SRT Marine Systems: A leader in marine technology

SRT Marine Systems is thriving and has a bulging order book, says Dr Michael Tubbs

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Coastguards, fishing ministries and port authorities need to track the movements of large numbers of vessels. SRT Marine Systems (Aim: SRT), founded in 1987, is a leader in providing the technology they need in order to do that. Customers range from sovereign agencies to individual vessel operators, including the RNLI lifeboat service.

SRT’s technology and systems enable its customers to solve important problems, such as establishing where borders and territorial sovereignty lie and detecting illegal fishing, smuggling and piracy. To that end, its maritime surveillance and monitoring systems are used by coastguards and border agencies, national fisheries authorities, and ports and waterways authorities. SRT’s digital AtoN systems (aids to navigation) communicate directly with vessels’ electronic charts and supplement static buoys and lighthouses.

The technologies involved include the automatic identification system for ships (AIS, which automatically transmits a vessel’s position, identification, course and speed) and transceiver systems. In one case study an AIS AtoN installation was used to protect a large wind farm by automatically marking its perimeter on ships’ electronic charts. In another, SRT supplied a low-cost vessel identifier to enable its partner to provide the authorities with a system to monitor its fishing fleet.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The global market for such maritime surveillance technology was worth $23 billion-$26 billion in 2025 and is expected to double by 2034. The navigation-safety market is estimated at $14 billion in 2025, growing to $24 billion by 2035.

SRT Marine Systems signs a $213 million contract with Kuwait

In October 2024, SRT signed a $213 million contract with Kuwait for a maritime surveillance system. Implementing that contract will take two years, followed by 10 years of support, training and maintenance. That’s a major contract for a company whose 2024-2025 turnover was £78 million.

And last January SRT was given the go-ahead for the second phase of a long-term project to build a national integrated maritime marine domain awareness (MDA) coastguard system. That is worth $15 million and should be completed by the end of 2025, followed by a five-year support phase. The third phase of the contract should start in 2026.

SRT now has five such long-term partnerships with sovereign states where the initial set of contracts (excluding follow-on contract phases) are valued at £325 million. These projects include five key elements: infrastructure; MDA system technology; training and organisation; data services and ongoing support. Data services include the delivery of supplementary data such as satellite surveillance scans and processed AI data.

There is increased interest in MDA technologies with regard to the security of borders and territories, so there are plenty more potential customers. SRT had a validated sales pipeline of £1.8 billion as of October 2025. The exact dates when these opportunities are likely to turn into contracts varies, but SRT’s chairman, Kevin Finn, says the company now has “good visibility” on about £500 million of the £1.8 billion. That £500 million includes an award letter for $200 million from a new sovereign customer that SRT received after its 2024-2025 year-end.

SRT Marine Systems revenue

SRT’s revenue has risen more than five times – from £14.8 million in the 15 months to the end of June 2024 to £78 million for the 12 months to the end of June 2025. This took the company into profit, with an operating profit figure of £6.4 million compared with an operating loss of £13.2 million for 2023-2024.

The MDA systems business contributed £68.5 million of 2024-2025 revenue, with navigation systems adding £9.5 million. MDA systems accounted for most of the revenue growth. SRT is thus well placed for further growth, with a global sales network of more than 5,000 distribution and retail partners, established brands, proven products and new products under development.

How SRT Marine Systems has fared

SRT’s results for the year to end-June 2025 showed revenue of £78 million (up 426%), operating profit of £6.4 million and adjusted pre-tax profit of £4.9 million . (The adjustment removes a one-off £3.45 million non-cash exceptional finance cost, which guarantees a project performance bond for an important customer.)

The outlook for the business is thus “very positive”, as the chairman, Kevin Finn, says in the 2024-2025 report. And there is plenty of potential for more growth as “the world seeks to acquire a new generation of integrated systems that empower them with insight and intelligence” over the marine domain.

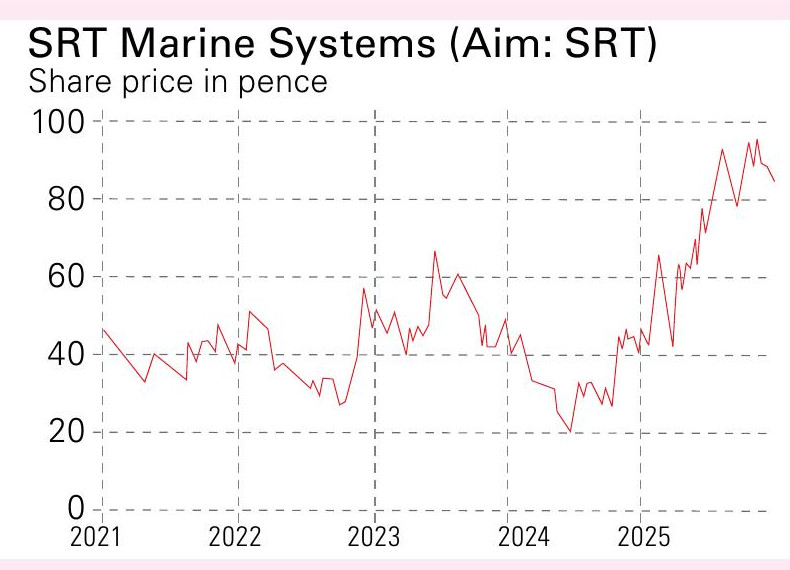

SRT has a market capitalisation of £203 million and does not yet pay a dividend because it is investing in new products and sales and service infrastructure. The shares currently trade at 80.5p and the forward price-earnings ratio is 18.3. The shares are up 96% over the past year and the future looks bright. As noted above, the company is in the process of delivering an initial set of contracts for five sovereign states worth £325 million and has good visibility on another £500 million out of its contract pipeline of £1.8 billion.

In addition, SRT is looking to broaden its product portfolio into digital on-board navigation and other related areas, such as aviation and Navy-related devices, where its core capabilities and technologies could give advantages. SRT is a relatively small company that has only recently moved into profit, but its growth prospects mean the risk is compensated for with potentially high rewards.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks