little bit away from US equities. This isn’t because I’m a committed bear on America. Yes, I am uncomfortable with how much a typical global portfolio will now have in pricey-looking US stocks when domestic politics are clearly becoming less business-friendly. However, that is about managing risk rather than a firm certainty that the tech boom has yet run its course.

Instead, my concern is that the amount of commentary that hinges on the US market, US economy and US politics – indeed, anything wrapped in the stars and stripes – has become monomaniacal. Markets have far too little idea what is happening elsewhere. Take the entire UK stock market, which is dying in part because there is so little attention paid to the small- and mid-cap segment that it no longer functions. The number of take-private deals at large premiums to the undisturbed price testifies to that.

When MoneyWeek was founded 25 years ago, analysis and commentary in the industry and the media included a range of sectors, countries and assets every week. Coverage began to decline after the financial crisis and worsened as the tech boom and the strong dollar sucked in capital. Now, many areas are neglected for long periods.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

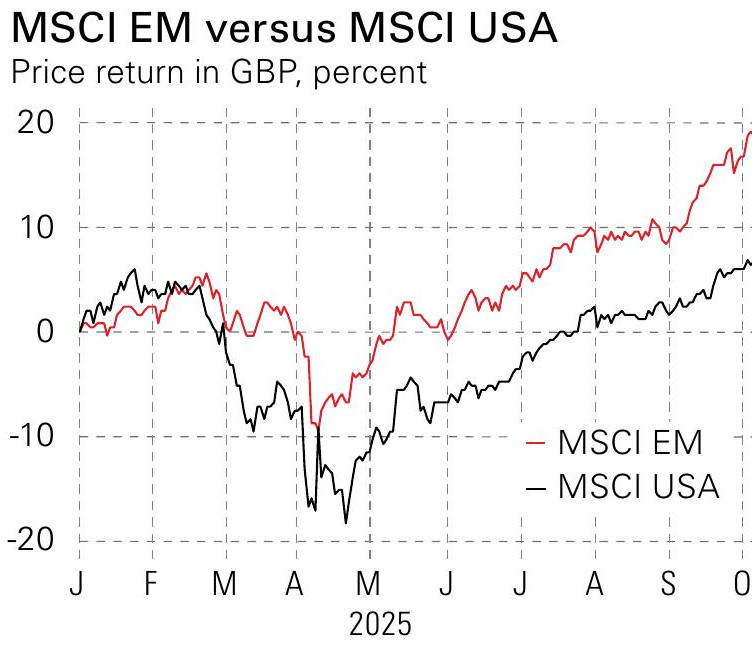

Investors are noticing emerging markets again

Consider emerging markets. I wrote about this shift relatively recently, but it bears repeating. After ages in the doldrums, they are having a good year: the MSCI Emerging Markets index is up by 16% in sterling terms in the first nine months (developed markets are up 8%, the US is up 6%). Yet that scratches just the surface of the changes: within the EM universe, India – the main bright spot of the past decade – is off 8%, while China has rebounded 29%. Korea is up 44%. Emerging Europe and Latin America are all doing very well. One cannot argue that there have been major economic or political shifts in most of these countries to change the case for them. The conclusion is that many are simply being noticed once more as flows into the US slow down.

The wider point here is not about emerging markets, but about the merits of keeping some of your portfolio in assets that are sensibly valued even when they are lagging. As private investors, we don’t need to worry about measuring our performance against a benchmark. Our goal is not to wager everything on the top-performing stocks and collect a performance fee. We aim to maximise our odds of earning a solid return and minimise our risks of devastating losses. Paying attention to out-of-favour assets is part of this.

As a final note, the MoneyWeek Wealth Summit – our annual event and MoneyWeek’s 25th birthday – on 7 November in London will run along these lines. Yes, it’s called Turmoil, tariffs and Trump 2.0. Yes, we have a session on AI. But our speakers will be looking at growth, value and wealth-preservation opportunities to suit a world that is mostly not America.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can US small caps survive the software selloff?

Can US small caps survive the software selloff?US stocks have made their worst start to a year since 1995 relative to a global benchmark. But experts think some sectors of the market are still worth buying.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems