What lies behind the returns from ESG investing?

Today’s mantra is that you don’t have to sacrifice performance if you own only ESG stocks. Yet that’s not logical

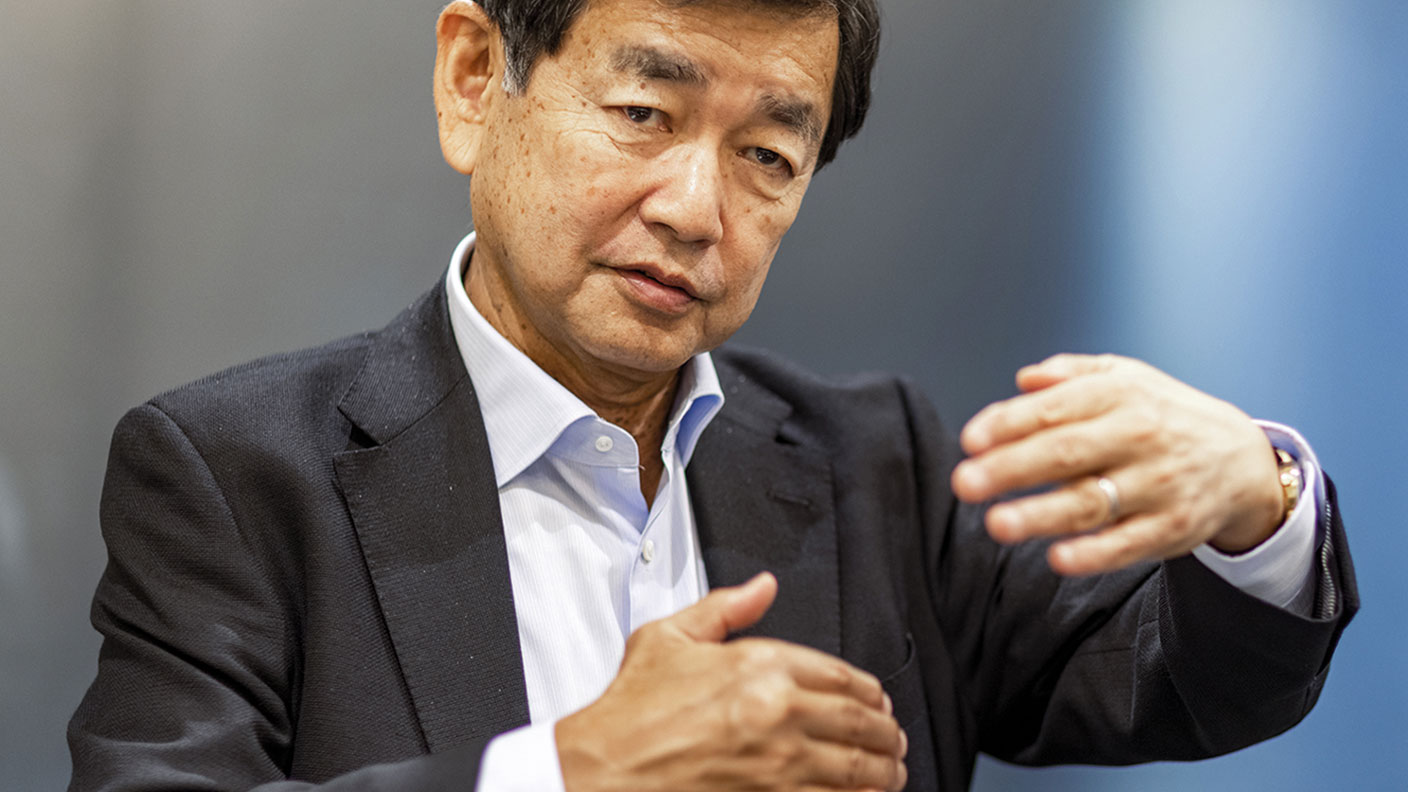

Last week, Eiji Hirano, former chair of the board of governors at Japan’s Government Pension Investment Fund (GPIF) – the world’s largest such fund – told Bloomberg that he sees signs of a “bubble” in ESG investing (that is, investing with environmental, social and governance issues in mind). The GPIF was an ESG pioneer in Japan, but now “needs to go back to its roots, and think about how to analyse if ESG is really profitable”.

It’s not the only one. Investors once took it for granted that ethical investing (ESG’s predecessor) would deliver worse returns than the market as a whole. The mere fact that ESG investing means buying from a more limited universe of stocks implies that in the long run, you’ll lose out, because there will be times when the stocks you not allowed to buy outperform the ones you are.

Yet these days, ESG is often presented as a “factor” in and of itself – an investment strategy, similar to value or momentum investing, that will result in long-term outperformance due to some fundamental attribute of the stocks concerned. Robert Armstrong, in his Unhedged newsletter in the Financial Times, looks at two research papers, both by US professors Lubos Pastor, Robert Stambaugh and Lucian Taylor, which try to shed light on the matter. In theory, ESG aims to cut the “cost of capital” for “good” companies, and raise it for “bad” ones, incentivising “good” behaviours and cutting off funding to “bad” ones.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

You can argue over how effective this is (if you raise the cost of capital too much, then “bad” companies will simply go private). But even if it works, it means the ESG investor must underperform in the long run. Why? Because for a company to have a lower cost of capital, an investor must pay a higher share price or accept a lower bond yield than they otherwise would. Yet the same team found that shares with high ESG ratings beat their less ESG-friendly peers by 35% in total between 2012 and 2020.

Why? Some argue it’s because so many ESG stocks also fit the criteria for the “quality” factor (whereby profitable stocks with strong balance sheets outperform) – the ESG label has nothing to do with it. But Pastor, Stambaugh and Taylor note that ESG outperformance is correlated with rising concerns about climate change. They argue that as a result, demand for ESG-badged products has surged faster than markets expected, driving the outperformance. In short, Hirano’s fears of a bubble look justified. In turn, as Armstrong notes, anyone investing in ESG now in the hope it will keep outperforming is betting that “the market still systematically underestimates consumers’ and investors’ taste for green products and assets – despite the fact that ESG products and funds have been very heavily promoted”. Not a bet I’d feel confident making.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John Stepek is a senior reporter at Bloomberg News and a former editor of MoneyWeek magazine. He graduated from Strathclyde University with a degree in psychology in 1996 and has always been fascinated by the gap between the way the market works in theory and the way it works in practice, and by how our deep-rooted instincts work against our best interests as investors.

He started out in journalism by writing articles about the specific business challenges facing family firms. In 2003, he took a job on the finance desk of Teletext, where he spent two years covering the markets and breaking financial news.

His work has been published in Families in Business, Shares magazine, Spear's Magazine, The Sunday Times, and The Spectator among others. He has also appeared as an expert commentator on BBC Radio 4's Today programme, BBC Radio Scotland, Newsnight, Daily Politics and Bloomberg. His first book, on contrarian investing, The Sceptical Investor, was released in March 2019. You can follow John on Twitter at @john_stepek.

-

Buying infrastructure funds - 'cheap is not always cheerful'

Buying infrastructure funds - 'cheap is not always cheerful'Opinion Well-balanced infrastructure funds offer better prospects than high-yielding renewables funds, says Max King

-

The new products and growth sectors driving America’s long-term winners

The new products and growth sectors driving America’s long-term winnersOpinion Felix Wintle, manager of the VT Tyndall North American Fund, highlights three favourite US stocks where he'd put his money

-

AJ Bell: a fine British fintech going cheap

AJ Bell: a fine British fintech going cheapOpinion Don’t overlook investment platform AJ Bell, a significantly undervalued British business with an excellent financial base

-

Investment trust boards are rushing to sell at a discount

Investment trust boards are rushing to sell at a discountPersistent discounts seem to be making investment trust boards too hasty about backing opportunistic offers

-

Is Donald Trump putting the US dollar in danger?

Is Donald Trump putting the US dollar in danger?Donald Trump's administration sees one of its greatest advantages – the US dollar – as a burden. Gold is the obvious beneficiary, says Cris Sholto Heaton.

-

The British railway industry is in rude health – here's why investors should jump aboard

The British railway industry is in rude health – here's why investors should jump aboardThe railway industry has bounced back from the devastating impact of the pandemic and is entering a new phase of development – and profitability

-

AGMs: a unique selling point for investment trusts that investors should capitalise on

AGMs: a unique selling point for investment trusts that investors should capitalise onOpinion Shareholder meetings aren’t just a regulatory requirement – they are a way to communicate with investors

-

A cyclical case for UK stocks

A cyclical case for UK stocksOpinion Depressed margins and relatively low valuations mean the UK market could rally strongly as conditions improve, says Cris Sholto Heaton.

-

Infrastructure investing: a haven of stable growth amid market turmoil

Infrastructure investing: a haven of stable growth amid market turmoilFrom booming construction in emerging markets to digital and green transitions, the infrastructure sector offers security, returns and long-term opportunities

-

The costly myth of “sell in May”

The costly myth of “sell in May”Opinion May 2025's strong returns for US stocks have once again shown that putting too much weight on seasonal patterns will only make investors poorer, says Max King