What lies behind the returns from ESG investing?

Today’s mantra is that you don’t have to sacrifice performance if you own only ESG stocks. Yet that’s not logical

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

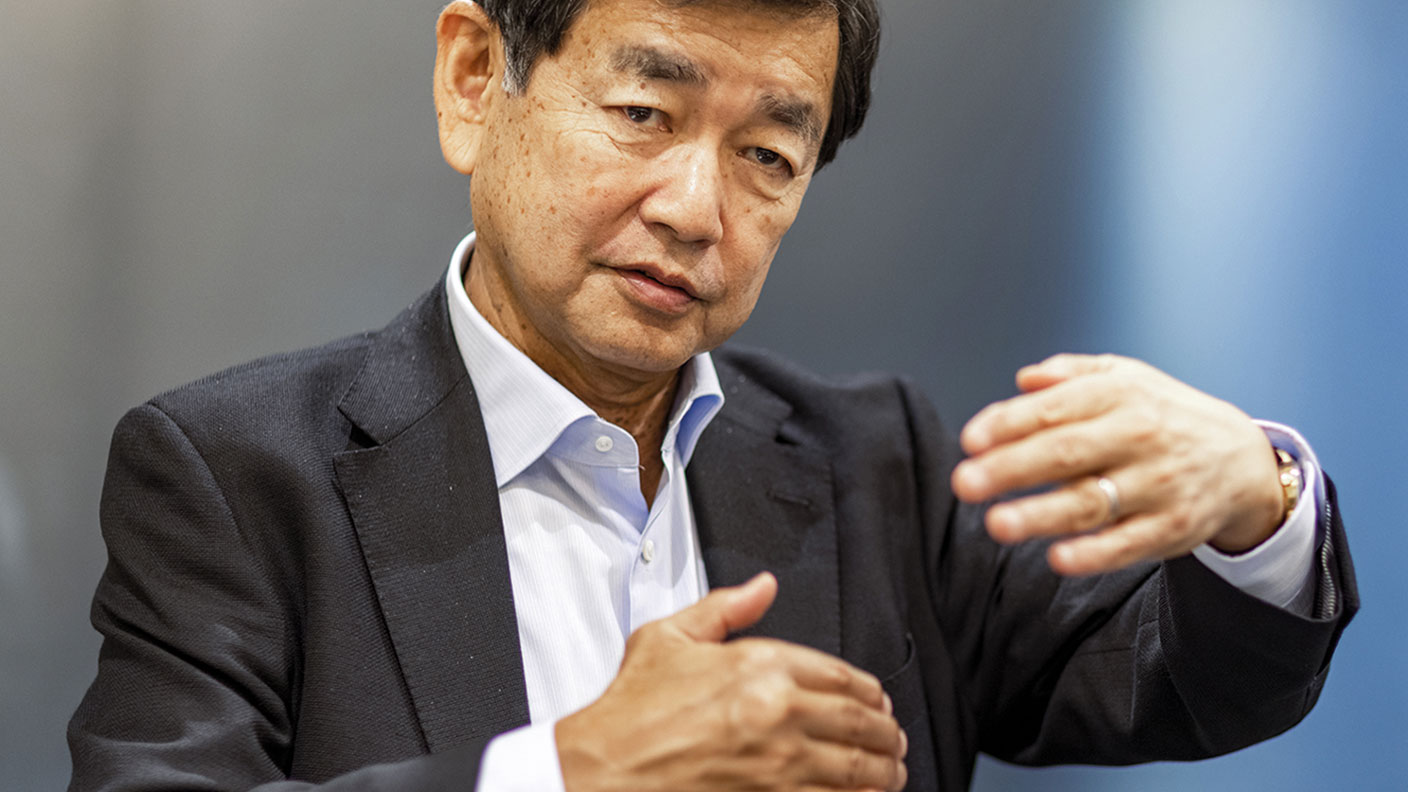

Last week, Eiji Hirano, former chair of the board of governors at Japan’s Government Pension Investment Fund (GPIF) – the world’s largest such fund – told Bloomberg that he sees signs of a “bubble” in ESG investing (that is, investing with environmental, social and governance issues in mind). The GPIF was an ESG pioneer in Japan, but now “needs to go back to its roots, and think about how to analyse if ESG is really profitable”.

It’s not the only one. Investors once took it for granted that ethical investing (ESG’s predecessor) would deliver worse returns than the market as a whole. The mere fact that ESG investing means buying from a more limited universe of stocks implies that in the long run, you’ll lose out, because there will be times when the stocks you not allowed to buy outperform the ones you are.

Yet these days, ESG is often presented as a “factor” in and of itself – an investment strategy, similar to value or momentum investing, that will result in long-term outperformance due to some fundamental attribute of the stocks concerned. Robert Armstrong, in his Unhedged newsletter in the Financial Times, looks at two research papers, both by US professors Lubos Pastor, Robert Stambaugh and Lucian Taylor, which try to shed light on the matter. In theory, ESG aims to cut the “cost of capital” for “good” companies, and raise it for “bad” ones, incentivising “good” behaviours and cutting off funding to “bad” ones.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

You can argue over how effective this is (if you raise the cost of capital too much, then “bad” companies will simply go private). But even if it works, it means the ESG investor must underperform in the long run. Why? Because for a company to have a lower cost of capital, an investor must pay a higher share price or accept a lower bond yield than they otherwise would. Yet the same team found that shares with high ESG ratings beat their less ESG-friendly peers by 35% in total between 2012 and 2020.

Why? Some argue it’s because so many ESG stocks also fit the criteria for the “quality” factor (whereby profitable stocks with strong balance sheets outperform) – the ESG label has nothing to do with it. But Pastor, Stambaugh and Taylor note that ESG outperformance is correlated with rising concerns about climate change. They argue that as a result, demand for ESG-badged products has surged faster than markets expected, driving the outperformance. In short, Hirano’s fears of a bubble look justified. In turn, as Armstrong notes, anyone investing in ESG now in the hope it will keep outperforming is betting that “the market still systematically underestimates consumers’ and investors’ taste for green products and assets – despite the fact that ESG products and funds have been very heavily promoted”. Not a bet I’d feel confident making.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton