ESG investing is important, but lots of other things matter too

Investors have been pouring money into "ESG" funds and shares, driving prices up and up. But less obvious areas of the market could prove more profitable, while still having your ESG cake and eating it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Ask someone if they approve of something nice-sounding and they will almost always say “yes”. So it is with environmental, social and governance (ESG) investing. Survey after survey tells us that most people are mad for it. They want to invest in line with their values. They want to know the companies they invest in care about their staff, communities, suppliers, customers and the climate. They consider (they say) ESG whenever they choose an investment. But here’s the problem (or the problem for ESG-labelled funds anyway): investors consider ESG, but lots of other things matter too.

A survey from the Association of Investment Companies shows that, given five criteria by which to judge an investment (performance, cost, ESG factors, the fund manager’s reputation, and the asset manager’s reputation), investors put ESG at the bottom – by some way. ESG gets an average importance score of 3.4 out of five. All the others come in over four, with performance top at 4.5. I am sure lots of people will argue that this is a silly way to do it. Some of the other things are clearly a function of ESG. The fund manager and the business he works for will only have a good reputation if their governance is good, for example. Remember Woodford? Quite.

There is also a view that ESG funds will automatically deliver better performance – as they appear to have over the last decade. So if you care about performance, you should be buying ESG funds anyway.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I’m not yet convinced. ESG’s apparent outperformance has only happened since around 2013 (to be fair, the ESG universe was pretty small before then), a period in which the types of stocks that often end up in ESG portfolios (technology and quality) have outperformed. There’s also been a hefty liquidity effect: as money has poured into the sector, ESG-eligible shares have been bid up and up. Neither of these things are necessarily sustainable – there is an obvious bubble brewing in renewables and there has also been very obvious outperformance from a sector most ESG funds actively avoid (fossil fuels) recently. It wouldn’t take much for the sector’s apparent outperformance to turn into rather nasty underperformance.

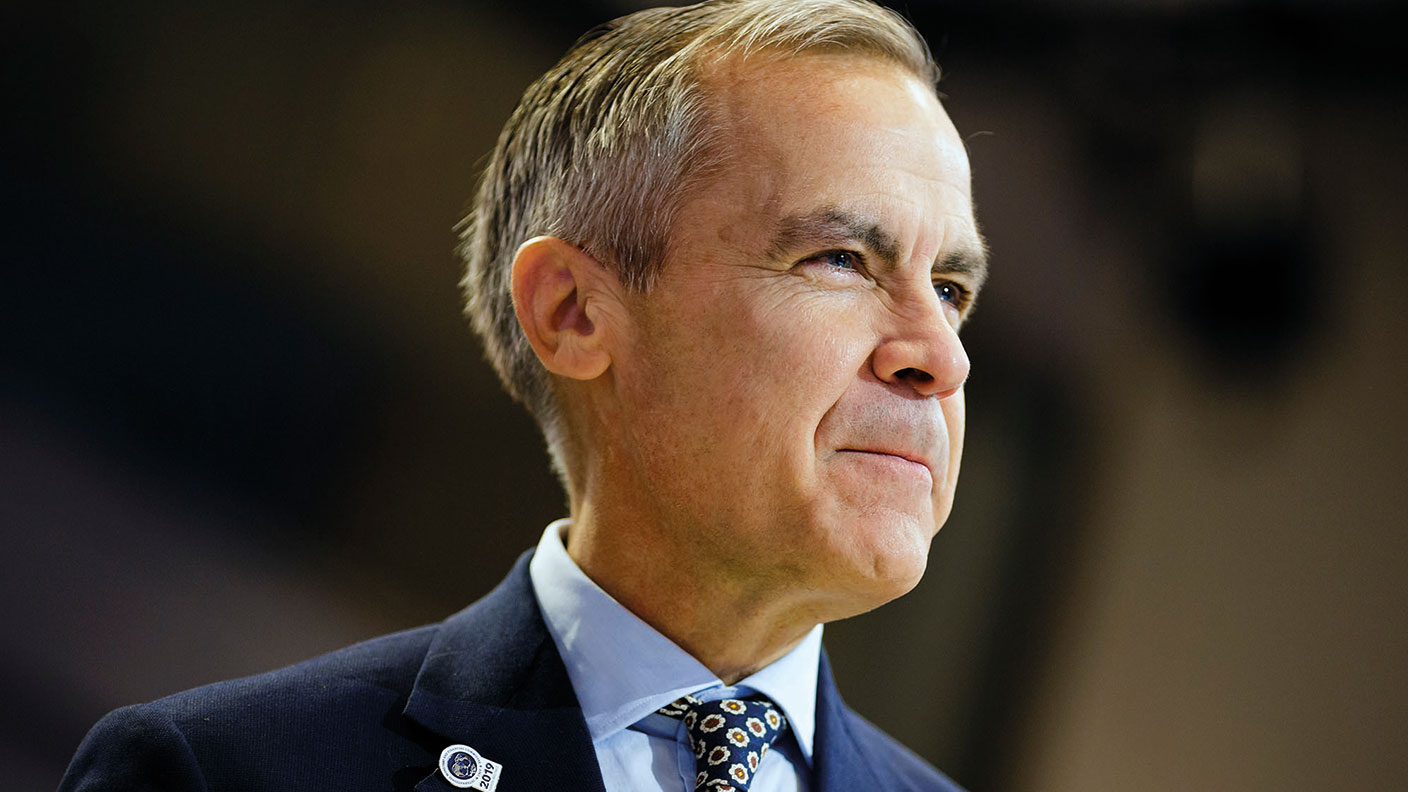

That could be a problem (particularly given that Mark Carney’s deal with financial institutions on net zero has effectively defaulted an awful lot of everyone’s cash into a vague but vast ESG fund). ESG investors have so far been able to have their cake and eat it (do-goodery plus returns). If that changes, inflows could fast turn into outflows.

The key to working around all this (given that we all want to help the planet) is to look for “cake and eat it” possibilities in the less crowded and less obvious areas of the market. In this week's magazine we look at the biodiversity sector, which is slowly becoming less overlooked; investments in soil may be a big part of the future. And check out Mike Tubbs’ list of nine stocks to buy and hold for ever. There is no reason any of them couldn’t make it into a standard ESG portfolio. Finally don’t forget nuclear power and of course fossil fuels. They aren’t in favour with the COP crowd, but we will need them for a long time to come, there is plenty of money to be made and, crucially, there is also a kind of moral high ground in being able to step back from the demonising and recognise the huge social value in keeping the lights on. There is a lot of focus on the E in ESG. The S is pretty vital too.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton